Notes ReceivableDefined with Examples, Journal Entries & More

What are Notes Receivable?

A Notes Receivable is a written agreement – a promissory note – to receive a specified sum of amount for a specific date detailed in the agreement.

With a Notes Receivable, the bearer of the note is given the right to receive the amount stated in the promissory note.

A Notes Receivable is always evidenced by a promissory note, which is a written promise signed by the maker to the bearer of the note.

There are two classifications of a Promissory Note in the Balance Sheet: Current Asset and Non-Current Asset.

When a Promissory Note has a maturity of less than a year, it will be classified under Current Assets.

But if it matures in more than a year, it shall be classified under Non-Current Assets.

In some instances, a company allows long outstanding amounts recorded under Accounts Receivable to be converted to Notes Receivable.

In doing so, the maker of the noted is afforded more time in settling their obligations.

Key Components of Notes Receivable

Notes Receivables need to have 5 key components: Principal Amount, Maker of the Note, the Payee, Stated Interest, and the Term or Duration of the Note.

Principal Amount

The amount stated in the Notes Receivable is the principal value of the agreement.

This is the amount that the maker of the note has to pay back including the interest rate.

Maker of the Note

The maker of the note is the person who promises to pay the amount owed based on the terms agreed in the Promissory Note.

The note, in the books of the maker, is classified as a Note Payable.

Payee

The Payee is the one to whom the principal amount plus interest will be paid.

From the Payee’s books, the principal amount will be recorded as notes receivable and any interest received will be recorded as Interest income.

Interest

A predetermined interest rate is included in the promissory note which the maker will have to pay to the Payee along with the principal amount when it falls due.

Term

The term of the note determines when the principal amount has to be paid, which can be before the maturity date or on the maturity date.

Either way, the maker will not be charged for penalties if it is paid early or on time.

Example and Journal Entries for Notes Receivable

ABC Inc. has sold $600,000 worth of jewelry to Gold Company which has to be paid within 30 days.

60 days have passed and Gold Company has not been able to make a payment yet.

For this reason, both companies have agreed that Gold Company will issue a promissory note for the principal amount of $600,000 and an interest rate of 8% for 3 months.

At the end of each month, ABC Inc. will receive $200,000 plus interest from Gold Company.

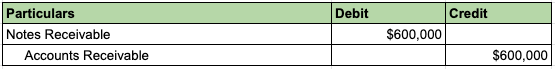

To record the transfer of Accounts Receivable to Notes Receivable, ABC Inc. will make this journal entry:

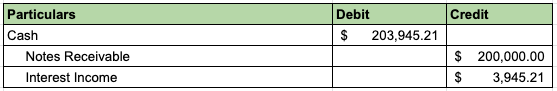

At the end of the month, ABC Inc. will receive the first payment from Gold Company for $200,000 plus the interest due $3,945.21 ($600,000 x 0.08 x (30/365)).

To record the receipt of payment, the journal entry will be as follow:

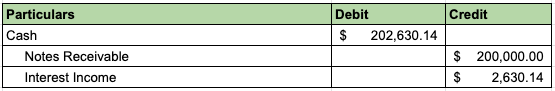

At the end of the second month, another payment of $200,000 will be due plus the interest on the balance amount which is $2,630.14 ($400,000 x 0.08 x (30/365)).

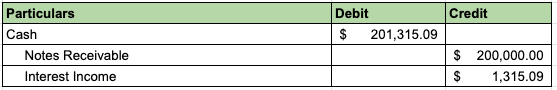

At the end of the third month, the final payment of $200,000 is due plus the interest on the balance of the principal amount which is $1,315.09 ($200,000 x 0.08 x (30/365)). ABC Inc. will record the final payment with the following journal entry:

When the note matures, the note receivable is completely paid off, and ABC Inc. has earned a total interest income of $7,890.44.

Notes Receivable vs Notes Payable

A company’s Balance Sheet as of a particular date can have both Notes Receivable and Notes Payable.

The Notes Receivable represents that amount that the company will be able to receive, while the Notes Payable represents the amount owed to other parties.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Alamo "Bad Debts, Credit Card Sales, Notes Receivable" Page 1 - 5. March 28, 2022