Current Ratio FormulaLet's learn how to compute current ratio!

While assets such as equipment, machinery, and buildings provide long-term economic benefits, it’s not like a business can live on them alone.

A business will need to maintain a certain level of liquidity.

You cannot pay for the salaries and wages of your employees with just your equipment and machinery after all.

And your suppliers will demand something a bit more liquid as payment.

I’m talking about cash and other liquid assets.

In the course of a business’s operations, it will be incurring expenses that need to be addressed immediately.

Or if not immediately, let’s say in less than a year.

We refer to the liabilities attached to these expenses as current liabilities.

To address these current liabilities, the business will to have pay with liquid assets, usually cash.

Liquid assets can also be referred to as current assets.

So there, matching current assets with current liabilities.

But there’s more to it than that. Imagine this.

You’re a supplier of raw materials.

On top of cash sales, you also allow credit sales.

For credit sales, you expect to receive payment within the set credit terms (usually a month or two).

Now let me ask you, what sort of payment are you expecting to receive?

Are you expecting a portion of a building?

How about a piece of machinery?

A part of equipment? No! Of course not! You’re expecting to receive cash!

This is why liquidity is important for most businesses.

You need to have a certain level of liquid assets to address your current liabilities.

Being unable to pay your business’s current liabilities will paint a bad picture and possibly ruin your relationship with suppliers – both current and future ones.

So you need to be mindful of your business’s liquidity.

There are several ways to measure a business’s liquidity and one of them is using the current ratio.

Current Ratio: What is it?

The current ratio is one of the liquidity ratios that measure a business’s liquidity or ability to pay short-term obligations (a.k.a. current liabilities).

Particularly, the current ratio measures a business’s ability to pay short-term obligations with its current assets such as cash, accounts receivable, inventory, etc.

It can also be an indication of a business’s financial health regarding short-term obligations.

If a business has a good current ratio, it won’t have any problem paying for short-term obligation.

However, if it has a poor current ratio, it’s the opposite.

It will have trouble paying off short-term obligations.

If a business is constantly unable to fully satisfy its short-term obligations, it might be an indication that the business is having trouble with handling finances.

Another name for the current ratio is the “working capital ratio”.

You can compute a business’s current ratio by dividing its current assets over its current liabilities.

Put into formula form, it should look like this:

Current Ratio = Current Assets ÷ Current Liabilities

To fully understand the current ratio and its formula, we must first understand what current assets and current liabilities are.

Current assets

Current assets refer to assets that a business expects to be sold, consumed, used, or exhausted within a short period, usually within a year.

We can also refer to them as assets that a business can reasonably convert into cash within a short amount of time.

Current assets are the most liquid assets of a business.

The shorter the amount of time it can be converted to cash, the more liquid it is.

This makes cash as the most liquid asset.

Current assets include, but are not limited to:

- cash

- cash equivalents

- marketable securities

- accounts receivable

- inventory

- prepaid expenses (e.g. prepaid rent, prepaid insurance)

- other liquid assets

Current assets are important to a business.

Most businesses have to maintain a certain level of current assets to fund day-to-day business operations.

Without them (especially cash), a business won’t be able to pay its short-term obligations such as accounts payable, salaries and wages, and other operating expenses.

Current Liabilities

Current liabilities refer to a business’s obligations that are due within a year or its normal operating cycle.

In other words, they are a business’s short-term obligations.

Since a business has to address these obligations in less than a year, they are usually paid off with current assets (usually cash).

Current liabilities include, but are not limited to:

- accounts payable

- short-term debt or loans or a portion of them (those that are due within a year)

- accrued expenses (e.g. rent payable, salaries and wages payable, interest payable, etc.)

- unearned revenue (or the business’s liability to provide goods and/or services)

- dividends payable

A business’s total current liabilities will usually have accounts payable as its major component.

Accounts payable (a.k.a trade payables) are a business’s obligation to its suppliers.

A business accumulates accounts payable as it makes credit purchases.

Management of current liabilities is important for any business.

Being unable to satisfy them when they become due can be detrimental to the business.

For example, if a business is constantly unable to pay its accounts payable, it will turn off suppliers.

Not only current suppliers but also future suppliers.

This makes it harder for the business to maintain operations.

Without readily available suppliers, the business’s won’t always have the materials or supplies it needs to produce a product or perform a service.

Current Ratio and Liquidity

The current ratio is a metric that measures a business’s ability to pay current liabilities with only its current assets.

In a way, it measures a business’s liquidity.

While generally having a current ratio of 1 is already considered sufficient, it will still depend on the industry that the business belongs to.

For example, retailers such as Walmart and 711 usually have low current ratios due to the nature of their operations.

They tend to accrue debt to finance their operations.

But, because of the nature of their operations (free cash flow and fast cast movement), they are still able to satisfy their suppliers.

However, as a general rule of thumb, a current ratio of 1.5 to 3.0 should be sufficient.

Any more or less will be troublesome for the business.

Having a current ratio of more than 3.0 may mean that the business is not handling its cash well.

It may not be investing in assets that can provide more economic benefits.

Or worse, it may have a huge number of receivables or inventory that it wasn’t able to convert to cash.

On the other hand, having a current ratio of lower than 1.5 may mean that the business is liquid enough to address its current liabilities.

However, it may not be able to address sudden or unplanned expenses.

Current Ratio Examples

Exercise#1

Let’s start with a more simple example.

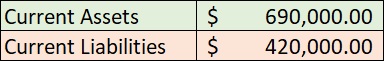

We have the following data regarding a business current assets and current liabilities:

With this data, we can already compute the business’s current ratio.

So let’s do just that!

Current Ratio = Current Assets ÷ Current Liabilities

= $690,000 ÷ $420,000

= 1.64

As per computation, the business has a current ratio of 1.64.

This means that it has enough current assets to fully satisfy current liabilities and then some more.

The business has good liquidity.

If it maintains the same level of liquidity for the upcoming years, it won’t be having trouble paying off its short-term obligations.

Exercise#2

Let’s kick it up a notch for the next example.

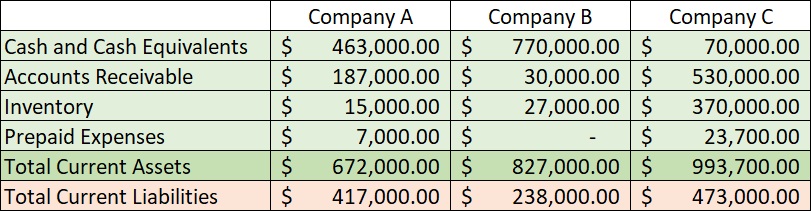

This time, we will be computing the current ratio of three businesses:

Let’s start first with Company A:

Current Ratio = Current Assets ÷ Current Liabilities

= $672,000 ÷ $417,000

= 1.61

Next, let’s compute Company B’s current ratio:

Current Ratio = Current Assets ÷ Current Liabilities

= $827,000 ÷ $238,000

= 3.47

And lastly, let’s compute Company C’s current ratio:

Current Ratio = Current Assets ÷ Current Liabilities

= $993,700 ÷ $473,000

= 2.10

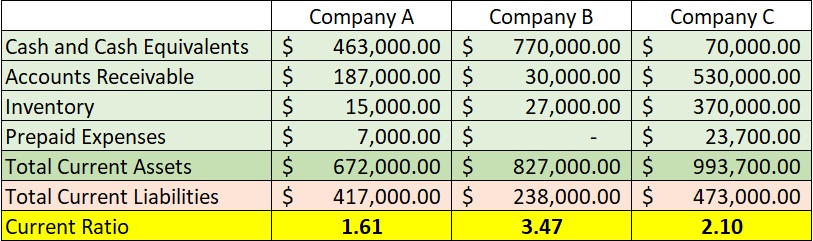

Now that we have the current ratios for each business, let’s update our table.

Looking at the table above, we can see that Company B’s current ratio of 3.47 is the highest.

Does this mean that Company has the best current ratio among the three?

Well, not necessarily.

With a current ratio that’s exceeding 3.0, it might mean that Company B is not making the most out of its assets.

From the details, we can see that Company B’s current asset is mostly comprised of cash and cash equivalents.

While cash is king, having an excess of it means foregoing opportunities for more profit.

Company B could have invested the excess cash in more profitable ventures.

So, that must mean that Company C’s current ratio of 2.10 is the best among the three right?

Well, if we’re looking at just the final figure, the answer is yes.

However, since we have the breakdown of Company C’s assets, we can make a more in-depth analysis.

Most of Company C’s current assets are composed of Accounts Receivable and Inventory.

While these assets can indeed be liquid enough, they may sometimes take longer to convert to cash.

There’s the possibility that Company C may not have enough cash to pay for short-term obligations when they become due.

Company A’s current ratio of 1.61 may be the lowest of the three, but it is sufficient enough.

Company A has enough current assets to pay for its current liabilities.

What’s more, the liquidity of Company A’s current assets is much higher than Company C’s.

With cash and cash equivalents of $463,000, it doesn’t have to liquidate its other current assets to pay its current liabilities of $417,000.

Limitations of the Current Ratio

Our last example demonstrates one of the limitations of the current ratio.

It does not discriminate between current assets.

That means that asset quality doesn’t matter for the current ratio.

What matters is quantity.

This isn’t a problem if most of a business’s current assets are highly liquid.

But if its current assets are composed of not-so-liquid assets, the current ratio may not truly represent the business’s liquidity.

For that, we have the other liquidity ratios such as the quick ratio and cash ratio.

The cash ratio in particular only considers cash and cash equivalents in measuring a business’s liquidity.

It’s the most conservative of the three liquidity ratios.

Another limitation of the current ratio is that it’s only a number of its own.

While the general rule of thumb is that a current ratio of 1.5 to 3.0 is healthy, it is not absolute.

Some industries have different standards.

A current ratio of less than 1.5, or even 1.0, can be acceptable and even expected for certain industries.

Likewise, a current ratio of more than 3.0 may be natural for some industries.

The current ratio also does not measure a business’s profitability on its own.

What it does is only measure a business’s liquidity.

A business can be liquid even if isn’t profitable.

It’s best to use the current ratio in conjunction with other ratios to make the most out of it.

Lastly, the current ratio is based on historical data.

It does not always accurately represent a business’s future financial standing.

Though, if we compare the current period’s current ratio with the previous periods’, we may be able to see a trend.

We can then refer to this trend to see if the business is able to at least maintain a healthy current ratio.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Michigan State University "Financial Ratios Part 1 of 21: The Current Ratio" Page 1. February 22, 2022

Webster University "Financial Ratios" Page 1. February 22, 2022

Iowa State University "Financial Ratios" Page 1. February 22, 2022