Period CostsDefinition, Examples, Calculation

Period costs, also often known as period expenses, are costs that are charged to expenses in the same period in which they were incurred.

These costs are not capitalized on the balance sheet of a business.

Period Costs

Period costs are expenses that are not associated with a business’s production process.

Instead, these expenses are incurred over a period of time.

These costs are items, such as rent expenses, marketing expenses, general expenses, selling expenses, and other expenses not related to producing inventory.

Because these expenses are not associated with the production process, they are expensed in the same period in which they occur.

If a cost is not connected to the production process of the company’s product, it is a period cost.

Period Costs and Product Costs

The costs sustained by a business are classified as product costs or period costs, and these costs are accounted for in different ways.

| Product Costs | Period Costs | |

| Definition | Costs associated with producing the product | Costs that are not associated with producing the product |

| Recording Method | Capitalized as inventory on the balance sheet and then expensed on the income sheet to the cost of goods sold | Expensed on the income statement in the period in which it was incurred |

| Examples | Direct materials, manufacturing overhead, and direct labor | General expenses, administrative expenses, marketing expenses, CEO salary, and selling expenses |

One way to easily tell if an expense should be classified as a period cost or not is to consider whether or not the cost is either indirectly or directly associated with producing the products the business makes, and, if it is not, it should be classified as a period cost.

Period Costs Example

This example shows the costs that a manufacturing company sustained in its first year of operating.

$20,000 for direct materials that are associated with the product’s production

$100,000 for production worker salaries

$15,000 for the rent of the business’s corporate office

$5,000 for marketing

$500 for the production facility electric bill

$40,000 for the salaries of the business’s accountants

Only part of the above costs are period costs, and they are listed below.

Rent expense for the Corporate Office: $15,000

Marketing Expenses: $5,000

Accountant’s Salaries: $40,000

The above expenses are not associated with manufacturing products.

Therefore, the rent for the corporate office, the marketing expense, and the accountant’s salaries for the first year need to be expensed during the initial year of the company’s operations.

How They Affect the Income Statement

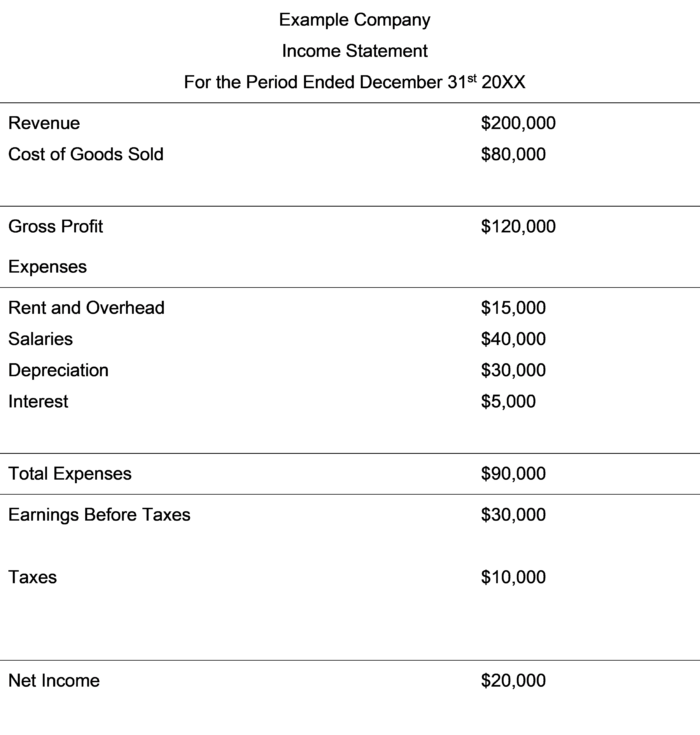

Once the period costs are expensed, they appear as part of the income statement and lower a business’s net income.

Look at the income statement below.

Example – Income Statement

There are many period costs that need to be expensed in the period in which they are incurred.

Several of these costs are listed above in the income statement, such as rent and overhead, salaries, depreciation, and interest.

In contrast to this, the cost of goods sold for products gets expensed on the company’s income statement after the inventory is sold.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "Period Costs" Page 1 . January 3, 2022

Louisiana State University "Period Costing Versus Product Costing" Page 11 - 56. January 3, 2022

Harper College "DEFINITIONS AND CONCEPTS" Page 1 - 15. January 3, 2022