Current Assets FormulaLearn how to compute total current assets

Any business owner knows the importance of liquidity for his/her business.

Having the ability to pay for any types of liabilities that are due is essential for the business’s continued existence and uninterrupted operations.

Just imagine what would happen if your business was unable to pay its bills:

Can’t pay rent? The lessor might evict you.

Can’t pay utility bills? Your machinery and equipment won’t run without electricity.

Can’t pay your employees salaries and wages? They will quit on you.

Can’t pay your suppliers? They’ll stop doing business with you.

If it isn’t clear to you by now, being able to pay “current” obligations is important for your business.

And to pay for these short-term obligations, your business needs “current assets”.

These are the type of assets that you can reliably convert into cash within a year (usually through normal business operations).

Examples of this type of asset are cash, receivables (e.g. notes receivable, accounts receivable), and inventory.

That said, an asset can also be “current” if a business can use, consume, or exhaust it within a year.

These are typically prepaid expenses such as prepaid rent, or prepaid insurance.

You cannot easily convert these assets into cash but you can usually use or consume them within a year.

It’s important for you, as the business owner, to know how many current assets your business has.

It allows you to know if you have enough to pay for short-term obligations.

That’s why in this article, we will be learning the “current assets formula”.

Along with that, we will also be discussing the different types of current assets a business typically holds.

Then to deepen our understanding of the “current asset formula”, we will be doing some exercises.

Current Assets Formula

While the current assets formula is simple, it greatly varies depending on what current assets the business has.

To illustrate, let’s take a look at what current assets Alphabet Inc. has:

From the illustration above, we can gather that Alphabet Inc. has the following as its current assets:

- Cash and cash equivalents

- Marketable Securities

- Accounts Receivable, Net

- Income Taxes Receivable, Net

- Inventory; and

- Other Current Assets

With that, Alphabet Inc.’s current asset formula will be:

Current Assets = Cash and Cash Equivalents + Marketable Securities + Accounts Receivable, Net + Income Taxes Receivable, Net + Inventory + Other Current Assets

Due to this, we can also refer to the current assets formula as the total current assets formula.

Using the formula above, let’s compute Alphabet Inc.’s total asset:

Current Assets = Cash and Cash Equivalents + Marketable Securities + Accounts Receivable, Net + Income Taxes Receivable, Net + Inventory + Other Current Assets

= $26,465,000,000 + $110,229,000,000 + $30,930,000,000 + $454,000,000 + 728,000,000 + 5,490,000,000

= $174,296,000,000

In short, a business’s current assets formula is the summation of its current assets.

If we were to make a universal formula, it will look like this:

Current Assets = Current Assets A + Current Assets B + Current Assets C + …

The current assets formula is a great indicator of a business’s short-term financial health.

Generally, if a business’s total current assets exceed its total short-term obligations, then it means that it has enough (and maybe even more) to pay off its short-term debts.

I say generally because there are exceptions. Having high excess current assets can also be a bad thing.

For example, a business can have too much inventory (overstocking), or it can have too many receivables.

Current Assets

To further understand the current assets formula, we must first understand what a current asset is.

A current asset can have either or both of these characteristics:

- Can be reliably converted into cash within a short amount of time (usually within one year)

- Can be used, consumed, or exhausted within a short amount of time (usually within one year)

Current assets are a business’s most liquid assets.

Cash (and cash equivalents) may be the most well-known current asset.

It’s also the most liquid.

That’s why you see cash as the first asset account in most balance sheets (the only time it isn’t is when the business doesn’t have any cash).

Other examples of current assets are accounts receivable, notes receivable, inventory, prepaid expenses, etc.

To evaluate if a business has a sufficient amount of current assets, we need to compare it with the business’s total current liabilities.

If the business has equal the amount of total current assets and total current liabilities, it means that it has a sufficient amount of current assets.

That said, having just enough current assets isn’t ideal.

The business has no safety net in case of unexpected expenses.

In general, a business would want to have enough current assets to generate a current ratio of 1.5 to 3.

Having less than 1.5 might mean that the business wouldn’t be able to answer to unexpected expenses.

On the other hand, having more than 3 might mean that the business isn’t making the most out of its assets.

That said, the ideal current ratio will change depending on the industry that the business belongs to.

Example of Current Assets

Now that we know the characteristic/s of a current asset, let’s discuss some of the well-known examples of current assets:

Cash and Cash Equivalents

Cash and cash equivalents include all the cash of the business and other items that are similar to cash.

This includes cash on hand, cash in bank, and petty cash.

As for cash equivalents, these are financial instruments that have a maturity date of three months or less.

These include treasury bills, commercial paper, and other liquid money market instruments.

Inventory

Businesses that sell or manufacture goods are familiar with this asset account.

For retailers or wholesalers of goods, inventory refers to unsold goods.

Retailers and wholesalers also refer to inventory as merchandise inventory.

For manufacturers, inventory can refer to unused raw materials, work-in-progress, and finished goods.

That’s why you can find the raw materials inventory, WIP inventory, and finished goods inventory on a manufacturer’s balance sheet.

Inventory can have either of the two characteristics of a current asset.

Businesses usually sell merchandise inventory and finished inventory within their usual operating cycle.

Raw materials and WIP inventory are usually consumed and converted to finished goods within a year.

While understocking on inventory is almost always detrimental to a business due to loss of potential sales, overstocking is also an issue.

This is especially true for businesses that deal with perishable goods.

Accounts Receivable

Accounts receivable refer to payments that customers owe to the business for goods or services that they receive.

They accumulate as the business makes credit sales or sales on account.

These are sales in which there is no cash payment at the time of sale.

Or if there is, it’s only partial.

The remaining balance will then be paid at a later date.

The term will depend on the company policy on credit sales, but as reference, it is usually 30, 60, or 90 days.

Some businesses also refer to accounts receivable as trade receivables.

The reason why accounts receivable are current assets is because businesses usually convert these assets into cash within a year.

Though there are cases where the credit term can be more than a year.

Accounts receivable that have a term of more than a year are not current assets.

They only become so if they become collectible within a year.

A business should do what it can to ensure the quality of its accounts receivable.

Due to their nature, there is a risk of default, meaning that accounts receivable carry the risk of becoming uncollectible.

The only way to turn this risk into zero is to not deal with accounts receivable at all. But that means losing on credit sales.

So to ensure that the business can collect on most if not all of its accounts receivables, it needs to have proper credit and collection policies in place.

Notes Receivable (Non-Trade Receivables)

Notes receivable refers to receivables that are usually made outside of normal business operations.

They are often represented by a promissory note- a written promise to receive a certain amount of cash from another party on a certain day/s.

Some notes receivable have interest attached to them.

A business will sometimes convert accounts receivable into notes receivable to give the customer-debtor more time to pay.

In some cases, the business will require a personal guarantee or even collateral.

Notes receivable can either be current or non-current assets. If the promissory note is due within a year, then it is a current asset.

Otherwise, it is a non-current asset.

Marketable Securities

Marketable securities refer to financial instruments that a business can reliably convert into cash within a short amount of time, usually within a year.

These include certain stocks, government bonds, certificates of deposit, etc.

Marketable securities are also cash equivalents if they are due within 90 days or less.

For marketable security to be considered a current asset, the holder must be able to cash it in a stock or bond exchange and get its face value (or close to it) within a year of purchase.

Prepaid Expenses

Prepaid expenses refer to expenses that a business has already paid for but are yet to be used or consumed.

The term “prepaid expenses” is a blanket term. It can be more specific such as prepaid rent, prepaid insurance, etc.

For example, George decides to pay a year’s worth of rent of $6,000 to his landlord.

In this case, George has prepaid rent of $6,000.

As the rent becomes due, the prepaid rent is “consumed”.

An appropriate amount of prepaid rent is then expensed.

Prepaid expenses are current assets as businesses typically use or consume them within a year.

Financial Ratios that use the Current Asset Formula

The following are ratios that use the current assets formula in their computation

Current Ratio

Current Ratio = Current Assets ÷ Current Liabilities

The current ratio measures a business’s ability to pay off current liabilities with its current assets.

It is one of the liquidity ratios, and as such, also measures a business’s liquidity.

In general, the ideal current ratio is between 1.5 and 3.0.

Having less may mean that the business has enough current assets to pay off all current liabilities, but it may not be able to accommodate unexpected expenses.

Having more may mean that the business is not making the most out of its assets.

Quick Ratio

Quick Ratio = (Current Asset – Inventory – Prepaid Expenses) ÷ Current Liabilities

Or

Quick Ratio = (Cash and Cash Equivalents + Marketable Securities + Receivables) ÷ Current Liabilities

Similar to the current ratio, the quick ratio measures a business’s ability to pay off current liabilities with its current assets.

The difference is that it only considers a business’s most liquid assets.

In most cases, this means that inventory and prepaid expenses are excluded from the equation.

This makes the quick ratio a more conservative measure of a business’s liquidity.

Net Working Capital

Net working capital is calculated by subtracting a company’s current liabilities from its current assets.

The net working capital isn’t technically a ratio.

Rather, it’s a quantitative measure of whether the business has enough current assets to pay off current liabilities.

If the figure is positive, it means that the business has enough current assets to pay for day-to-day operating costs and then some.

A negative figure would mean that the business has more current liabilities than current assets.

This would lead to the business being unable to satisfy all its current liabilities.

Current Assets Formula: Exercises

Exercise#1

Below is the consolidated balance sheet of Apple Inc. for the year ended December 31, 2020:

Compute Facebook Inc.’s total current assets using the current assets formula.

First, for us to come up with Facebook Inc.’s current asset formula, we need to identify its current assets.

From the illustration above, we can gather that Facebook Inc., has the following current assets:

- Cash and Cash Equivalents

- Marketable Securities

- Accounts Receivable, Net; and

- Prepaid Expenses and Other Current Assets

With this, we come up with Facebook Inc.’s current assets formula:

Current Assets are calculated by adding together Cash and Cash Equivalents, Marketable Securities, Net Accounts Receivable, and Prepaid Expenses along with Other Current Assets.

Now that we have our current assets formula, we can compute Facebook Inc.’s total current assets for the year ended December 31, 2020:

Current Assets = Cash and Cash Equivalents + Marketable Securities + Accounts Receivable, Net + Prepaid Expenses and Other Current Assets

= $17,576,000,000 + $44,378,000,000 + $11,335,000,000 + $2,381,000,000

= $75,670,000,000

As per our computation, Facebook Inc. has total current assets of $75,760,000,000.

Let’s check if our computation is correct:

As highlighted in green, Facebook Inc.’s total current assets amount to $75,670,000,000.

This means that our computation is correct.

Exercise#2

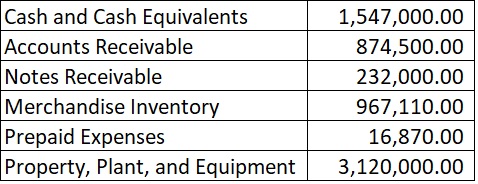

The following data were gathered while assessing a business’s assets:

And here are some additional data about the business’s accounts receivable and notes receivable:

- $120,000 of accounts receivable are due in more than a year.

- $52,000 of notes receivable are due within 720 days

Let’s compute the business’s total current assets using the current assets formula.

First, we must identify its current assets. From the data above, we gather that the business’s current assets are the following:

- Cash and Cash Equivalents

- Accounts Receivable

- Notes Receivable

- Merchandise Inventory; and

- Prepaid Expenses

Property, Plant, and Equipment is not a current asset account. Rather, it is a capital asset account (typically a non-current asset).

Furthermore, from the additional data, we gather that accounts receivable and notes receivable have non-current components to them.

Remember that we only include the current portion of these assets in the computation of current assets.

Accounts Receivable (Current Portion) = $874,500 – $120,000

= $754,500

Notes Receivable (Current Portion) = $232,000 – $52,000

= $180,000

With all these considerations, we come up with the business’s current assets formula:

Current Assets = Cash and Cash Equivalents + Accounts Receivable + Notes Receivable + Merchandise Inventory + Prepaid Expenses

We can now compute the business’s total current assets:

Current Assets = Cash and Cash Equivalents + Accounts Receivable + Notes Receivable + Merchandise Inventory + Prepaid Expenses

= $1,547,000 + $754,500 + $180,000 + $967,110 + $16,870

= $3,465,480.00

As per computation, the business has total current assets of $3,465,480.

Be sure to be mindful of the additional details on seemingly current assets.

Sometimes, they may have non-current components such as the accounts receivable and notes receivable we have in this example.

Always remember to only include current assets in the computation of total current assets.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Iowa State University "Financial Ratios" Page 1 . February 22, 2022

Michigan State University "Financial Ratios Part 1 of 21: The Current Ratio" Page 1 . February 22, 2022

Cornell Law School "marketable securities" Page 1 . February 22, 2022