Interest PayableInterest that has accrued but is yet to be paid

Anyone would know that you need money to buy things.

That stays true in business. If you want to purchase goods and materials for your business, you’ll need money.

And yes, that still applies if you purchase them on account as you’ll have to pay with money eventually.

It’s all good if your business has enough money to make such purposes.

But what if it doesn’t?

Let’s say that you want to purchase a piece of equipment for your business.

However, it doesn’t enough cash to pay for the purchase.

What are you likely to do?

In such a case, you either inject more cash into the business by using your personal money.

Or you can approach a lender to borrow money.

But of course, when your borrow money, you’d have to repay it eventually.

In addition, lenders will usually charge interest for the money they lent to you.

As such, borrowing money typically comes with incurring interest expenses.

Usually, the payment of interest follows a payment schedule.

This sometimes results in the accrual of interest expense where its payment will only be made in the next period or month.

Such an accrual creates a liability. To be more specific, it creates interest payable.

So long as there is interest that remains unpaid, there will always be interest payable.

In this article, we will discuss what interest payable is.

How does one accumulate interest payable?

And where does it appear on the business’s financial statements?

We will to try answer these questions and more as we go along with the article.

What is Interest Payable?

Interest payable is a liability account that represents the amount of interest that the business has yet to pay as of the balance sheet date.

Interest payable occurs when a business incurs interest expense but does not pay for it.

It can accumulate when a business is billed interest but no payment is made.

It can also accumulate when interest accrues but its corresponding payment will only be made in the next period.

For example, a loan contract states that the borrower must pay the principal and interest every 15th of the month.

This means the interest from the 16th to the last day of the month will only be paid on the next month.

As such, the accrual of such interest results in the accumulation of interest payable.

Interest payable can be an important factor in financial statement analysis.

If its amount is “normal”, we can infer that the business is paying interest on time.

However, if the amount is much greater than the normal amount, it might be an indicator that the business is defaulting on its debt obligations.

Normally, payments are applied to interest first before the principal.

And if the interest payable just keeps on increasing, it probably means that the business is not paying enough to fully pay the interest.

This further means that no part of the payment applies to the principal.

In the worst-case scenario, the business is not paying its debt obligations at all.

Interest payable is normally a current liability.

In other words, it’s a liability that should be payable within a year or less.

We may also refer to “interest payable” as “accrued interest”.

In some cases, both accounts may appear on the same balance sheet if the accrued interest is material enough to warrant a separate account.

Presentation of Interest Payable

Since interest payable is a liability account, it should appear on a business’s balance sheet (if ever the business has any unpaid interest).

Interest payable is usually a current liability, so you’ll normally find it on the current liabilities section of a business’s balance sheet.

Its normal balance is credit since it’s a liability account.

Journal Entries to Record Interest Payable

There are two ways to accumulate interest payable:

- When a lender bills you for interest but no payment has been made yet; and

- Through the accrual of interest expense

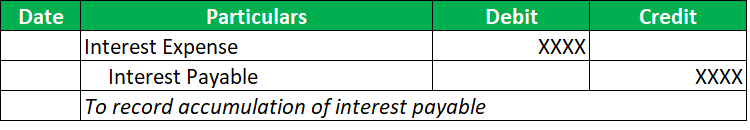

In both cases, the credit entry will always be “Interest Payable” while the debit entry will be “Interest Expense”.

Here’s an example of the accumulation of interest payable:

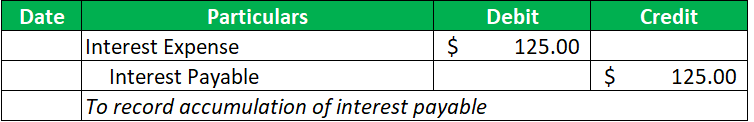

For example, let’s say that you currently have a loan of $10,000 with an annual interest of 15% (1.25% monthly).

Interest and principal payments are made every 1st day of the month.

This means that a previous month’s interest will only be paid on the 1st day of the next month.

As such, there should be an accrual of interest expense to record the unpaid interest.

As per computation, you should accrue $125 interest expense per month.

The journal to record such accrual will look like this:

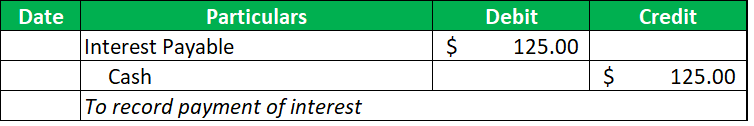

Assuming that you do pay interest every 1st day of the month, the corresponding journal entry should look like this:

Since interest payable is a liability account, a credit entry will increase its balance.

On the other hand, a debit entry will decrease its balance.

Usually, interest payable will only decrease when the business pays for it.

If the business does not pay for any of its accrued interest, it will most likely stay as is or increase.

Having no interest payable means that the business pays all accrued interest on or before the balance sheet date.

The Importance of Recording Interest Payable

It’s important to keep track of your interest payable as it can help ensure that you’re paying on time.

It also helps in paying for unnecessary expenses.

Most lenders will penalize their borrowers for late or non-payment of interest.

As such, if you diligently keep track of your interest payable, you’re more likely to be aware of when and how much you should be paying for interest.

Preferably, the interest payable account should only include the accrued interest for the month or period.

This means that any accrued interest from the previous month or period is paid on the current month or period.

This will keep the interest payable from ballooning in amount.

If the amount of interest payable is more than the expected amount, it may indicate that the business doesn’t pay interest on time.

Or worse, the business doesn’t pay interest at all.

This is a bad look for the business as non-payment of interest usually means non-payment of its corresponding debt.

Eventually, if the interest payable just keeps on growing, the business might face liquidity issues.

As such, always record your interest payable. Make sure that is the right amount.

And you should pay for it as soon as possible.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "§ 3-112. INTEREST." Page 1 . August 22, 2022

Cerritos "CHAPTER 9: CURRENT LIABILITIES" Page 1 . August 22, 2022