Bad Debt ProvisionExplained with Journal Entry Examples

Provision for Bad Debts Defined

The provision for Bad Debts refers to the total amount of Doubtful Debts that need to be written off for the next accounting period.

Doubtful Debt represents an expense that reduces the total accounts receivable of a company for a specific period.

This is in line with the accrual basis of accounting – probable expenses are recognized when invoices (sales) are issued to customers.

The provision is necessary to be recognized because knowing the amount of loss is difficult to ascertain until it actually happens.

There are three different types of debts:

Good Debts

Debts that will eventually be paid and do not pose any signs of it being uncollectible are referred to as a Good Debt.

Doubtful Debts

Doubtful debts refer to outstanding invoices that do not provide a clear picture of when it is going to be paid – if it is going to be paid at all.

Bad Debts

When doubtful debts are proven to be irrecoverable or uncollectible, they will be written off as bad debts in the company’s books and subsequently be removed from the accounts receivable balance.

Journal Entries in Case of Bad Debt and Provision

There are two methods to record a company’s Bad Debt: The Direct Method and the Allowance Method.

Direct Method

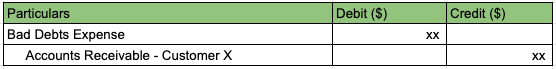

The Direct Method directly records bad debts against the receivable account.

In turn, the total collectible is reduced and so does the Net Income of the company.

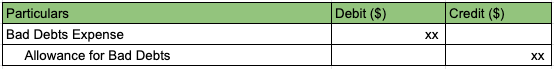

The journal entry under the Direct Method can be posted as follows:

Allowance Method

Allowance Method

Instead of directly writing off the bad debts account from the books, an allowance is first recorded and is typically done for receivables with material amounts.

With this method, an Allowance for Bad Debts is recorded which is a contra asset and reported in the balance sheet as a reduction from the Accounts Receivable account.

When it can be ascertained that the amount is uncollectible, another entry will be passed which will reduce the Provision for Bad Debts / Allowance for Bad Debts and also reduce the Accounts Receivable account.

Allowance for Bad Debts journal entry example:

Write-Off of Bad Debts

Examples of Provision for Bad (and Doubtful) Debts Journal Entries

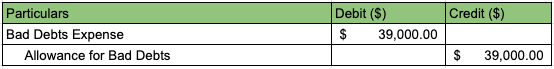

At the end of the accounting period for the year 2020, Company X has estimated that 20% of their Accounts Receivable balance will become uncollectible based on the company’s previous history.

The Accounts Receivable balance on December 31, 2020 is $195,000.

Company X will record the Provision for Bad Debts with the following journal entry:

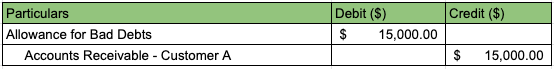

The following year, Company X has ascertained that Customer A has filed for bankruptcy and will no longer be able to recover the outstanding amount due from them in the amount of $15,000.

When Company X recorded the allowance for bad debts, the company’s expenses and allowance for bad debts increased by $39,000, and in effect, the Net Income decreased by the same amount.

The next year, when Company X wrote off the balance of Customer A, the Allowance for Bad Debts decreased and so did the customer balance which is an Accounts Receivable account.

Therefore, upon the recording of the allowance for bad debts, it directly affects the Income Statement.

When writing off bad debt, it only affects the Balance Sheet.

Conclusion

The Provision for Bad Debts directly impacts the financial statements of the company.

For this reason, a reasonable estimate of the provision must be made in order to fairly and accurately present the financial statements for a given period.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard Business School "WHAT IS BAD DEBT PROVISION IN ACCOUNTING?" Page 1 . February 23, 2022

Cornell University "Allowance for Doubtful Accounts and Bad Debt Expenses" Page 1 . February 23, 2022