Valuation Account

What is a Valuation Account?

The valuation account in accounting refers to balance sheet accounts that are also paired with another balance sheet account in order for the company to be able to come up with the carrying value of their assets or liabilities.

The carrying amount of these assets and liabilities are a result of the pairing between assets and liabilities accounts.

Essentially, valuation accounts and contra-accounts have the same meaning and function.

They bring the balance sheet accounts to their carrying values in order for companies not to overstate their financial position.

Common examples of valuation accounts include the following:

- Allowance for Doubtful Accounts (contra asset for Accounts Receivable)

- Allowance for Obsolete Inventory (contra asset for Inventory)

- Accumulated Depreciation (contra asset for Depreciable Fixed Assets)

- Premium on Bonds Payable (contra account to Bonds Payable that increases its value)

- Discount on Bonds Payable (contra account to Bonds Payable that decreases its value)

Journal Entries & Examples

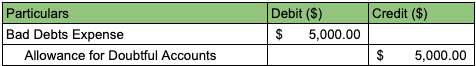

Allowance for Doubtful Accounts

Company ABC made a total credit sales of $250,000 for the year 20xx.

Out of that, Company ABC’s previous experience has indicated that 2% of the total credit sales become uncollectible.

Using the valuation method, the accounts receivable of Company ABC must be brought down to its carrying value and a journal entry to record the Allowance for Doubtful Accounts of $5,000 must be entered.

To do that, the bookkeeper has to post the following journal entry:

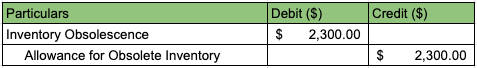

Allowance for Obsolete Inventory

Company ABC has determined that they have an obsolete inventory worth $3,000 but has identified that it can be sold for $700.

The reduction of the inventory value of $2,300 ($3,000 – $700) represents the allowance for obsolete inventory.

To post that in a journal entry, the bookkeeper will make this entry:

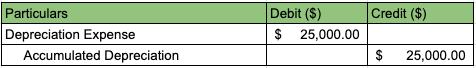

Accumulated Depreciation

Suppose Company ABC uses a straight line method for depreciating their assets and determined that the useful life of all their assets worth $125,000 is 5 years, the depreciation amount to be recorded at the end of the year is $25,000 ($125,000 / 5 years) assuming that these assets have no salvage value.

The journal entry for the above example is:

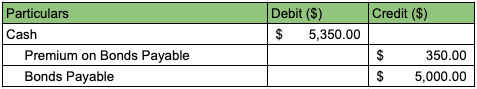

Premium on Bonds Payable

During the year, Company ABC issued a $5,000, 5% 3 year bond for $5,350 and interest payments are going to be made annually.

The journal entry to record the above transaction would be:

Discount on Bonds Payable

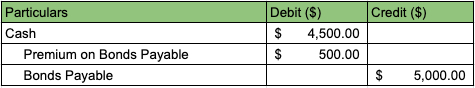

If for example, Company ABC has sold the bond above for $4,500 which is less than the face value of the bond, it means that the company sold at a discount.

This transaction will be recorded in the books as:

Importance of Valuation Accounts

For companies to be able to accurately present their financial position, they must be able to present the value of the assets and liabilities to their conservative amounts rather than just their historical value.

This allows a fair presentation of the company’s financial reports to the stakeholders of the business.

The other terms that refer to valuation account is contra account or valuation reserve.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "17 CFR § 210.12-09 - Valuation and qualifying accounts. " Page 1 . December 3, 2021

Columbia Business School "Valuation: Accounting for Risk and the Expected Return" Page 1 . December 3, 2021

IESE Business School " IESE Business School-University of Navarra - 1 COMPANY VALUATION METHODS. THE MOST COMMON ERRORS IN VALUATIONS" White paper. December 3, 2021