Operating EarningsThe profits a business earns from its main operations

The primary purpose of starting and running a business is to earn profits.

Now while a business can still make a profit through other means such as earning interest income from lending money when it’s not a lending business, most of its income will come from its main operations.

For example, a bakery will earn most of its income from the sale of its bread products, a restaurant will earn mostly from the sale of its food, a construction business will mostly earn from performing construction services, and so on and so forth.

We refer to the income that a business earns from its main operations as its revenue.

However, profit isn’t the same as revenue.

That’s because revenue only considers the income a business earns from its main operations.

On the other hand, profit considers how much earnings are left after deducting all activities (both from operating and non-operating activities).

That’s why in a typical income statement, you’ll see revenue as the top line item, while profit, or more specifically, net profit/income as the bottom line item.

The thing with net profit though is that it includes income and expenses from a business’s main operations and other sources (non-operating activities).

This means that there is a chance that net profit may not accurately represent the operational performance of the business.

Thankfully, there’s another measure of profit that isolates the earnings and expenses from the main operations of a business.

We refer to this as the “operating earnings”.

In this article, we will be exploring operating earnings.

What’s the difference between operating earnings and net profit?

How does one calculate operating earnings?

Is it an important metric for a business?

Let’s try to answer these questions as we go along with the article.

What are Operating Earnings?

Operating earnings refer to the profits that a business earns solely from its main operations.

It’s the profit the business earns from its revenues after subtracting the expenses directly associated with operating the business.

Such expenses include the cost of goods sold (COGS) or cost of sale (COS), as well as operating expenses such as selling and marketing expenses, general and administration (G&A) expenses, etc.

We also refer to operating earnings as operating income or operating profit.

What makes operating earnings different from net profit is that it isolates the profit that a business earns from its main operations.

This makes operating earnings a great tool for gauging the operational performance of a business.

For example, a bakery was able to earn a profit from the sale of one of its capital assets.

Selling capital assets isn’t a part of a bakery’s main operations.

A bakery mainly sells bread.

Thus, operating earnings will not consider such a profit in the calculation.

This is to ensure that only the earnings from the bakery’s main operation, which is selling bread, are included in the computation.

Operating earnings is a also great management tool as it can help in gauging whether or not the business is operating efficiently.

Positive operating earnings may signify that the business is able to operate efficiently.

On the other hand, negative operating earnings may signify inefficiencies in the business’s operations.

Operating earnings can also help in assessing the quality of the business’s earnings.

Typically, a majority of the business’s earnings will come from its main operations.

Operating earnings are more consistent than non-operating income, which makes them more reliable.

Like the other measures of income (revenue, net profit), you can find operating earnings on the income statement.

It’s typically there after the total operating expenses line item.

The Operating Earnings Formula

There are three formulas for calculating operating earnings.

The first one looks like this:

The first variation of the operating earnings formula starts with the total revenue.

From there, direct and indirect operating costs are deducted.

Direct costs refer to expenses that are directly traceable to the generation of revenue, an example of which is the cost of goods sold.

Indirect costs refer to expenses that are not directly relatable to the generation of revenue, but they are still necessary for maintaining the operations of the business.

Indirect costs include operating expenses such as rent, utilities, employee compensation, depreciation, amortization, etc.

The second variation of the operating earnings formula is as follows:

The second variation of the operating earnings formula starts with the gross profit (total revenue – cost of goods sold) rather than the total revenue.

It’s similar to the first variation, only going straight to deducting the operating expenses from the gross profit.

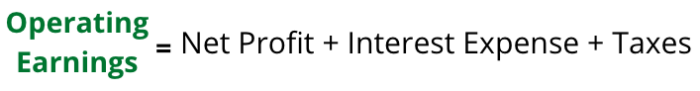

The third variation of the operating earnings formula is as follows:

The second variation of the operating earnings formula is different as it starts from the bottom line rather than the top line.

From the net profit, we add back the interest expenses and taxes.

An issue may arise with this variation if the business has non-operating income and expenses as they’re included in the calculation of net earnings.

To address this issue, you may use this improved version:

Operating earnings are calculated using this formula: Net Profit plus Interest Expenses plus Taxes, minus Non-Operating Income, plus Non-Operating Expenses.

With this improved version, we neutralize the effect of non-operating income and expenses on the business’s net profit.

Operating Earnings VS EBIT (Earnings Before Interest and Taxes)

While most will interchange operating earnings and EBIT, they’re not always the same.

Operating earnings always only include income and expenses from a business’s main operations.

This means that operating earnings always exclude non-operating income and expenses.

On the other hand, EBIT only excludes interest and taxes (hence, earning before interest and taxes).

If a business has other non-operating income and expenses, EBIT includes them in its calculation.

If a business doesn’t have income and expenses from non-operating activities, its operating earnings and EBIT will be equal.

However, if a business does have non-operating income and expenses, then its operating earnings and EBIT will probably show different figures.

Operating Earnings Vs Operating Margin

Operating earnings refer to the difference between the business’s revenue and its operating costs and expenses.

As such, it is typically presented in money form.

This money form won’t always be useful when comparing the business’s operational performance to its competitors as different businesses may have different sizes.

It’s useful though when comparing present performance with past performance, provided that the business is operating at the same level throughout the years.

If a business wants to compare its operational performance with that of its competitors, it’s better to use the operating margin.

It’s a metric that measures the business’s operating earnings to its total revenue.

Unlike operating earnings, the operating margin is expressed as a percentage.

The formula for calculating the operating margin is as follows:

Operating Margin = Operating Earnings ÷ Total Revenue

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

NYU Stern "Measuring Earnings and Profitability" Page 1 . August 30, 2022