Drawing AccountAn account that records all owner withdrawals

While a business won’t exist without the funding from its owner/s, one would usually treat it as a separate entity.

This is more apparent with corporations that are considered separate legal entities from their shareholders.

But a business doesn’t need to be a corporation for it to technically have an identity of its own.

For example, a business will typically have its own name that may (or may not) be different from its owner/s.

Another, the business cannot claim the personal expenses of its owner/s as its own business expenses.

However, a business may also act as an extension of the owner/s.

As such, the owner/s might occasionally or even regularly take out cash from the business for personal use.

These cash withdrawals aren’t for free.

They have to be accounted for so that the business can have a record of all the withdrawals that the owner/s have made.

And at the end of each year, the total of these withdrawals is pitted against the capital account/s of the owner/s.

We refer to the account that records all owner withdrawals as the drawing account.

In this article, we will be exploring what a drawing account is.

How does it work?

What is its significance to the business?

What are the journal entries to make regarding drawing accounts?

We’ll be answering these questions as we go along with the article.

What is a Drawing Account?

A drawing account is an accounting record of all owner withdrawals.

It is typically used in sole proprietorships or partnerships.

In it, you can find all the withdrawals the owner or owners have made from the business for a particular year or accounting period.

It is a contra equity account, meaning that it naturally has a debit balance.

However, unlike most equity accounts, a drawing account is not a permanent account.

Rather, it is a temporary account.

This means that the business closes the drawing account at end of each year or accounting period.

Owner withdrawals aren’t exclusive to cash withdrawals.

Anytime an owner removes an asset from the business, there is a “drawing”.

For example, if an owner takes a certain amount of inventory from his/her business, then there’s a “drawing”.

That owner’s drawing account then increases by the amount of the inventory s/he takes out of the business.

Take note that the drawing account is not an expense account.

It should not affect the net income of the business.

Rather, it represents a direct reduction of an owner’s equity in the business.

Whenever there’s an increase in a drawing account, there is a corresponding decrease in total assets.

And since it’s a contra-equity account, any increase in it results in a decrease in total equity.

Features of a Drawing Account

A drawing account is technically a capital/equity account.

However, since it is a contra-equity account, it naturally has a debit balance instead of a credit.

It records all owner withdrawals and distributions in a sole proprietorship or partnership.

For corporations, dividends represent owner distributions.

Here are more features of a drawing account:

A drawing account helps track capital use by an owner for personal use

A drawing account is especially useful for keeping track of business assets withdrawn and used by owners for personal use.

For example, an owner takes out $500 cash from the business to pay for a personal loan.

A drawing account records this cash drawing.

The drawing account is proof that the owner has indeed taken $500 cash from the business and then used it for personal use.

This is more useful in a partnership where there are multiple owners.

A drawing account helps in maintaining the total capital balance of the business, as well as the individual capital accounts of each owner.

A drawing account is not a permanent account. Rather, it is a temporary account

Unlike most equity accounts, the drawing account is not a continuing or permanent account.

Rather, it is a temporary account. As such, a drawing account’s balance will always be zero at the beginning of the year.

This is because, at the end of each year, the drawing account is closed.

Its total balance is credited (to zero it), while its corresponding capital account is debited.

This represents a reduction in the capital account of the concerned owner.

For example, let’s say that John is a co-owner of a business.

At the end of the year, John’s drawing account has a total of $1,500.

This drawing will consequently reduce his equity in the business by the same amount.

The temporary nature of a drawing account helps keep track of how much an owner “draws” from the business from year to year.

A drawing account is not an expense account

A drawing account has similar characteristics to an expense account.

It has a natural debit balance. It is a temporary account.

And any increase in the drawing account results in a reduction of total equity.

However, it is not an expense account. This is because “drawings” are not business expenses.

Rather, they are simply a reduction of an owner’s equity in the business.

Since a drawing account is not an expense account, it shouldn’t affect the net income of the business.

Likewise, it should not appear on the business’s income statement. Any drawing might appear on the cash flow statement if there are cash drawings.

Recording Transactions in a Drawing Account

A drawing account only increases when an owner takes out an asset from the business for personal use.

In other words, it only increases when an owner makes a drawing. It only decreases when it is closed at the end of the year or accounting period.

To record the increase in a drawing account, we will need to make a debit entry to the said drawing account and a corresponding credit entry to the asset account that represents the asset that the owner has taken out of the business for personal use.

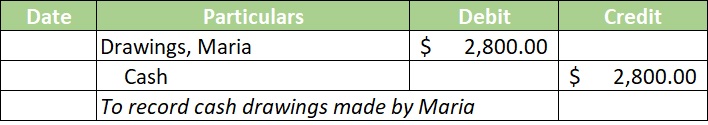

To illustrate, let’s say that Maria is a co-owner of a business.

Sometime during the year, Maria takes $2,800 cash from the business to pay for personal expenses. The journal entry to record this transaction should look like this:

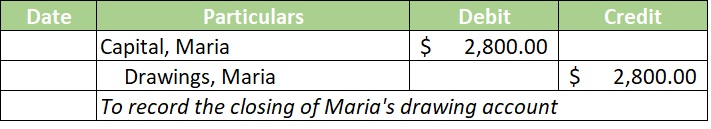

Now let’s assume that Maria hasn’t made any other drawings for the rest of the year.

This means that by the end of the year, Maria’s drawing account will have a balance of $2,800.

Since this drawing account is a temporary account, we have to close it out. To do so, we will have to credit its entire balance.

The corresponding debit entry will be a debit to the owner’s equity account.

In this case, the journal entry to record the closing of Maria’s drawing account should look like this:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "22 U.S. Code § 286r - United States participation in special drawing account" Page 1 . August 15, 2022

University of Idaho "Journalizing Closing Entries" Page 1 . August 15, 2022