Net ReceivablesDefined with Formula & Examples

Most businesses nowadays offer sales on credit to customers.

It gives the customers the option to pay cash outright or pay at a later date.

For the business itself, it opens up the opportunity to increase sales by being able to reach out to more customers as opposed to just selling only on a cash basis.

Customers that don’t always have cash readily available can now avail themselves of the business’s products or services.

There is a catch though because granting credit comes with risks that the business has to shoulder.

Since the business won’t be receiving cash when the sale was made, its liquidity will be affected.

This is more pronounced if the payment is received at a much later date.

But more importantly, there is the risk of the customer not paying at all.

This should be avoided as much as possible as it means a loss for the business.

However, if your business has been in operation for quite some time now, you’ll know that some accounts just aren’t collectible.

Even some businesses that have strong credit and collection policies get these kinds of accounts from time to time.

It’s just an inherent risk that comes with granting credit.

What you can do instead is to make the loss as minimal as possible.

Still, you have to account for those uncollectible accounts.

The question now is “how to account for uncollectible accounts or bad debts?”.

After reading this article, you will learn about accounts receivable, uncollectible accounts, and how to account for them both.

Why do businesses have Accounts Receivable?

When a business makes a credit sale, it won’t be receiving cash.

It’d still be receiving something in return though– a promise to receive payment at a later date.

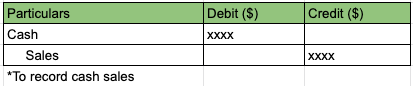

To record a cash sale, the journal entry would look like this:

“Cash” is debited, and “Sales” is credited.

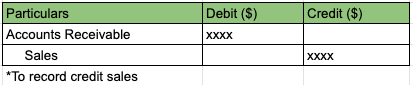

So if a business makes a credit sale, what would the journal entry look like?

It can’t be cash since the business won’t be receiving any cash.

Still, it needs to record an asset as the debit entry.

So what asset account should the business record?

Well, that would be the “accounts receivable” account.

Typically, the journal entry for a credit sale will look like this:

Accounts receivable refer to the accumulated credit granted to customers for the products they’ve purchased or services they’ve availed of.

It represents the uncollected payments or accounts derived from credit sales.

Accounts receivable are often treated as current assets as they can typically be converted into cash within a year.

Most businesses offer credit terms of 30 days, but there’s really no rule as to how long the credit term should be.

Some businesses within certain industries can even have credit terms of more than a year.

In such cases, the accounts receivable is treated as a noncurrent asset and only becomes a current asset once they become collectible within a year.

Only businesses that employ the accrual accounting method record accounts receivable.

Businesses that employ the cash accounting method don’t record accounts receivable simply because it doesn’t involve the inflow or outflow of cash.

Under the cash accounting method, sales/revenues are only recorded if cash is involved.

What are net receivables?

“Net receivables” refers to the amount of accounts receivable that a business deems to be truly collectible.

It could also refer to the amount of money that a business expects to receive from its customers for the credit sales it made.

Alongside other metrics such as the receivable turnover ratio and average collection period, it is used to measure a business’s effectiveness in collecting its accounts receivable.

The net receivables figure is usually computed by subtracting the allowance for doubtful accounts from the gross accounts receivable.

Put into formula form, it should look like this:

Net Receivables = Gross Accounts Receivable – Allowance for Doubtful Accounts

If there is a large difference between the gross accounts receivable and net receivables, it might be an indication that the business is having major problems with its credit sales.

Either it’s having issues with its credit policy (e.g. weak credit policy), or that it may be ineffective or inefficient in its collection.

For example, a business may have granted credit to customers regardless of their capacity to pay.

Sure, it may increase its sales, but the consequence is that it may grant credit to customers that don’t have the capacity to pay, or even worse – won’t pay even if they can.

The business may report a high sales figure, but the amount of cash it can collect from them might be much lower due to bad debts.

The issue with net receivables is that the figure can be manipulated.

Since the figure for allowance for doubtful accounts is an estimate, the business’s accounting staff or management may misrepresent it by reporting a lower amount.

Allowance for doubtful accounts

The allowance for doubtful accounts is an estimate of the amount of accounts receivable that a business deems to be uncollectible.

It is a contra-asset account that offsets the balance of accounts receivable to arrive at the net receivables figure.

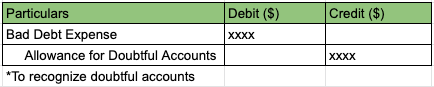

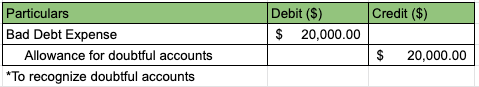

Whenever a business recognizes bad debt expense, it also recognizes the same amount of allowance for doubtful accounts.

The journal entry will look like this:

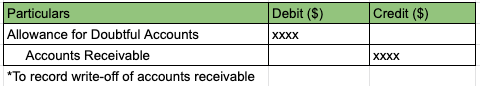

When an account is written off because it is deemed to be truly uncollectible, no additional bad debt expense is recorded unless the amount of allowance for doubtful accounts is insufficient.

Instead, the allowance for doubtful accounts is reduced by the amount of receivable written off.

This is because an estimate of doubtful accounts is no longer needed as there is already an actual figure to be written off.

The journal entry will look like this:

As per GAAP, you don’t wait for a receivable to become “bad” before you record bad debts expense.

Rather, you make periodic estimates of uncollectible or doubtful accounts.

The amount can be arrived at by using various methods, some of which involve the credit sales figure or the aging of accounts receivable.

Methods for estimating doubtful accounts

There are many ways to estimate the allowance for doubtful accounts, but the following are the commonly used methods:

Percentage of Sales Method

Under the percentage of sales method, a certain percentage of the net credit sales or total credit sales for the period is considered to be uncollectible.

The percentage to be applied could be based on historical data or the business’s credit policy.

Once the percentage has been determined, it is to be multiplied by the net credit sales or total credit sales to determine the amount of bad debts expenses and allowance for doubtful accounts to be recognized.

In some cases, the net sales or total sales figure is used instead of the net credit sales or total credit sales.

For example, let’s say that company MT has the following data for credit sales:

| Credit sales | $2,000,000.00 |

| Sales discounts attributable to credit sales | $60,000.00 |

| Sales returns attributable to credit sales | $140,000.00 |

The management of company MT estimates that 4% of its net credit sales are uncollectible.

Before we compute for the amount to be recognized as doubtful accounts, we must first get our net credit sales figure:

Net Credit Sales = Credit Sales – Sales Returns, Discounts, and Allowances

Net Credit Sales = $2,000,000 – ($60,000 + $140,000)

Net Credit Sales = $2,000,000 – $200,000

Net Credit Sales = $1,800,000

As per computation, the net credit sales of company MT amounted to $1,800,000.

Now that we have our net credit sales figure, we can finally compute the estimate of uncollectible accounts:

Allowance for doubtful accounts = Net Credit Sales x Percentage to be applied

Allowance for doubtful accounts = $1,800,000 x 4%

Allowance for doubtful accounts = $72,000

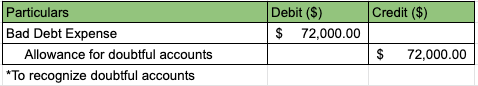

Company MT will recognize $72,000 as its allowance for doubtful accounts.

The journal entry will look like this:

If the total credit sales figure was used instead of the net credit sales, the allowance for doubtful accounts to be recognized would be $80,000:

Allowance for doubtful accounts = Total Credit Sales x Percentage to be applied

Allowance for doubtful accounts = $2,000,000 x 4%

Allowance for doubtful accounts = $80,000

Percentage of Accounts Receivable Method

Under the percentage accounts receivable method, a certain percentage of the current balance of accounts receivable is considered to be uncollectible.

It is much like the percentage of sales method but instead of using the credit sales figure, the balance of accounts receivable is used instead.

For example, company JG has $50,000 of accounts receivable as of December 31, 2020.

The top management estimated that 6% of the company’s accounts receivable is uncollectible:

Allowance for doubtful accounts = Accounts Receivable x Percentage to be applied

Allowance for doubtful accounts = $50,000 x 6%

Allowance for doubtful accounts = $3,000

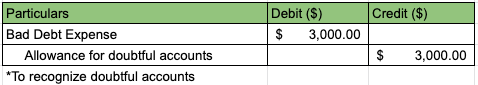

As per computation, company JG will have to recognize $3,000 as allowance for doubtful accounts for the year ended 2020:

Note that the ending balance of allowance for doubtful accounts under this method should be based on the ending balance of accounts receivable.

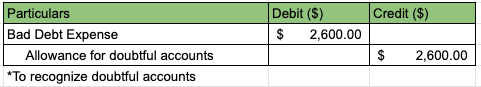

For example, if company JG has an existing credit balance of $400 for allowance for doubtful accounts, the journal entry would instead be:

This is because we want to have an ending balance of $3,000 for allowance for doubtful accounts.

Since there already exists a credit balance of $400, we subtract that amount from the ending balance of $3,000 that we want to achieve.

The resulting figure would be $2,600 which we will recognize as the allowance for doubtful accounts for the year 2020.

Accounts Receivable Aging Method

Unlike the previous two methods, the accounts receivable aging method requires a bit more data than just figures from the income statement (credit sales) or balance sheet (accounts receivable).

For this method, we’ll have to use the accounts receivable aging report.

In an aging report, all of a business’s accounts receivable are grouped by their age (e.g. below 30 days, 30 to 60 days, 60 to 120 days, etc.).

Here’s a simple example:

Under the accounts receivable aging method, a certain percentage is applied to each age group.

For example, a business may assign the percentages to be applied as follows:

| Not yet due | 1-30 days past due | 31-60 days past due | 61-120 days past due | Over 120 Days past due |

| n/a | 3% | 7% | 15% | 50% |

If we apply these percentages to the above company X example, we would arrive at:

| Accounts Receivable | Total | Estimate of Uncollectible Accounts | ||

| Not yet due | $412,000.00 | x | 0% | $0.00 |

| 1-30 days | $243,000.00 | x | 3% | $7,290.00 |

| 31-60 days | $70,000.00 | x | 7% | $4,900.00 |

| 61-120 days | $107,000.00 | x | 15% | $16,050.00 |

| Over 120 Days | $12,000.00 | x | 50% | $6,000.00 |

| Total | $844,000.00 | $34,240.00 |

Company X will recognize $34,240 as the allowance for doubtful accounts.

The journal entry would be:

Note that as with the percentage of receivables method, the ending balance for allowance for doubtful accounts under this method should be based on the aging report.

If there is already an existing balance for allowance for doubtful accounts, the journal entry would be an adjusting entry to reflect the new balance.

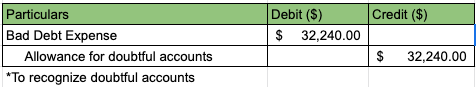

For example, if company X already has an existing credit balance of $12,240.00 for allowance for doubtful accounts, it would only need to recognize an additional $20,000.00 to reflect the balance of $32,240.

The journal entry would then be:

Gross accounts receivable vs net receivables

“Gross accounts receivable” represents the amount of outstanding balances of accounts receivable that were earned from credit sales.

On the other hand, “net receivables” represents the amount of accounts receivable that is deemed to be truly collectible.

The difference between the two will be the allowance for uncollectible accounts.

Under GAAP, the net receivable or net accounts receivable balance should be presented on the balance sheet instead of the gross balance.

This is to show the net realizable value of the amount owed to the business by customers instead of just the gross amount.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Alamo Colleges "Bad Debts, Credit Card Sales, Notes Receivable" Page 1. November 19, 2021

Michigan State University "Managing Accounts Receivable" Page 1. November 19, 2021

California State University "Sales and Accounts Receivable" Page 1. November 19, 2021