Step CostsWhen there's a drastic increase or decrease in costs

You can generally categorize costs into two categories depending on their behavior.

They could be either be variable or fixed.

They could sometimes be a mix of both.

Variable costs are those costs that tend to change depending on the level of activity.

For example, the cost of materials increases as the level of production goes up.

Another example would be sales commission, where it increases or decreases depending on the level of sales.

On the other hand, fixed costs are those costs that stay the same no matter the level of activity.

They don’t increase or decrease if there are changes in the level of production, sales, etc.

Well, that’s only true to an extent.

Fixed costs can increase or decreases when certain thresholds are breached.

For example, think of a production plant that is already operating at maximum capacity.

If the business operating the plant wants to increase production, it has to secure extra space to accommodate the increase.

To do so, the business has to either rent or acquire a new plant, with both options carrying additional costs.

Unlike the usual variable costs where the increase or decrease is proportional to the changes in the level of activity, changes in the fixed costs are usually disproportionate.

Let’s go back to the production plant sample above.

Let’s say that its maximum capacity is 10,000 units.

The business wants to increase production by 1,000 units.

If the business pushes through with the increase in production level, there will be a disproportionate increase in costs.

The business has to bear the full cost of renting or acquiring a new plan just to accommodate the additional 1,000 units.

We refer to costs that behave like this as step costs.

In this article, we will be learning about them.

What are Step Costs?

Step costs refer to expenses that are fixed for a given level of activity.

Meaning that they’re generally fixed costs within a certain range of activity.

But they increase or decrease when a threshold is breached.

The increase or decrease is usually disproportionate to the changes in the level of activity.

When we plot a step cost on a graph, it will show a stair-step pattern (which is probably why we refer to it as a step cost).

It will remain fixed for a certain range of activity (represented by horizontal line) and then will have a spike increase or decrease (represented by a vertical line) when a threshold is breached.

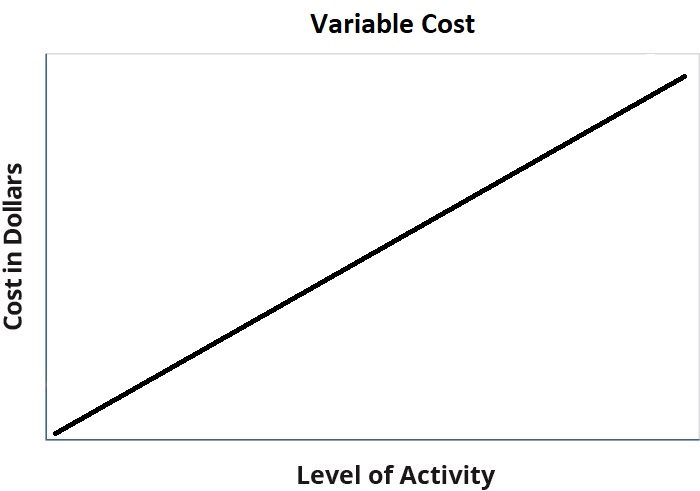

To illustrate the difference between variable and step costs, here’s a sample line graph for variable costs:

And here’s a sample line graph for a step cost:

The difference is noticeable, right?

The line graph for variable costs is a smooth incline, while the line graph for step costs has drastic increases.

And it looks like a stair-step too.

The horizontal line represents the range of activity where costs remain the same.

The vertical represents the change in costs whenever a threshold is breached.

Steps costs can greatly affect a business’s profitability.

As such, it only makes sense to be wary of the thresholds that cause them to change.

It’s good practice to identify the activity level where step costs increase or decrease.

This way, the management can gauge whether an increase or decrease in the level of activity can result in additional profits or not.

Understanding step costs helps the business in maintaining the highest level of profitability.

Why are Step Costs important?

Businesses need to be wary of step costs, especially when they are about to breach a threshold (reaching a higher level of activity than the maximum capacity).

Changes in step costs can be drastic.

If the revenue that comes with the increase in the level of activity cannot cover the increase in cost, then increasing the level of activity does more harm than good.

It may eat up the profits the business would have gained if it stuck with its usual level of activity.

Worse, it may even result in a loss.

In such a case, it may be better to not accommodate the increase in the level of activity to maintain the level profitability.

On the other hand, step costs can also decrease when the level of activity becomes low enough to cause the decrease.

For example, a business decides to shut down one of its branches as it’s constantly performing poorly.

This causes a drastic decrease in costs (e.g. decreases in the cost of rent, salary, property taxes, etc.), but can lead to an increase in profitability.

The decrease in costs may be greater than the decrease in profits, which leads to a net increase in profits.

Some businesses apply some management tricks to control costs (including step costs).

For example, instead of hiring additional full-time staff to increase production capacity, the business might opt to offer overtime to existing employees.

Or the business can implement product efficiencies that increase production capacity without having to drastically increase costs.

Steps Costs – Example

Think of this scenario. A production plant is already operating at maximum capacity with its current equipment and machinery.

If it wants to increase production, it has to acquire another piece of machinery.

A piece of machinery usually goes for $7,500 and can provide an additional production capacity of 1,500 units.

Currently, the plant is producing 5,000 units of products, all of which are sold within the same period that they produced.

Each unit of product sells for $10.

The business’s sales team gathers that it can reliably sell 500 more units of products.

As such, they propose to upper management to increase production by 500 units.

The question now is, would it be a good move to increase the production volume to accommodate the increase in demand?

Let’s lay down the important facts first. A piece of machinery costs $7,500.

A unit of product sells for $10.

There is a proposal to increase the production volume by 500 units.

Let’s see if the additional sale is enough to cover the increase in cost:

Additional Revenue = 500 × $10

= $5,000

The business can generate additional revenue of $5,000 if it pushes through with the increase in production.

However, it’s not enough to cover the cost of acquiring an additional piece of machinery, which is $7,500.

And that’s not even considering other costs such as materials, labor, utility, and maintenance costs.

As such, it isn’t a good idea to accommodate the additional 500 units of products.

Step Costs – To Take the Step or Not?

When dealing with step costs, there are two you need things that you need to consider.

First, you need to identify which costs behave like step costs.

These are usually costs that seemingly stay fixed… for a certain range of levels of activity that is.

If it’s a fixed cost and you think that it’ll change if there’s a change in the level of activity that breaches a threshold, then it probably is a step cost.

The next thing to consider is the levels of activity that these step costs increase or decrease.

Knowing when these step costs change helps gauge whether a planned increase or decrease in the level of activity improves profitability.

If the increase or decrease does not result in more profits, then the business might want to reconsider going through with it.

An increase in revenue doesn’t always necessarily lead to an increase in profits.

The increase in revenue might be overshadowed by a larger increase in costs.

Dealing with step cost doesn’t always mean “stepping up” though. If the level of activity slacks down, such as a decrease in demand or production, the business will have to consider “stepping down” on costs.

What this means is that it might need to reduce or eliminate some costs.

For example, it might need to let go of some employees to save on labor costs when production slacks down.

Or it might need to merge two branches to save on rent and maintenance costs.

It’s important to remember that when dealing with step costs, the increase or decrease should not reduce the level of profitability that the business is currently enjoying.

Rather, it should maintain it, or even better, improve it.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Iowa State University "Managerial Costs" Page 1 . April 4, 2022

Sacramento State University "Activity Based Costing" Page 1 - 12. April 4, 2022