Inventoriable CostsKnow which costs drive up the costs of your products

When selling goods, you’d have to consider the cost of the goods that you’re selling.

Even more when deciding on the sales price.

Otherwise, instead of generating profits, you’d be bleeding out money instead.

One of the main purposes of running a business is to generate revenue (and consequently, profits) after all.

Knowing which expenses go towards your cost of goods will be beneficial for you and your business, whether it be in the short run or the long run.

If you know which expenses increase the cost of goods, you’ll be able to devise a strategy to keep them at the minimum.

This results in you generating more profits.

So which expenses or costs do go towards your cost of goods?

Well to start, the cost of the actual goods is one.

But is that all?

How about the cost of ordering the goods?

How about the cost of labor for the team inspecting the goods?

Should you also include the cost of holding the goods?

What about the salaries and wages of the sales and administrative staff?

Or the cost of renting and maintaining the space to house your goods?

In this article, we hope to answer those questions.

We will learn of the expenses and costs that go towards a business’s cost of goods (and the cost of goods sold).

We will also be having an exercise so that we can identify which costs contribute to the cost of goods and which ones don’t.

Hopefully, when you’re equipped with the knowledge of these costs, you’ll be able to control them so that you can ensure that your business constantly makes a profit.

(Hint: we also refer to these costs as inventoriable costs.)

What are Inventoriable Costs?

Inventoriable costs refer to costs that you can directly associate with a product.

You can also refer to inventoriable costs as product costs.

What constitutes inventoriable costs will depend on the business.

For example, for a business that mainly manufactures goods, the inventoriable costs will usually consist of the following:

- cost of raw materials

- direct labor

- manufacturing overhead; and

- other costs necessary to transport the materials to the factory or production floor (e.g. freight-in, inspection costs, etc.).

However, for a business that mainly sells products in a retail or wholesale setting, what constitutes inventoriable costs will be different.

The inventoriable costs will consist of all costs necessary to transport the products from the manufacturer to its stores, as well the costs necessary to make the products saleable.

And depending on the arrangement, it may also include the actual cost of the product.

So as you can see, inventoriable costs will widely differ from industry to industry.

And even if they’re within the same industry, inventoriable costs may still differ from business to business.

But what we can gather from the above examples is that inventoriable cost mainly consists of costs that are necessary for a business for it to have saleable goods.

Well, that and that they are costs that you can associate with the manufacturing or transportation of a product.

Inventoriable costs do not directly appear on a business’s income sheet when you incur them.

Rather, they appear on the balance sheet as part of the business’s inventory asset account.

Once the business sells or disposes of the inventory, that’s the time when inventoriable costs appear on a business’s income statement.

If it’s a sale, the inventoriable costs associated with the sold products appear as Cost of Sales or Cost of Goods Sold on the income statement.

Calculating Inventoriable Cost on a Per Unit Basis

While just knowing the inventoriable costs of your business is already beneficial, you’d also want to know it on a per-unit basis.

Meaning that you’d also want to compute the inventoriable cost or product cost per unit.

Knowing the product cost per unit helps in determining the appropriate price for your product.

There are many ways to determine the product cost per unit depending on the inventory costing method the business uses.

But for this article, we’ll go with the simplest computation:

Product Cost per Unit = Total Inventoriable/Product Cost ÷ Total Number of Goods Available for Sale (in units)

As you can see from the formula above, you only need to divide the total inventoriable costs by the total number of units of goods available for sale.

Again, what consists of inventoriable costs will depend on the business.

In a manufacturing setting, goods available for sale will consist of goods that have completely gone through the manufacturing process.

In a retail or wholesale setting, goods available for sale will consist of products that can be readily purchased by a customer.

For example, let’s say that a manufacturing company was able to completely manufacture 2,500 units of products for a total cost of $400,000 in inventoriable costs.

Using the formula, we compute for the product cost per unit:

Product Cost per Unit = Total Inventoriable/Product Cost ÷ Total Number of Goods Available for Sale (in units)

= $400,000 ÷ 2,500

=$160

As per computation, the product cost per unit is $160.

With this knowledge, the manufacturing company can decide on an appropriate selling product per unit of product.

To make a profit, the sales price must be higher than the product cost per unit.

It cannot be lower as it will always result in a loss.

Accounting for Inventoriable Costs

As already mentioned, inventoriable costs don’t necessarily appear on a business’s income statement as they are incurred.

Rather, they are included in the cost of the business’s inventory, hence inventoriable cost.

Inventory is an asset account that generally represents the cost of goods available for sale.

Though for manufacturing businesses, inventory may also represent the cost of raw materials and work-in-progress.

When the business sells or disposes of the inventory, that’s the time when inventoriable costs appear on the income statement.

For the sale of products, inventoriable costs will appear as Cost of Sale (COS) or Cost of Goods Sold (COGS), which is an expense account.

The rationale behind this is the matching principle where expenses are reported at the same time/period as the revenue they are related to.

So if you report revenue from a product sale in January 2022, you should also report the cost of goods sold related to the sale in the same period.

This also allows accountants to monitor a business’s revenue against its COGS.

Inventoriable Costs vs. Period Costs

We can generally divide a business’s costs/expenses into two categories: inventoriable costs, and period costs.

Inventoriable costs are those costs that we can associate with a business’s products.

On the other hand, period costs are those that we cannot.

Instead, they are costs that a business generally incurs whether it produces a product or not.

Examples of period costs are the following:

- Salaries and wages of administrative staff

- Rent expense for the office that houses the business’s administrative function

- Office supplies expense

- The cost of sales commission

- Selling expenses

- Advertising expenses

A business will initially report inventoriable costs in its balance sheet as part of its inventory.

They only appear on the income statement once the business sells or disposes of the inventory.

In contrast, period costs are directly reported on the income statement as expenses.

Meaning that a business will always report period costs in the period that it incurs them, which isn’t always the case with inventoriable costs.

A business will only have inventoriable costs if it manufactures products, or stocks up on products intended for sale.

On the other hand, a business will incur period costs whether it manufactures a product or not.

Period costs are generally associated with the passage of time after all.

You can also refer to period costs as operating expenses or selling and administrative expenses.

The US GAAP requires all businesses to report all selling and administrative expenses as period costs.

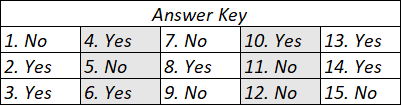

Exercise: is it an inventoriable cost or not?

The following are examples of expenses that businesses typically incus.

The goal of this exercise is for you to determine whether the expense is an inventoriable cost or not.

Answer “Yes” if you think that the expense is an inventoriable cost. Otherwise, answer “No”.

- Salaries and wages of store supervisors

- Cost of raw materials used in the manufacturing of a product

- Salary of a floor supervisor that supervises the production of a certain product

- Cost of rent for the space that houses the manufacturing function of the business

- Cost of supplies that the office staff consumes

- Freight costs necessary to transport the goods from the manufacturer to the store

- Advertising expenses incurred to promote a new product

- The cost of maintenance of the machinery used in the manufacturing of a product

- Salaries and wages of sales personnel

- Salaries and wages of personnel directly involved in the manufacturing of a product

- Cost of rent for the space that houses the business’s administrative function

- The wages of a waiter in a restaurant

- Cost of packaging a product so that it becomes available for sale

- Cost of oil and lubricants used for the machinery and equipment involved in the manufacturing process

- The cost of sales commission