Accounts Receivable LedgerDefined with Examples & More

Having a sound and well-functioning accounting system is essential for the success of your business.

Without one, a lot of misrepresentations and misappropriations can happen.

Assets, particularly cash, can be easily embezzled.

Revenue and income can be easily overstated.

There’s no proper tracking of accounts receivable.

Overall, it’s just not a good look for the business.

This is why businesses invest in their accounting function, some even spending more for the monitoring of certain asset accounts.

One of the asset accounts that might need a little bit more attention is the “accounts receivable”.

In essence, “accounts receivable” is the accumulation of non-interest bearing loans extended to customers who purchased products or availed of services on credit.

If not properly maintained and/or monitored, the business might lose track of its receivables and lose money in the process.

Fortunately, there are many tools available that can help in the management of accounts receivable such as financial ratios, aging reports, and various special journals.

One of these tools is the so-called accounts receivable subsidiary ledger, or simply called accounts receivable ledger.

After reading this article, you will be equipped with knowledge about the accounts receivable ledger and why it’s worth it to maintain one.

What is “accounts receivable”?

When a business makes a credit sale, it won’t be receiving cash yet.

Rather, it receives a promise to be paid at later date.

To represent this promise of payment, an asset account is recorded – the accounts receivables.

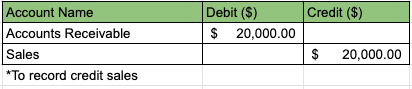

As an illustration, let’s say that company LC made a credit sale of $20,000.

To record the transaction, company LC will enter in its journal the following entry:

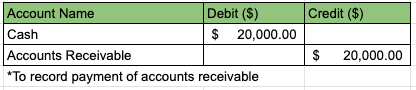

When full payment is eventually received from such sale, the journal entry will be:

Accounts receivable are typically treated as current assets because they are usually convertible to cash within a year.

However, some accounts receivable may also be treated as non-current assets if they are expected to be converted to cash after a year or so.

Accounts receivable ledger – what is it?

The accounts receivable ledger (also referred to as the accounts receivable subsidiary ledger) is an accounting ledger in which all transactions related to accounts receivable are recorded (e.g. credit sales, payment of accounts receivable, sales returns, etc.).

It is more detailed than the general ledger as it also includes the transaction and payment of each customer who availed themselves of credit.

The total balance of the accounts receivable ledger is regularly matched with the balance of the accounts receivable in the general ledger.

This is to ensure accuracy.

Businesses use the account receivable ledger to account for and record every transaction (e.g. sale, payment) for each customer/buyer.

It is especially useful if the business has many customers that avail themselves of credit.

With just the general ledger and journals, it’d be hard to keep track of them individually.

Thankfully, there is the accounts receivable ledger.

With it, the business now has a record of each customer’s outstanding balance as opposed to just knowing the total balance that it expects to collect/receive.

The information that is usually recorded in the accounts receivable ledger includes the following:

- The invoice amount, date, and number

- Name of customer

- Record of payments

- Debit and credit memorandums

- Discounts, returns, and allowances

- Reference for each recorded transaction (e.g. general journal, cash receipts book, sales book)

Here’s a simple example of what an accounts receivable ledger would look like:

Again, it’s important that the total balance of the subsidiary ledger correlates to the accounts receivable balance in the general ledger.

This makes it easier for accountants and bookkeepers to detect discrepancies and errors.

If the balances are not equal, then reconciliation must be done.

Am I required to prepare an accounts receivable ledger?

Technically, no, you’re not required to prepare an accounts receivable ledger.

In fact, you are not required to prepare any kind of subsidiary ledger at all.

Oftentimes, the general ledger will suffice… for most small businesses anyways.

For medium to large businesses that cater to many customers, the general ledger might not be enough on its own.

Note though that while it isn’t required, it’s still recommended that you prepare and maintain an accounts receivable ledger.

Why you should maintain an accounts receivable ledger

Admittedly, preparing and maintaining an accounts receivable ledger is extra work.

However, let me tell you now that the benefits you get from doing so are worth it.

It keeps your general ledger from being cluttered. Plus, you can customize what specific details you want to include in your accounts receivable ledger.

If your business is catering to a lot of customers, say 50 or more, then whether you should maintain an accounts receivable subsidiary ledger or not is a no-brainer – you definitely should.

If no accounts receivable ledger is maintained, then all transactions will be recorded on the general ledger.

Or it could be that there will be no detailed information about the accounts receivable transactions.

Just imagine having tens or hundreds of customers purchasing or paying at the same time, it’d be hard or maybe even impossible to keep track of a specific customer’s credit balance.

This is because you’ll be recording all accounts receivable transactions (e.g. credit sales, sales returns, sales discounts, payments) in one account.

An individual customer’s accounts receivable balance will be buried among the hundreds or even thousands of recorded transactions.

With the accounts receivable ledger, you won’t have to worry about any of that.

It can grant you quick access to each customer’s credit balance, as well as all of its related transactions.

So if you want to have a detailed record of your accounts receivable on a per-customer basis, then you might want to prepare and maintain an accounts receivable ledger

Benefits of maintaining an accounts receivable ledger

The main benefit of having an accounts receivable ledger is that gives us access to more detailed information about a business’s accounts receivable.

It makes it easier to gather data about an individual customer’s credit balance.

That said, it’s recommended that you assign to at least one employee the responsibility of preparing and maintaining your business’s accounts receivable ledger.

This will ensure that the ledger is properly maintained.

Fraud prevention

You can also restrict access to your accounts receivable ledger so that only authorized personnel can view it.

For example, you can restrict access to just you, the top management, the accountant, the employees of the credit department, and the accounts receivable ledger/bookkeeper.

This way, employees that have no business with credit sales or accounts receivable cannot access your business’ accounts receivable ledger.

This helps in preventing internal fraud and embezzlement.

Since access is limited, it’d be relatively easier to pinpoint who’s responsible whenever there is fraud or embezzlement.

Some of the common accounts receivable scams include the following:

- Lapping

- Fraudulent receivables to offset bogus sales

- Posting a customer’s payment to another unrelated customer’s account in an attempt to disguise embezzlement

- Borrowing against receivables using customer accounts as collateral

These can all be prevented with the accounts receivable ledger and proper internal controls.

Easier project management

An accounts receivable ledger can also help in the management of a business’s various projects.

Let’s say that your business maintains several projects for various groups of customers.

Since an accounts receivable ledger can give you access to detailed information about a customer’s balance, it’d be easier for you to classify your customers.

For example, Let’s say you provide song production, songwriting, and musical instrument lessons as services.

You can classify your accounts receivable for each of the services your business provides.

That way, you can track which customer still owes your business money, and for which job.

Say a customer who availed of songwriting services hasn’t paid for it yet.

You can easily track that with an accounts receivable ledger.

Not only that, it gives you a feel of which services/projects are most profitable, and which demographic usually pays on time.

Speaking of which…

Makes it easier for you to understand your demographic

Another benefit of maintaining a subsidiary ledger is that it can aid you in establishing your demographic and target market.

With it, you can identify which age group is most likely to pay on time (e.g. teens, young adults, adults), which geographic region is more likely to purchase a product or avail of a service, or which particular industry offers you more business as well as cash inflow.

You can then design a certain product or service that specifically caters to the preferences of these customers.

You can also give special discounts or looser credit terms to encourage them to purchase more of your products or avail of more of your services

Conclusion

While it isn’t really required for you to maintain an accounts receivable ledger for your business, it is still recommended that you do so.

Yes, it means extra work.

Yes, it requires resources.

But the benefits it provides easily outweigh the cost.

With an accounts receivable ledger, you’d have access to detailed information about an individual customer’s account.

This makes it easier to track who has already paid and who still owes your business money.

With it, you can also determine which group of customers pay diligently, and who only pay when they are reminded.

Lastly, with proper internal controls, the accounts receivable ledger can help in preventing fraud and embezzlement.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Vermont "What is Accounts Receivable?" Page 37-45. November 17, 2021

Cornell University "Accounts Receivable" Page 1. November 17, 2021

University of Georgia "ACCOUNTS RECEIVABLE, AR AGING RECONCILIATION & ANALYSIS" White paper. November 17, 2021