Accumulated DepreciationDefined with Examples, Formula & How to Calculate

Imagine this: an asset, maybe a piece of machinery or equipment.

You can use this asset for an indefinite amount of time and it does not deteriorate through wear and tear.

You don’t even have to worry about its maintenance as it does not seem to need it.

It’s like a perfect asset that doesn’t age!

Isn’t that wonderful?

You no longer have to worry about purchasing a replacement.

You also won’t have to worry about its disposal as you can use it for as long as you want.

But it’s hard to imagine, right?

Unfortunately, assets do deteriorate in the real world.

For example, you can use computers for about 3 to 4 years before their performance deteriorates.

You can use phones for 2 to 3 years before you need to upgrade them.

Machinery and equipment deteriorate via wear and tear – as you use them, you’ll notice that their performance decreases.

It’s even more noticeable when the repairs and maintenance cost for these assets increases.

Whether we like it or not, assets eventually lose their usefulness.

In accounting, we refer to the Deterioration of Assets as depreciation.

Here’s how depreciation works: a portion of the asset’s cost is expensed periodically, from the moment that it becomes usable.

The most commonly used method for recording depreciation is the straight line method in which the cost of the asset less its salvage value is divided over its useful life.

Other methods include the declining balance method, and sum-of-the-year’s digits (SYD).

So how do we record depreciation?

Since it is an expense, it is a given that the debit entry will be an expense account.

But what about the credit entry?

Do we credit the corresponding asset account?

Or do we use another account?

Let’s find out!

Accumulated Depreciation

The answers to the above questions are:

1. You don’t credit the corresponding account; and

2. We use another account instead, which is the “accumulated depreciation” account.

So you ask, what is accumulated depreciation?

From the name itself, we can deduce that it’s the accumulation of an asset’s depreciation.

Meaning that it is an asset’s total recorded depreciation ever since it was acquired and made available for use.

Let’s say you want to look at how much depreciation is already recorded for a particular asset.

Well, you can always consult its corresponding accumulated depreciation account for that.

The accumulated deprecation account naturally has a credit balance.

This is because it is a contra asset account.

It serves to offset the balance of its corresponding asset account.

For example, accumulated depreciation – machinery offsets the balance of the machinery account.

This way, we can know the net value of the asset (or its cost less all recorded depreciation expense).

Since accumulated depreciation is a contra asset account, it appears on a business’s balance sheet.

As the asset ages, its corresponding accumulated depreciation account increases.

At the end of the asset’s useful life, the net value of the asset should be equal to zero.

But if it has a salvage value, its net value must be equal to that.

This will indicate that the asset has fully served its useful life.

You can also opt to assign a nominal amount to the asset so that it can remain in your books.

You will eventually have to dispose of the asset either by selling it or putting it out of commission.

When you do so, you must reverse the asset account along with its corresponding accumulated deprecation account.

This will eliminate all records of the asset from your books.

Why maintain accumulated depreciation?

Right? Why can’t we just directly credit depreciation from the asset account itself?

Why go through the step of maintaining an accumulated depreciated account for every depreciable asset?

Well, there’s a good reason for it.

By crediting accumulated depreciation instead of the asset account, we can do the following:

- Present the asset’s (the one being depreciated) original cost on the balance sheet; this way, we won’t have to look for the original documentation of the asset just to know of its original cost.

- Present the total amount of all the recorded depreciation expenses related to the asset on the balance sheet. The accumulated depreciation account represent this amount.

- Lastly, we compute the asset’s still-depreciable portion . We do this by subtracting accumulated depreciation from its corresponding asset account. We also refer to this amount as the asset’s book or net value.

You can also tell how well an asset is into its useful life with it.

The asset is still in its early years when its accumulated depreciation is still of a relatively small amount.

If its accumulated depreciation is near equal to its original cost, the asset is probably near the end of its useful life.

Accumulated depreciation on the Balance Sheet

Most balance sheets report accumulated depreciation as a reduction to the cost of the corresponding asset.

This means that you won’t see the actual amount of accumulated depreciation on the balance sheet.

Rather, you’d only see the book or net value of the asset.

Here’s an example:

As you can see from the above illustration, the cost of the asset and its corresponding accumulated depreciation are presented as a single line item.

In cases like this, a detailed account of the business’s depreciable assets can be found on the notes to financial statements.

There, you can find the original cost of each asset as well as its corresponding accumulated depreciation.

A more detailed balance will list all of the business’s accumulated depreciation accounts, one for each depreciable asset account.

This form of presentation is preferred by investors who are planning to invest in asset-heavy businesses.

We already learned that we can have a general idea of an asset’s age via its accumulated depreciation.

The age of these assets might matter more for these investors.

Here’s an example of this form of presentation:

As can be seen from above, each depreciable asset is listed separately along with its corresponding accumulated depreciation account.

Methods for calculating Accumulated Depreciation

You can compute for an asset’s depreciation (and consequently, its accumulated depreciation) by using any of the following methods:

Straight Line Method

The straight line method is probably the simplest method of depreciation.

Under this method, the cost of the asset is depreciated evenly over its useful life.

If you’re going to use this method of depreciation, expect to have equal monthly depreciation expense in regards to the asset.

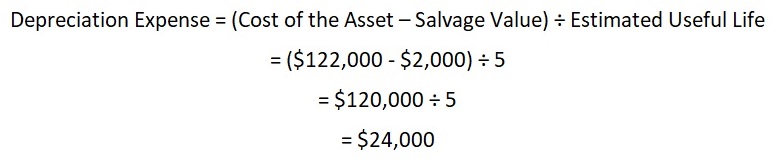

The straight line method uses the following formula for the computation of depreciation:

Depreciation Expense = (Cost of the Asset – Salvage Value) ÷ Estimated Useful Life

Cost of the asset refers to the acquisition cost of the asset, plus any expenses necessary to make the asset available for use.

This could include the cost of transportation, installation, warranties, and testing.

On the other hand, salvage value refers to the value that you’d expect the asset to sell for after it has been fully depreciated.

If you expect the asset to be unsellable after it is fully used, then you can assign a value of zero as its salvage value.

Lastly, estimated useful life refers to the number of years you’d expect the asset to be fully useful.

After an asset fully serves its useful life, it either becomes entirely unusable, or its operational efficiency becomes very undesirable.

The straight line method is most suited to assets that you know will be operating at relatively the same level over its useful life.

That said, nothing is stopping you from using this method of depreciation for all of your assets.

The main draw of this method is its simplicity and ease of use after all, which is probably the reason why it is the most commonly used method.

Exercise #1

Alex acquires a piece of machinery for a total cost of $122,000.

This cost includes the price of the asset and other costs necessary to make it available for use.

Alex expects to get, at most, 5 years of use from this asset.

After that, he estimates that he’ll be able to sell it for $2,000.

Alex wants to know how much depreciation expense he should be recognizing for every year and month.

He decided to use the straight line method of deprecation for this particular asset.

First, we need to identify the variables.

The cost of the asset is $122,000.

This is the cost that Alex has to incur to acquire the asset and make it available for use.

As for the salvage value, it’s $2,000.

It is the amount that Alex expects the asset to sell for after it has been fully depreciated.

5 years is the estimated useful life of the asset as it is the expected number of years that the asset will be useable.

Now that we have our variables, we can compute the periodic depreciation that Alex will have to recognize:

Alex will have to recognize a yearly depreciation expense of $24,000.

To compute the monthly depreciation expense, we simply have to divide yearly depreciation expense by the number of months in a year:

$24,000 ÷ 12 = $2,000

Alex will have to recognize a monthly depreciation expense of $2,000 for this particular asset.

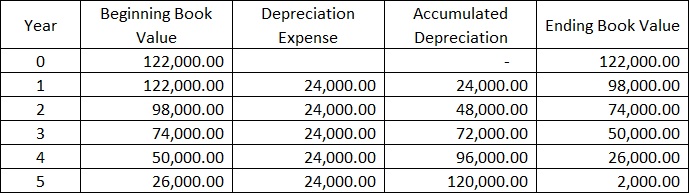

To see how accumulated deprecation comes into the equation, we can refer to the table below:

You can see from the above table that accumulated deprecation increases as the years go by.

At the end of year 5, the book value of the asset is $2,000 which is equal to its salvage value.

Declining Balance Method

The declining balance method is a method in which larger amounts of depreciation expenses are recorded in the earlier years of the asset.

The rationale behind this is that some assets are more useful when they are just new.

As they age, their operational efficiency declines, but not to the point where they become unusable.

However, the decline is significant enough in that there is a noticeable difference in its operational efficiency.

As such, the business may make more use of the asset in its early years, which accelerates its depreciation.

There are two commonly used forms of the declining balance method: the 150% declining method, and the double-declining method.

Both forms use the following formula for the computation of depreciation expense:

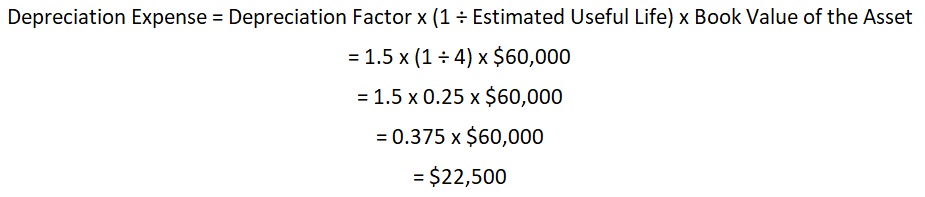

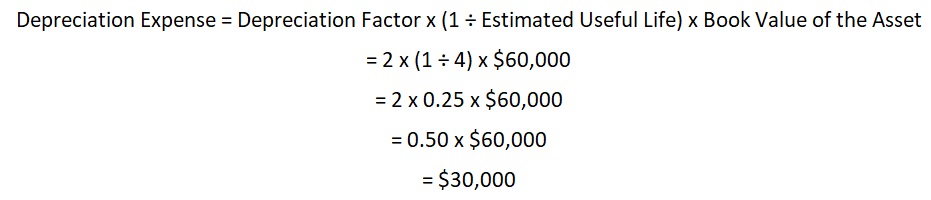

Depreciation Expense = Depreciation Factor x (1 ÷ Estimated Useful Life) x Book Value of the Asset

The depreciation factor will depend on whether you’re using the 150% declining method or the double-declining method.

Under the 150% declining method, the depreciation factor is 150% or 1.5.

Under the double-declining method, the depreciation factor is 200% or 2.

The declining balance method is suitable for assets that are more useful in their early years than in their later years.

Exercise#2

Byron acquires an asset for a total cost of $60,000.

He expects the asset to be useful for about 4 years.

He does not expect the asset to have any value after it is fully depreciated.

Let’s compute the amount of depreciation expense Byron must recognize using the declining balance method.

First, we will be using the 150% variant. For year 1, Byron must record a depreciation expense of:

For year 1, Byron must recognize a total depreciation expense of $22,500.

His monthly depreciation expense is=

$22,500 ÷ 12 = $1,875

For the rest of the years, refer to this table:

You can see from the table that the depreciation expense decreases as the years go by (except for year 4).

For the last year of the asset’s useful life, the formula will not be used.

Instead, the remaining book value for that year will be fully depreciated.

If the asset has a salvage value, subtract it from the remaining book value.

Now let’s compute for the depreciation expense using the double-declining variant:

Under the double-declining variant, a larger deprecation expense of $30,000 is recorded.

For the rest of the years, you can refer to this table:

As always, the formula is not used for the last useful life of the asset.

Instead, its remaining book value less salvage value is fully depreciated.

Sum-of-the-Years’ Digits (SYD)

The Sum-of-the-Years’ Digits (SYD) is another accelerated method of asset depreciation.

Just like the declining balance method, the rationale behind SYD is that some assets are more useful in their earlier years than their later years.

This method is best suited for an asset that loses most of its value in the earlier years of its useful life.

To compute depreciation expense using this method, we must first determine the useful life of the asset.

Then we add up the digits of each year of the asset’s useful life, hence the name.

For example, if an asset has a useful life of 5 years, then we add up the digits 1, 2, 3, 4, and 5.

This will result in a total of 15. This figure will be important for the computation of depreciation expenses under SYD, as shown in the following formula:

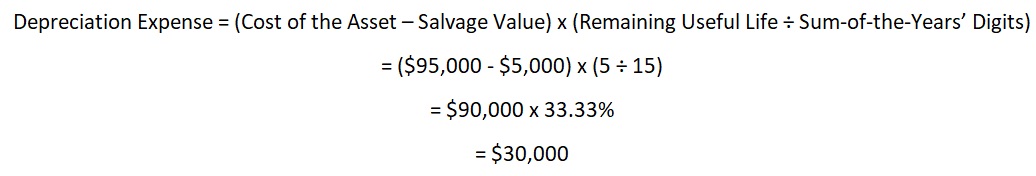

Depreciation Expense = (Cost of the Asset – Salvage Value) x (Remaining Useful Life ÷ Sum-of-the-Years’ Digits)

Let’s say that an asset has a useful life of 5 years.

That makes our SYD equal to 15.

At the beginning of the first year of its useful life, it still has 5 years remaining useful life.

The depreciation factor will then be 5 ÷ 15 = 33.33%.

For the second year, it will be 4 ÷ 15 = 26.67%, and so on and so forth.

Exercise#3

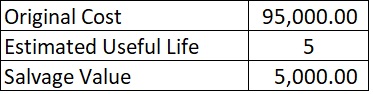

We gather the following data regarding a depreciable asset:

Let’s compute for this asset’s depreciation using SYD.

First, we must determine the SYD.

Since the asset has an estimated useful life of 5 years, its SYD is equal to:

1 + 2 + 3 + 4 + 5 = 15

For the first year, our depreciation expense will be:

We need to recognize a total of $30,000 depreciation expense for the asset’s first year.

The monthly depreciation for the first year will be:

$30,000 ÷ 12 = $2,500

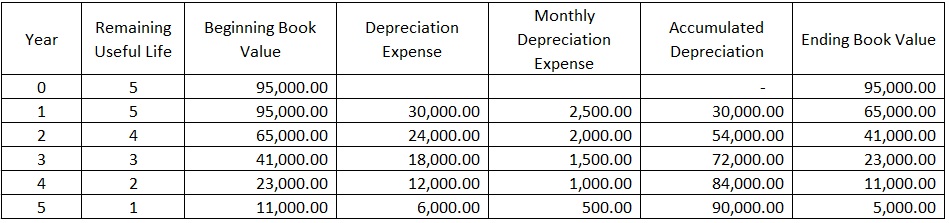

For the rest of the years, refer to this table:

You can see from the above table that the depreciation expense for the earlier years is greater than what it is in the later years.

This is because SYD is an accelerated method of depreciation.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School " 47 CFR § 32.3100 - Accumulated depreciation. " Page 1. January 13, 2022

Provo City School District "Plant Assets and Depreciation" Chapter 23. January 13, 2022

Harper College "CHAPTER 8 ACCOUNTING FOR LONG-TERM ASSETS" Chapter 8. January 13, 2022