Deferred Revenue ExpenditureWhen a revenue expenditure covers several periods

In accounting, expenses usually only cover a one-year period.

Well, there are capital expenses but they don’t technically count as expenses.

Rather, capital expenses are treated as assets that the business will depreciate (for tangible properties) or amortize (for intangible assets) over their respective useful lives.

Businesses incur capital expenses when they purchase properties that have useful lives of more than a year.

Usually, capital expenses are huge in terms of amount.

Your usual everyday expenses don’t have this kind of trait to them.

However, a business may sometimes incur a huge expense that doesn’t qualify as a capital expense.

This is primarily because there is no corresponding long-term property to represent the expense.

So how should the business account for such an expense?

Should it treat just like any other business expense?

Well, that depends really.

A business may sometimes incur a huge expense that technically qualifies as revenue expenditure, meaning that it only covers a year.

In such a case, the business will account for it just like how it accounts for any other revenue expenditure.

If it’s an expense that covers several periods though, then its recognition in the income statements might require deferment.

This act of deferring revenue expenditures gives rise to a new type of expense that we refer to as deferred revenue expenditures.

In this article, we will be looking into what a deferred revenue expenditure is.

What is its definition?

How does an expense or expenditure qualify as one?

What impact do they have on a business?

How do we account for deferred revenue expenditures?

We’ll be answering these questions (and more) as we move along with the article.

What is Deferred Revenue Expenditure?

Before we proceed with the definition of deferred revenue expenditure, let’s review first what a revenue expenditure is.

As a business operates, it will incur everyday expenses that are necessary to maintain its operations.

These expenses are usually only, meaning that they only cover a year or less.

We refer to these short-term expenses as revenue expenditures.

Since they’re short-term, they are fully recognized in the business’s income statement in the same period that they are incurred.

Common examples of revenue expenditures include the cost of sales, salaries and wages, rent expenses, etc.

So, how do deferred revenue expenditures fit into this?

Let’s make it easier by dissecting the term “deferred revenue expenditure”.

We already know what a “referred expenditure” is. But what is “deferred”?

According to the Merriam-Webster dictionary, “deferred” means “withheld for or until a stated time”.

This means that deferred revenue expenditure is a revenue expenditure that is withheld or put on hold until a stated time.

But why is there a need for deferment?

The main reason for the deferment is that the expenditure covers several periods.

This means that a deferred revenue expenditure can affect the business far beyond the current period.

For example, let’s say that a fairly new business enters into a 5-year marketing and advertising contract for $50,000.

Now while this revenue expenditure is paid for wholly in the current year, its benefits last for 5 years.

As such, there is a need for deferment for the portion that doesn’t cover the current period.

In this case, the business will have to defer the portion that covers the next four years.

Basically, deferred revenue expenditure refers to a revenue expenditure that a business pays for in the current period but its benefits or effects cover more than just the current period.

Features of a Deferred Revenue Expenditure

To make the definition of deferred revenue expenditure easier to digest, here’s a bullet list of some of its commonly known features:

- The business has already paid for it in the current period

- Its benefits or effects cover more than just the current period, meaning that it covers several periods

- It’s usually a huge expense since it covers several accounting periods

- It could also be a revenue expenditure that only covers one period or less. However, it only benefits the business at a later period

- Unlike capital expenses, deferred revenue expenditure doesn’t relate to the purchase or acquisition of a long-term asset (though it still creates an asset on the balance sheet)

- It could also relate to exceptional and/or extraordinary losses that can affect the business for several periods. These losses are often the result of unforeseen events such as earthquakes, floods, etc. Since these losses often have a huge financial impact, there might be a need to spread out the losses over several periods, hence, deferred revenue expenditure

Accounting for Deferred Revenue Expenditure

Deferred revenue expenditure always leads to the creation of an asset on the balance sheet.

For example, let’s say that a business pays for a 5-year advertising contract for $50,000.

The journal entry for such a transaction would then be:

Prepaid advertising expense is an asset that represents the prepayment made by the business.

As a year goes by, the business consumes a portion of the prepaid advertising expense.

For simplicity, let’s assume that the business consumes the advertising contract evenly over its 5-year period.

This means that the business incurs $10,000 ($50,000 ÷ 5) in advertising expenses every year (until the business fully consumes the contract).

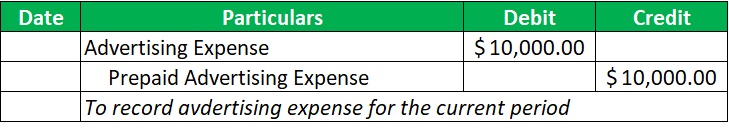

The journal entry to record the advertising expense would then be:

The business will have to record this journal entry for every period that it incurs advertising expenses that relate to the prepaid advertising contract.

The deferment of the recognition of expenses ensures that they are recognized in the period that the business benefits from them.

In this example, the business can benefit from a potential increase (or at the very least, retention) in its revenue due to the advertising contract.

Since the advertising contract covers a 5-year period, the recognition of its cost should also be spread out over the same period.

It’s important to account for your business’s deferred revenue expenditure as it represents future expenses that you’ve already paid for.

This ensures that you won’t be making double payments for the same expense.

This also ensures that your business’s income statement for the current period only represents revenue and expense items that relate to it, hence, representing a more accurate net income figure.

Deferred Revenue Expenditures vs Capital Expenses

While both deferred revenue expenditures and capital expenses can cover several periods, they are different types of expenses.

Purpose

Firstly, capital expenses usually relate to the purchase or acquisition of long-term assets.

For example, the purchase of machinery or equipment is a capital expense.

Capital expenses may also relate to repairs and maintenance that significantly affect the value of a long-term asset, such as extending its useful life.

Meanwhile, deferred revenue expenditures don’t usually relate to the purchase or acquisition of long-term assets.

Rather, they are expenses that relate to the cost of operation or the creation of revenue.

As such, capital expenses mainly relate to capital investments. Businesses make these investments (e.g. purchasing additional machinery, building, etc.) in the hopes of increasing their earning capacity.

For example, having more production plants increase the maximum amount of production.

On the other hand, deferred revenue expenditures mainly relate to the maintenance of the business’s earning capacity.

While they have the potential to increase the business’s total revenue, they don’t increase earning capacity.

For example, advertising expenses don’t increase a plant’s production capacity.

Rather, a business incurs advertising expenses to ensure that it makes the sales.

Asset Account

While both create an asset account on the balance sheet, they differ on what asset accounts they make.

Capital expenses always lead to the creation of long-term asset accounts such as building, land, equipment, machinery, copyright, etc.

Whereas, deferred revenue expenditures lead to the creation of various asset accounts such as prepaid expenses, deferred losses, etc.

Periods Covered

Since capital expenses relate to long-term assets, they always cover several periods.

They are recognized in the income statement as depreciation (for tangible properties) or amortization (for intangible assets) expenses.

On the other hand, while a deferred revenue expenditure usually covers several periods, it sometimes only covers a period of one year or less.

This is the case when the business pays for a short-term expense that covers a future accounting period.

For example, the business pays for 6 months’ worth of rent on the first day of December.

The payment only covers a month of the current year.

The business will eventually consume the remaining five months of the prepaid rent in the following year.

While the prepayment only covers 6 months, it still requires the recognition of deferred revenue expenditure (prepaid rent in this case).

This is because a portion of the payment represents expenses that the business will incur in a period other than the current period.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard "Deferred Revenue " Page 1. August 11, 2022

ECFR.gov "Treatment as Deferred expenses" Editorial. August 11, 2022