Types of LiabilitiesHow to Classify Different Liabilities in your Business

Almost every single business is going to have some sort of liability at some point in it’s life span.

In fact, it is more common to have liabilities than to not have them but, what are the main types of liabilities and how are they classified for your business?

Today we are going to discuss the three primary types of liabilities which include: short-term liabilities, long-term liabilities, and contingent liabilities.

Liabilities can be any type of legal obligation or debt owed to another person or company.

But, liabilities are not necessarily bad and are often times needed to progress the business and help it grow.

According to the International Financial Reporting Standards Framework (IFRS), a liability is “a present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying economic benefits.”

In other words, liabilities are debts that your business owes as a result of past events or transactions and just like assets, liabilities are part of doing business.

Liabilities are debts that a company plans on paying with the expectation that its future cash flow will be more than substantial to account for the balance owed as well as any interest incurred.

Assets are anything that your business owns while liabilities are anything your business owes.

While using an accounting software will help you track your assets and liabilities, it is still important to understand the different types of liabilities on a balance sheet and the type of items that get allocated to these accounts.

This will ensure that you record your liabilities so that they are reflected correctly on your financial statements.

Types of Liabilities on the Balance Sheet

The two main categories of liabilities on the balance sheet are:

- Short-term liabilities – short term liabilities (also known as current liabilities) are any debts that will be paid within a year.

- Long-term liabilities – long term liabilities (also known as non-current liabilities) are any debts that will take more than a year to be paid.

- Contingent liabilities – contingent liabilities are not used as often but they are the third most common type seen on a balance sheet. Contingent liabilities include any potential lawsuits or product and equipment warranties and are only recorded if they are likely to occur.

Short-term Liabilities

Short term liabilities are obligations that need to be paid within a years time, which is why they are called short-term or current liabilities.

Management should keep a close eye on short term liabilities to make sure the company has enough liquidity to meet the obligations of these liabilities within the shorter period of time.

Here are the most common types of short term liabilities:

Accounts Payable

The only type of liabilities that many small businesses have on their balance sheet in the beginning are accounts payable.

This account represents debts owed to vendors, utilities, and suppliers that have been purchased on Net terms or on credit.

Most accounts payable terms are Net15 or Net30, while some may stretch out to Net45 or even Net60.

The terms vary depending on the vendor or supplier.

Until paid, these are considered short term liabilities.

Principle and Interest Payable

Principle and Interest Payable represents any payments due towards the payment of a mortgage or loan.

While the loan itself is considered a long-term liability, the principle and interest payments are considered short term liabilities because they are due within a set term, usually less than a year.

While the loan may be a 30 year loan, most loan payments, which include principle and interest, are due every 30 days, which makes them a short term liability.

Short-term Loans

Loans that are due within a year (12 month time frame) are considered short term loans.

Some examples of short-term loans could be a personal line of credit that needs to be paid in full within 12 months, bank overdrafts, trade credits, etc.

Taxes Payable

Taxes are paid on a monthly, quarterly, or annual basis, depending on your payment schedule and tax jurisdiction but both state and income taxes are short term liabilities.

Both state and income taxes are due within a years time frame, making them short term liabilities.

Accrued Expenses

Accrued expenses are used to allocate expenses that have been built up over time and are due to be paid within a years time.

This type of short term liability is only used if you are using the accrual method of accounting.

For example, your internet bill may only be billed on a quarterly basis, but you need to account for the expense on your balance sheet for each month.

You would accrue the internet expense over the months in the quarter even though the payment is not due until the end of the quarter.

Say your average internet bill is $300 every three months.

To accurately show this on your financial statements for the accrual method of accounting, you would make an accrued expense entry for $100 for three consecutive months: January $100, February $100, March $100 = $300 total.

This accurately reflects your expenses for each month even though the actual payment is only made every three months.

In other words, expenses are recognized when they are incurred, not when they are paid.

Unearned Revenue

Unearned revenue is a little different than the types of short term liabilities we’ve discussed so far because it is money that has been received in advance of goods or services.

Examples of unearned revenue include prepayments towards a project, annual subscriptions for software or media, monthly maintenance plans, prepaid insurance, prepaid rent, etc.

Let’s use a common example from Amazon.

Say you just purchased Amazon Prime for a year and it cost you $79 for the period of January – December (12 months).

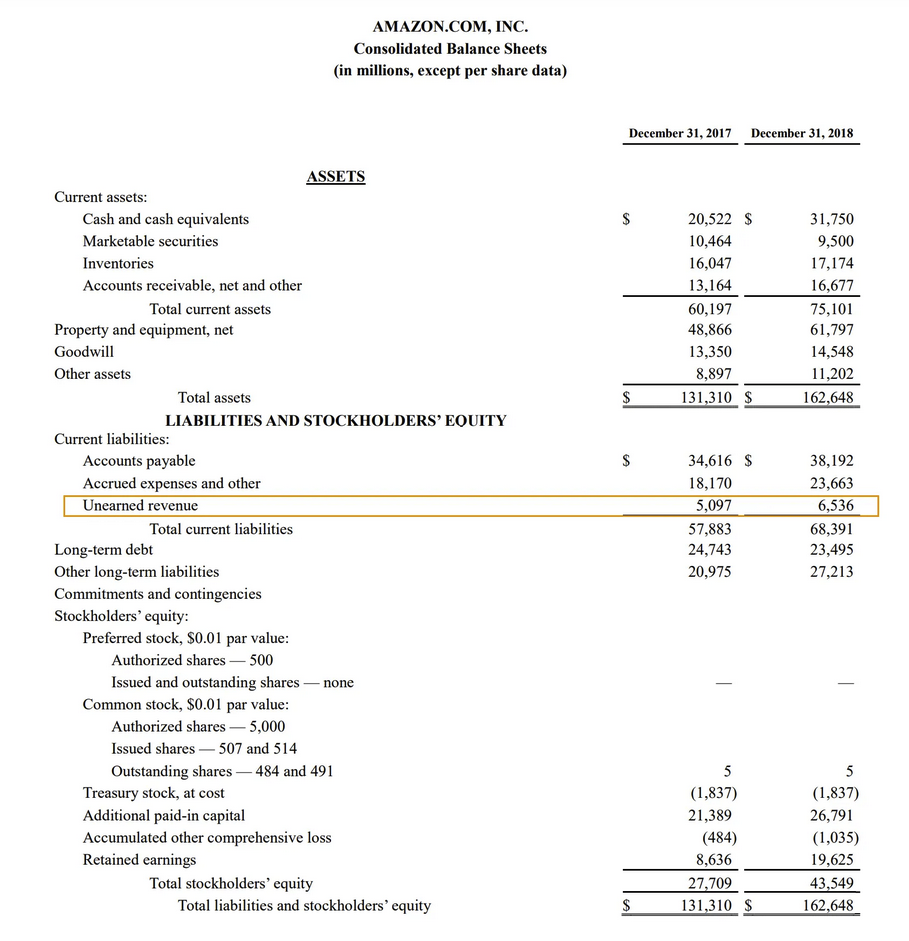

On Amazon’s balance sheet above, you can see they have an unearned revenue account.

This is where all of the prepaid Amazon Prime subscriptions, and other prepaid items live until they are used.

When the payment is made initially, the full amount of $79 will be recognized on Amazon’s balance sheet as unearned revenue but at the end of the first month, a portion of this balance will be deducted from unearned revenue and recognized as revenue.

The $79 prepayment gets reduced as follows:

$79/12 months = $6.58/month

$79 initial prepayment for Amazon Prime – $6.58 January – $6.58 February – $6.58 March – $6.58 April – $6.58 May – $6.58 June – $6.58 July – $6.58 August – $6.58 September – $6.58 October – $6.58 November – $6.58 December = $0 left in unearned revenue

$6.58 will be deducted from unearned revenue and recognized as revenue each month until the subscription period of 12 months is over.

Long-term Liabilities

Long-term liabilities are debts that do not need to be paid within a 12 month period (1 year).

All long-term liabilities are due more than one year into the future and are often referred to as non-current liabilities.

These are the most common type of long-term liabilities found on the balance sheet:

Long-term Notes Payable

Notes payable is very similar to accounts payable except for the length of the terms for payment.

When a formal loan agreement has payment terms that go beyond one year (12 months), this is a notes payable.

As mentioned before, accounts payable are obligations that need to be met within a years time.

Some common examples of notes payable could be the purchase of a company car or a loan from a bank.

A notes payable is anything with a written promise to pay a certain amount at some future date.

Deferred Taxes

While taxes are usually considered a short-term liability, there are times where they need to be deferred for longer than a year.

If for some reason you have taxes that are not due within the next 12 months, they would be considered a long-term liability and would be allocated to a deferred taxes account.

Bonds Payable

Bonds payable are always considered a long-term liability and they are often issued by hospitals, local governments or utilities.

Interest on bonds payable are usually paid every 6 months or annually until the agreed upon principal amount is paid.

Mortgage Payable

Mortgages are considered a long-term liability and are recorded as mortgage payable on the balance sheet.

However, the monthly principal and interest payments due are considered currently liabilities and are recorded as such on the balance sheet.

Capital Leases

Capital leases are not as straightforward as some of the other liabilities because they involve the leasing rather than the purchasing of equipment.

The total amount of a capital lease is recorded as a long-term asset on your balance sheet but the amount is also recorded as a long-term liability as well.

Contingent Liabilities

As mentioned before, contingent liabilities are not as common but they do come up occasionally and it is good to understand the basics of them.

Two of the most common types of contingent liabilities are lawsuits and product warranties.

Contingent liabilities are actually more like potential liabilities because they are recorded depending on the outcome of a future event.

For example, say your company is faced with a $200,000 lawsuit, the company will want to incur a $200,000 contingent liability for this future event.

A contingent liability is only recorded if the probability of the liability to happen is 50%.

If your company wins the lawsuit or it is dropped, then no liability would arise.

Managing Liabilities

The above balance sheet shows all of the different types of liabilities: non-current assets and current liabilities.

You can see they have some deferred taxes and deferred revenue as well.

A large part of being a successful business owner is managing your liabilities, both long-term and short-term.

By understanding your liabilities and tracking them properly, you reduce the risk of loss from not paying the liabilities on time.

As your business grows and becomes more complex, it will be even more crucial to manage liabilities so that you do not run into cash-flow issues.

Taking on debt or liabilities is a great way to grow your businesses because liabilities are debts that a company plans on paying with the expectation that its future cash flow will be more than substantial to account for the balance owed as well as any interest incurred.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "AccountingPeriods andMethods" IRS PDF. October 6, 2021

University of Alabama "What is a liability?" Page 1 . October 6, 2021

Harvard Business School Online "How to Prepare a Balance Sheet: 5 Steps for Beginners" Page 1 . October 6, 2021