Contra AccountDefinition, Types, Uses, and How to Set them Up

What is a Contra Account

A Contra Accounts is a general ledger account that is shown on the Financial Statements that is used to reduce the balance of its paired account.

In other words, the Contra Account’s purpose is to be the opposite of the paired or associated account.

When the normal balance of an asset is a debit, a contra account’s normal balance would be a credit, and when a liability’s normal balance is a credit, the contra account is a debit.

Contra Accounts help show the net value of an account in the financial statements.

Understanding a Contra Account

For accounting purposes and convenience of taxation, firms show the historical cost of accounts instead of directly showing the net value.

Apart from taxation purposes, showing the original amount of an account will help keep the books of the company clean and when financial reports are issued, stakeholders will be able to paint a full picture of the company’s financial performance and position.

An example of a contra account is Accumulated Depreciation which is a contra asset account.

In the Balance Sheet, the Asset account will show the historical cost of the assets purchased and directly below that, Accumulated Depreciation will be shown as a credit that reduces the asset account to arrive at its book value.

Types of Contra Accounts

There are different types of Contra Accounts and the most common are contra asset, contra liability, contra equity and contra revenue accounts.

Contra Asset Account

The most known type of a contra asset account is the Accumulated Depreciation which reduces the amount of Fixed Assets.

In the Balance Sheet, the Fixed Asset will show the total of the cost of all the fixed assets acquired and the Accumulated Depreciation will show the total accumulated amount of depreciation expense recognized each year.

The normal balance of an asset is a debit.

Therefore, a contra asset account is credited in order to reduce the amount of the asset.

A contra asset account is not considered an asset since it does not generate present or future economic benefits to the company and it cannot be considered as a liability either because it does not carry any long-term obligation for the company.

Contra Liability Account

A contra liability account is the lesser known type of a contra account.

A bond discount is an example of a contra liability account and it reduces the amount of a bond payable.

The net value corresponds to the carrying value of the bond.

Although a bond discount is a contra liability account, it cannot be considered as a liability since no future obligation can be expected from it.

Where a liability’s normal balance is a credit, a liability contra account is debited in order to reduce the amount of the liability.

Contra Equity Account

When a corporation buys back its shares that have been previously issued, it is recorded as a Treasury Stock.

A treasury stock is an example of a contra equity account that reduces the amount of total equity.

Contra Revenue Account

Very common contra revenue accounts that can be immediately spotted on the Income Statement are Sales Returns, Sales Allowances, and Sales Discounts which are deducted from the Gross Revenue total to arrive at the Net Revenue amount.

- Sales Returns – Amount that is reduced from the gross revenue for goods that have been previously sold but returned to the seller.

- Sales Discounts – Amount of discount given to customers who are usually able to pay earlier than the due date of an invoice.

- Sales Allowances – Sales Allowances are given when goods sold have slight defects when delivered to the customer.

How to Record a Contra Account

Contra Asset Accounts can be in the form of an Allowance for Bad Debts or Accumulated Depreciation.

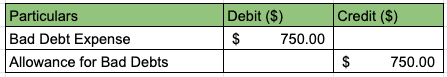

For both contra asset accounts, the entry is a debit to an expense and the credit is to the contra asset account.

For example, a company has determined that 5% of their accounts receivable in the amount of $15,000 will become uncollectible.

Therefore, the allowance for bad debts is $750 (5% of $15,000).

To record this, the journal entry will be:

In the Balance Sheet, the Accounts Receivable will be shown at $15,000 and below that, the allowance for Bad Debts will be shown as deduction to the Accounts Receivable for $750.

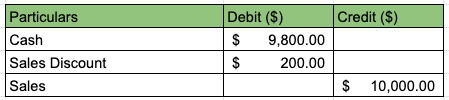

To record a revenue contra account, the company must be able to determine how much the contra account is.

For example, a company has provided services to its customer for $10,000 with a sales discount of 2%.

Upon receipt of the invoice, the customer paid in cash immediately.

To record this transaction, the accountant will pass this journal entry:

On the Income Statement, the Sales Discount will be shown as a deduction of the Gross Revenue to show the Net Revenue.

Example of a Contra Account

Assuming that for the year ended December 31, 2020 Company ABC has total Furniture and Fixture of $735,000, Office Equipment of $980,000, Leasehold Improvements of $625,000 and Accumulated Depreciation of $88,000, the section of Property, Plant and Equipment in the Balance Sheet will be shown as:

| Furniture & Fixture | $ 735,000.00 |

| Office Equipments | $ 980,000.00 |

| Leasehold Improvements | $ 625,000.00 |

| Property, Plant & Equipment, Gross | $ 2,340,000.00 |

| Accumulated Depreciation | $ (88,000.00) |

| Property, Plant & Equipment, net | $ 2,252,000.00 |

For the year ended December 31, 2020 Company ABC has also recorded a total Revenue of $38,000,000 with Sales Discounts amounting to $1,750,000 and Sales Returns and Allowances of $680,000.

When preparing the Income Statement, this information will be recorded as follows:

| Gross Sales Revenue | $ 38,000,000.00 |

| Sales Discounts | $ (1,750,000.00) |

| Sales Returns and Allowances | $ (680,000.00) |

| Net Revenue | $ 35,570,000.00 |

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Georgia "10.3 Uncollectible Accounts" Page 1 . November 17, 2021

Middlesex Community College "ADJUSTING ENTRIES " Page 1 - 2. November 17, 2021

California State University "Reporting and Analyzing Receivables " Page 2 - 4. November 17, 2021