Depreciation ExpenseExplained with Journal Entry Examples

What is Depreciation Expense?

When assets are purchased by the company, it is not immediately recorded as an expense at the time of purchase.

Rather, it is capitalized and its cost is spread across its useful life.

The reason is that expenses should be recorded at the same time that revenues are generated from the use of such assets.

To record the cost of purchasing the asset as an expense would overstate the expenses of the company for the current period and understate the expenses in future periods.

Depreciation is a non-cash expense, meaning that there is no cash outflow when the expense is recorded.

When companies record the depreciation expense, the credit is not to cash but to accumulated depreciation – a contra asset account.

Depending on the asset type, there are different depreciation methods that companies can opt to use.

Depreciation Expense Methods

Three of the most commonly used depreciation methods are the Straight-Line Depreciation Method, Declining Balance Method, and the Units-of-Production Method.

Straight-Line Depreciation

The most popular method of depreciating an asset is through Straight-Line Depreciation.

Under this method, the salvage value of the asset is deducted from the cost of the asset.

The difference is then divided by the useful life of the asset.

To compute for the annual depreciation, the formula to be used is:

Depreciation Expense = (Purchase Price of the Asset – Residual Value) / Useful Life

For example, Company Z purchased a piece of machinery for $15,000 with a salvage value of $2,500 and useful life of 5 years.

At the end of year 1, the depreciation expense that Company Z will record is $2,500 (($15,000 – $2,500) / 5 years).

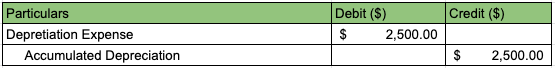

To record this, the bookkeeper will pass this entry:

Declining Balance

This method intends to record a higher depreciation amount in the early years of the asset’s useful life and eventually declines and the company then records a lesser depreciation amount.

A declining balance is an accelerated method of depreciating assets.

Under this method, a factor higher than 1 is chosen.

For example, the company has decided to use a factor of 2, making the depreciation method a double-declining balance.

Depreciation expense is calculated using the formula: (Book Value of the Asset × 2) ÷ Useful Life.

Using the same example above, the depreciation expense would be:

Year 1: $5,000 ((12,500 * 2) / 5)

Year 2: $3,000 (($12,500 – $5,000) * 2) / 5

Units-Of-Production

This type of depreciation method is usually used by mining companies.

Under this method, the depreciation expense is computed by dividing the depreciable cost by the total number of units the asset is expected to produce for the duration of its useful life and multiplied by the number of units produced for the year.

When the company produces more units, the depreciation expense is higher.

In so doing, the depreciation expense matches when the machine is most at work to produce more units.

The depreciation expense formula under Units-of-Production is:

Depreciation = ((Purchase Price – Salvage Value) / Useful Life in Units ) x Units Produced

In the same example above, assume that the machinery is expected to produce a total of 15,000 units.

For the first year, the machine was able to produce 3,000 units.

The depreciation will therefore be computed as:

Depreciation = (($15,000 – $2,500) / 15,000 ) x 3,000

Depreciation = $2,500

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Minnesota "10.3 Recording Depreciation Expense for a Partial Year" Page 1 . March 11, 2022

Michigan State University "Financial Ratios Part 19 of 21: Depreciation-Expense ratio" Page 1 . March 11, 2022

Cornell Law School "18 CFR § 367.4030 - Account 403, Depreciation expense." Page 1 . March 11, 2022