Quick AssetsDefined along with Formula & How to Calculate

What are Quick Assets?

Quick Assets are highly liquid assets of a company that may already be in cash form or can be easily converted to cash.

Examples of Quick Assets are cash and cash equivalents, accounts receivable and marketable securities.

The Quick Ratio is the financial ratio used by management to assess the liquidity of the company and its ability to settle current liabilities as soon as possible.

The Basics of Quick Assets

Quick Assets are computed from the Current Assets of the company which includes highly liquid assets such as cash and equivalents, marketable securities, and accounts receivable.

Inventories are excluded from Quick Assets because it may take some time before they can be converted to cash.

The common practice of companies is to keep a portion of their quick assets under cash and marketable securities so that they can meet the investing, operating, and financing activities of the company.

However, should the company fall short in cash, it may resort to external financing to satisfy the immediate cash requirement of the business.

For some industries, especially those that sell products or services to another business, their accounts receivable tend to be higher.

But for retail companies that sell directly to customers, their accounts receivable balances may be too low.

Therefore, the accounts receivable amount on the Balance Sheet depends on the company’s business industry.

Examples of Quick Assets: Quick Ratio

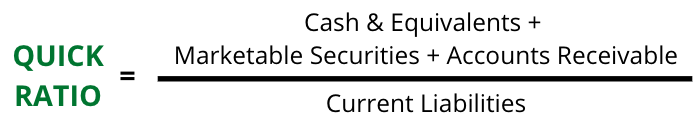

To measure the ability of a company to meet its obligations that are due within a year, the quick ratio is used.

The total quick assets are divided by the current liability to come up with the quick ratio.

The Quick Ratio is also referred to as an Acid Test Ratio.

Should the company’s sales or cash balance slow down, investors and analysts will be able to rely on the quick ratio to determine whether the company has the assets necessary to cover immediate obligations.

The formula of the Quick or Acid Test Ratio is shown below:

Another way to compute the Quick Ratio is also shown below:

Quick Assets vs. Current Assets

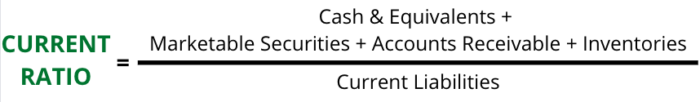

A conservative analysis of the company’s liquidity is provided by the Quick Ratio as it only includes highly liquid assets and excludes assets that are less liquid and may take time to convert to cash.

By using this calculation, companies are able to determine whether they can address short-term obligations when they become due.

While the Quick Ratio only includes the most liquid assets in the calculation and excludes inventories, a Current Ratio includes inventories.

To show it as a formula:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Iowa State University "Financial Ratios" Page 1 . October 13, 2022

University of Wisconsin Madison "Balance Sheet Ratios and Analysis for Cooperatives" Page 1 - 3. October 13, 2022