Straight Line DepreciationDefined with Formula, Calculation & Examples

Most, if not all, properties in this world have a limited useful life.

For example, food expires, buildings deteriorate over time, technology such as smartphones decline in performance over time, PCs and laptops slow down as they age, equipment and machinery will one day be no longer able to perform at a level that is required of them, etc.

While it would be ideal to have assets that last forever, they simply don’t exist yet in this world.

So for now, until such an asset becomes widely available, we have to resort to making the most of our existing assets.

Capital assets, such as machinery and equipment, aren’t cheap you know?

That said, since these assets lose their value over time, we need a way to account for this decline in value.

We refer to this process as depreciation.

What depreciation does is that it allocates the cost of the capital asset (particularly a tangible asset) over its useful life.

Every accounting period, a certain portion of the asset’s cost is expensed until the end of its useful life.

This allocation of expenses over the asset’s useful life is also beneficial to businesses.

Capital assets usually require a huge amount of investment.

If a business were to recognize the full cost of a capital asset as an expense upon acquisition, it would be a huge blow to its revenue and profits for that accounting period.

Imagine recognizing $1 million as an outright expense for a single piece of asset.

Pretty heavy right?

There are many methods to record depreciation.

In this article, we will be learning of probably the most well-known method: the straight line depreciation method.

What is Straight Line Depreciation?

Straight line depreciation is one of the methods of accounting for a tangible asset’s depreciation.

It’s probably the most well-known and most commonly used among all the depreciation methods.

What it does is that it evenly allocates the cost of the asset (less its salvage value) over its useful life.

Meaning the depreciation expense related to the asset for its first year will be the same as its last year.

It’s the simplest among all the depreciation methods.

You simply need to divide the cost of the asset (less its salvage value) over its useful life.

The resulting figure would be the asset’s annual depreciation.

Most businesses default to the straight line depreciation method due to its simplicity and straightforwardness.

That said, it may not always be the most optimal method of depreciation for certain assets, particularly those that rapidly decline in value in their earlier years.

However, there is currently no standard that requires a business to use a specific depreciation method for a specific type of asset.

So it should still be okay to use the straight line depreciation for all of a business’s depreciable assets.

The other well-known method of depreciation is the double declining balance depreciation method.

What it does is that it accelerates the depreciation of an asset by allocating more depreciation expense in its earlier years.

You can learn more about this depreciation method by reading this article.

Straight Line Depreciation Formula

As already mentioned, calculating an asset’s depreciation using the straight line depreciation method is simple.

You only need to divide the asset’s original cost less its salvage value over its estimated useful life.

Put into formula form, it should look like this:

Depreciation Expense = (Original Cost of the Asset – Salvage Value) ÷ Estimated Useful Life

The formula has three components: the original cost of the asset, salvage value, and estimated useful life.

Original Cost of the Asset

The original cost of the asset refers to the total necessary costs the business incurred to acquire the asset and make it available for use.

That means the purchase price of the asset plus other necessary costs such as shipping fees, transportation fees, and installation costs.

For example, if an asset has a purchase price of $5,000 and installation cost of $500, then its original cost will be $5,500.

This will be the cost of the asset that the business will record in its books.

Salvage Value

Salvage value refers to an asset’s estimated value at the end of its useful life or when it becomes fully depreciated.

It is usually based on what the asset owner expects to receive in exchange for the fully depreciated asset.

As such, it is considered in the calculation of an asset’s depreciation.

The book value of an asset when it becomes fully depreciated must be equal to its salvage value.

For example, if an asset is expected to sell for $800 at the end of its useful life, then its salvage value is $800.

Estimated Useful Life

An asset’s estimated useful life is the length of time that the asset is useable.

For example, if a business estimates that it can get 5 years of use out of an asset, then its estimated useful life is 5 years.

Straight Line Depreciation Examples

Exercise#1

Alma acquires a piece of machinery for a total cost of $9,700.

She expects that she can use the asset for 5 years.

She estimates that she can sell the asset for $500 at the end of its useful life.

Alma decides to use the straight-line depreciation method to account for the asset’s depreciation.

Our task is to determine the depreciation expense that Alma has to recognize annually until the end of the asset’s useful life.

We will be using the straight line depreciation formula:

Depreciation Expense = (Original Cost of the Asset – Salvage Value) ÷ Estimated Useful Life

= ($9,700 – $500) ÷ 5

= $9,200 ÷ 5

Just a quick intermission.

We can also refer to the difference between the asset’s original cost and its salvage value as its depreciable value.

In this case, the asset’s depreciable value is $9,200.

Now let’s continue with the computation.

= $9,200 ÷ 5

= $1,840

As per computation, Alma has to recognize an annual depreciation expense of $1,840 to account for the asset’s depreciation.

After five years of doing so, the asset book value should equal its salvage value.

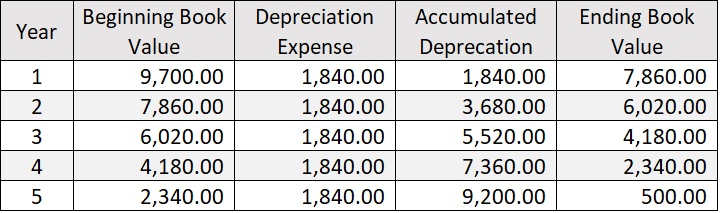

You can also refer to the following table for the asset’s depreciation schedule:

As you can see from the above table, the annual depreciation expense of $1,840 will result in a final book value of $500, which is the asset’s salvage value.

Exercise#2

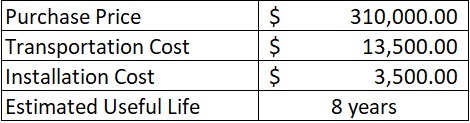

The following data were gathered regarding the acquisition of a specialized piece of equipment:

It is also gathered the asset is specifically made for the business that acquired it.

Because of this, the asset has no resale value.

The business plans to use the straight line depreciation method to account for the asset’s depreciation.

Our task is to determine the annual depreciation expense that the business has to recognize.

First, we need to determine the original cost of the asset.

From the data above, the business incurred $310,000 to purchase the asset, as well as $13,500 to transport it, and $3,500 to install it.

Adding all these costs together, we get:

Original Cost of the Asset = $310,000 + $13,500 + $3,500

= $327,000

As per computation, the original cost of the asset is $327,000.

With that, we can proceed with the computation of depreciation expense.

Take note that the asset has no salvage since it has no resale value.

Depreciation Expense = Original Cost of the Asset ÷ Estimated Useful Life

= $327,000 ÷ 8

= $40,875

As per computation, the business will have to record an annual depreciation expense of $40,875.

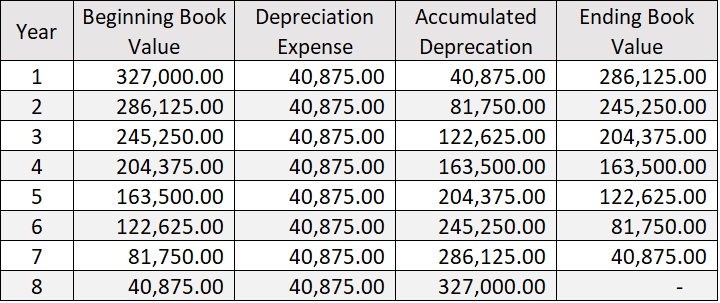

The table below reflects the depreciation schedule of the asset:

As you can see from the above table, the uniform annual depreciation expense of $40,875 ultimately result in a final book value of zero.

Since the asset has no resale value, it’s equal to worthless after the end of its useful life.

As such, it should have a book value of zero when it becomes fully depreciated.

The Simplicity of Straight Line Depreciation

The main draw of the straight line depreciation method is its simplicity.

Because the asset is depreciated evenly over its useful life, you usually only need to do one calculation.

You don’t have to do any complicated calculations unlike the other methods of depreciation.

But this simplicity is also the straight line depreciation method’s limitation.

It does not always accurately reflect an asset’s decline in value.

Some assets rapidly decline in value due to certain factors.

The straight line depreciation method cannot accurately capture this rapid decline in value.

For example, a piece of equipment or machinery may be used more during its earlier years.

As a result, it accumulates more wear and tear during its earlier years.

This should also be reflected in the accounting for its depreciation.

Because of this, the straight line depreciation method isn’t the best for this type of asset.

Another example, most smartphones rapidly lose value because of the almost yearly introduction of newer and better models.

The older models become obsolete rather quickly because of the introduction of better models.

This rapid decline in value should be reflected in the smartphones’ accounting for depreciation.

As such, the straight line depreciation method isn’t the best for this type of asset once again.

In conclusion, the straight line depreciation method may be simple and convenient but it is not always the best depreciation method.

It is not well suited for assets that rapidly lose value.

But for assets that depreciate evenly over their useful lives (e.g. buildings), its best to use the straight line depreciation method.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "Straight-line depreciation" Page 1 . February 22, 2022

University of Memphis "CHAPTER 12 – Depreciation Methods " Page 2 - 5. February 22, 2022

UMass Lowell "Straight-line and double-declining-balance depreciation compared " Page 1 . February 22, 2022