Accrued ExpenseExplained with Journal Entry Examples

What is an Accrued Expense?

Accrued Expense refers to expenses that a person or a company has already incurred but has not been paid yet.

They can also be referred to as Accrued Liabilities, and are recorded during the period when they were incurred.

Understanding Accrued Expenses

Accrued Expenses arise when companies adhere to the Accrual Basis of Accounting which states that expenses need to be recorded in the period when they were incurred, and not when they are paid.Sometimes, the amount of accrued expense will differ from the actual invoice sent by the supplier because they are only estimates.

Accrued Expense is recorded in the Current Liabilities section of the Balance Sheet, and represents the future liability that the company has to pay, typically within a year.

Examples of Accrued Expenses include salaries that are already due to employees at month end and they only get to be paid on the 1st day of the following month, or it could be purchases on credit payable within 30 days.

Accrual vs. Cash Basis Accounting

The difference between Cash Basis Accounting and Accrual Accounting is that in Cash Basis, transactions are only recorded when cash is received or paid.

The problem with this method is that financial reports may not be accurately presented because the recognition of expenses and sales are not recorded when they were incurred or earned.

As a result, there may be an overstatement or understatement of a company’s income and the other account balances.

Although it will take bookkeepers more effort – having to record journal entries for the accrual and then posting another entry for the cash payment or receipt – the recording of accrued transactions will allow companies to present a more accurate report of their financial statements.

This will in turn allow management to assess the financial health of the company and foresee their future financial position.

Accrued Expenses vs. Prepaid Expenses

Prepaid Expense refers to expenses that are paid in advance for a product or service that will only be delivered in the future.

On the other hand, an Accrued Expense is an expense that has already been incurred but the payment is yet to be made.

In the Balance Sheet, prepaid expenses are recorded as Current Assets while Accrued Expenses are recorded as Current Liabilities.

Examples of Accrued Expense

Purchase of Goods

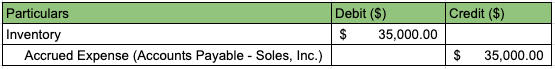

XZ Corporation is a Shoe manufacturing company and purchased raw materials from Soles Inc. worth $35,000 with a payment term of 30 days from receipt of goods.

When XZ Corporation received the items ordered from Soles Inc. on September 15, they will record this transaction with the below journal entry:

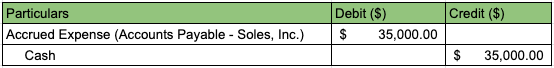

On October 15, 30 days after the items were received, XZ Corporation made a payment in favor of Soles Inc.

The journal entry to record the payment is:

In Accrual Basis Accounting, the company will have to record two journal entries – one to record the expense the company incurred and the corresponding liability for making a purchase on credit, and the second one is to record the payment of the goods purchased.

If the company was using Cash Basis Accounting, they would have only recorded one transaction on October 15 when the payment was made.

Salaries

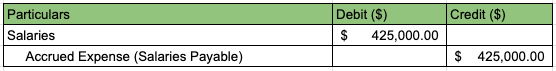

XZ Corporation’s employees are always paid on the 1st day of the following month for the current month’s wages.

At the end of the year, their payroll office reported that the total wages to be recorded for the month of December is $425,000.

The bookkeeper will then post the following journal entry to record the accrual of the salaries expense:

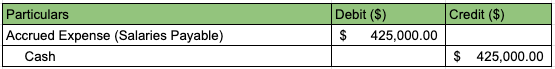

On January 1 of the following year, when the company pays the employees their wages, this will be the journal entry to be posted:

By recording accrued salaries expense, the company is able to report an accurate picture of their expenses related to the revenues which they have also earned for the same month.

This way, the expenses of the company for the year will not be understated, and the Net Income will not be overstated.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "Accounting Periods and Methods" Publication. February 7, 2022

Harvard "Accounting Accruals – What are they and why do we do them?" Page 1 . February 7, 2022