Temporary AccountDefined with Examples

What is a Temporary Account?

Temporary accounts are closed at the end of each accounting period.

They represent the transactions that are relevant for reporting only for one accounting cycle.

Typically, these accounts are found in the Income Statement and are part of the revenues and expenses of the company.

A non-income statement account that is closed at the end of an accounting period is the Drawings Account but it is not considered as a temporary account.

When a temporary account is closed, it will open with a zero balance in the next accounting period.

The objective behind this is to ensure that the profitability of the company is only computed for the current accounting period.

For example, if a company reports a net profit for three consecutive years of $20,000, $35,000 and $30,000 and does not close the revenue account each year, they will report a total revenue of $90,000 which is misleading because it covers for three periods.

It is for this reason that temporary accounts must always be closed at the end of each accounting period so that the company will be able to only show the relevant income statement report.

Examples of Temporary Accounts

In accounting, there are three types of temporary accounts: Revenues, Expenses and Income Summary.

Revenues

The total revenues represent the total sales the company has generated during the accounting period.

It shows what the earnings of the company are, and being a temporary account, it has to be closed at the end of the accounting period.

Where a normal balance of a revenue in the trial balance is a credit, closing the revenue account means passing a debit entry.

The corresponding credit is to the Income Summary for the same amount.

Expenses

Expenses represent the total operational expenses of the company.

The day to day operations of the business has a corresponding expense.

Under the matching principle in accounting, the expenses incurred for the period must match the related revenue.

The expense accounts of the company depends on what business they are operating but ultimately, common expenses include salaries and wages, advertising, interest expenses, among many.

To close the expense account, a credit entry is posted because its normal balance is a debit and its corresponding debit is towards income summary.

Income Summary

Income Summary is an account where revenues and expenses are closed at the end of the accounting period.

The net income or not loss can be determined depending on the balance of the income summary.

If the balance of Income Summary is a debit, it means the company operated at a profit and the same amount is credited to the capital or retained earnings account.

If the balance is a credit, the company has operated at a loss and the same amount is debited to the capital or retained earnings account.

For example, the balance of the Income Summary after the revenues and expenses are closed, is a debit amount of $36,000.

To close the Income Summary Account, the journal entry to be posted is a debit to Income Summary for $36,000 and a credit to Capital or Retained Earning for $36,000.

What is the Drawings Account?

The Drawings Account is part of Owner’s Equity and it represents the total drawings the owners or partners of the company did for the current accounting period.

However, its balance is not carried over to the next accounting period – it is closed to the Capital account.

Temporary Account vs Permanent Account

There are distinct differences between a temporary and a permanent account.

The main differences between the temporary and permanent accounts are the following:

- Temporary accounts are closed at the end of the accounting period. Permanent accounts are carried over to the next accounting period and its balance remains open even as long as the business is still operating.

- Temporary accounts are also known as nominal accounts and they include Income Statement accounts such as revenues and expenses. Permanent accounts are also known as real accounts and include Balance Sheet accounts under Assets, Liabilities and Owners’ Equity.

- Temporary accounts are zeroed out at the end of the accounting period and start with a zero balance in the next period. The balance of permanent accounts are not closed but are rather carried forward in the next accounting period. The ending balance of the current period becomes the opening balance in the next.

How to Close a Temporary Account

Company ABC has reported a total revenue of $65,000 and total expenses of $50,000 at the end of the year.

To close the temporary accounts, the following entries are to be passed:

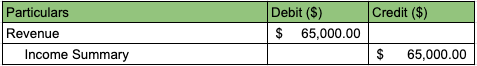

Close the Revenue Account

To close the total revenue of $65,000 the journal entry is:

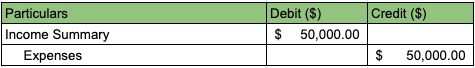

Close the Expense Account

To close the total expense of $50,000 the journal entry is:

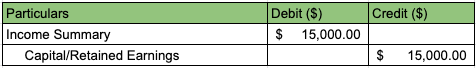

Close the Income Summary Account

Based on the above, the company has made a net income of $15,000 which is a credit balance of the Income Summary account. To close this amount, the following entry has to be posted:

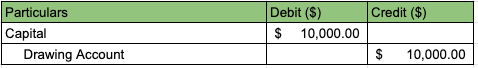

At the end of the accounting period, the drawings account has an ending balance of $10,000.

This amount has to be closed against the capital account. To close the drawings account, the journal entry that need to be passed is:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

UC Davis "Best Practices for Clearing, Default and Suspense Accounts" Page 1 . November 29, 2021

West Virginia University "An Introduction to Payroll Suspense Accounts" Page 1 . November 29, 2021