Selling, General and Administrative (SG&A) Expense

Acronyms help shorten certain business terminology to help make communication more simple and concise, but if you don’t know what these acronyms mean, it can be confusing.

One common acronym used in business is SG&A and you may find yourself on this page because you are not sure what it stands for.

We are here to help!

SG&A stands for Selling, General and Administrative expense and it basically covers every category of Cost of Goods Sold (COGS).

These are the day-to-day operating costs needed to run a business but that are not related to the production of goods and/or services.

How much a company spends on their SG&A actually plays a huge role in their profitability, or net income.

On an income statement, SG&A and any other related expenses are listed below the gross margin.

These expenses are deducted from gross margin to give us our net income.

Here are some of the major examples of expenses that SG&A includes:

- Salaries of marketing, human resources, accounting, and information technology staff members

- Commission costs

- Legal costs

- Marketing, Advertising and promotion

- Rent

- Utilities

- Office equipment no associated with manufacturing

- Office supplies not used for manufacturing

Again, expenses included in SG&A cannot be related to production and manufacturing.

Here is a list of expenses that are not included in SG&A:

- Materials and labors or any costs related to manufacturing

- Interest payments

- R&D costs (research & development)

Types of SG&A

The acronym SG&A has two key components: “Selling” and “General & Administrative Expense.”

Let’s break these down further to better understand how expenses are categorized under either of these two components.

Selling Expenses

Expenses related to selling fall under either direct or indirect costs.

- Direct selling expenses – these types of expenses are incurred when a unit of product or service is sold. Direct selling expenses are different than most other SG&A expenses because they are often variable. When a product or unit is sold, it needs to be packed and shipped and if a commissioned salesperson was involved, there will be sales commissions due.

- Indirect selling expenses – these types of expenses are usually generated either before a sale or after a sale. Examples include marketing expenses, web and social media expenses, and marketing, advertising and promotion costs. Base salaries paid to salespeople are included in indirect selling expenses because they are paid regardless if there is commission involved or not. Other types of expenses related to sales activity could include travel expenses, etc as well.

General & Administrative Expenses

The day-to-day costs of running a business fall under General & Administrative expenses (G&A).

Examples include rent, utilities, legal costs, accounting costs, human resources, insurance, salaries and wages for staff other than salespeople such as management and administrative staff.

Some other examples of costs are rental equipment as long as they are not related to manufacturing or sales.

Any costs related to manufacturing or sales would not be a part of SG&A.

SG&A and Operating Expense: What is the difference?

SG&A expense is a big portion of a company’s operating expenses.

In fact, some companies, especially smaller ones, may use the terms SG&A and operating expenses interchangeably.

But to make sure there is no confusion, it is important to understand that Research & Development expenses are excluded from SG&A and according to the U.S. accounting standards, they are to be treated as a separate operating expense, with its own line item.

Depreciation is also reported on its own line item under operating expenses.

When in doubt on how to categorize a certain expense, an accounting professional can help determine what account it needs to be placed in.

Operating expenses and SG&A are both key parts of calculating a company’s net income, and for that reason it is important to understand and categorize them correctly.

Setting up SG&A Accounts

Most accounting software programs can help you setup your operating expenses.

But before you enter them into a software program, it is good to first identify each category of expense that is not directly linked to the production or manufacturing of a product or service.

To make this easier, start by creating three categories: selling expenses, general expenses, administrative expenses.

Here is an example to give you some ideas of what types of expenses go into each category:

| Selling expenses (related to sales and production only) | General expenses (not related to production) | Administrative expenses |

| Advertising | Equipment | Administrative staff Wages & Salary |

| Marketing | Repairs & Maintenance | Compensation for all other employees (non-salespeople) |

| Sales Base Salaries (fixed) | Insurance | Executive salary & compensation |

| Sales Commissions (variable) | Internet | HR services |

| Travel & Entertainment (related to sales only) | Office supplies | |

| Shipping of products | Professional Services (legal, accounting, etc) | |

| Social and Web Costs | Utilities Expense |

Once your categories are created, you can enter them into your accounting software so that they show up on your income statement.

SG&A Formula

Financial ratios help businesses track and measure their progress and they simplify data to make it easier to understand and present to potential key players such as investors or lenders.

The SG&A formula simply adds together selling expenses and general & administrative expenses as follows:

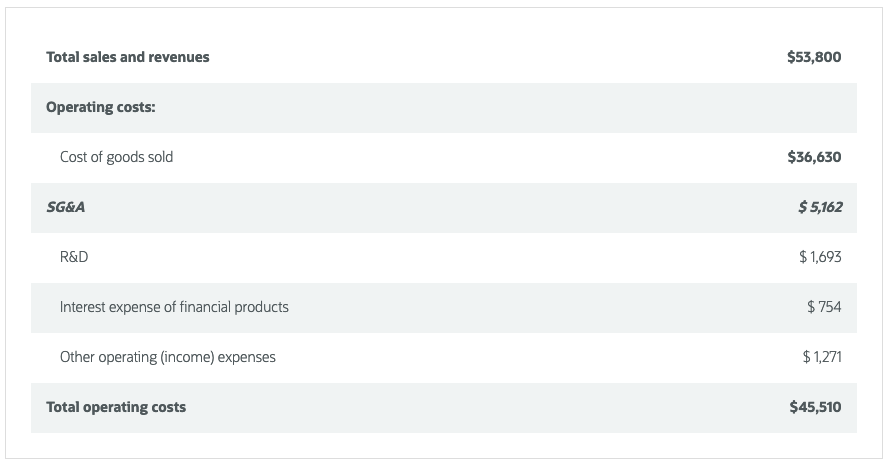

To tie all of this information together, let’s look at a sample income statement:

As you can see in the sample income statement, all of these expenses fall under Operating costs but SG&A is separate from Cost of Goods sold.

Furthermore items like research & development and interest expense are separate as well.

This is obviously a very simplified income statement to give you an idea of the order in which it is categorized on the income statement.

If you were to drill down into an SG&A account on the income statement, here is an example of what it might look like:

Conclusion

Monitoring and understanding your SG&A expenses is important because it effects your bottom line.

When a company is looking to cut costs, SG&A is often the focus in implementing cost controls.

If sales are low, operating expenses and SG&A expenses are still incurring and thus, may need to be decreased or cut.

Clearly categorizing these accounts is key to staying on top of costs and managing cost controls.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard.edu "Preparing an Operating Budget—Cost of Goods Sold, SG&A, and Operating Income" Page 1 . October 20, 2021

Cornell.edu "Statements of comprehensive income" Page 1 . October 20, 2021