Assets VS LiabilitiesWhich ones do you own and which ones do you owe?

On a typical balance sheet, you’ll find three major categories of accounts.

These categories are assets, liabilities, and equity.

This follows the basic accounting equation, which is “Assets = Liabilities + Equity”.

The asset accounts represent the debit side of the balance sheet, while the liability and equity accounts represent the credit side.

Asset accounts generally represent properties that the business owns or controls.

These properties provide the business with economic benefits.

For example, machinery and equipment aid in the generation of revenue by facilitating the production of goods that the business will eventually sell.

Cash gives the business the ability to pay for its expenses and liabilities, as well as purchase other assets.

Liability accounts represent the financial obligations of the business.

A business accumulates these obligations for several reasons.

For example, a business might apply for a loan so that it can acquire a high-value asset.

Or the business might often purchase inventory (goods or materials) on credit.

A particular type of liability represents a business’s obligation to provide goods or deliver services.

Lastly, equity accounts represent the stake of the owners in the business.

Equity can also be seen as the residual amount that owners get after deducting liabilities from assets.

In a way, you can consider equity as the business’s obligation to its owners.

In this article, we will be taking a closer look at assets and liabilities.

We will explore each category, then compare the two to see their differences.

By the end of the article, you should acquire enough knowledge to identify which are assets and which are liabilities.

What are Assets?

Assets are items or properties that the business owns or controls.

These are items or properties of value that the business accumulates as it continues to operate.

Assets often provide the business with an economic benefit.

For example, cash allows a business to pay for its expenses and liabilities.

It also allows the business to purchase other kinds of assets.

Machinery and equipment facilitate the production of goods that the business sells to generate revenue.

Do note that the asset accounts you find on a balance sheet are items or properties that have a monetary value.

While the saying “a business’s employees are its greatest asset” isn’t necessarily a lie, it does not fit with accounting’s definition of assets.

There are many ways that a business can accumulate assets.

A common way is through acquiring properties.

For example, a business may purchase a piece of equipment for cash or credit.

Another way to accumulate assets is through the generation of revenue.

When a business makes a sale, it can either be cash or credit sale.

Cash sales provide the business with additional cash, while credit sales allow the business to accumulate accounts receivables.

Asset accounts normally have debit balances.

This means that debit entries increase an asset account, while credit entries decrease it.

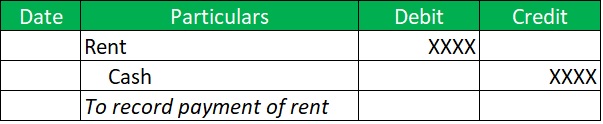

For example, when a business pays for rent with cash, this will be the journal entry:

The credit entry to cash represents a reduction in the business’s cash balance.

Paying for rent with cash meant that the business parted with some of it.

Assets can further be categorized into two sub-categories: current and non-current.

Current assets are assets that a business typically uses, exhausts, or consumes within a year. Non-current assets are those that can provide economic benefits for more than a year.

Current Assets (or Short-term Assets)

Current assets are assets that have either or both of the following characteristics:

- The business can convert it to cash within a short amount of time, usually within a year

- The business typically uses, exhausts, or consumes it within a short amount of time, usually within a year

Current assets are a business’s most liquid assets, with cash being the most liquid of them all.

Current assets are usually what a business uses to settle short-term obligations.

Them, along with current liabilities determines a business’s liquidity ratio.

The following are some of the common examples of current assets:

Cash and Cash Equivalents

Cash (and cash equivalents) is a business’s most liquid asset.

It is what the business uses to pay for expenses as well as liabilities.

Cash can come in many forms such as “cash on hand” which represents the cash that is within the premises of the business; “cash in bank” which represents the cash the business has kept in a bank; and “petty cash fund” which represent the cash that the business has set aside to pay for small expenses.

Cash equivalents are marketable securities that are readily convertible to cash.

This makes them just as good as cash, hence cash equivalents.

Accounts Receivable

When a business makes a credit sale, it accumulates accounts receivable.

This particular type of asset represents the amount that customers owe to the business.

It is a promise on the customer’s part to pay the business at a later date for the goods or services that s/he receives.

Good management of accounts receivable helps in ensuring the profitability as well as survivability of the business.

It’s not enough that the business accumulates accounts receivable. It must be able to collect them too.

Inventory

What inventory represents will depend on the business itself.

For a retail or wholesale business, inventory represents the goods that it will sell.

Or you can also see it as the goods that remain unsold as of the balance sheet date.

For a business that manufactures its own goods, inventory represents three things:

- Raw materials that the business still has to consume (raw materials inventory)

- Work in progress (WIP inventory); and

- Finished goods that are available for sale (finished goods inventory)

Prepaid Expenses

Prepaid expenses represent the expenses that the business has paid for in advance.

Since the corresponding expenses have yet to be incurred by the business, the prepaid amount is considered an asset.

The business “consumes” its prepaid expenses when it incurs the corresponding expense.

For example, let’s say that a business prepays its rent for the year.

Every time a month passes, it “consumes” a portion of the prepaid rent.

Non-current Assets (or Long-term Assets)

Non-current assets are assets that can provide the business with economic benefits for more than a year.

These assets typically have a useful life of more than a year and are usually more valuable than current assets.

As such, instead of recognizing the cost of these assets as expense when the business acquires them, it must spread it over the useful lives of these assets.

For tangible assets, this is done through depreciation.

For intangible assets, its amortization.

Non-current assets can either have a physical form or not.

Those that have physical forms are tangible or fixed assets.

Examples of such assets include buildings, building improvements, machinery, equipment, and furniture and fixtures.

Those that don’t have physical forms are intangible assets.

Although they don’t have a physical form, they still have value.

An example of an intangible asset is a patent, which can give a business a competitive edge.

Other examples include copyright, trademark, licenses, etc.

These assets typically provide the business with economic benefits for more than a year.

Some assets that you may consider as current assets at a glance may actually be non-current assets.

For example, accounts receivable that are only collectible after a year.

Since such assets don’t have the characteristics of a current asset, they are considered non-current assets.

Be mindful of this kind of asset.

Always remember that current assets are either convertible to cash or consumable within a year.

Any asset that doesn’t fit that description is a non-current asset.

Contra Assets

Unlike your typical asset accounts, contra asset accounts naturally have a credit balance.

They’re still asset accounts, but instead of increasing the asset balance, they decrease the balance of certain assets.

Currently, there are two main contra asset accounts: accumulated depreciation and allowance for doubtful accounts.

Accumulated depreciation represents the total amount of depreciation that is already charged off of an asset.

It reduces the balance of its corresponding depreciable asset account.

For example, “accumulated depreciation – equipment” reduces the book value of the equipment account.

Allowance for doubtful accounts represents the amount that the business expects to be uncollectible.

It reduces the balance of the accounts receivable account.

Goodwill

Goodwill is a peculiar kind of asset.

A business can internally generate it, but the only way you can find it on the balance sheet is when a business acquires it through the acquisition of another business or business unit.

The thing with internally generated goodwill is that you’ll know when a business has it.

However, current accounting standards won’t allow its recognition in a business’s books.

The main reason for this is that it’s hard to put an accurate value on internally generated goodwill.

Ever wonder why some businesses sell for more than just their assets?

That’s because of goodwill.

As a business operates, it accumulates positive or negative goodwill.

Examples of goodwill include customer loyalty, brand image, competent employees, good reputation, etc.

For example, let’s compare a newly built business to one with an established reputation.

The two businesses have the same level of assets.

They also offer the similar products.

Which business do you think would generate more revenue?

If I were to answer, it’s probably the business with the established reputation.

The reason is that it may already have a loyal customer base, as well as a brand reputation which the newly built one doesn’t have yet.

In other words, the one with the established reputation has goodwill while the newly built one doesn’t have it yet.

What are Liabilities?

Liabilities refer to the financial obligations of the business.

A business accumulates liabilities for several reasons.

For example, the business may take out a loan to acquire a capital asset such as a piece of equipment or machinery.

This results in the accumulation of loans payable, a liability account.

The business can also accumulate liability when it incurs an expense but doesn’t pay for it immediately.

For example, the business pays for its rent every 5th day of the following month.

In this case, the business accumulates a liability at the end of every month.

This is because it incurs the monthly rent but only pays for it in the following month.

Liability doesn’t necessarily mean an obligation to pay with cash though.

Sometimes, a liability account may represent an obligation to deliver goods or services.

This is the case with unearned revenue where the customer pays in advance for a good or service that is deliverable at a future date.

Since the business has already received payment, it’s obligated to deliver goods or services to the customer.

Liability accounts naturally have a credit balance.

This means that credit entries increase a liability account, while debit entries decrease it.

For example, let’s say that a business purchases inventory on account.

The journal entry will then be:

The credit entry to accounts payable represents an increase in liability.

Since the business has yet to pay for the purchase of inventory, it accumulates accounts payable, a liability account.

Like assets, liabilities can be further categorized into two sub-categories: current and non-current liabilities.

Current liabilities are obligations that the business has to settle within one year.

On the other hand, non-current liabilities are obligations that only become payable after a year or more.

Current Liabilities (or Short-term Liabilities)

Current liabilities represent the financial obligations that a business has to address within a short amount of time, usually within a year.

It’s important for a business to be liquid enough to not have any issues when dealing with current liabilities.

That way, it won’t have to worry about having liquidity issues.

Also, being habitually unable to pay current liabilities on time may accumulate negative goodwill for the business.

This can result in the business losing its suppliers.

Here are some of the commonly known examples of current liabilities:

Accounts Payable (or Trade Payables)

Accounts payable represent the amount that the business owes for the purchases is made on credit.

Usually, accounts payable have a term of 30 days, but some suppliers may offer a business more lenient terms due to their amicable relationship.

Some businesses within certain industries have a longer operating cycle which could qualify them for a longer credit term.

If a business has a not-so-good reputation, suppliers might not allow it to make purchases on credit.

Or if they do, they might only offer a term of 15 days.

To prevent that, a business must ensure that it pays its accounts payable on time.

Accrued Expenses (or Accrued Liabilities)

A business accumulates accrued expenses when it incurs an expense but doesn’t pay for it immediately.

For example, a business pays its employees every 20th of the month.

This means that it only pays for the work done by its employees from the 21st until the last day of a month on the following month.

This results in the business incurring a compensation expense for these yet-to-be-paid workdays.

And to record the expense, a corresponding credit entry to accrued expenses is made.

Unearned Revenue

Unearned revenue represents an obligation to deliver goods or services.

A business accumulates this kind of liability when it receives payment for goods or services that it has yet to deliver.

For example, a customer pre-orders, with payment, a product that is only available after a month.

Since the business already received payment for a product that it still has to deliver, it accumulates unearned revenue.

Another example is a gift card. When a gift card is purchased the business receives cash.

However, until the gift card is used, the revenue related to it will remain unearned.

This is because as long as the gift card is usable, the business has an obligation to honor it via the delivery of goods or services.

Non-current Liabilities (or Long-term Liabilities)

Non-current liabilities are obligations that only become payable after a year or so.

For most businesses, non-current liabilities consist of loans from banks or other financial institutions.

Since these liabilities are long-term, they often come with an obligation to pay interest.

Do note though that a non-current liability may have a current portion.

The portion that is payable within the year is the current portion of a non-current liability.

Liabilities don’t stay non-current forever after all.

The business will still have to pay them eventually, current or non-current.

Assets VS Liabilities

Now that we’ve discussed both assets and liabilities, it’s time to compare them.

What’s the difference between these two categories of balance sheet accounts?

Well first, let’s review the basic accounting equation:

Assets are always equal to the sum of a company’s liabilities and equity.

As you can see, the assets and liabilities are on different sides of the equation.

This is also true on the balance sheet. Assets are on the debit side, while liabilities and equity are on the credit side.

This leads us to their first difference: asset accounts naturally have debit balances, while liability accounts naturally have credit balances.

Thus, debit entries increase asset accounts, whereas they decrease liability accounts.

In contrast, credit entries decrease asset accounts, whereas they increase liability accounts.

Another difference between assets and liabilities is ownership or control.

Assets are items that the business has ownership or control over. In short, the business owns them.

On the other hand, liabilities are items that other parties have ownership or control over.

Rather than own them, the business owes them.

In general, a business would want to have more assets than liabilities.

It means that the business has enough assets to pay for all its liabilities (including equity).

If the business has more liabilities than assets, it could mean that it isn’t solvent.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard Business School "HOW TO READ & UNDERSTAND A BALANCE SHEET" Page 1 . April 4, 2022

Iowa State University "Understanding Net Worth" Page 1 . April 4, 2022