Payroll AccountingProperly account for employee compensation and other related payroll costs

Employees are important resources for every business.

They don’t appear on a business’s financial statements like any other assets that give value and economic benefits.

However, any business owner would know that employees are a business’s most valuable asset.

Without them, the business won’t grow.

A business owner can only do so much on his/her own after all.

Rome wasn’t built in a day, and it sure wasn’t built by just one person.

That’s why it’s important for a business to do what it can to keep its employees satisfied.

And one way of doing that is to give them proper compensation.

If you’re compensating your employees well enough, they’re more than likely to stay with you and even help your business grow.

On the other hand, if you don’t compensate your employees properly, they’ll probably quit on you.

They will look for a job that pays better.

The topic of employee compensation is a delicate one indeed.

And so, you have to properly account for it.

To do that, we have this thing called “payroll accounting”.

Its main purpose?

To properly account for employee compensation and other related payroll costs such as government-mandated deductions.

Not only does it give you an accurate picture of your business’s expenses, but it also helps in making sure that you’re paying your employees the right amount of compensation.

While you usually hire an accountant or bookkeeper to do your business’s payroll accounting, it never hurts to learn about it.

That’s why in this article, we’ll do just that!

We’ll learn about payroll accounting and what it involves.

Payroll Accounting: What is it?

Payroll accounting mainly keeps track of employee compensation and other related payroll costs.

It involves the calculation, management, recording, as well as analysis of any expense that is related to payroll.

The calculation of what the employee receives is an example.

Another example is the reconciliation of employee benefits, withholding taxes, and other payroll-related deductions.

Payroll accounting aims to keep track of the five essential payroll-related costs (as well as obligations):

- Employee compensation – this refers to the salaries, wages, paid time off (PTO), and other taxable income that you usually report on an employee’s W-2 form

- Withholding taxes or taxes withheld from employee paychecks – this includes government-mandated deductions such as federal income taxes, social security, Medicare, and state or local income taxes (if applicable)

- Required employer taxes – this refers to the employer’s matching obligation for his/her employees’ social security, Medicare taxes, as well as federal and state unemployment taxes

- Paycheck deduction for benefits – this refers to deductions that are usually voluntary. They are often made for the benefit of the employee such as health, vision, dental, and other insurance. It could also include a savings plan. Some employees may opt to defer a portion of their compensation to invest in an employer-provided retirement plan

- Other government-mandated deductions – this refers to other deductions that are specific to an employee; examples include wage garnishment to pay for child or spousal support, wage garnishment to pay for outstanding tax liabilities, etc.

While there are some universal aspects to payroll, the country’s legal laws (as well as state or local city requirements) highly influence its calculation.

For example, the minimum wage for one state might be different in another.

Be sure to stay up to date with your business’s payroll accounting!

That goes for both the financial and compliance aspect.

Employee Compensation

Employee compensation refers to the salary, wages, and other taxable income that an employee receives.

It is typically the employee’s main source of income.

Additionally, while employee compensation is mostly monetary, it can also include non-monetary perks such as gym memberships, employee discounts, and other similar perks and benefits

Employee compensation is an employer’s way to remunerate an employee for his/her service.

An employer may also give more incentives to employees who stay longer such as a loyalty award/bonus on the employee’s 5th year with the business.

Some employers give importance to staff growth by sending them to various development sessions or even sponsoring a scholarship.

You could say that calculating employee compensation is the main ingredient of payroll accounting.

It can influence other payroll-related costs.

For example, the deduction for social security and Medicare taxes is based on the compensation that the employee receives.

So when does one incur an employee compensation cost? Is it when the employee receives payment?

For example, let’s assume business A hires a new employee on January 11.

Business A pays its employees every 10th of the month.

This means that the new employee will only be paid on February 11.

Does that mean that business A only records the compensation cost of the new employee on February 11?

Well no, according to the accrual accounting method.

Rather, business A needs to accrue a proportionate amount for the work rendered by the new employee from January 11 to January 31.

This is because the expenses incurred in January should be recorded in January.

Do note though that employee compensation may not always be recognized as an expense outright but is instead included in the cost of inventory.

This mainly applies to direct and indirect labor in a manufacturing setting.

Performance Obligations under Payroll Accounting

Performance obligations refer to the other four essential payroll-related costs which are: taxes withheld from employee paychecks, required employer taxes, paycheck deduction for employee benefits, and other government-mandated deductions.

Aside from the required employer taxes, performance obligations are withheld or deducted from an employee’s salary or wages.

The employer then later pays them to the government (withheld taxes and other government-mandated deductions) or private institutions (paycheck deduction for benefits).

Required employer taxes are an employer’s counterpart for FICA payable (social security and Medicare taxes), and as such, are payable to the government.

The following are the most common withholdings/deductions under US laws:

- Federal income tax withholdings; a portion of the employee’s compensation is withheld for the payment of income taxes

- State withholdings; this is only applicable in states that require them

- FICA payable: this refers to social security and Medicare taxes

- Deductions for employee health insurance

- 401K deductions for retirement savings

A business records performance obligations at the same time as employee compensation.

FICA Payable: Social Security and Medical Taxes

These are mandatory deductions and are set annually by the government.

That said, the rates do not necessarily change every year – they remained the same between 2020 and 2022.

The amount of FICA contribution due is dependent on the employee’s compensation.

The rate for social security taxes/contributions 6.2% in 2022.

This means that for every $1 that the employee earns, s/he must contribute $0.062 for social security.

That said, there’s a maximum wage base for social security taxes, which is $147,000 in 2022.

This means that the maximum social security tax that can be deducted from an employee is $9,114 in 2020.

The rate for Medicare taxes/contributions is 1.45% in 2022.

Unlike social security taxes, there is no maximum wage base for Medicare taxes.

In fact, there is an additional 0.9% tax on wages exceeding $200,000 regardless of filing status.

This means the Medicare tax rate for employee compensation in excess of $200,000 is 2.35%.

In addition to the deductions from the employee’s income, the employer also has to pay a matching amount to the government.

This means that if the employee pays a total of $5,120 for FICA payable, the employer also has to pay $5,120.

However, the employer is not liable for the additional 0.9% tax for Medicare contributions.

For example, let’s say that an employee earns a total of $230,000 as compensation.

This means that s/he has to pay $9,114 ($147,000 x 6.2%) for social security taxes and $3,605 (1.45% for the first $200,000 and 2.35% for the excess $30,000) for medicare taxes.

The employee’s FICA contribution amounts to $12,719.

For the employer’s part though, s/he only needs to pay $12,449 ($9,114 for social security tax, $3,335 for Medicare tax).

This is because the employer is not liable for the additional 0.9% Medicare tax.

Set Up Your Business’s Payroll Accounting

Under US federal laws, there are certain requirements that employers must consider and fulfill before starting the hiring process.

It is in your best interest to know of this so that you don’t have to pay unnecessary penalties:

1) Federal Employee Identification Number (EIN)

The government assigns a unique identification number for each employee, which we refer to as the Employee Identification Number (EIN).

The purpose of an EIN is to track the employee’s federal tax payments.

The company can get EIN from the employee himself/herself or the IRS.

2) Type and Frequency of Employee Compensation

An employee can either be paid a salary or a wage.

The difference between the two is that a wage is paid on an hourly basis while a salary is usually a fixed amount.

Salaried employees are usually full-time employees of a business.

Wage employees can either be full-time or part-time employees.

After you set an employee’s amount and type of compensation, the next thing to consider is the frequency and period of payments.

For example, you can set salary and wage payments every 25th of the month, which makes it a monthly affair.

Some employers may opt to pay on a weekly or bi-weekly basis.

As a rule of thumb, the frequency of payments shouldn’t be lesser than once a month.

3) Employee Benefits

Aside from the government-mandated deductions/contributions, an employer can offer extra benefits such as health and life insurance or a 401K retirement plan.

The employer has the option to fully cover such benefits. S/he can also opt to subsidize the costs while deducting a portion of the employee’s compensation to contribute to the benefit.

For example, an employer may fully cover an employee’s uniform cost, or s/he can provide a uniform allowance.

Or that an employer can cover 50% of an employee’s health insurance.

The employer has to be transparent about the benefits, and whether they will be deducted from the employee’s salary or wages.

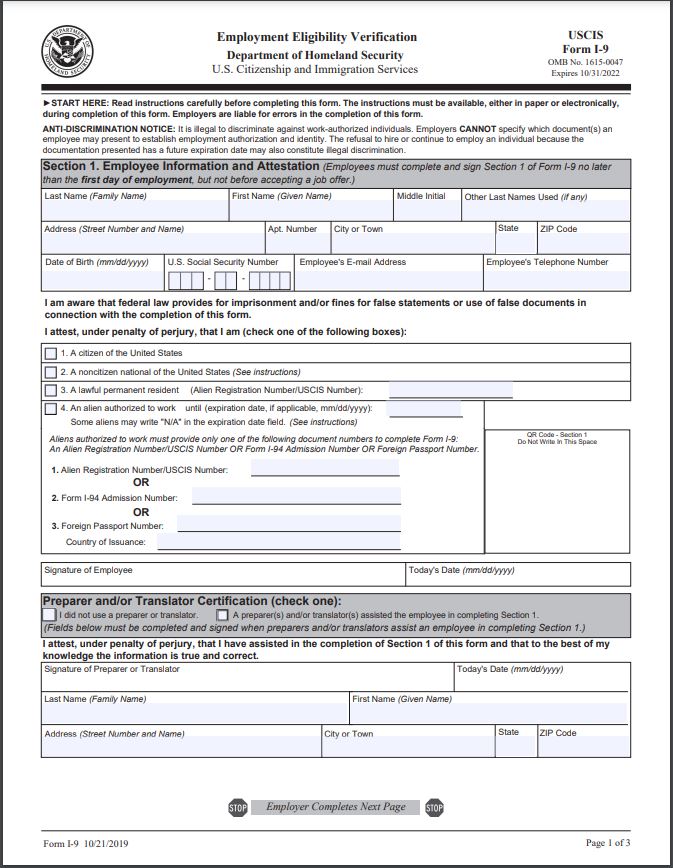

4) Employees’ Forms

Lastly, before hiring an employee, an employer must make sure that the potential hire has the right to work.

For example, most US citizens have the right to work in the US.

Non-citizens may have the right to work if they have the proper authorization.

You may ascertain a person’s right to work via the IRS I-9 Form, Employment Eligibility Verification.

It includes the potential employee’s personal information as well as an attestation that s/he has the right to work in the US.

Source: Form I-9, Employment Eligibility Verification

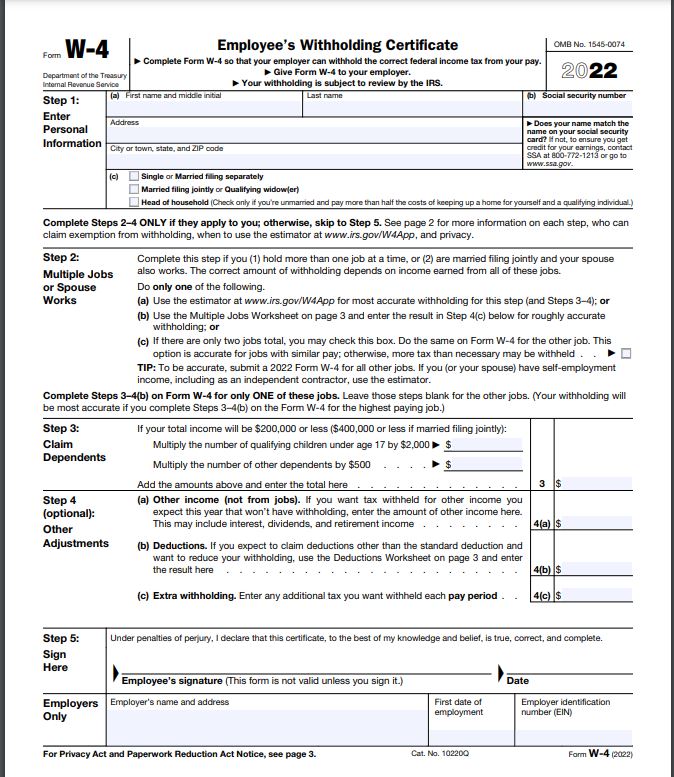

Another form that the employer should be mindful of is the IRS W-4 Form, Employee’s Withholding Certificate.

This form will help you in calculating the appropriate amount to withhold from the employee’s compensation.

Source: W-4 Form, Employee’s Withholding Certificate

Lastly, an employer may require a completed direct deposit form from the employee.

This authorizes the employer to deposit on the employee’s bank account which helps in streamlining the payroll process.

Payroll Accounting Calculations

Now that you have set up your business’s payroll accounting, the next thing to learn is the relevant calculations.

Typically, the compensation that an employee earns and the employee that s/he receives isn’t the same.

This is because of the deductions that we have discussed previously.

Calculate Total Compensation Expense

But anyways, payroll accounting starts with the calculation of the compensation earned by your employees.

To make it simple, you can categorize the compensation cost into two categories: direct and indirect compensation.

Direct compensation refers to all the compensation an employee earns in exchange for his/her labor (e.g. salary, wages, overtime pay, etc.).

On the other hand, indirect compensation refers to arbitrary compensation such as performance bonuses or sales commissions.

Add up both the sum of direct and indirect compensation earned by your employees to get the total compensation expense.

Calculate Withholdings and/or Deductions

The next step is to calculate withholdings and deductions.

Be sure to check with your federal and state requirements to know which type of compensation to include in the calculation for withholding and/or deductions.

Some types of compensation may be exempt from the computation.

Now that you know the amount of compensation and deductions, the next step is to record them via a journal entry.

But wait, don’t forget about provisions.

Calculate Provisions

Provisions refer to accrued expenses that occur because of the employer’s contractual relationship with the employee.

These are often made for the accrual of legal requirements such as holiday and vacation pay.

They are accrued in the month that they are incurred, though they do eventually get paid in the subsequent months.

Record the Journal Entries in Your Books

It’s finally time to record the results of the above calculations as a journal entry in your books.

Typically, all payroll-related costs are recorded as an expense, but only record those incurred by the business as expenses.

Those shouldered by employees are not the employer’s expenses.

Rather, the employer only pays for them on behalf of the employee.

Make the Payments

After recording your journal entry, you should have an idea of how much pay the employees should receive.

As a reference, it is the total cost of compensation minus any withholdings and/or deductions.

As for the government-mandated withholdings/deductions, do not forget to take into account your counterpart for FICA contributions.

It usually is the same amount as the FICA contribution of your employees, but be aware if an employee is earning more than $200,000 total income.

As for the other deductions (e.g. for benefits such as insurance, 401K retirement savings, etc.), be sure to pay them to the proper institutions.

Calculate Adjustments and Apply Them if Necessary

Some provisions may require adjustments at the end of the period.

Provisions are mostly based on estimates, which is why they might need reevaluation now and then.

If adjustments are necessary, be sure to record them.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "Definition of compensation" Page 1 . March 8, 2022

IRS.gov "Tax Withholding" Page 1 . March 8, 2022

IRS.gov "Depositing and Reporting Employment Taxes" Page 1 . March 8, 2022

IRS.gov "Understanding Employment Taxes" Page 1 . March 8, 2022