Petty Cash AccountingProperly account your business's petty cash fund

They often say that in business, cash is king.

That’s why cash is considered to be one of the most important assets of a business.

And since it’s important, a business would want to protect it.

It’s why you rarely see businesses pay with actual cash for huge expenditures.

They’d rather pay with checks or online transfers.

But for small expenditures, don’t you think checks are overkill?

You wouldn’t want to issue a check for a $5 purchase because that’s just inefficient.

For such small expenditures, you might want to consider establishing a petty cash fund.

A petty cash fund is a small amount of a business’s cash that it uses to pay for small expenditures.

For example, the cost of snacks for a meeting.

Just like any other cash account of the business, the petty cash fund must have proper controls to protect it.

It may be a small amount of money, but it’s still cash after all.

Establishing a petty cash fund for your business necessitates the creation of a petty cash accounting system.

You need to properly account for your business’s petty cash.

Even if the amounts are low, petty cash expenditures still matter.

A cent that you lose due to lack of a proper accounting system is still a cent lost.

As these small losses accumulate, they’ll eventually become a major discrepancy.

Since these losses are unaccounted for, you’ll be having a hard time tracking them.

So do yourself a favor.

If you’re planning to establish a petty cash fund for your business, make sure that you create a proper petty cash accounting system so that you can account for it.

If you don’t know how to account for your business’s petty cash fund, don’t worry.

This article is made to teach you the basics of petty cash accounting.

Establishing Your Business’s Petty Cash Fund

To reiterate, a petty cash fund is a small amount of cash that is set aside to pay for small expenditures.

It provides an alternative to writing checks or using business credit cards to cover small expenditures.

It’s simple, just take the needed amount from the petty cash fund to pay for small purchases or expenses.

Or the system can also be set up so that the disbursements from the petty cash fund are exclusively for reimbursements.

A business can also set aside multiple petty cash fund accounts.

But before you establish your business’s petty cash fund, you need to consider some controls first.

As a minimum, the roles of custody and approval must be segregated.

This means that the person who approves petty cash disbursements should not be the same person who has custody over the petty cash fund.

Other things you need to consider are the following:

Determine the amount of the petty cash fund

You’ll want to base your petty cash fund on your business’s usual small expenditures.

For example, if you find that your business spends $250 on small expenditures per week, you may want to set your petty cash fund for the same amount or maybe a larger amount.

Establish guidelines as to which expenditure the petty cash can be used for

Having readily accessible cash can be tempting.

Without restrictions, your employees might use it for all kinds of expenditures.

To combat this, you want to set boundaries.

Clearly define which expenditures the petty cash fund can be used for.

For example, you may want to explicitly state the petty cash fund cannot be used for personal purchases and expenses.

Set the maximum amount for petty cash requests

Finally, you need to set the maximum amount that your employees can request for petty cash transactions.

In a sense, this is you defining what amount a “small expenditure” is (it varies from business to business).

If the request exceeds the maximum petty cash amount, the employee will have to make a cash disbursement request.

The amount needed by the employee will then be extracted from the business’s other cash accounts (e.g. cash in bank).

Or the employee can use the business credit card instead

Petty Cash Accounting (with Sample Journal Entries)

After establishing your business’s petty cash fund, the next step is to create a petty cash accounting system.

Just like any other type of transaction, you must properly account for petty cash transactions too. No matter how small their amounts are.

Setting Up the Petty Cash Fund Account

To start with, let’s learn about the journal entry for establishing your petty cash fund.

Let’s say that you set a $250 petty cash fund for your business.

The journal entry should look like this:

Pretty simple right?

Accounting for petty cash doesn’t have to be complicated after all.

One way to improve petty cash accounting is to require a receipt for each transaction.

To supplement the receipts, you can set up a petty cash voucher or slip system.

The petty voucher or slip should include the employee’s name, as well as the date and amount of the petty cash transaction.

Document the receipt as well as the petty cash voucher/slip for recording purposes.

The petty cash custodian will accumulate the receipts until such time when the petty cash fund needs replenishment.

Depending on the amount you set for the petty cash fund, you might need to replenish it once a week or month.

At a minimum, you’ll want to update your petty cash account once a month.

This is so that all petty cash transactions are recorded in the same month that they are incurred.

Petty Cash Disbursements

Let’s proceed with the recording of petty cash disbursements.

Let’s say that the petty cash custodian accumulated the following receipts: $50 for transportation fees, $40 for meals, $20 for postage stamps, and $120 for emergency repairs and maintenance.

The journal entry to record the expenses should look like this:

Replenishment of the Petty Cash Fund

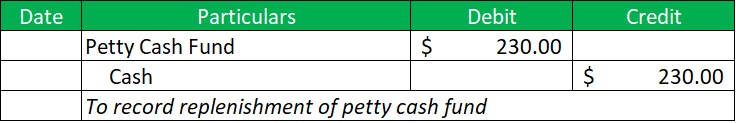

Since the petty cash fund only has $20 left in it, the petty cash custodian requested a check for $230.

This is to replenish the petty cash fund.

The journal entry for the petty cash replenishment should look like this:

After the replenishment, the petty cash fund should be back to its set amount of $250.

Basically, whenever you remove cash from the petty cash fund, it will have a corresponding credit entry to the petty cash fund account.

This usually happens for petty cash disbursements.

On the other hand, whenever cash is added to the petty cash fund, there will be a corresponding debit entry to the petty cash fund account.

This happens upon setting up the petty cash fund, and subsequently when replenishing it.

Petty Cash Reconciliation

There may come a time when there’s a discrepancy in your petty cash records.

This can happen due to employee theft or accounting errors.

Your custodian is only human after all.

To elaborate, a discrepancy happens when the receipts plus the remaining petty cash don’t add up to the set amount for the petty cash fund.

For example, let’s say you set your petty cash fund to be $100.

Adding up all the receipts and the remaining petty cash only amounts to $93.

This means that there is a discrepancy of $7.

Depending on the petty cash fund policy set by you, this can go two ways.

Either your business absorbs the loss or the custodian pays for it.

There is no standard here, however. What matters is to reconcile the petty cash fund.

The discrepancy might just be the result of an accounting error.

Be sure to review the receipts.

There might just be an error in the amounts, or they might be a missing receipt.

Remember, the total receipts plus the remaining petty cash should add up to the amount set for the petty cash fund.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Internal Revenue Service "Publication 583 (01/2021), Starting a Business and Keeping Records" Page 1 . March 11, 2022