Return on Capital EmployedDefined with Formula, Calculation & Examples

Investing in a business can be fairly risky.

You can never be 100% sure if it’ll result in a profit or loss.

And other factors such as the economy and economic policies, situations of market, and perhaps even natural disasters that are outside of the business’s operations and can also affect your prospects.

These external factors can’t usually be predicted and are thus out of our control.

That said, even with all the risk, some investors are still willing to invest in these businesses.

The allure of having a source of passive income is just that great.

But it’s not like these investors are making investments here and there without any care for the risks.

They still do. They just make informed decisions based on certain data.

When investing in a business, you would want to know about its profitability and financial condition.

While you can find pieces of information from the business’s financial statements, you can also rely on other metrics such as financial ratios.

Among these ratios are the so-called profitability ratios such as the following:

- ROE or Return on Equity

- ROA or Return on Assets

- ROIC or Return on Invested Capital; and

- ROCE or Return on Capital Employed

Among the ratios mentioned above, the Return on Capital Employed or ROCE ratio is the most popular among investors.

ROCE, when understood correctly, can be a great tool for identifying which investments are likely to give you a return.

With such knowledge, you can reduce the risk that comes with investing.

In this article, we will be learning about ROCE.

We will be learning about its definition as well the formula for its computation.

We will also be learning of its advantages and inherent limitations.

Return on Capital Employed (ROCE): What is it?

Return on Capital Employed or ROCE is one of the profitability ratios.

It measures a business’s ability to generate profits using its capital employed.

Investors and shareholders use ROCE to determine if a business or investment is more likely to generate a return.

Like most ratios, it is often expressed in percentage form.

A higher percentage means that the business or investment is better at producing profits or returns

Another name for ROCE is the “primary ratio”.

From a business owner’s perspective, ROCE measures his/her business’s efficiency in producing profits from the capital it gathered from both investors and creditors.

Having a higher ROCE makes the business more attractive to potential investors.

Creditors are also more likely to extend credit to a business that has a high ROCE.

A business would want to have a ROCE that is higher than the rate at which it is borrowing capital.

If ROCE is higher, then that means its earnings exceed the cost of borrowing capital.

A higher ROCE also means that the business is earning more per dollar of capital employed.

A business would also want to have a consistent and rising trend for ROCE.

A volatile trend for ROCE would mean that the business is producing volatile profits.

There may be periods where the business is earning high, and where it is earning low.

This volatility may be high-risk, high rewards but is a major turn-off for investors that seek a more stable investment.

ROCE is also useful in comparing businesses that belong to capital-intensive industries.

It can also be used in comparing businesses that have different capital levels (provided they are within the same industry).

What makes ROCE a step above the other profitability ratio, Return on Equity (ROE), is that it considers both sources of capital: debt and equity.

Return on Capital Employed (ROCE) Formula

The consensus in computing ROCE is that you divide the EBIT (earnings before interest and taxes) by the capital employed.

Put into formula form, it should look like this:

ROCE = EBIT ÷ Capital Employed

Where:

EBIT: Earnings before Interest and Taxes

Capital Employed: Total Assets – Total Current Liabilities

The flaw with this formula is that it does not consider the possibility of non-operating gains and losses.

That means that it can include non-operating revenue in its computation.

This is a point of concern as non-operating revenue is usually volatile and unreliable.

Thus, it can inflate ROCE but not necessarily in a good way.

To address this flaw, we can use operating profit as the numerator instead of EBIT.

The modified formula will then be:

ROCE = Operating Profit ÷ Capital Employed

Where:

Operating Profit = Revenue – Cost of Goods Sold – Operating Expenses

Capital Employed = Total Assets – Total Current Liabilities

This modified formula ensures that only revenue and expenses from operations are included in the computation.

This is important as investors will tend to only look at a business’s operating efficiency.

They put more importance on the revenue and profits generated by a business’s operations.

There’s also a conservative variation of the ROCE formula.

Instead of using EBIT or operating profit, we use Net Income as the numerator instead.

This results in a lower ROCE, but in exchange, it considers the effect of interest expense and taxes.

This conservative variation of the ROCE formula is as follows:

ROCE = Net Income ÷ Capital Employed

All three variations of the ROCE formula aim to compute a business’s earnings vis-à-vis capital employed.

So depending on your preferences, it’s okay to use whichever variation.

That said, the operating profit variation works best for general use.

Understanding Capital Employed

As can be seen from our three variations of the ROCE formula, capital employed is the constant denominator.

It can be computed using the formula:

Capital Employed is calculated by subtracting Total Current Liabilities from Total Assets.

What we get is the figure for the business’s total non-current liabilities and equity.

In other words, the capital sourced from a business’s shareholders and creditors.

It is somewhat similar to invested capital, though its computation is much simpler.

Some analysts and investors use the average capital employed as the denominator in computing ROCE instead of the capital employed in any given period.

This makes more inclusive of the movement in the capital employed, which is computed using balance sheet items.

The formula for ROCE using the average capital employed will then be:

ROCE = (EBIT or Operating Profit or Net Income) ÷ Average Capital Employed

Where:

Average Capital Employed = (capital employed at the beginning of concerned period + capital employed at the end on the concerned period) ÷ 2

Exercise#1

Mary is considering investing in Company M.

While researching for company M’s financial data for the financial year 2021, she gathers the following information:

Mary wants to know Company M’s ROCE for the financial year 2021.

With the data gathered by Mary, we can compute Company M’s ROCE for 2021.

First, we need to determine Company M’s operating profit:

Operating Profit = Revenue – Cost of Sales – Operating Expenses

= $1,570,000 – $628,000 – $254,000

= $688,000

Next, we need to determine Company M’s capital employed:

Capital Employed = Total Assets – Total Current Liabilities

= $2,500,000 – $780,000

= $1,720,000

Now that we have the variable that we need, we can finally compute company M’s ROCE:

ROCE = Operating Profit ÷ Capital employed

= $688,000 ÷ $1,720,000

= 0.40 or 40%

As per our computation, company M’s ROCE is 0.40 or 40%.

This means that for every $1 of capital employed, company M generates a $0.40 operating profit.

Now with this data, should Mary invest in company M?

Well that depends.

While 40% ROCE is certainly not a bad number, without any other metrics to compare it to, we cannot reliably say if it’s worth investing in company M.

If we have information about the industry standard or company M’s past figures for ROCE, we can make a more informed decision.

Keep this in mind as this is one of the limitations of ROCE.

Exercise#2

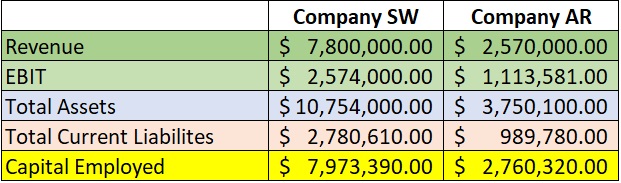

Company SW and company AR are two businesses that operate within the same industry.

Below are financial data gathered from the two business’s financial reports and statements:

From the data above, we can gather that company SW is a bigger business than Company AR in terms of assets and revenue.

Company SW’s EBIT is also higher than Company AR’s.

But, do all of this translate to company SW having a higher ROCE than company AR? Let’s find out.

Since we have the data we need to compute each business’s ROCE (EBIT and capital employed), we can proceed with computing their respective ROCE.

Let’s start first with company SW:

ROCE = EBIT ÷ Capital Employed

= $2,574,000 ÷ $7,973,390

= 32.28%

Next, we compute company AR’s ROCE:

ROCE = EBIT ÷ Capital Employed

= $1,113,581 ÷ $2,760,320

= 40.34%

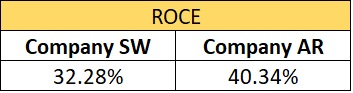

Now that we have both businesses’ ROCE, let’s compare them:

As you can see, while company SW is the bigger business, company AR has the higher ROCE.

This means that company AR is more efficient in generating profit from its capital employed. Company AR produces more return per dollar of capital employed.

From this example, we can gather that a “bigger” business doesn’t necessarily translate to it having a higher ROCE compared to a “smaller” business.

What matters is how much EBIT or operating profit the business earns for every dollar of capital employed.

Advantages of Return on Capital Employed (ROCE)

One of the advantages of ROCE is that it’s a ratio. Meaning that it can be used to compare businesses of varying sizes, provided they’re with the same industry.

Say, company A has a net worth of $10 million, while company B has a net worth of $1 million.

The difference in size doesn’t matter for ROCE.

You can use ROCE to compare the two businesses as long they’re within the same industry.

ROCE is also a great tool for comparing the performance of businesses that operate within capital-intensive industries.

These businesses tend to have a relatively high level of debt because of how much capital is needed to sustain their operations.

Long-term ROCE is an especially important indicator for these businesses.

A stable and/or rising trend for ROCE is preferable for these businesses as it would mean that they can produce stable or rising returns from their capital-heavy financial structures.

Limitations of Return on Capital Employed (ROCE)

As useful as ROCE is, it has its limitations.

First, since one of the components of ROCE, capital employed, uses data from the balance sheet, it may not provide an accurate picture of the business’s future profitability.

In addition, it only takes short-term earnings into consideration, particularly the concerned period’s earnings.

ROCE also does not capture the risk factor of a business’s different investments.

This could lead to inaccuracies in the assessment of the business’s long-term profitability and viability.

To mitigate this, it would be wise to compare the current year’s ROCE to previous years’ ROCE.

From there, determine the trend for the business’s ROCE.

If the trend is stable or rising, the business is more likely to be viable in the long run.

However, if the trend is volatile or falling, it might be better to invest in other businesses.

Lastly, ROCE is only a number on its own.

You need other data to compare it to so that you can make the most out of it.

A ROCE of 30% or 60% is meaningless on its own.

But if we compare it to the industry standard of, let’s assume 50%, then a ROCE of 60% is much preferred compared to 30%.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

NYU "Measures of Profitability" Page 1 . February 16, 2022

Webster University "Financial Ratios" Page 1 . February 16, 2022