Impaired AssetsDefined, Examples & More

The value of things constantly changes over the years.

What was once valuable may be almost worthless tomorrow (and the reverse could be true too).

And that’s not yet accounting for depreciation.

Let’s take a look at one of the previously popular cellular phones- the Nokia 3310.

Known for its durability (to the point where it’s jokingly exaggerated by the internet) and affordability (compared to other cellphones of the time), the Nokia 3310 can be seen as a giant of its time.

It was priced at $160 upon release.

In 2003, the Nokia 3310 was retailing for less than $60– that’s more than a 50% drop in price in just three years!

Imagine now in the year 2021 how much a Nokia 3310 would cost you.

And I’m referring to the original model, not the updated 2021 version.

Probably not much right?

And if it costs the same as the cheapest smartphone today or maybe even less, you’d probably still choose the smartphone anyway.

The decrease in the value of the Nokia 3310 is the result of technological obsolescence – one of the possible causes of asset impairment.

What is asset impairment you ask?

A brief description of it would be “a non-recoverable reduction in the value of an asset”.

Although it results in the reduction of an asset’s value, it is not to be confused with depreciation and amortization.

In this article, we will learn more about what asset impairment is, and how it can affect your business.

IAS 36 – Impairment of Assets

IAS 36 Impairment of Assets is an international accounting standard that “seeks to ensure that an entity’s assets are not carried at more than their recoverable amount (i.e. the higher of fair value less costs of disposal and value in use)” (source: IAS 36 – Impairment of Assets).

It contains guidelines on when an asset should be tested for impairment, what are the indications of impairment, what happens when an asset is impaired, when an impairment loss can be reversed, etc.

What is asset impairment?

Asset impairment is what occurs when an asset’s recoverable value is less than its carrying value.

There are several possible indicators of impairment, both external and internal.

Recoverable value refers to the greater of an asset’s fair value less cost to sell or its value in use.

Value in use refers to the present value of the future cash flow expected to be derived from an asset.

If either recoverable or value in use is lesser than an asset’s carrying amount (or book value), then there is asset impairment.

The difference between an asset’s carrying amount and the greater of the fair value less cost to sell, or value in use, is then recorded as an impairment loss in the company’s books.

The most prominent example of asset impairment is the goodwill impairment that came out of the AOL-Time Warner merger.

In 2002, AOL Time Warner Inc. recorded an impairment loss of $45.5 billion and a majority of it is related to goodwill impairment.

To put into context AOL acquired Time Warner on January 10, 2001 (two years before the impairment) which generated $127 billion of goodwill in AOL’s books.

The impairment was caused by a significantly lesser cash inflow than what was expected.

Source: AOL Time Warner Inc. 2002 10K

What is an impaired asset?

When an asset is affected by impairment, then it becomes an impaired asset.

If an asset’s book value is greater than its recoverable value, then it is most probably an impaired asset.

Therefore, its book value must be written down to its recoverable value.

Along with the writing down of book value, an impairment loss is recorded.

Goodwill and long-term tangible assets are the common victims of impairment.

Let’s take a look once again at the AOL Time Warner Inc. example above.

As a result of the goodwill impairment, the company’s goodwill has become an impaired asset.

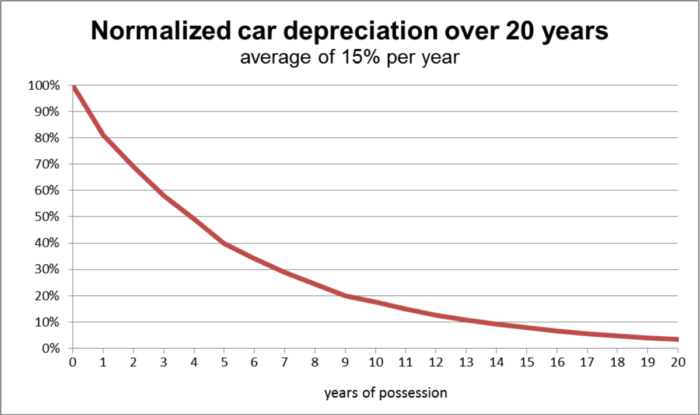

Assets that are depreciated on an accelerated basis are less likely to be affected by impairment.

This is because the net book value of such assets is less likely to be more than their recoverable value due to the accelerated depreciation.

What is an impairment test?

An impairment test is a set of procedures performed by a company on an asset or asset that it finds to be affected by asset impairment.

If there is evidence that the carrying amount (or book value) of an asset may be higher than its recoverable value, then there might be impairment and as such, an impairment test must be performed.

A company is required to perform an impairment test on an asset (or asset group) if there is any indication of impairment.

If even one of the internal or external indicators previously mentioned is present, then an impairment test must be performed on an asset.

An asset can be tested for impairment more than once in a period.

Assets that have an indefinite useful life such as Goodwill are required to be tested for impairment at least once a year.

This is because these assets are not subject to amortization, and so to reflect any decreases in their value, they need to be tested for impairment.

If an asset’s recoverable value is confirmed to be less than its book value, then there is an impairment loss.

Therefore, the book value of the asset must be reduced to its recoverable value, and a corresponding impairment loss must be recognized.

When do you recognize impairment loss?

When to record impairment loss and how much should be recorded depends on which accounting standard is being followed (IFRS or US GAAP).

Under the IFRS, a one-step approach is implemented in which an impairment loss is recorded if the carrying amount (or book value) of an asset is greater than its recoverable amount.

Recoverable amount refers to the greater of an asset’s fair value less cost to sell or value in use.

For example, let’s say company A has an asset that is expected to bring in $8,000 annual revenue for the next five years at a discount rate of 3%.

Computing for the present value of cash flow results in $36,637.66, which is the asset’s value in use.

As per expert opinion, the asset is said to have a fair value of $38,000 and is expected to have a selling cost of $3,000 (resulting in a net fair value of $35,000).

Assuming that the asset has a book value of $40,000, then it would have to be written down for impairment.

Since the value in use is the greater of the two, the asset’s book value would have to be written down by $3,362.34, and a corresponding impairment loss must be recognized.

If there was no selling cost, then the asset’s book value will have to be written down by $2,000 to reflect the $38,000 fair value.

Under the US GAAP, a two-step approach is implemented.

The first step is to perform a recoverability test that determines whether an asset should be impaired.

This is done by comparing the asset’s book value with the undiscounted cash flows that the asset is expected to generate.

If the asset’s book value is greater, then an asset impairment is recognized.

Otherwise, the asset does need to be impaired.

The second step is to measure the amount of impairment loss to be recorded.

This is done by comparing an asset’s book value to its fair value (or value in use if the fair value cannot be determined).

The difference between the two is recorded as an impairment loss.

Using the example we had for the IFRS method, we apply the first step.

The undiscounted cash flows expected to be generated by the asset amounted to $40,000.

Since the book value is not greater than the undiscounted cash flows, the asset does not need to be impaired.

If we change the asset’s book value to $42,000, then there is asset impairment, and therefore an impairment loss must be recorded.

We then proceed to step 2.

Proceeding to step 2, we then compare the asset’s book value of $42,000 with its fair value.

The asset’s fair value is $38,000, and therefore, its book value should be written down by $4,000.

A corresponding impairment loss is to be recorded.

What are the indications of asset impairment?

Asset impairment can be caused by both internal and external factors.

Some examples of external indicators include:

- A technological advancement that causes technological obsolescence to an asset, which in turn results in a decrease in the value of the asset. The aforementioned Nokia 3310 story above is an example of this. Another example is the decline of floppy disks when USB flash drives and memory cards were introduced.

- The release of new economic and/or legal rules and regulations that negatively affect the value and function of an asset. An extreme example of this is when the government decides to ban the use of certain pieces of equipment and machinery. Since the asset can no longer be legally used, its value declines and may even be worthless.

- A market downturn – or when the market or key market indexes take a dip. While a market downturn does not always result in a decrease in an asset’s value, the fact that it still can makes it an indicator of asset impairment.

- Increases in market interest rates. Usually, when there is a drastic increase in market interest rates, the value of most assets falls.

- The market value of the asset declines. Market value (also referred to as open market valuation (OMV) refers to the price an asset would usually sell in the marketplace. It can also refer to the value of particular equity or business given by the investment community. Basically, if the valuation of an asset given by these external parties decreases, then it may indicate that there is asset impairment.

- When the carrying/book value of a company’s net assets is higher than the market capitalization. Market capitalization refers to the current price of a company’s outstanding shares. It can be computed by multiplying the current price of a single share by the number of outstanding shares. If the resulting figure is less than the book value of a company’s net assets, there probably is asset impairment.

Some examples of internal indicators include:

- The deterioration of an asset beyond the normal wear and tear due to lack of proper maintenance. The normal wear and tear of a long-term asset are already accounted for by recognizing depreciation expense (for tangible assets) or amortization expense (for intangible assets). If it is found out that the asset deteriorated beyond its expected wear and tear, then it might indicate that there is asset impairment

- An asset is performing worse economically than expected. For example, if an asset was expected to bring annual revenue of at least $5,000.00 but only generates $3,000 for consecutive periods, then that may be an indication that the asset is impaired

- There is evidence of physical damage. If an asset is damaged, it may no longer be able to function at its maximum capacity. As such, there is an indication that the asset is impaired.

- There is evidence of obsolescence. An asset has become obsolete if it can no longer be sold or used. For example, a company has 80 units of products to be sold. It sold 40 of them. The remaining 40 are deemed unsellable. This makes them obsolete and should be tested for impairment. Another example: a company had a computer dedicated to running certain machinery in its factory. Due to necessary repairs made to the machinery, it has become incompatible with the computer. This makes the computer obsolete since it is no longer usable.

- An asset is set for disposal earlier than the previously set disposal date. For example, an asset was slated for disposal at the end of its useful life which is on December 2025. However, due to circumstances, the asset is planned to be sold at a significantly earlier time – June 2022. The asset being disposed of significantly earlier may indicate that there is asset impairment

- An asset is becoming idle or has been sitting idle for a considerable amount of time. Not only is an idle asset still subjected to depreciation, it should also be tested for impairment.

- An asset is reassessed to have a finite useful life instead of an indefinite one. This rarely happens as most long-term assets (except land and goodwill) have a finite useful life. However, if an asset that was once deemed to have an indefinite useful life turned to have a finite useful life, it should be tested for impairment.

- There is a plan to discontinue or restructure an operation to which an asset belongs. For example, a particular plant is to be discontinued. This might be an indicator that any asset located within the plant is impaired.

- The carrying amount of investment in subsidiaries, joint ventures, or associates is higher than the carrying amount of the investee’s assets, or that the investment failed to provide the expected profits.

Note that there might be other impairment indicators that have not been mentioned in the above list.

Just know that if there is evidence that an asset’s carrying amount might be higher than its recoverable value, then there is an indication of impairment.

Are all assets susceptible to impairment?

While it is widely believed that only accounts receivable, and long-term assets (both tangible and intangible) are susceptible to impairment, the fact of the matter is that any asset is susceptible to impairment, even cash!

It is true though that accounts receivable, and long-term assets are the most likely targets of asset impairment.

This is because these assets often have long useful lives (for long-term assets) or can be outstanding for a long time (for accounts receivable).

And because of that, they are more susceptible to any changes in value.

An example of cash being impaired is when a bank that you deposited in goes bankrupt and can no longer return the money you deposited.

It does not happen often as much as the impairment of long-term assets, but the possibility of it happening is there.

Another example of impairment of an asset that is not a long-term asset is when inventory becomes obsolete.

If a company’s inventory (could be the whole inventory or just a part of it) is deemed to be unsellable, it becomes obsolete.

And since asset obsolescence is an indicator of impairment, then the company’s inventory is most probably impaired.

In short, all assets are susceptible to impairment.

Accounts receivable and long-term assets are more likely to be affected by asset impairment.

Impairment VS Depreciation and Amortization

While the three are related to the reduction in the value of an asset, they are not the same.

The main difference is that depreciation and amortization are expected reductions.

Impairment is not.

Impairment denotes a sudden and irreversible drop in an asset’s value.

On the other hand, depreciation and amortization are reductions in an asset’s value that are spread over its useful life.

Depreciation and amortization are expected of an asset and are recognized annually.

Impairment is unexpected and cannot be planned for unless the indicators are present.

An asset does not need to be tested for depreciation and amortization.

On the other hand, an impairment test must be performed on an asset before impairment loss can be recognized.

Impairment applies to both tangible and intangible assets.

Depreciation only applies to tangible assets, and amortization only applies to intangible assets.

Can Impairment be reversed?

Under US GAAP, reversal of impairment is not allowed, which makes the recognition of impairment loss truly permanent.

This is in stark contrast with the IFRS which allows the reversal of impairment loss (except for goodwill impairment).

Goodwill impairment cannot be reversed under any circumstances whether you’re following the IFRS or the US GAAP.

Nonetheless, it’s still important to know when impairment can be reversed. Quoting directly from IAS 36, the procedures for recognizing reversal of impairment are as follows:

- Same approach as for the identification of impaired assets: assess at each balance sheet date whether there is an indication that an impairment loss may have decreased. If so, calculate recoverable amount. [IAS 36.110]

- No reversal for unwinding of discount. [IAS 36.116]

- The increased carrying amount due to reversal should not be more than what the depreciated historical cost would have been if the impairment had not been recognised. [IAS 36.117]

- Reversal of an impairment loss is recognized in the profit or loss unless it relates to a revalued asset [IAS 36.119]

- Adjust depreciation for future periods. [IAS 36.121]

- Reversal of an impairment loss for goodwill is prohibited. [IAS 36.124]

Impairment and COVID-19

The global pandemic brought along with it a lull in the economic landscape of the US.

Some businesses had to stop their operations, some had to shut down their stores and warehouses.

There is no doubt that COVID-19 brought with indicators of impairment.

If your business’s core operations are affected by the pandemic, then it is advisable to test your assets for impairment.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Financial Accounting Standars Board "Asset impairment" Page 1. October 26, 2021

Appalachian State University "Impaired Capital Assets" Page 1 . October 26, 2021

University of Richmond "A Study of Long-Lived Asset Impairment UnderU.S. GAAP and IFRS Within the U.S. InstitutionalEnvironment" Page 1. October 26, 2021