Accounting CycleSteps & Definition of the Whole Process

Financial statements such as the balance sheet, income statement, and cash flow statements are important documents for any business.

They are what translate the operations of a business into numbers and figures that we can understand.

For example, an income statement allows us to know how much the business has earned.

A balance sheet allows us to know how many assets and liabilities a business has.

A cash flow statement allows us to know the movement of cash within a business.

But have you ever wondered how financial statements are prepared?

Where do they get their numbers?

How can we be sure that they are accurate and represent the true financial condition of the business?

When and how often are they prepared?

What makes them compliant with the GAAP or IFRS?

Let’s think of it as a typical manufacturing cycle.

We first start with the raw materials.

The raw materials are then worked on to be converted into the final products that will be sold by the business.

For the “manufacturing” of financial statements, the raw materials will be the raw transaction data.

These raw data will be worked on to produce our final products, which are the financial statements.

This process is what we refer to as the accounting cycle (also referred to as the bookkeeping cycle or accounting process).

This article aims to define what an accounting cycle is and the steps involved in it.

But before we do all that, let’s discuss some assumptions first:

- Your business is using the double-entry system; the accounting cycle that we will be discussing isn’t compatible with the single-entry system

- Your business is using the accrual accounting method; GAAP and/or IFRS compliant financial statements must employ the accrual accounting method

And with that, let’s learn about the accounting cycle.

What is the accounting cycle?

The accounting cycle is a multi-step process that begins when a transaction occurs and ends with the preparation of financial statements.

An accounting cycle will involve identifying and analyzing transactions (or accounting events), the recording and posting of transactions in the appropriate books (journals and ledgers), the preparation of trial balances, and finally the preparation of financial statements.

Basically, an accounting cycle is a process that converts a business’s raw financial data into financial statements.

I say that the end of an accounting process is the preparation of financial statements, but really, that only applies to interim periods (month, quarter).

In truth, there are extra steps to take at the end of a fiscal year.

These steps involve the closing of the books to prepare them for the next fiscal year.

Just like any cycle, the accounting cycle will repeat itself for as long as the business stays in operation.

An accounting cycle will typically have a period of 12 months or a fiscal year, meaning that the cycle starts over every 12 months or one fiscal year.

For interim periods, the length of the accounting cycle will be the same as the length of the said period.

The accounting cycle is what ensures that your business’s financial statements are accurate and relevant.

This is important as the financial statements you prepare must be accurate and represents the true financial condition of your business.

The IRS, for one, requires that you report and remit the right amount of taxes. This is only possible with accurate financial statements.

Additionally, your financial statements are gateways between your business and investor and creditors.

It just won’t do if you present to them inaccurate financial statements now, would it?

How many steps really are there in an accounting cycle?

Some sources will say as many as 10 steps, while some will say as little as 6 steps.

But no matter how many steps they mention, the content still stays the same.

It’s just a matter of integrating (or not integrating) multiple processes into one step.

So it’s not a matter of how many steps are there but rather what are the steps in an accounting cycle.

An accounting cycle can have as many steps so long as the necessary processes are still there.

That said, the necessary processes that should be present in an accounting cycle are the following:

- Identifying and analyzing business transactions

- Recording of the transactions in the journal (via journal entries)

- Posting the journal entries into the corresponding ledger accounts

- Preparation of the unadjusted trial balance

- Worksheet: preparation of adjusting entries and applying them to the trial balance

- Preparation of the adjusted trial balance

- Preparation of the financial statements

- [End of the fiscal year] Closing of books (zeroing out temporary accounts)

- [End of the fiscal year] Preparation of the post-closing trial balance

- [Optional] Preparation of reversing entries

Some flowcharts will combine the recording of journal entries and posting to general ledgers, while some combine the preparation of unadjusted and adjusted trial balances.

Whichever the case, as long as the above processes are included (except the preparation of reversing entries which is optional), then you have yourself an accounting cycle.

The accounting cycle and its many steps

Let’s discuss the processes of an accounting cycle step by step.

Identifying and analyzing transactions

An accounting cycle begins when a transaction occurs.

But, to know when a transaction has indeed occurred, you must first know what’s considered a transaction, specifically a business transaction.

Let me present to you the following and see if you can identify which is a business transaction:

- A manager purchased a car using his personal credit card; the car will be for personal use

- The company purchased raw materials using the personal credit card of one of its owners

The second bullet point is considered a business transaction.

Were you able to get it right? If not, don’t worry.

We’ll be discussing why it’s considered a business transaction.

By definition, business transactions are measurable events that affect a business’s financial condition.

For example, if a business makes a sale, its financial condition is affected because of the increase in revenue and assets (either cash or accounts receivable).

The important thing to note is that a business transaction causes a measurable change in the business’s assets, liabilities, and/or equity. In the case above, the purchase of raw materials increased the company’s assets (inventory).

Since it was purchased using the owner’s credit card, the company’s liability (notes payable) also increases as it now has an obligation to pay back the owner.

A business transaction should be backed by a source document.

The source document will serve as evidence that a transaction has occurred.

For example, a business must keep a copy of the official receipt or sales invoice issued to its customers as proof that sales were made.

For purchases, a business must keep a copy of whatever document the vendor/supplier/service provider issues.

Record the transaction in a journal via journal entries

So now that you’ve identified your business’s transactions.

The next step is to record such transactions.

We do that by making journal entries in the journal (e.g. general journal, sales journal, purchase journal, etc.).

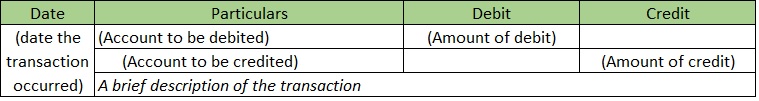

A journal entry will typically look like this:

Using the double-entry system, a journal will have the following columns at a minimum:

- Date – the date the transaction occurred

- Particulars – where details of the transaction will be entered (e.g. account to be debited, account to be credited, a short description)

- Debit – amount to be debited

- Credit – amount to be credited

You must make sure the debit and credit columns are equal.

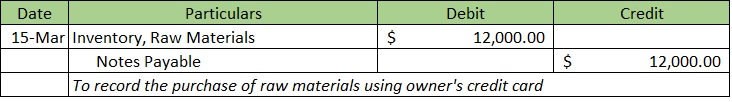

Let’s go back to the business transaction above (purchase of raw materials).

We’ll assume that the purchase amounted to $12,000 and that it was all paid using the owner’s personal credit card.

Let’s assume further that it occurred on March 15. The journal entry would then be:

A journal entry must be made whenever a transaction occurs.

This is because a journal presents a business’s transactions in chronological order.

If a journal entry can’t be made at the exact time a transaction occurs, then at least have it be recorded within the same day said transaction occurred.

Post the journal entries into their respective ledger accounts

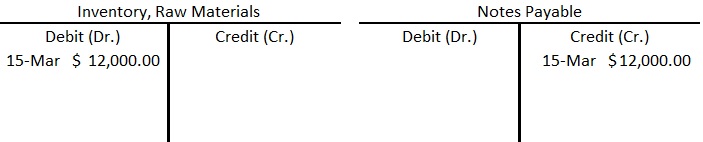

Once the journal entries are recorded in the journals, the next step is to post them into their respective ledger accounts.

A ledger (e.g. general ledger, subsidiary ledgers) is a document that provides a summary of all transactions by account.

For example, the accounts receivable account in the general ledger will list down all its debit and credit transactions for a certain period.

Let’s try posting the above journal entry to the corresponding ledger accounts (let’s assume that the company is using T-accounts and that there are no other transactions):

Preparation of the unadjusted trial balance

After the general ledger comes the preparation of an unadjusted trial balance.

An unadjusted trial balance is a listing of all the accounts found in a general ledger.

It is prepared at the end of the period (e.g. month, quarter, year) before any adjusting entries are made.

An unadjusted trial balance’s purpose is to make sure that the balances are arithmetically correct.

Meaning that the total debit and credit balances should be equal.

If there are any errors, they should be detected and corrected.

An error can be as simple as entering a debit balance as a credit balance(and vice versa), or it could be as complicated as failing to post a journal entry.

Here’s an example of an unadjusted trial balance:

Notice that the debit and credit balances match.

The accounts are arranged in the same way as the financial statements: assets first, then next are liabilities and equity, then comes revenue end expense items.

Worksheet: preparation of adjusting entries and applying them to the trial balance

With the unadjusted trial balance prepared, we now have a base for the adjustments we have to make via adjusting entries.

Adjusting entries are necessary to ensure that the business’s financial statements comply with the GAAP and IFRS. Without them, certain transactions won’t be recorded (e.g. deprecation and amortization)

The following are the main types of adjusting entries:

- Deferrals

- Accruals

- Missing Transaction Adjustments

- Tax Adjustments

Assume that we have these adjusting entries:

We then apply these adjusting entries to the unadjusted trial balance via a worksheet:

Preparation of the adjusted trial balance

With the worksheet completed, we can now prepare an adjusted trial balance.

An adjusted trial balance is just like the unadjusted trial balance in that it lists all the general ledger accounts and their balances in one document.

The difference is that the adjusting entries are applied making it a suitable reference for the preparation of financial statements.

Just like the unadjusted trial balance, it is important that the debit and credit balances of an adjusted trial balance match.

If they don’t, then there must be an error in the application of the adjusting entries.

Here’s an example of an adjusted trial balance:

Preparation of financial statements

Now that the adjusted trial balance is complete, the preparation of financial statements will now commence.

The three financial statements that must absolutely be prepared are the balance sheet, income statement, and cash flow statement.

There are other financial statements other than these three, and any business is free to prepare them.

The revenue and expense accounts will be used in the preparation of the income statement.

The asset, liabilities, and equity accounts will be used in the preparation of the balance sheet.

Lastly, any accounts that affect the cash flow will be used in the preparation of cash flow statements.

Here’s an example of a balance sheet (made from the adjusted trial balance above):

For interim periods, the accounting cycle ends here. For the end of the fiscal year, there are still steps that we need to take to complete the accounting cycle.

Closing the books: preparing closing entries and the post-closing trial balance

At the end of a fiscal year, the books must be closed before a business can proceed to the next accounting cycle.

That means zeroing out temporary accounts, particularly income statement accounts (revenue and expense accounts).

This is done to ensure that the next period will only include the revenues and expenses that are relevant to it.

If revenue is higher than expenses, then the difference will increase the retained earnings (found in the balance sheet).

If expenses are higher, then retained earnings are decreased.

After the closing entries are recorded and posted in their respective ledger accounts, then the preparation of the post-closing trial balance comes next.

A post-closing trial balance is prepared to ensure the total debit and credit balances are still equal after the application of the closing entries.

And with that, the accounting cycle can start over in the new fiscal year.

[Optional] Preparing the reversing entries

Some businesses use reversing entries to simplify the accounting process.

They are made at the beginning of the period to cancel out the effects of adjusting entries.

For example, if an accrual for rent of $500 was recorded in the previous period, then at the beginning of the current period, the $500 recorded rent will be reversed.

The bookkeeper can then record the whole amount of rent payment for the period instead of considering the accrual of rent.

This step is optional as not all businesses use reversing entries.

They don’t necessarily impact a business’s financial condition.

They just simplify the accounting process.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harper College "Chpt 4: Completing the Accounting Cycle" Page 1 - 9. December 3, 2021

Ivy Tech Community College "What is the accounting cycle?" Page 1 . December 3, 2021

University of Oregon "Accounting Cycle" Page 1. December 3, 2021