Prior Period AdjustmentDefined with Examples

What is a Prior Period Adjustment?

Accountants will always strive to report financial statements with 100% accuracy.

But sometimes, accounting errors happen and they cannot be totally avoided.

It is for this reason that prior period adjustments are applied by companies.

Put simply, a prior period adjustment is a way for companies to correct the past financial year’s accounting errors and was reported in the prior year’s financial statements.

Accountants go back to the past and correct the past errors in the present year’s financial statements.

What does Prior Period Adjustment Mean?

Prior period adjustments are a means to correct past accounting errors that are considered material.

When talking about accounting errors, it means non-fraudulent errors that result because of an error in omission (when transactions are not recorded) and error of commission (error because of a miscalculation).

These accounting errors can also be as a result of an application of wrong accounting methods or misapplication of accounting Generally Accepted Accounting Principles (GAAP), or facts that were overlooked and were not determinable by the management then .

Accounting errors that are not deliberately committed and are material, may be corrected through prior period adjustments.

What is a Material Error?

Prior Period Adjustments are only applied if the accountants of the company have determined that the accounting errors are material.

The materiality principle states that the accounting principles can be ignored if there is little to no impact on the financial statements and that users of these financial statements will not be misled.

If in the opinion of the accountants the accounting errors are material and have a reasonable impact on the presentation of the financial statements that could affect the financial decision making of its users, these accounting errors must be corrected through prior period adjustments.

How Prior Period Adjustment Works

Prior period adjustments are accounted for by restating the financial statements of the prior year or years.

This is done by doing the following:

- Adjust the carrying amounts of the assets and liabilities impacted by the prior period adjustment as of the presented first accounting period; and

- The adjustment must offset the beginning balance of the retained earnings account of the same accounting period.

Example

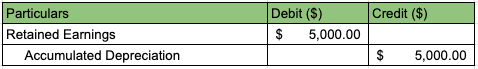

The accountants of Company ABC have discovered a material error of the recording of depreciation of their fixed assets in the previous year which has resulted in reporting depreciation for $5,000 lower than it should be.

To correct this accounting error, they must pass the following entries shown below.

Restatement of the Financial Statements

The journal entry for the current period must be posted to the financial statements as follows:

The entry will also have to include a note of where the error came from and its cumulative effect.

Retained Earnings Correction

Upon the correction and adjustment of the current accounting period, the Retained Earnings must show the corrections as well.

Based on the above example, the beginning balance of Retained Earnings (assuming the previous year’s ending balance is $175,000) will disclose the change and will result in the following:

| Retained Earnings, beginning balance | $ 175,000.00 |

| Prior Period Adjustment | |

| Correction of Error in Depreciation | $ (5,000.00) |

| Adjusted Retained Earnings, Beginning Balance | $ 170,000.00 |

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of North Texas "PRIOR PERIOD ADJUSTMENTS" Page 1 - 11. November 30, 2021