Allowance for Bad DebtLearn how to calculate and estimate Allowance for Bad Debt!

What is Allowance for Bad Debt?

An Allowance for Bad Debt is synonymous with the Allowance for Doubtful Accounts or Allowance for Uncollectibles.

It is a method of valuation of the Accounts Receivable which takes into consideration an estimate of how much the company foresees as uncollectible by the end of the accounting period.

This valuation method is used in order to accurately report the Assets of the company – in particular, the Accounts Receivable so that the firm’s financial position is not overstated.

By the closing period, the Accounts Receivable account must be computed for its book value which is the total receivables less allowance for bad debts.

When selling on credit, there is always the risk that customers will not be able to pay.

For companies to show this risk, they set up the allowance for bad debts.

How Does Allowance for Bad Debt Work?

Any company that allows credit sales will show Accounts Receivable in their books.

The total receivables that companies report on the Balance Sheet will not always be the total amount that they will collect from their clients because there is always the risk that they will default on their payments.

This will result in an overstated Accounts Receivable and an overstatement of the Balance Sheet.

So that companies will be able to show the real value of their Accounts Receivable, they will provide an estimate of how much will be uncollectible – the portion of the outstanding receivables that will not be paid.

There is a possibility that customers will pay their outstanding invoice but there is also a possibility that they will completely default.

When this happens, the balance of the customer account will be written off completely.

Two Methods for Estimating Allowance for Bad Debt

In order for companies to report their Accounts Receivable at book value, companies use either the Sales Method or the Receivables Method in the valuation of their Accounts Receivable.

Sales Method

The Sales Method of Accounts Receivable valuation is straightforward.

Companies simply take a percentage of the Credit Sales that they think will become uncollectible based on past data.

If a company is still new, they can refer to industry practices or a rule of thumb to establish the percentage.

For example, 2% of credit sales based on historical data is never collected.

If the company made credit sales of $200,000 for the current year, the Allowance for Bad Debts will be $4,000 ($4,000 / $200,000 = 2%).

The book value of the Accounts Receivable will be $196,000 ($200,000 – $4,000 = $196,000).

Accounts Receivable Method

The Accounts Receivable Method is a more detailed form of valuation method for Accounts Receivable because it takes advantage of the Aging of Receivables.

The idea behind this is simple: the longer the invoices are in the receivables list, the higher the possibility of them being uncollected.

Should the invoices remain uncollected after 365 days, companies usually decided to write them off.

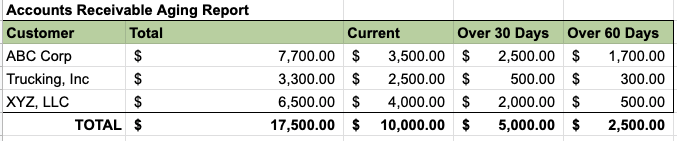

As an example, the company’s Aging Report has shown that Outstanding Invoices that are below 30 days is $10,000, 30 days to 60 days is $5,000 and above 60 days is $2,500:

Based on the company’s past experience, 1% of the receivables that are below 30 days will be uncollectible, 3% of the 30 days to 60 days and 5% of the 60 days and above of the receivables will also become uncollectible.

To compute the Allowance for Bad Debts, the accountant of the company will assign the percentages of the uncollectibles based on the Aging Report.

Based on the above, the Allowance for Bad Debt is computed as follows:

Below 30 days: $100 (1% of $10,000)

30 to 60 days: $150 (3% of $5,000)

60 days above: $125 (5% of $2,500)

Total Allowance for Bad Debts: $375 ($100 + $150 + $125)

If the total Accounts Receivable is $17,500 and the total Allowance for Bad Debts is $375, the book value of the Accounts Receivable is $17,125 ($17,500 – $375).

Allowance for Bad Debt Requirements

The Generally Accepted Accounting Principles (GAAP) requires that the Allowance for Bad Debts should be reasonably estimated in order for companies to be able to report probable losses should a part of their Accounts Receivable become uncollectible.

A reasonable estimate is an amount that companies randomly select – the reasonable estimation of what is uncollectible is based on the collection history of the company.

However, for companies that are fairly new, they might not be able to rely on past collection histories to come up with a reasonable estimate for uncollectibles.

What they can do instead is take estimates from other companies in the same industry, rule of thumb, or industry averages.

Default Adjustments

Even with companies posting an allowance for bad debts, some invoices already included in the allowance will default.

When this happens, the receivable has to be written off and a result of the write off is a reduction in the Allowance for Bad Debts and a reduction of the Accounts Receivable.

The journal entry to write off an Accounts Receivable is as follows:

The reduction to both the Allowance for Bad Debts and Accounts Receivable is because the written off invoice(s) simply does not become part of what the company is still expecting to collect.

Adjustment Considerations

The Allowance for Bad Debt is a Balance Sheet account shown as a contra asset – an account to reduce the amount of the asset account which is the Accounts Receivable in this case.

As part of the Balance Sheet, the balance is carried over in the next reporting periods.

If a company projects that for the current year, the Allowance for Bad Debts will be 8% of the total Accounts Receivable ($30,000).

That means passing an entry for $2,400.

However, the Allowance for Bad Debt already has a balance of $2,000.

That means that to show the estimated uncollectible for the current year, only $400 is required to be added to the existing balance.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Internal Revenue Service "Topic No. 453 Bad Debt Deduction" Page 1. November 15, 2021

Cornell Law School "§ 1.166-4 Reserve for bad debts." Page 1 . November 15, 2021

University of Illinois "Allowance for Uncollectible Accounts Receivables " Page 1 . November 15, 2021