Bad Debt ExpenseDefined with Examples

Selling on credit allows a business to reach out to more potential customers.

This can lead to more revenue that was otherwise unattainable with just cash sales.

The trade-off is that a business won’t be receiving cash at the time of sale.

Instead, what it receives is a promise of payment at a later date recognized as accounts receivable in the business’s books.

This wouldn’t be a problem if the customer follows through on their promise of payment.

The business with still be receiving cash that way, just not at the time of sale.

Unfortunately, that isn’t always the case when it comes to credit extended to customers.

Some accounts receivables may become uncollectible and will remain as such for an indefinite amount of time.

You won’t be able to convert some of your business’s receivables into cash.

It’s an inherent risk that comes with granting credit.

To minimize, if not completely stop the accumulation of these uncollectible accounts, you must first know what causes it in the first place.

By reading this article, you’ll be able to know what bad debt is, why it accumulates, and how to recognize it in your business’s books.

With such knowledge, you should be able to design internal controls and policies to reduce the accumulation of uncollectible accounts – also known as bad debts.

What is bad debt?

Bad debt, in the most literal sense, is a receivable that turned “bad”.

It is a receivable that a business is entitled to but cannot collect.

Do note that for a receivable to truly be considered a bad debt, the business must demonstrate why it is uncollectible.

This can be done by sending out final notices of collection, hiring a collection agency, declaring intent to file a lawsuit, etc.

If all options were exhausted but still did not result in a collection, that’s the time when a receivable becomes bad debt.

Bad debts are essentially worthless assets as you won’t be able to collect them nor convert them to cash.

As such, they should be written off so that your business’s financial statements truly represent its financial standing and performance.

By not doing so, your business’s net worth, as well as its net income, will be overstated.

Why does bad debt accumulate?

It’s easy to say that bad debt is caused by customers who can’t or don’t want to pay.

However, it isn’t always as simple as that.

Sometimes, bad debt can be caused by the business itself.

Here are some reasons why bad debts occur:

- The customer does not have enough liquid assets to pay their dues

- The customer is experiencing insolvency and may be on the verge of bankruptcy, or may already be bankrupt

- A business may have sold a faulty product to the customer which made them unhappy; as such, they refuse to pay unless a replacement product is sent to them

- Credit was granted to a customer that does not have the intention to pay from the very start

- The customer cannot be reached and is actively avoiding the business

- Accounts receivable came from a bogus sale; since there is no actual customer to collect from, there really is no receivables to be collected

- The business has a weak credit policy (e.g. no clear credit terms, credit is granted without performing credit checks, any employee is allowed to grand credit, etc.)

Regardless of the cause and/or reason, bad debt is bad debt.

Having too many of it isn’t good for a business.

Bad debt eats up a business’s resources as it is considered a loss.

What doubly hurts is that it came from a sale you once thought you’d receive cash from.

So, not only are you recognizing a loss, but you’d also have to accept the fact that you made a sale that eventually turned worthless.

What was once revenue turned out to actually be a loss.

And that’s on top of having to write off accounts receivable which is an asset.

That’s why it’s important to have a strong and well-functioning credit policy in place if your business is granting credit.

What is a bad debt expense?

Let me ask you a question: how do you recognize a bad debt?

Do you create a contra asset account and put all bad debts there?

Should you recognize a loss?

Will you reduce the “accounts receivable” account by the amount of bad debts and call it quits?

Well, the answer is yes to all of those questions… sort of.

Depending on the method of recognizing bad debts, you either directly write off the accounts receivable or maintain a contra asset account.

But whatever the method, what remains true is that you’d be recognizing a loss.

This loss is called the bad debt expense.

Bad debt expense is an expense incurred when a business deems a receivable to be uncollectible.

While it may hurt to recognize a loss that isn’t necessarily the fault of your business, recognizing bad debt expense is essential to truly reflect your business’s financial health.

Imagine this: you were able to sell $7,000 worth of products but it was on credit.

If you’re unable to collect on the credit sale, can you confidently say that you truly earned the sale?

Probably not huh?

Accounting for bad debt expense is important and should be kept in mind when preparing financial statements.

Not doing so will overstate a business’s assets and net income.

While your financial statements may look good, it does not truly represent the financial health of your business.

Besides, there’s a benefit to recognizing bad debt expense.

With it, you can identify which customers are more likely to pay and which ones are more likely to default.

You can then use such information in designing your credit policy so that you don’t extend credit to customers that won’t pay.

Methods of recognizing bad debt expense

There are two main methods of recognizing bad debt expense: the (1) direct write-off method, and the (2) allowance method.

Both methods recognize bad debt expense.

Where they differ is the timing.

Direct write-off method

Under the direct write-off method, bad debt expense is recognized only when a receivable is declared to be uncollectible a.k.a. bad debt.

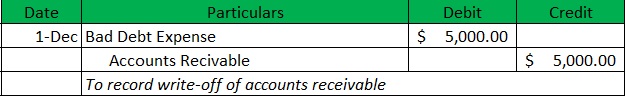

For example, on December 1, a business declares $5,000 of its accounts receivable as uncollectible due to the customer becoming bankrupt.

Along with the writing-off of accounts receivable, the business will also have to recognize a bad debt expense of the same amount.

The journal entry will look like this:

A debit of $5,000 is made to the Bad Debt Expense account to recognize the loss brought by the recognition of bad debt.

A credit of $5,000 is made to the accounts receivable account to reflect the writing-off of bad debt.

The main advantage of using the direct write-off method is that amount of bad debt expense recognized is equal to the actual amount of bad debt.

That means that it will not be understated or overstated.

However, since it doesn’t always uphold the matching principle used in the accrual accounting method, it isn’t the recommended method by GAAP.

Allowance Method

Under the allowance method, bad debt expense is recognized periodically, ideally the same period as the credit sale is made.

Instead of waiting for the actual write-off of bad debts, an estimate is instead used to determine the amount of bad debt expense to be recognized.

A contra asset account called “allowance for doubtful accounts” is maintained when bad debt expense is recognized.

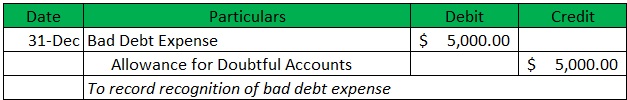

For example, on December 31, a business estimates that $5,000 of its accounts receivable will be likely uncollectible.

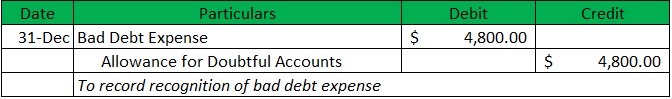

Under the allowance method, the journal entry will be:

Same as with the direct write-off method, a debit of $5,000 is made to the Bad Debt Expense.

However, the credit entry is different. Instead of crediting accounts receivable, a credit of $5,000 is made to Allowance for Doubtful Accounts which is a contra asset account.

It is deducted from the accounts receivable to arrive at the amount of net receivables.

Another thing to notice is the timing of recording.

Instead of waiting for the actual write-off of bad debts, a bad debt expense is recognized at the end of the period (or at the time of sale depending on company policy).

This is to adhere to the matching principle of the accrual accounting method. As such, the recommended method of recognizing bad debt expense under GAAP is the allowance method.

When the $5,000 doubtful accounts actually become bad debt and are to be written-off, the journal entry will be:

Allowance for Doubtful Accounts is debited instead of bad debt expense.

This is because bad debt expense has already been recognized.

Also, since there is an already actual amount of bad debts to be recognized, an estimate is no longer needed.

Thus, Allowance for Doubtful Accounts is debited to reduce its amount.

The issue with the allowance method is that it uses an estimate instead of an actual amount to recognize bad debt expense.

This may cause the bad debt expense to be overstated or understated.

To mitigate this risk, proper care must be done in the computation of estimates.

One way is to look at historical data as a reference. Another is to refer to the industry average.

Speaking of the computation of estimates, there are several ways to do it.

Estimating bad debt expense under the allowance method

Under the direct write-off method, there is no need to compute for bad debt expense.

This is because the amount to be recognized is always equal to the amount of bad debts to be written off.

Under the allowance method though, it’s a different story.

Since an estimate is used, there is a need for computation.

The issue is that there is no one way to compute estimates.

The method of determining estimates will depend on the business.

As such, instead of giving you just one method of estimating bad debt expense, this article will present you with three methods: the (1) percentage of sales method, (2) percentage of accounts receivable method, and (3) accounts receivable aging method.

Percentage of Sales Method

Under the percentage of sales method, a certain percentage is applied to the net credit sale or total credit sales to arrive at the estimated bad debt expense.

What percentage is to be applied will depend on the business.

It could be based on historical data, the business’s credit policy, or maybe even the industry average.

If the percentage to be applied is already determined, then the estimate for bad debt expense can be computed.

The computation is quite simple. Just multiply the percentage rate to the business’s net credit sales or total credit sales.

Put into formula form, it will look like this:

Bad Debt Expense = Net Credit Sales x Percentage to be applied

-or-

Bad Debt Expense = Total Credit Sales x Percentage to be applied

For example, let’s say that company NU has the following data for its credit sales:

| Credit sales | $800,000.00 |

| Sales discounts attributable to credit sales | $40,000.00 |

| Sales returns attributable to credit sales | $60,000.00 |

The management of company NU estimates that 3% of its net credit sales this year will be uncollectible,

First, we compute for company NU’s net credit sales:

Net Credit Sales = Credit Sales – Sales Returns, Discounts, and Allowances

Net Credit Sales = $800,000 – ($40,000 + $60,0000)

Net Credit Sales = $800,000 – $100,000

Net Credit Sales = $700,000

Now that we know company NU’s net credit sales, we can finally compute for the bad expense to be recognized:

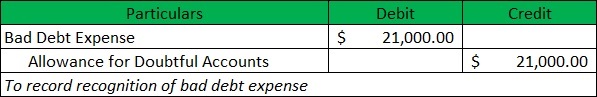

Bad Debt Expense = Net Credit Sales x Percentage to be applied

Bad Debt Expense = $700,000 x 3%

Bad Debt Expense = $21,000

As per computation, the bad debt expense to be recognized is $21,000. The journal entry will then be:

Percentage of Accounts Receivable Method

The percentage of accounts receivable method is similar to the percentage of sales method in that it uses a certain percentage to be applied.

The difference is that it applies the percentage to the current balance of accounts receivable instead of net credit sales.

Once again, the percentage to be applied will depend on the business.

The computation for bad debt expense under this method is simple too.

Once the percentage to be applied is determined, just apply it to the accounts receivable balance.

Put into formula form, it will look like this:

Bad Debt Expense is calculated by multiplying your total Accounts Receivable by the designated percentage you’ve chosen to apply.

For example, company HJ has an ending balance of $120,000 for accounts receivable in the year 2020.

Its management estimates that 5% of the current accounts receivable will become bad debts.

Since we already have the figure for the accounts receivable balance, we can go straight to the computation of bad debt expense:

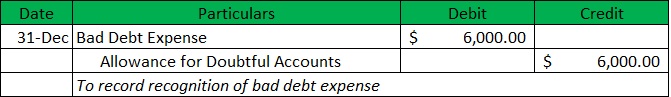

Bad Debt Expense = Accounts Receivable x Percentage to be applied

Bad Debt Expense = $120,000 x 5%

Bad Debt Expense = $6,000

Company HJ will have to recognize a bad debt expense of $6,000 for the year 2020. The journal entry to recognize bad debt expense will then be:

Note that if there is already an existing balance for allowance for doubtful accounts, the bad debt expense to be recognized should be adjusted.

This is because, under this method, the ending balance of allowance for doubtful accounts should be a percentage of the accounts receivable ending balance.

For example, if company HJ has an existing credit balance of $1,200 for allowance doubtful accounts, then the bad debt expense to be recognized would instead be $4,800 ($6,000 – $1,200 = $4,800).

The journal entry would instead be:

The resulting figure for the allowance of doubtful accounts will then be $6,000 after the journal entry has been made.

This is exactly equal to 5% of the ending balance of accounts receivable.

Accounts receivable aging method

The accounts receivable aging method is a level above the other two methods.

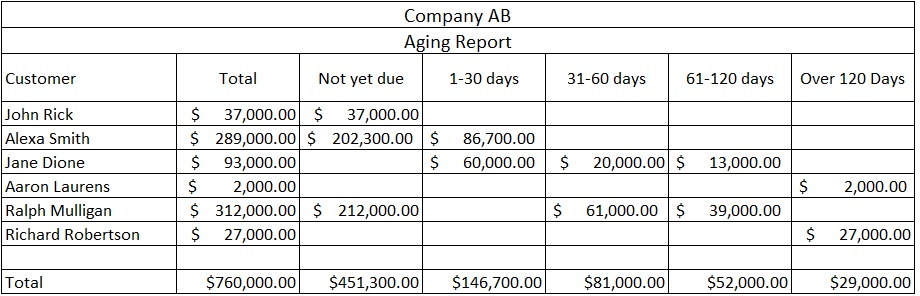

Under this method, we will require a particular accounting record: the accounts receivable aging report or the accounts receivable aging journal.

An aging report groups a business’s accounts receivable by their age (e.g. current, 30 to 60 days, 60 to 120 days, Over 120 days, etc.).

Here’s a simple example of what one would look like:

Once we have the aging report, we can start computing for the bad expense to be recognized.

Under the accounts receivable aging method, a certain percentage will be applied to each age group.

Ideally, a different level of percentage will be applied for each age group.

For example, a business may assign the percentage to be applied for each age group as follows:

| Not yet due | 1-30 days past due | 31-60 days past due | 61-120 days past due | Over 120 Days past due |

| n/a | 2% | 5% | 12% | 50% |

Let’s try computing for company AB’s bad debt expense by using the schedule of percentage above:

| Accounts Receivable | Total | Percentage to be applied | Estimate of Uncollectible Accounts | |

| Not yet due | $451,300.00 | x | 0% | $0.00 |

| 1-30 days | $146,700.00 | x | 2% | $2,934.00 |

| 31-60 days | $81,000.00 | x | 5% | $4,050.00 |

| 61-120 days | $52,000.00 | x | 12% | $6,240.00 |

| Over 120 Days | $29,000.00 | x | 50% | $14,500.00 |

| Total | $760,000.00 | $27,724.00 |

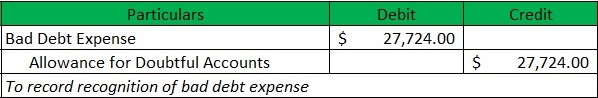

As per computation, company AB will have to recognize $27,724 as a bad debt expense.

The journal entry will be:

As with the previous method of computing bad debt expense, the ending balance for allowance for doubtful accounts should be based on the aging report.

If there is an existing balance for allowance for doubtful accounts, the bad debt expense to be recognized should be adjusted.

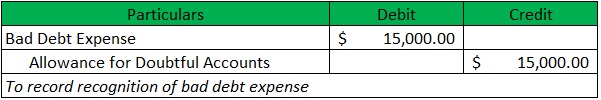

For example, if company AB has a credit balance of $12,724 for allowance for doubtful accounts, it would only need to recognize $15,000 additional bad debt expense ($27,724 – $12,724 = $15,000).

That way, the ending balance would still be $27,724.

The journal entry will be:

As already mentioned before, there is no one way to compute your bad debt expense under the allowance method.

As such, choose the method that suits your preference.

Alternatively, if you only have a small pool of customers who avail themselves of credit, it might be better to base your bad debt expense on a per-customer basis.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell University "Allowance for Doubtful Accounts and Bad Debt Expenses" Page 1 . November 29, 2021

Harvard Business School "What Is Bad Debt Provision in Accounting?" Page 1 . November 29, 2021

Harvard University "When are invoices charged back to bad debt expense? " Page 1 . November 29, 2021