Current Assets

Cash is an asset that all companies have in common.

A company needs cash for it to operate after all.

But cash is just one among the many assets that a company can have.

There is more to a company than just its cash.

For example, a company that deals in the sale of products will need to have an inventory of the products it sells.

A company that is in the business of manufacturing will need pieces of machinery and equipment for production.

There are two major classifications for assets: the current assets, and the non-current assets.

In this article, we will learn about current assets.

Current assets: what are they?

According to IAS (International Accounting Standards Committee) 1, current assets are assets that:

- Can be reliably realized in an entity’s normal operating cycle

- Held primarily for the trading purposes

- Can be reliably realized within 12 months after the reporting period

- Cash and cash equivalents (only includes unrestricted cash)

From the definition above, we can gather that if an asset can be reliably sold, traded, used, or liquidated within a year (usually through operations), we classify it as a current asset.

In other words, if it’s a liquid asset (an asset that can be easily converted to cash), it is a current asset.

Of course, with cash being the most liquid asset (unless restricted), it is a prime example of a current asset.

Other examples of current assets are inventory, accounts receivable, short-term investments, prepaid expenses, etc.

While there are assets that are acquired for capitalization purposes (such as properties, land, building), a current asset’s main purpose is to fund the day-to-day operations of a company.

Cash is needed to finance operations.

Inventory represents a company’s goods for sale.

Accounts receivable is acquired through non-cash sales.

Current assets are important for a company as they keep the company’s operations flowing.

Can you imagine a business running without its cash or inventory?

Current Assets in the Balance Sheet

In a company’s balance sheet, assets are listed according to their liquidity with the most liquid asset being listed first, and the least liquid asset listed last.

That’s why in most balance sheets, you’d see cash as the first listed item.

It is a company’s most liquid asset after all.

Cash and Cash Equivalents

Cash is cash.

It includes every coin and currency that a company owns, be it domestic or foreign.

Cash in bank, cash on hand, petty cash, cash in the registers – these are all accounted as cash.

Do note that for presentation purposes, foreign currencies must be translated to a company’s operating currency.

Cash equivalents are investments that can easily and reliably be converted to cash.

The US treasury bills, also referred to as “T-bills”, are an example of cash equivalents.

They can be converted to cash at any time with no risk, and with no loss in value.

They’re practically like cash, hence cash equivalents.

Accounts Receivable

Accounts receivable are acquired through non-cash sales.

It represents the whole amount of what customers owe the company.

For example, customer A ordered and received goods from your company and has yet to pay.

In such a case, your company should recognize accounts receivable to account for the sale (unless your company is employing the cash accounting method).

Do note that for accounts receivable to be classified as current assets, they should be collectible within a year.

Accounts receivable that have credit terms exceeding a year do not qualify as current assets.

It’s common practice for companies to recognize allowance for doubtful accounts (a contra-asset account against accounts receivable).

The reason for this is that some accounts are expected to never be collected, hence ‘doubtful accounts’.

By recognizing allowance for doubtful accounts, a company can present in its balance sheet the net accounts receivable which represents the amount that the company can reliably collect.

Inventory

Inventory represents the amount of a company’s goods available for sale.

For companies that are in the manufacturing business, inventory could include raw materials, work in process, and finished goods (which can also be treated as goods available for sale).

Just like with accounts receivable, inventory needs to be convertible to cash within a year for it to qualify as currents assets.

Most merchandise inventory can be classified as current assets as they can be reliably converted to cash within a year.

Prepaid Expenses

Prepaid expenses (also referred to as prepaid liabilities) are advance payments for expenses that the company expects to incur.

An example would be prepaid rent which is acquired when a company prepays their rent.

Although they are not convertible to cash, prepaid expenses qualify as current assets because they are expected to be used/consumed within a year.

Marketable Securities

Marketable securities are equity or debt securities that can be easily traded or sold.

Since these are heavily traded in public exchanges, it’s to be expected that there will always be buyers for these securities.

Because of their liquid nature, they qualify as current assets.

Non-trade Receivables

Non-trade receivables are receivables owed to the company by employees, suppliers, or other third parties through non-trade activities.

If a company allows it, employees can owe the company via salary advances or employee loans.

Suppliers may owe a company via prepaid deposits.

Either way, these are receivables that were not acquired through operations.

As with accounts receivable, non-trade receivables need to be collectible within a year to qualify as current assets.

Other Current Assets

A company may have assets that qualify as current assets but cannot be classified under the mentioned examples above.

A company may list the assets one by one, but if there are too many, they may opt to include all of it under the line item Other Current Assets.

Details of these assets will then be included in the notes to financial statements of the company.

Here’s a real-life balance sheet for illustration (showing only the Current Assets portion):

As can be seen from above, the first asset to be listed is Cash and cash equivalents being that they’re the most liquid asset.

The next line items will depend on a company’s history with the asset.

Apple Inc. has listed Marketable securities for its next current asset, which is then followed by Accounts receivable, Inventories, Vendor non-trade receivables, and lastly Other current assets in that order.

It could be that historically, marketable securities are Apple Inc.’s most liquid asset after cash and cash equivalents.

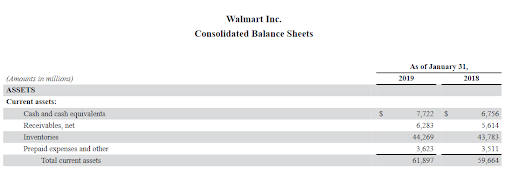

Let’s take a look at another company’s balance sheet to compare, this time Walmart Inc.’s:

Same with Apple Inc., Walmart Inc.’s balance sheet first listed Cash and cash equivalents.

It is then followed by Receivables, Inventories, Prepaid expenses and other (assets).

Notice that the order in which they listed their current assets is different from Apple Inc.

Now let’s try constructing the current assets section of a balance sheet.

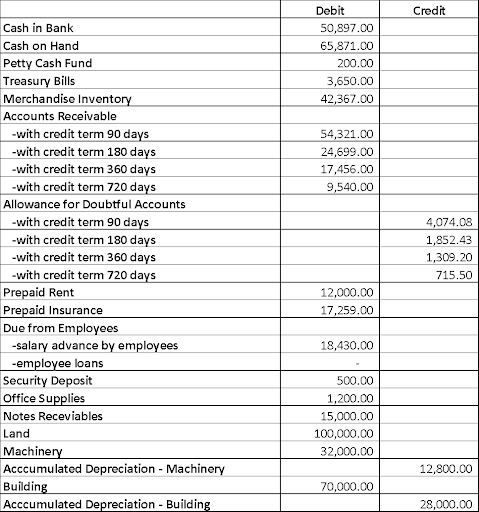

Suppose the Bee Company has these asset items in their trial balance:

The first step we need to take is to identify which assets qualify as current assets.

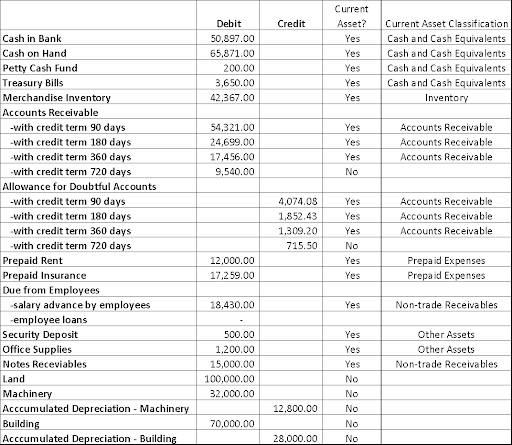

Next, we will classify these assets under these classifications: Cash and Cash Equivalents, Accounts Receivable, Inventory, Prepaid Expenses, Non-trade Receivables, and Other Assets.

Let’s identify and classify each asset:

Following the table above, the current asset section of BEE Company’s balance sheet should look like:

The importance of current assets

While the actual current assets are important to a company, the figure they are represented by in financial statements is important too.

The figure represents the liquidity of a company at a specific point in time.

It communicates to the owner/s if the company can sustain its day-to-day operations.

Management can use it to make decisions and suggest policies so that operations won’t be impeded due to a lack of liquid assets.

Creditors and investors are always concerned about a company’s current assets, as they need to know how liquid the company is – the more liquid a company is, the larger is its capacity to make timely payments.

Important financial ratios can be arrived at by using the current assets figure.

These ratios that measure a company’s liquidity are the Current Ratio, Quick Ratio, and Cash Ratio.

The Current Ratio can be used to measure a company capacity to settle its current liabilities with its current assets.

This ratio is computed by dividing the total current assets by total current liabilities.

If a company’s current ratio is more the 1, it means that that company has more current assets than current liabilities.

The Quick Ratio, similar to the current ratio, measures a company’s capacity to pay its current liabilities but only with its quick assets.

Quick assets refer to assets that can be converted into cash within 90 days or in a short period.

They are a company’s most liquid assets. Examples of quick assets are Cash and cash equivalents, accounts receivable, and marketable securities.

It is computed by dividing the total quick assets by total current liabilities.

The Cash Ratio measures a company’s capacity to immediately pay its current liabilities with only its cash and cash equivalents.

It is computed by dividing the total cash and cash equivalents by the total current liabilities.

Of the three liquidity ratios, the cash ratio is the most conservative and restrictive as it only allows cash and cash equivalents as payment for short-term debts.

Creditors are most interested in this ratio as it informs them if a company maintains sufficient cash to pay off its immediate obligations.

No other asset is more liquid than cash after all.

Let’s try computing liquidity ratios using Walmart Inc.’s balance sheet:

For the fiscal year ended January 31, 2019, Walmart Inc. has total current assets of $61,897,000,000.

It is composed of cash and cash equivalents – $7,772,000,000, receivables (net) – $6,283,000,000, inventories – $44,269,000,000, and prepaid expenses and other assets -$3,623,000,000.

Walmart Inc. has total current liabilities of $77,477,000,000.

With the above data, let’s compute the three liquidity ratios.

First, we compute the current ratio.

We compute for it by dividing total current assets by total current liabilities:

Current Ratio = $61,897,000,000 / $77,477,000,000

Current ratio = 0.8

Walmart Inc.’s current ratio is 0.8 which is less than 1.

That means that for $1 of current liability, Walmart Inc. only has $0.80 of current assets to pay it off.

Next, we compute the quick ratio by dividing total quick assets by total current liabilities.

In this case, the quick assets are the cash and cash equivalents, and receivables.

Quick Ratio = ($7,772,000,000 + $6,283,000,000) / $77,477,000,000

Quick Ratio = $14,055,000,000 / $77,477,000,000

Quick Ratio = 0.18

Walmart Inc.’s quick ratio is 0.18 which is significantly less than its current ratio.

It’s because a majority of their current assets consists of inventories the amount of which is not included in the computation of quick ratio.

Lastly, we compute the cash ratio by dividing total cash and cash equivalents by total current liabilities:

Cash ratio = $7,772,000,000 / $77,477,000,000

Cash ratio = 0.1

Walmart Inc.’s cash ratio is 0.1.

This means that Walmart Inc. only has $0.10 cash and cash equivalents for every $1 of current liabilities.

From what we gather from the computed ratios, Walmart Inc. isn’t liquid, which means that it can’t pay the entirety of its current liabilities with just its current assets.

Most of its current assets consist of inventories, which isn’t as liquid as cash.

Walmart Inc. might want to reconsider the amount of current assets it maintains so that it can reliably and readily pay for its current liabilities.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "703 Basis of Assets" Page 1 . August 30, 2021

IRS.gov "Accounting Periods and Methods" Page 1 . August 30, 2021

SBA.gov "Glossary of Business Financial Terms" Page 1 . August 30, 2021