Liquidity RatioDefined with Examples, Formula, List & How to Calculate

You might have already heard of the phrase “cash is king when it comes to business”.

It makes sense though.

Cash is really needed to successfully operate a business.

Cash fuels the operations of a business after all.

Need to pay the salaries and wages of your employees?

You’ll need cash for that.

Need to pay your monthly rent?

You’ll need cash for that.

Need to restock on supplies and raw materials?

You’ll need cash for that.

But let’s go beyond cash for just a bit.

A business isn’t entirely defined solely by how much cash it has on hand and in the bank anyway.

There’s a reason why a business’s total current asset isn’t only consisted of its cash.

Along with cash, a business’s current assets will mainly consist of other liquid assets such as accounts receivable and inventory.

All of these current assets, along with current liabilities, will define a business’s liquidity.

If your business has enough liquid assets, it won’t have any problem paying off short-term debts.

It most definitely won’t be having liquidity issues either.

The business can operate smoothly without having to worry about disruptions due to unpaid debts.

Overall, having enough liquid assets often helps a business rather than slow it down.

But is liquidity the end all be all of any business?

Can a business still be profitable if it’s constantly having liquidity issues?

Does having good liquidity necessarily result in a profitable business?

Can a business still operate if it does not have enough liquid assets?

We will try to address all of the above questions in this article.

We will learn what liquidity is and why it matters for a business.

Along with that, we’ll also learn of the different metrics used to measure a business’s liquidity.

What is liquidity and why does it matter for your business?

Liquidity refers to a business’s ability to pay off its current liabilities with just its current assets.

It’s usually represented by a ratio or a percentage.

A business that has good liquidity is almost always in good financial health.

The most basic metric of liquidity is the current ratio which compares the business’s current assets to its current liabilities.

If the business has a current ratio of at least 1, you can say that it is fairly liquid.

Liquidity is important for any business.

If it doesn’t have enough liquid assets to sustain its day-to-day operations, it will be facing liquidity issues later.

Worse, it might result in insolvency which is always bad news for any business.

If these issues remain unanswered for a very long time, the business might even face bankruptcy and ultimately, might be shut down.

Think of it this way. You have a current and upcoming bill that you have to settle immediately, or your business’s operations will be put on hold.

Which is the better scenario? Having enough liquid assets to settle the bill, or having to gamble whether or not you’d have enough cash by the time the bill becomes due?

Surely it’s the first scenario, right?

I mean, I would definitely be more comfortable if I have enough cash ready to settle an upcoming debt rather than having to risk it.

If you want to measure your business’s liquidity, don’t worry.

It isn’t really that complicated.

I already mentioned one of the metrics of liquidity, which is the current ratio.

Fortunately, you can find all the data you need to calculate your business’s current ratio in one place: the balance sheet.

Also, did you know that assets are arranged in terms of their liquidity?

Measuring a business’s liquidity using liquidity ratios

Measuring something is easier if it can be done with numbers.

Thankfully, we have the right tools for that: the liquidity ratios.

Liquidity ratios are metrics that are used to measure a business’s liquidity.

They are among the most important financial metrics used to assess a business’s financial health.

They measure a business’s ability to pay off current liabilities without having to resort to external sources of funding.

The commonly known liquidity ratios are the following:

- current ratio;

- quick (or acid-test) ratio; and

- cash ratio

These ratios have one thing in common: the data required for their computation can be found on a business’s balance sheet.

We will be tackling these ratios one by one.

We might as well do some exercises to familiarize ourselves with these ratios even more.

Current Ratio

The current ratio is probably the most well-known liquidity ratio.

It basically measures a business’s ability to pay off current liabilities with just its current assets.

It answers the question “if the business were to liquidate all its current assets, will it be able to cover all its current liabilities?”.

The current ratio can also be referred to as the working capital ratio.

It can be computed by using the following formula:

The current ratio is calculated by dividing a company’s current assets by its current liabilities.

For example, Tony has a business that has total current assets of $250,000 and total current liabilities of $125,000.

To compute Tony’s business’s current ratio, we simply use the formula:

Current Ratio = Current Assets ÷ Current Liabilities

= $250,000 ÷ $125,000

= 2.0 or 200%

As per computation, the business can cover every $1 of current liability with $2 of its current assets.

This also means that the business is very liquid.

It won’t have any issue paying for its short-term obligations.

Exercise #1

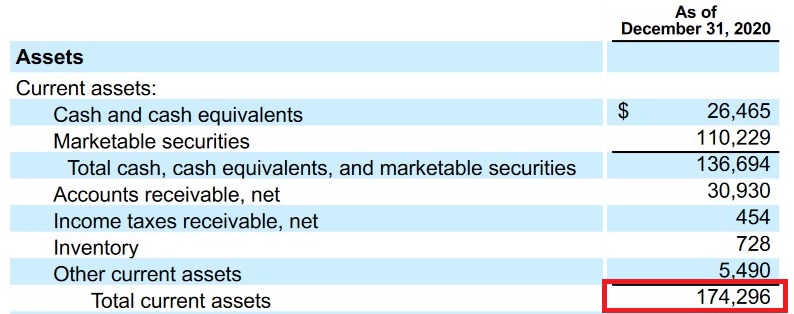

Below is Alphabet Inc.’s consolidated balance sheet for the year ended December 31, 2020:

Let’s solve for Alphabet Inc.’s current ratio for 2020.

First, we need to identify the current assets and current liabilities:

For total current assets, we have $174,296,000,000.

For total current liabilities, we have $56,834,000,000

Now that we have the data required, we can compute Alphabet Inc.’s current ratio:

Current Ratio = Current Assets ÷ Current Liabilities

= $174,296,000,000 ÷ $56,834,000,000

= 3.07

As per computation, Alphabet Inc.’s current ratio for 2020 is 3.07.

This means that every $1 of its current liability is covered by $3.07 current assets.

The main flaw of the current ratio is that it includes the business’s inventory.

Depending on the business itself, inventory can be liquidated for less than a month to more than a year.

Aside from that, inventory can also become obsolete, which lessens its value, or worse, make it worthless.

Another flaw is that it includes prepaid expenses as current assets, which cannot always be converted to cash.

That’s why the current ratio operates on the assumption that the business’s entire inventory can be easily and readily converted to cash.

This makes it relatively unreliable for businesses that have inventory that takes more than a year to be converted into cash such as car manufacturers and dealers.

The solution? Just remove inventory from the formula! And that is what the quick ratio is all about.

Quick Ratio (or Acid-test Ratio)

The quick ratio is a modification of the current ratio.

It’s like the current ratio in which it compares the business’s current assets to its current liabilities.

The difference is that it excludes inventory from the equation.

Meaning that the quick ratio measures the business’s ability to pay short-term obligations with its current assets without having to liquidate inventory.

You can compute the quick ratio in two ways by using either of the following formulas:

Quick Ratio = (Current Assets – Inventory) ÷ Current Liabilities

This formula assumes that aside from its inventory, the business can reasonably convert its current assets into cash.

If the business has other current assets that aren’t necessarily liquid such as prepaid expenses, the second variation of the formula may be used:

Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) ÷ Current Liabilities

The quick ratio does away with the assumption that all of the business’s inventory can be liquidated readily.

This makes it a more suitable liquidity ratio for businesses that have inventories that typically stay in their possession for over a year.

The quick ratio is also seen as a measurement of the business’s ability to pay off current liabilities with just its quick assets.

Quick assets are those that can be reliably converted to cash within 90 days.

Quick assets include cash and cash equivalents, marketable securities, and to an extent, accounts receivable.

Speaking of accounts receivable, the quick ratio assumes that all of it can be reliably collected within a short amount of time.

This means that the normal quick ratio formula does not account for any potential or undeclared bad debts.

This can be remedied by using the net accounts receivable balance for the computation of the quick ratio.

Exercise #2

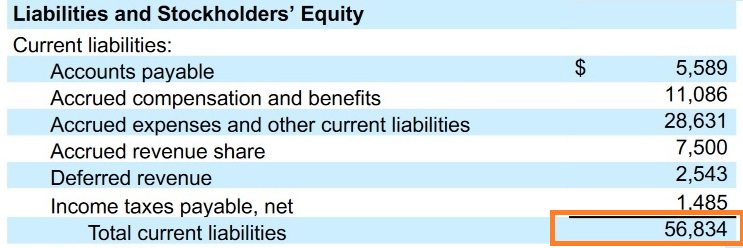

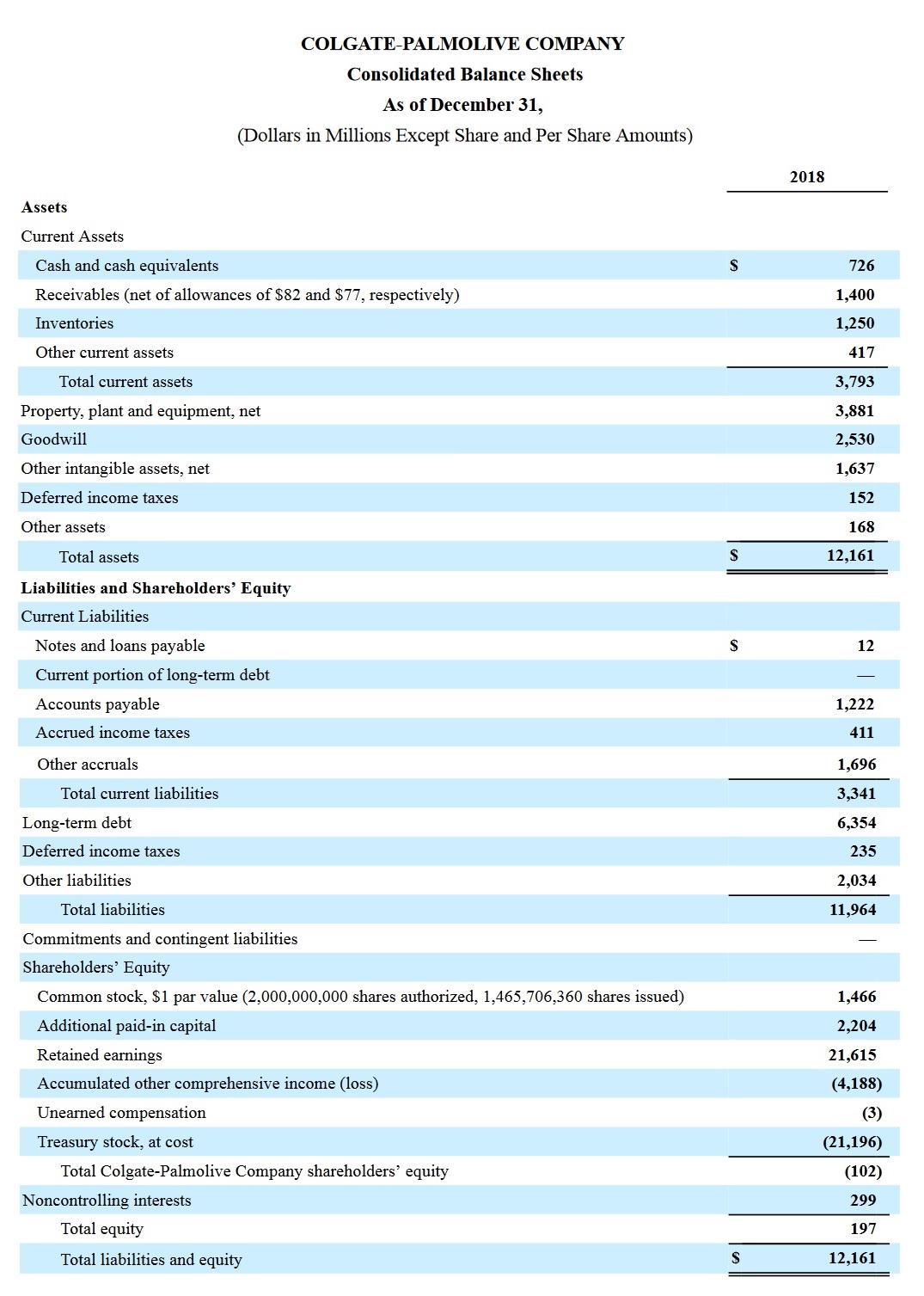

Below is the consolidated balance of the Colgate-Palmolive Company for the year ended December 31, 2018:

Let us compute the Colgate-Palmolive Company’s quick ratio for 2018.

First, we need to identify the quick assets of the Colgate-Palmolive Company:

As can be seen from the above illustration, the current assets section is comprised of four line items: Cash and cash equivalents, Receivables, Inventories, and Other current assets.

Since we’re not sure of the nature of the other current assets (in terms of liquidity), we will not be treating them as quick assets.

As such, quick assets only include cash and cash equivalents of $726,000,000, and Receivables (net) of $1,400,000,000.

This gives us a total of $2,126,000,000 quick assets.

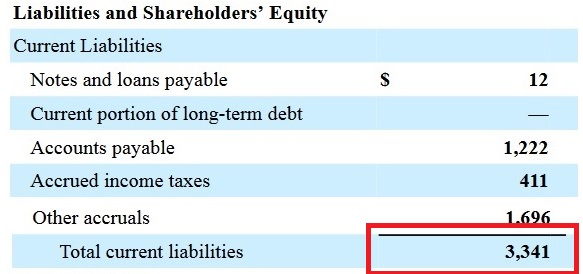

Next, we need to identify the total current liabilities:

For total current liabilities, we have $3,3341,000,000.

Now that we have our required data, we can already compute the quick ratio:

Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) ÷ Current Liabilities

= $2,126,000,000 ÷ $3,341,000,000

= 0.64

As per computation, the Colgate-Palmolive Company has a quick ratio of 0.64 for 2018.

This means that its quick assets can only cover 64% of its current liabilities.

If we compare it to their current ratio of 1.14, there is a difference of 0.5.

Its fairly high inventory contributes to the difference.

Cash Ratio

Of the three commonly known liquidity ratios, the cash ratio is probably the most conservative of them all.

It does away with the business’s other current assets and only uses cash and cash equivalents for its numerator.

By that, I mean that the cash ratio measures the business’s ability to pay off short-term obligations with just its cash and cash equivalents.

That means not having to liquidate other assets aside from cash equivalents.

Cash equivalents refer to items that are as good as cash such as marketable securities that can be readily converted to cash.

You can compute a business’s cash ratio by using the formula:

Cash Ratio = (Cash + Cash Equivalents) ÷ Current Liabilities

As I’ve already mentioned, the cash ratio is the most conservative measurement of a business’s liquidity.

It is particularly useful if you want to evaluate a business’s ability to cover for its very short-term obligations.

For example, bills that are due within a week or a day.

It’s also more suitable for businesses that have current assets that are historically not very liquid at all.

These could include a consistently high amount of uncollectible accounts, or inventory that cannot be readily converted to cash within a year.

For example, let’s say Betty recently acquired a business that previously allowed sales on credit.

However, due to the poor management of the previous owner, the business accumulated lots of uncollectible accounts.

It’s virtually all of its outstanding accounts receivable.

Because of this, Betty decided to temporarily disallow sales on credit.

In this situation, it’s more prudent to use the cash ratio to measure the business’s liquidity.

This is because the business’s accounts receivable are practically worthless due to the inability to collect on them.

Only the cash and cash equivalents remain as the business’s liquid assets.

Exercise #3

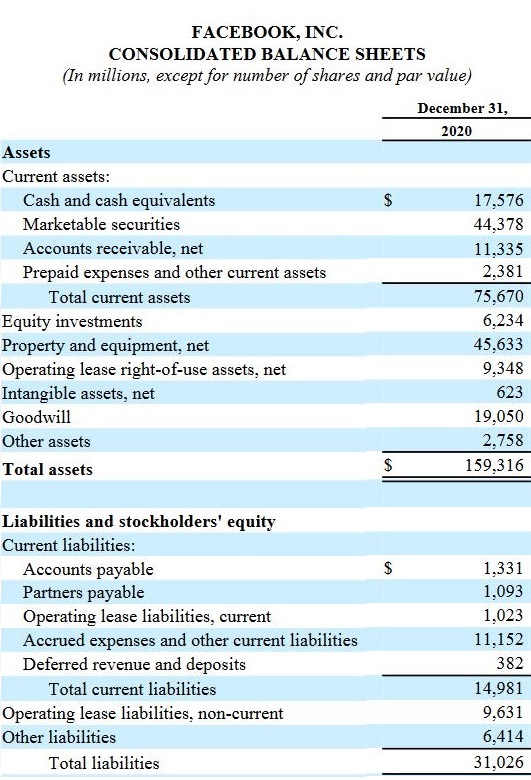

Below is the consolidated balance sheet of Facebook, Inc. for the year ended December 31, 2020:

Let’s compute Facebook, Inc.’s cash ratio for 2020:

First, we need to identify Facebook, Inc.’s cash and cash equivalents:

As can be seen from above, Facebook Inc. has cash and cash equivalents, and marketable securities.

As such, we will be computing the cash ratio for each assumption:

- Marketable securities cannot be readily converted to cash

- Marketable securities are as good as cash, which makes them cash equivalents

For the first assumption, our total cash and cash equivalents is $17,576,000,000.

For the second assumption, we will be adding the marketable securities which will result in a new total of $61,954,000,000.

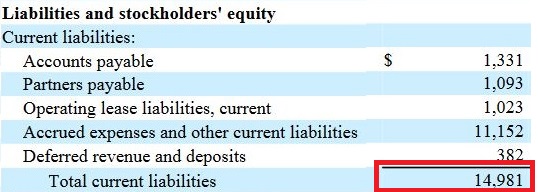

Next, we identify the total current liabilities:

For total current liabilities, we have $14,981,000,000.

Now we can compute Facebook, Inc.’s cash ratio.

Let’s compute first using the first assumption:

Cash Ratio = Cash and cash equivalents ÷ Current Liabilities

= $17,576,000,000 ÷ $14,981,000,000

= 1.17

Even with just its cash and cash equivalents, Facebook, Inc. can cover all of its current liabilities, with some extra.

Now let’s compute Facebook, Inc.’s cash ratio using the second assumption:

Cash Ratio = Cash and cash equivalents ÷ Current Liabilities

= $61,594,000,000 ÷ $14,981,000,000

= 4.11

With the addition of marketable securities, Facebook Inc.’s cash ratio ballooned up to 4.11, which is really high.

Is this a good cash ratio?

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) isn’t exactly a liquidity ratio, but it does have an impact on the business’s liquidity.

DSO measures the time it takes for a business to collect payment from its credit sales.

Meaning that if the business is able to collect on its accounts receivable in a short amount of time, it can translate to good liquidity as it will have more cash readily available.

On the other hand, if the business has a high DSO, it could mean that the business might face liquidity issues if it heavily relies on its credit sales to generate revenue.

You can compute for a business DSO by using the formula:

Days Sales Outstanding = Average Accounts Receivable ÷ Total Credit Sales x No. of days in a period

*Average Accounts Receivable can be computed by adding up the beginning and ending accounts receivable balances and dividing the sum by two

**The ending balance of the accounts receivable can be used instead of the average accounts receivable

***No. of days in a period depends on the period being measured (e.g. 1 year = 365, a month = 28, 30, or 31, etc.)

What’s a good liquidity ratio?

While it is true that a high liquidity ratio is more preferable to a lower one, there is a thing called excessive liquidity.

By that, I mean that the business may be holding too many liquid assets when it could have invested them in more profitable channels.

It could mean that the business is not managing its cash as well as it should.

It could also mean that the business has a high inventory balance, but most of it consists of obsolete inventory.

So yeah, a high liquidity ratio isn’t always good news.

That said, a low liquidity ratio isn’t good either.

It means that the business doesn’t have enough current assets to cover all of its current liabilities.

That is always not a good thing.

It’s important for a business to find the balance between liquidity and profitability.

Generally, just having enough liquid assets to cover current liabilities will equate to a business having good liquidity ratios.

But it’s better if the business can accommodate emergency expenses too.

With that said, a current ratio of 1.2 to 2 can be considered a healthy liquidity ratio.

Ideally, the quick ratio should just be enough to cover liabilities due within 90 days.

As for the cash ratio, having just enough to cover the very short-term obligations will do.

Do note though that different industries have different standards for liquidity ratios.

For example, a business that only provides services will have different liquidity ratios compared to a business that heavily relies on inventory.

A retail business that holds a large amount of inventory will always have significantly lower quick and cash ratios compared to its current ratio.

Compared to that, a business that only offers services may have closer current, quick, and cash ratios.

Are you having liquidity issues? Here’s what you can do

You can improve your business’s liquidity by doing the following:

Review and update your payment cycle

This goes both ways with you as the debtor and the creditor.

As a debtor, you can negotiate with your vendors or suppliers the terms of payment.

For example, you can ask your vendor or supplier for an early payment discount.

Doing this can already save you hundreds to thousands of dollars.

Which means more working capital for you.

As a creditor, you can offer your customers early payment discounts.

Sure, you’ll be losing some money, but it will encourage your customers to pay earlier than expected.

This will result in your business having more cash flowing in consistently.

Thus, it improves your business’s liquidity.

Replace or dispose of old and unnecessary assets

It can be hard to let go of assets, even if you got them for free.

But older machinery and equipment tend to cost you more due to maintenance costs.

Also, if you don’t need the asset, even if it’s still relatively new, it only adds up to your maintenance costs.

Disposing of these assets will not only result in you getting cash for the sale, but you also free up some of your working capital due to fewer maintenance costs.

Having more available working capital improves your business’s liquidity.

Consider looking into a line of credit

A line of credit allows a business to have quick access to external funds if its liquid assets are not enough to cover its current liabilities.

Some business lines of credit can offer up to $100,000/year of quick access funds with no annual fees (for the first year usually).

This is particularly useful if you need a way to inject some liquidity into your business without having to sell your non-current assets.

Limitations of liquidity ratios

While liquidity ratios are indeed useful tools that can be used by any business, they do have their limitations.

For one, they are just numbers on their own.

You can unlock their full potential by using them for liquidity analysis.

By that, I mean you compare a business’s liquidity to its previous periods’.

Maintaining a healthy liquidity ratio will usually mean that the business’s financial condition is doing great.

You can also compare them against the industry standards, or even other businesses (provided they’re within the same industry).

This is especially useful for bench-marking or setting goals.

That said, liquidity ratios do have a limitation in that they don’t account for the business’s ability to borrow money.

Having a large line of credit can combat liquidity issues.

A business that has a lower than 1 current ratio may not be having liquidity issues due to it having a large and reliable line of credit.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Webster University "Financial Ratios" Page 1 . January 11, 2022

Iowa State University "Financial Ratios" Page 1 . January 11, 2022

"FINANCIAL STATEMENT ANALYSIS" Page 1 . January 11, 2022