Asset DisposalDefined with Examples & More

When running a business, you’ll be accumulating properties that add value to your business by contributing to revenue generation.

We refer to these properties as assets.

Some of these assets will serve your business for years.

For example, the machinery and equipment you use for the manufacturing of your products can serve you for several years.

While it would be ideal if all of your assets had an indefinite life, that’s just not the case.

Assets eventually lose their value and usefulness after years of use.

When an asset no longer contributes to the profit generation of your business, you may want to dispose of it.

But it’s not like you part ways with an asset only when it becomes fully depreciated.

Sometimes, you may opt to sell the asset even if you can still get some use out of it.

This could be because you’re upgrading, or just needing an injection of cash.

Either way, by selling your asset, you’ll be parting with it.

In a way, by selling your asset, you’re also disposing of it.

Like any transaction that your business participates in, you have to account for asset disposals.

If not properly accounted for, you may misrepresent your total asset.

You may report assets that you’ve already disposed of on your business’s balance sheet as still existing or it could be the other way around.

Both scenarios result in an inaccurate balance sheet and for this reason asset disposals must be properly documented.

In this article, we will discuss what asset disposal is and how to account for it.

We’ll also go over some exercises and examples to deepen our understanding of asset disposal.

Asset Disposal: What is it?

Asset disposal is the act of removing an asset, particularly a long-term asset, from a business’s financial records.

It may be the result of several events such as the following:

- The asset is fully depreciated, and as such, must be disposed of. If an asset is fully depreciated, it probably does not add value to a business anymore. If the business decides to keep it, it might incur unnecessary maintenance costs

- The business sold the asset for whatever reason. A business upgrading its equipment is a common reason. Since the business is upgrading its equipment, it will have to dispose of its current ones

- The business loses ownership or possession of the asset due to unforeseen circumstances (e.g. theft, force majeure, etc.)

Proper accounting for asset disposal is important for any business.

Long-term assets often contribute greatly to the success of a business.

As such, it’s crucial to properly account for them.

Proper documentation of assets disposals also helps in keeping accounting records clean and updated.

It also ensures that your financial records are relevant and accurate.

If asset disposal has compensation (usually due to the sale of the asset), it can result in a disposal gain or loss.

When the disposal proceeds are greater than the carrying value of the asset, there will be a disposal gain.

When the proceeds are lesser instead, there will be a disposal loss. Lastly, if the difference between the disposal proceeds and the carrying value of the asset is zero, there will be neither gain nor loss.

Accounting for Asset Disposal

Accounting for asset disposal is pretty simple.

You only have to close the corresponding asset accounts and contra-asset accounts.

For example, you have a piece of fully-depreciated equipment.

Since it is already depreciated, you decide to dispose of it.

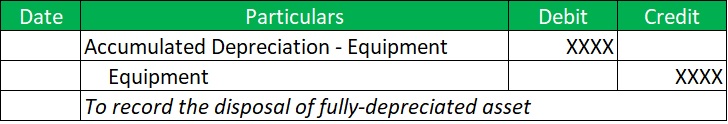

In the above case, the accounts that we’ll have to close are the Equipment asset account, and the Accumulated Depreciation – Equipment contra-asset account.

Since an asset account normally has a debit balance, we need to credit it to close it out.

On the other hand, a contra-asset account normally has a credit account.

As such, we need to debit it to close it.

The journal entry for the disposal of the piece of fully-depreciated equipment should look like this:

An asset becomes fully depreciated when it reaches the end of if useful life. (For more information about depreciation and accumulated depreciation, you may refer to this article.)

An asset becomes fully depreciated when it reaches the end of if useful life. (For more information about depreciation and accumulated depreciation, you may refer to this article.)

Exercise #1

Tom owns a piece of machinery that he acquired for $30,000.

It has an estimated useful life of five years.

Tom also surmised that it won’t have any value after it fully serves its useful life.

Thus, the asset does not have a salvage value.

Tom uses the straight-line method to record the asset’s depreciation.

Today, the piece of machinery reaches the end of its useful life.

Since Tom won’t be getting any use out of it anymore, he decides to dispose of it.

What should his journal entry or entries be to record the asset disposal?

This is a case of asset disposal due to an asset reaching the end of its useful life (a.k.a. fully-depreciated asset).

To record the asset disposal, we have to close out the corresponding asset and contra-asset accounts.

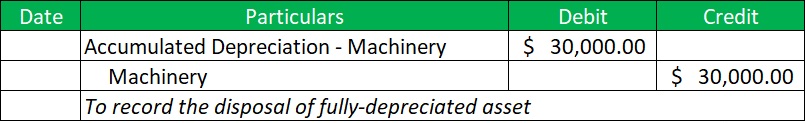

In this case, we have to close out the Machinery and Accumulated Depreciation – Machinery accounts.

We already know what the balance of the Machinery account is: $30,000 (which is its acquisition cost).

But how about the balance for the Accumulated Depreciation – Machinery account?

For fully-depreciated assets that don’t have a salvage value, it’s simple.

Whatever the cost of the asset is will be its accumulated depreciation when it becomes fully depreciated.

And this is the case with Tom’s piece of machinery.

As such, the balance of Accumulated Depreciation – Machinery is also $30,000.

Thus, the journal entry for the disposal of Tom’s piece of machinery should be:

Asset Disposal via Sale of an Asset

Asset disposal does not only occur when the asset becomes fully deprecated.

It also occurs if a business loses ownership or possession of the asset.

For example, a business will lose ownership over an asset if the business sells it.

In such a case, the business has to de-recognize the asset from its books.

Hence, asset disposal.

Of course, the sale of an asset means that the business will be receiving some form of compensation (usually in the form of cash).

As such, there is an opportunity for a business to gain from the sale of an asset.

However, it also means that a business can also incur losses if the compensation received is less than the carrying value of the asset being sold.

Suppose that a business is able to sell an asset for more than its carrying value.

Such a sale will result in a disposal gain.

This gain from the sale of the asset must be recorded in the business’s books.

As such, the journal entry for the asset disposal with disposal gain should be:

Conversely, if the proceeds from the sale of the asset are less than the carrying value of the asset, the business suffers a disposal loss instead.

Same with the disposal gain, disposal loss must be recorded in the business’s books.

The journal entry for asset disposal with disposal loss should look like this:

When the proceeds of the sale are equal to the carrying value of the asset, there will be neither gain nor loss on asset disposal. The journal entry should then be:

Exercise#2

Jerry owns a piece of equipment that he acquired for $20,000.

It has an estimated useful life of 5 years.

Jerry estimates that he’ll be able to sell it for $200 at the end of its useful life.

He decides to use the straight-line method to record the depreciation of the asset.

At the end of the 3rd year of the asset, Jerry decides to sell it as he’ll be upgrading his equipment.

He receives $9,000 from the sale of the asset.

What do you think his journal entry or entries should be for the sale of the piece of equipment?

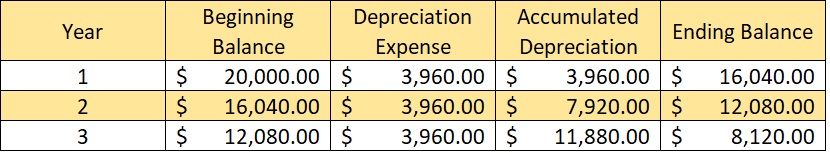

First, we need to calculate the annual depreciation expense of the piece of equipment:

Depreciation Expense is calculated by subtracting the asset’s salvage value from its original cost and then dividing the result by its estimated useful life.

= ($20,000 – $200) ÷ 5

= $3,960

Then we compute for the accumulated depreciation. Since it is the end of the asset’s 3rd year, we simply need to multiply the annual depreciation by 3:

$3,960 x 3 = $11,880

So now that we have our accumulated depreciation, we can compute the asset’s carrying value.

To do so, we only have to subtract the asset’s accumulated depreciation from its cost:

$20,000 – $11,800 = $8,120

All these computations can also be found in the table below:

The next step is to compute whether Jerry made a gain or loss from the sale of the asset.

To do so, we subtract the carrying value of the asset from the proceeds of the sale.

If the resulting figure is positive, then there is a gain on disposal.

If it’s negative, there is a loss on disposal.

$9,000 – $8,120 = $880

As per computation, there is a gain on disposal.

The journal entry for the sale of the piece of equipment should then be:

Asset Disposal Due to Unforeseen Circumstances

When a business loses possession of an asset, asset disposal occurs.

This could happen due to several reasons that are outside of the business’s control or normal operations.

For example, a business may lose possession of an asset due to theft.

A business can also lose possession of an asset due to natural disasters such as storms or typhoons.

In such cases, the business has to de-recognize the asset from its books as it can no longer benefit from the asset.

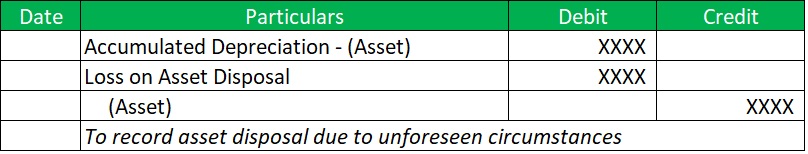

Unless the asset is already fully depreciated, there will always be a loss on asset disposal due to unforeseen circumstances.

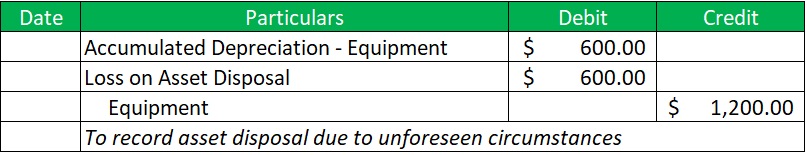

The amount of loss will always be equal to the carrying value of the asset. As such, the journal entry should be:

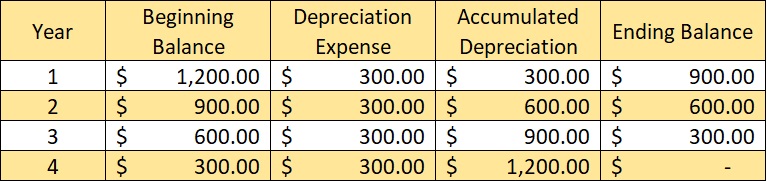

For example, let’s say that Butch owns a piece of equipment which he acquired for $1,200.

He estimates that he can use it for 4 years at most. He also gathers that it has no value after that.

At the end of the 2nd year of the asset’s life, Butch’s piece of equipment was stolen.

Despite best efforts, Butch cannot recover it.

As such, he has to de-recognize it from his books.

Assuming that Butch uses the straight-line method for the depreciation of the asset, his depreciation schedule should look like this:

At the end of the 2nd year of the asset’s life, it has an accumulated depreciation is $600 and a carrying value of $600. As such, the journal entry for the asset disposal should be:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "Publication 544 (2020), Sales and Other Dispositions of Assets" Page 1 . February 4, 2022

IRS.gov "Topic No. 703 Basis of Assets" Page 1 . February 4, 2022

IRS.gov "About Form 4797, Sales of Business Property" Page 1 . February 4, 2022