Incurred ExpensesDefined, and Identifying Incurred Expenses

There are different methods for recording expenses.

When you’ve received a product or service, but have not yet paid for it, one way or another, you will need to record this expense.

Do you record the expense before or after you’ve actually paid for the product or service?

When is really the right time to record “expenses” as “expenses”.

The truth is, it will depend on the accounting method that you or your business uses.

Under the cash accounting method, it’s pretty simple because expenses are only recorded in the books as expenses if they are paid for in cash.

For example, if you purchased office supplies on credit, under the cash accounting method, you won’t be recording office supplies expenses until you paid for them.

Things are a lot different with the accrual accounting method though.

Expenses are not recognized based on whether they are paid for or not.

Rather, under the accrual accounting method, expenses are recorded when they are incurred – be there cash involved or not.

But what does “incurred” mean?

According to the Merriam-Webster dictionary, incur is defined as to cause yourself to have or experience something unpleasant or unwanted.

But what does that have to do with accounting for expenses?

In this article, we will learn what “incurred” means in accounting, and what it means when someone says incurred expenses or incurred costs.

We will also learn the risks of having too many incurred expenses.

What does incurred mean?

Incurred in accounting, particularly under the accrual accounting method, means that all transactions must be recorded in the books as they occur.

This is regardless of their nature.

That means that transactions must be recorded when they are made regardless of when they are paid.

For example, an expense must be recorded as they are incurred regardless of whether they are paid for or not.

There are some schools of thought that refer to “incurred expenses” as expenses or costs that are already availed of but have yet to be paid.

For example, a business has entered into a lease contract where it is expected to pay $3,000 per month.

It has still yet to pay the rent for last month.

In such a case, the business has incurred a $3,000 rent expense.

Some businesses do this to differentiate between unpaid and paid expenses.

In this case, incurred expenses can also be referred to as unpaid expenses.

Nonetheless, an expense is considered incurred when a resource is consumed.

It could be through the passage of time or the physical consumption of a resource.

For example, in a typical lease contract that bills monthly, you will incur rent expenses once a month passes.

Another example would be depreciation expenses.

Typically, depreciation for fixed assets is expensed monthly, meaning that it is incurred through the passage of time.

As for physical consumption, a great example is the cost of goods sold.

Whenever a business makes a sale of goods/products, it also incurs an expense equivalent to the cost of the goods/products sold.

You can also incur expenses without any corresponding documents such as supplier invoices, or official receipts.

In fact, some expenses can only be recognized through journal entries (e.g. deprecation, amortization, bad debts expense related to allowance for doubtful accounts).

Incurring obligations and expenses

While incurred expenses can be tagged to incurring obligations, you don’t always necessarily incur an expense when you incur an obligation.

Some of the obligations you incur don’t immediately result in the consumption of resources.

For example, when a customer pays in advance for your goods, then you incur an obligation to deliver such goods.

However, since no resources were consumed yet, you have not incurred an expense.

Another example, a business enters into a five-year lease agreement with the commitment to pay monthly rent.

In such a case, the business has incurred an obligation to pay rent for the next five years.

Meaning that it has incurred an obligation to eventually incur an expense.

But at the time the incurred obligation was recorded, an expense is not yet recorded.

The rent will only be considered as an incurred expense when it is consumed.

A financial obligation coming from accruals typically has a corresponding incurred expense.

For example, a business recognized accrued salaries and wages because it still has unpaid but already incurred salaries and wages at the end of the period.

This happens when the business pays its employees’ salaries and wages sometime during the month rather than on its last day.

When are expenses deemed incurred?

To know when an expense is incurred, let’s have a quick exercise.

The following are several scenarios:

- A) Company A ordered from its supplier office supplies (paper, pencil, pens, etc.) on September 17.

The supplier sent an invoice on September 18, but company A only received the office supplies on September 20.

Company A later paid for the office supplies on September 28. - B) Company B pays its employees’ salaries and wages every 5th and 20th of the month.

Does it incur a salaries and wages expense at the end of the month? - C) Company C availed the services of company X to perform repairs and maintenance on its machinery and equipment.

Company C paid company X $2,500 on July 14 as advanced payment.

Repairs and maintenance were completed on July 21. Company C was billed $5,000 for the whole service.

Company C paid an additional $2,500 on July 22 for the completed service. - D) Company D entered into a lease contract with company Y that will last for a year.

Company D is to make rental payments of $800 every 10th of the month.

Company Y is obligated to provide company D office space in exchange for rental payments.

The contract is set to commence on September 11 and will end on September 10 of the next year. - E) On July 7, a customer sought company E’s cleaning services and paid $100 upfront.

The customer needs cleaning services on July 10 to help with an afterparty cleanup.

On July 10, company E performed cleaning services.

$10 of cleaning supplies were used, and $50 was paid to the contracted laborers.

Your task is to determine whether an expense is incurred or not; if an expense is indeed incurred, determine when it should be recorded in the books.

Scenario A

Is there an incurred expense? Yes.

When was it incurred?

On September 20.

Company A ordered the office supplies on September 17 but only received them on September 20.

Going back to how we defined “incurred” earlier, an expense is incurred when a resource is consumed.

In this case, the receipt of office supplies is when a resource was consumed.

Thus, when Company received the office supplies on September 20, it would have to record supplies expenses in its books to recognize the incurred expense.

Alternatively, company A can recognize the office supplies as an asset account.

It will then recognize supplies expense only when the office supplies are actually consumed.

Most businesses don’t do this practice as it often is inefficient and impractical.

Scenario B

Scenario B is structured differently than the other scenarios.

We know for sure that Company B incurs salaries and wages expense every 5th and 20th of the month.

But is that all there is to it?

What about the work that the employees do from the 21st until the last day of the month?

Under the accrual accounting method, transactions must be recorded as they are incurred.

So think about this: company B’s employees still worked on the 21st until the last day of the month.

What happens to the cost of their labor? Will it remain unrecorded until paid for?

Of course not.

As these salaries and wages were already incurred by the end of the month, they must be recorded in the books as an incurred expense.

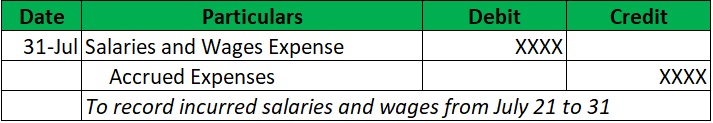

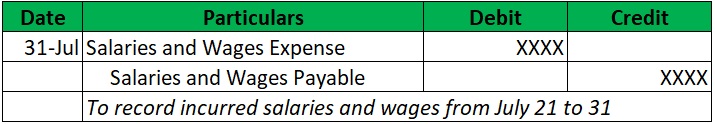

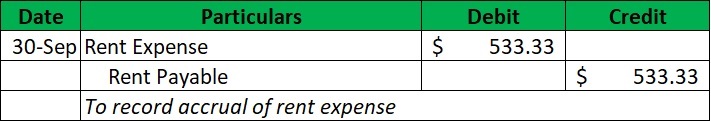

This can be done via recording an accrual through a journal entry, such as follows:

-or-

Note that accruals are not exclusive to salaries and wages.

Any expenses that are incurred but are not yet recorded by the end of the month/period must be accrued.

A prime example of an incurred expense that is only recorded through accrual is the depreciation of long-term assets.

Scenario C

Is there an incurred expense? Yes.

When was it incurred? On July 21.

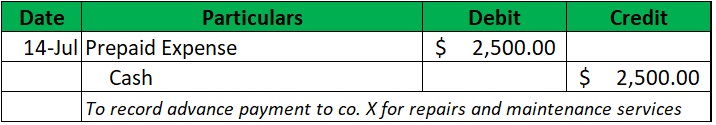

When company C paid company X $2,500 in advance on July 14, no expense was incurred yet.

This is because there was no consumption of resources yet – which is the completion of repairs and maintenance services.

Rather, company C’s advance payment is a prepaid expense. It is recorded as follows:

This prepaid expense account will be consumed when actual repairs and maintenance services are performed.

By then, there is an incurred expense.

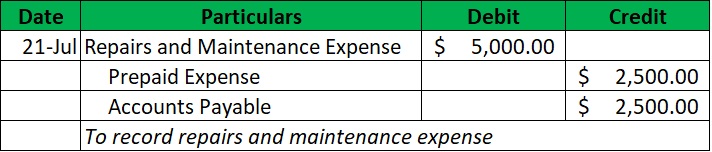

On July 21, when company X completed its repairs and maintenance services and billed company C for $5,000, that’s the time when company C incurred an expense, particularly repairs and maintenance.

As such, the expense should be recorded in the books on July 21.

Since the advanced payment wasn’t enough to cover the entire bill, Company C will have to record a liability (accounts payable):

Scenario D

Is there an incurred expense? Not yet.

When company D entered into a lease contract with company Y, it incurred an obligation.

However, since no resource was consumed yet (rent in this case), there is no incurred expense.

So on September 11 when the lease contract was commenced, there is no need to record rent expense yet.

This is one of those cases where an obligation is incurred, but there is no corresponding incurred expense to record.

By the end of September, the rent for September 11 to 30 has already been consumed.

Thus, an accrual must be made to record the incurred rent expense:

On October 10, when rent is paid, the journal entry will be:

Scenario E

Is there an incurred expense? Yes.

When was it incurred? On July 10.

When company E received $100 from a customer for a service that has yet to be delivered, it incurred an obligation.

This is because company E now has an obligation to render services for the customer in exchange for the payment received.

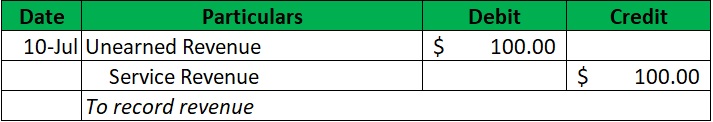

The $100 that company E received on July 7 should be recorded as:

The recording of such incurred obligation does not have a corresponding incurred expense… yet.

This is because no resources were consumed at the time the obligation was incurred (the cost service in this case).

On July 10, when company E actually performed cleaning service, that is when expenses were incurred.

Particularly the $10 consumed cleaning supplies and $50 cost of contracted labor, which amounts to a total of $60.

Let’s assume that company E has an inventory for cleaning supplies:

And since the unearned revenue is actually earned now, it needs to be recognized as such:

Do you now know how to determine when an expense is incurred?

If not, you can always refer to this exercise and you’ll eventually get the hang of it.

Why it is important to recognize when an expense is incurred

Under the accrual accounting method, transactions must be recorded when they occur.

Revenue must be recorded when earned. Expenses must be recorded when incurred.

This is why it’s important to know when an expense is deemed incurred.

Recording expenses in the incorrect period will overstate that period’s expenses.

Not only that, it will understate the expenses of the period that said expenses should have been recognized.

This is more pronounced when a business prepares monthly financial statements.

It might also affect certain projections (e.g. monthly expenses).

Always go back to the definition of incurred expense: an expense is incurred when a resource is consumed.

It could be either through the passage of time or actual physical consumption.

You can also refer to the matching principle, one of the basic underlying guidelines in accrual accounting.

It states that an expense must be reported in the period in which its related revenue is earned (cost of sales).

Furthermore, if an expense is not directly related to revenue, then it should be reported in the period that it expires or is consumed.

The risk with accumulating incurred expenses

(In this section, incurred expenses refer to expenses that are yet to be paid)

The unsupervised accumulation of incurred expenses, particularly unpaid expenses, poses a risk for a business.

While it allows a business to continue operations without the immediate need for cash outlay, having too many unpaid expenses can have financial consequences.

Incurred expenses, particularly unpaid expenses, are liabilities.

Having them accumulate to the point where they cannot be covered by your liquid assets is a surefire way to insolvency, and eventually, bankruptcy.

To combat this, always go back to your business’s budget for expenses.

Don’t go over your budget, whether it pertains to paid or unpaid expenses.

If you have to go over, make sure that it isn’t an amount that your assets, particularly liquid assets, can’t handle.

This way, you won’t have to worry about liquidity issues turned into insolvency.

Managing your obligations and expenses isn’t easy, but if you have a budget to fall back on, it should be more manageable.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard "Accounting Accruals – What are they and why do we do them? " White paper. December 7, 2021

Cornell Law School "expenses incurred" Page 1 . December 7, 2021