Plant AssetsLong-term assets that contribute to the revenue generation of the business

A business, even the small ones, will own some form of assets eventually (aside from cash, that is).

A retail business will purchase supplies so that it can have goods to sell.

A manufacturing business will purchase materials that it will use to produce goods that it will eventually sell.

Some businesses may even acquire non-cash assets in the form of accounts receivable, which are essentially short-term loans to customers that don’t accrue interest.

All of these assets contribute to the total earnings and overall value of the business.

Some assets can even provide the business monetary benefits for more than just one period.

For example, if a business owns a building, then it can enjoy the benefits that the building provides for as long as its useful life allows (which is usually not less than 20 years).

Another example would be the machinery and equipment used in the production process.

The business can use these assets to produce its goods and they usually have a useful life of 5 years or more.

Among these assets that have long lives are plant assets.

These assets often provide long-lasting benefits to the business, which is why they are still sought after even though they can be expensive.

Understanding how these plant assets operate can be beneficial in managing the operations of the business.

In this article, we will be discussing what plant assets are.

How does one know whether an asset is a plant asset or not?

What are the possible benefits that a plant asset can provide?

How should a business account for its plant assets?

Are plant assets current assets?

Let’s try to answer these questions as we go along with the article.

What are Plant Assets?

The term “plant asset” was birthed in the industrial revolution era.

During this era, most businesses were factories and plants, which is why the term “plant” assets came to.

The term refers to long-term tangible assets that contribute to the revenue generation and operations of the business.

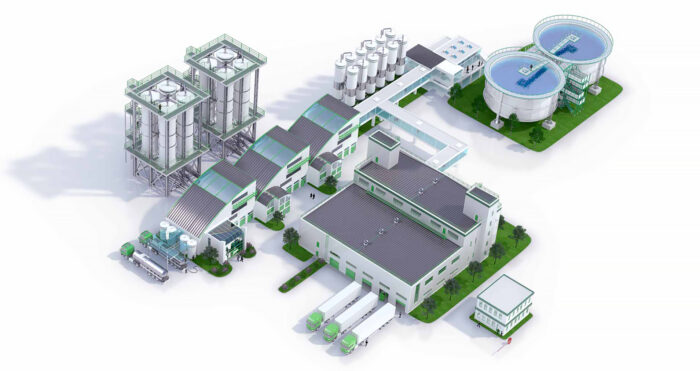

Examples of plant assets include factory equipment, machinery, production plants, etc.

However, the term “plant assets” is not limited to just assets that you can find in a factory or plant.

It could also include office equipment, vehicles, furniture and fixtures, land, etc.

Basically, as long as it’s a long-term tangible asset that the business uses to generate revenue, then it may be a plant asset.

Since plant assets have a useful life that is greater than 1 year, their cost will not be recorded as an expense outright during their acquisition or purchase.

Rather, the business will spread out the cost over the asset’s useful life via depreciation.

For example, if a plant asset has an acquisition of $25,000 (no salvage value) and a useful life of 5 years, assuming that the business uses the straight-line depreciation method, then it will record an annual depreciation expense of $5,000 every year until the end of the asset’s useful life.

Do note that land, while a plant asset, is non-depreciable. Land usually has an indefinite useful life and as such, it does not depreciate.

Nowadays, the term “plant assets” isn’t as often as it used to.

Most balance sheets will refer to these assets as fixed assets, long-term assets, or PPE (property, plant, and equipment).

Nevertheless, all these terms refer to the same thing: long-term tangible assets that contribute to the revenue generation of the business.

Classifying an Asset as a Plant Asset

To classify an asset as a plant asset, it should have the following characteristics:

- Has a useful life of more than 1 year

- Is tangible; this means that it has a physical form

- The business uses it in its operations and/or revenue generation

The asset must have all of the characteristics above. It cannot have just one of them.

For example, a business may own a trademark. A trademark is an asset that can provide monetary benefits to the business.

It also usually has a useful life of more than 1 year. These are already two of the three characteristics of a plant asset.

However, a trademark is an intangible asset. It does not have a physical form. As such, we cannot classify a trademark as a plant asset since.

Now let’s take a look at an office building.

An office building is an asset that a business typically uses to house various functions such as administrative, accounting, sales, customer service, etc.

As such, it’s an asset the business uses in its operations. It usually has a life of more than 1 year (20 years or more).

Lastly, it’s tangible since it has a physical form. As such, an office building can qualify as a plant asset.

The Types of Plant Assets

Plant assets can further be categorized into the following categories:

- Office Equipment

- Plant Equipment and Machinery

- Buildings

- Land

- Improvements

Office Equipment

Office equipment refers to plant assets that the business uses for its office (or non-plant) operations.

Depending on the type of business, it could refer to computers, monitors, printers, etc.

It could also refer to furniture and fixtures such as chairs, tables, and desks.

Since office equipment can include diverse types of assets, the business may choose to further categorize the assets that belong to it.

Plant Equipment and Machinery

Plant equipment and machinery refer to plant assets that the business uses in the production process. These assets are often essential to the manufacturing function of the business.

They help in the conversion of raw materials into sellable products. As such, these assets contribute a great ton to the business’s revenue generation.

Buildings

Buildings refer to plant assets that are structures that can house the many functions of the business (e.g. production, administrative, accounting, customer service, etc.).

These assets usually hold large amounts of value and can have very long useful lives (usually not less than 20 years).

A building may house office functions and may be referred to as an office building.

It may also be a factory that houses the production process of the business.

A building may also be a store where customers do their transactions.

Even a storage facility or a warehouse can be considered a building.

Do note that for a building to be classified as a plant asset in the business’s balance sheet, it must own it.

If the business is only renting the building, then it shouldn’t be classified as a plant asset.

Land

Land is another plant asset that usually holds a large amount of value.

Most businesses that operate in a physical capacity will need land for their operations.

Land can also be held by a business for capital appreciation. Some purchase it for the sole purpose of renting it to other businesses.

Just like buildings, land can house the many functions of a business.

Though not all businesses own the lands where they operate on. Some just rent them.

Unlike the plant assets mentioned thus far, land typically does not depreciate. They may still fall in value via impairment though.

Improvements

Improvements are plant assets that are usually attached to land or a building.

These assets improve the value of the assets that they are attached to.

For example, an improvement may improve the usability of land.

We refer to this kind of improvement as a land improvement.

An improvement may also improve the quality of a building.

For example, the business has reinforced the building’s windows to make it safer and more secure.

We refer to this kind of improvement as a building improvement.

Improvements should be depreciated if it is practically feasible to measure their useful life.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harper College "Plant Assets, Natural Resources, and Intangible Assets" Page 1 - 14. October 11, 2022

Western Kentucky University "ACCOUNTING FOR PLANT ASSETS" Page 1 . October 11, 2022