Journal Entry ExamplesExamples, Format, Revenue and Expense Accounts, Debits and Credits, and More!

The following ten journal entry examples give you an understanding of the most common way in which company’s record their regular financial transactions.

These journal entries are a necessary step in the accounting process, and each provides an equal debit and credit to a separate account for every transaction.

These transactions will also be listed in chronological order to help ensure the data is manageable.

Let’s get started!

Example #1 – Journal Entries for Revenues

Journal Entry for Sales:

Whenever a company makes a sale on credit, the corresponding journal entry will make a debit to accounts receivable and a credit to the sales account.

If this sale were instead made in cash, the debit would go to the cash account, and the credited account would remain the same.

Journal Entry for Allowance for Doubtful Accounts:

Whenever sales are made on credit, there will be some customers that will be unable to pay.

For these situations, an adjustment will be made for bad debt expenses.

This will debit the bad debt expense account and credit the allowance for doubtful accounts.

If the customer later comes up with the money to pay this debt, then the entry can be reversed with a debit to accounts receivable and a credit to bad debt expense.

Then you can simply record the receipt of cash with a debit to the cash account and a credit to accounts receivable.

Example #2 – Journal Entries for Expenses

Journal Entry for Accounts Payable:

In order to pay for an expense on credit, the related expense or asset account will be debited, and the payable account will be credited.

Journal Entry for Payroll:

Payroll expenses are a bit more complicated due to taxes; however, you will still simply have to debit these expense accounts and credit the cash account.

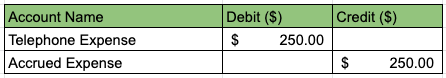

Journal Entry for Accrued Expenses:

For accrued expenses, simply debit the relevant expense account and credit the accrued expense account.

Journal Entry for Depreciation:

To record depreciation expense, debit depreciation expense, and credit the accumulated depreciation account.

Journal Entry for Petty Cash:

To either establish or replenish a petty cash fund, the petty cash account will be debited, and the regular cash account will be credited.

Example #3 – Journal Entries for Assets

Journal Entry for Cash Reconciliation:

Banks typically build up charges which will need to be reconciled.

To do this, debit accounts such as the Office Supplies Account and the Bank Service Charges recognize these expenses and credit the cash account.

Journal Entry for Prepaid Expense Adjustment:

Prepaid expenses will need to be adjusted as time passes, and to do this, debit the appropriate expense account and credit the prepaid expense account.

Journal Entry for a Fixed Asset:

When purchasing a fixed asset on credit, the appropriate asset account will be debited, and the account payable will be credited.

If the same purchase were instead made in cash, the asset account would be credited, and cash would be debited.

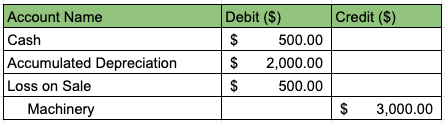

Journal Entry for the Disposal of Assets:

To dispose of a fixed asset, its accumulated depreciation account will be debited, and the applicable fixed asset account will be credited.

This could result in a gain or a loss depending on the particular situation.

Asset Disposal by Sale with Loss:

Asset Disposal by Sale with Gain:

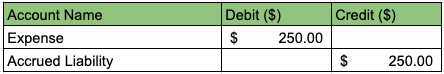

Example #4 – Journal Entries for Liabilities

For expenses that are owed but have not been paid, an accrued liability account will be used.

To record this, the applicable expense account will be debited, and the accrued liability account will be credited.

Example #5 – Journal Entries for Equity

Journal Entry for Declaration of a Dividend:

When a company declares dividends, the retained earnings account will be debited, and dividends payment will be credited.

After the company actually pays the dividends out to stockholders, the dividends payable account will be debited, and the cash account will be credited.

Journal Entry for the Re-Purchase of Stock:

If a company chooses to re-purchase shares of its stock, the treasury stock account will be debited, and the cash account will be credited.

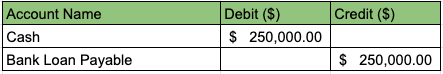

Journal Entry for Debt Raised through a Bank Loan:

If a company chooses to raise money through a bank loan, the cash account will be debited, and the bank loan payable account will be credited.

Example #6 – Journal Entries for Transactions

To see more of how journal entries work, let’s take a look at some regular transactions and how journal entries would look for them.

Here are the journal entries for these transactions.

Example #7 – Practical Journal Entries

Through the month of July 2021, the Pear Corporation performed the following transactions.

Try recording a journal entry for each of these transactions and compare it to the ones posted here.

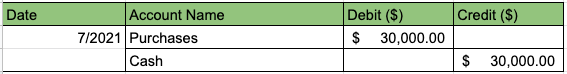

Transaction #1

On July 2nd, 2021 $30,000 in equipment was purchased.

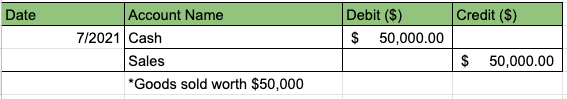

Transaction #2

On July 9th, 2021, `15 MP3 players were sold for $50,000

Transaction #3

On July 16th, 2021, expenses were incurred, totaling $7,000.

Transaction #4

On July 29th, 2021, $6,000 of office supplies were purchased.

Example #8 – Practical Journal Entries

Here are the Pear Corporations transactions during the month of August.

Observe the list of transactions, and then try recording a journal entry for each.

Journal Entries

Example #9 – Practical Journal Entries

Big Office Inc. started business on January 1st, 2021, with initial capital of 30,000 shares of common stock at $3 each.

During the company’s first month of business, it performed the following transactions:

- Received Capital worth $90,000.

- Paid $2,000 for the first month’s rent.

- Paid $10,000 for the following five months of rent.

- Purchase $20,000 worth of furniture at a 5% trade discount.

- Purchase $12,500 worth of office supplies on credit.

- Received $30,000 for services rendered to customers.

- Payment of balance for $12,500 worth of office supplies purchased on January 6th.

- Purchase of $20,000 worth of equipment with $10,000 in cash and $10,000 in notes payable.

- Provided $45,000 in services to customers on credit.

- Received $12,500 from customers for the services rendered on January 13th.

- Purchased office supplies worth $1,250.

- Customers paid $32,500 to cover the remaining balance for services rendered on January 13th.

- Paid $560 in electrical expenses.

- Paid $348 in utilities expenses.

- Paid $2,900 for miscellaneous expenses accrued during the month of January.

- Paid $30,200 in wages to employees.

Read the list and then try recording journal entries for each of the transactions.

When you are done, try comparing them to the list of journal entries below.

Example #10 – Practical Journal Entries

Some purchase transactions for Construction Supplies Ltd. are listed below.

After reading the transactions, record the journal entries.

Then, compare the entries to the ones below.

Transaction #1

On April 4, 2021, $15,000 of items were purchased.

Transaction #2

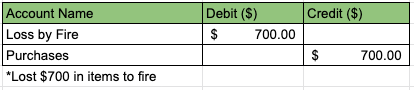

On April 9, 2021, $700 worth of items were destroyed by fire.

Transaction #3

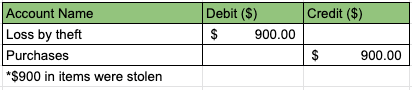

On April 12, 2021, $900 worth of items were stolen.

Transaction #4

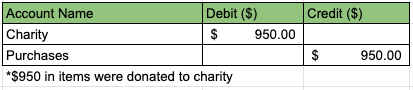

On April 12, 2021, $950 worth of items were donated to charity.

Transaction #5

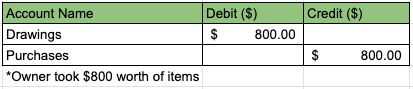

On April 22, 2021, $800 worth of items were taken by the owner.

Conclusion

All business enterprises benefit from an effective recording of journal entries.

First of all, it records all of the direct financial effects of a given transaction in one place.

Secondly, it efficiently organizes all of a company’s transactions in chronological order, which helps accountants to easily locate any given transaction.

Last but not least, accurate and detailed journal entries allow accountants to easily pinpoint errors and compare transactions to help the company run more efficiently.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Colorado "Accounting Journal Entries: Definition, How-to, and Examples" Page 1. November 17, 2021

Columbia University "Getting Started with Journal Entries" Page 1. November 17, 2021

Princeton University "Other Journals and Journal Types" Page 1. November 17, 2021