Periodic Inventory vs Perpetual InventoryKnow which inventory management system works best for your business

If your business holds inventory, you will want to keep track of it.

Inventory is an important asset and can greatly affect a business’s profitability and sustainability.

That’s why it is important for businesses to implement a system for monitoring and tracking their inventory.

By keeping track of inventory, you know how much you need to restock or perhaps you will discover that you are either overstocking and understocking.

Monitoring your inventory can also minimize inventory costs because you don’t have any hidden waste or overages.

Currently, there are two ways to monitor inventory: the periodic inventory system, and the perpetual inventory system.

Each system has its own set of benefits and drawbacks.

Both the US GAAP and IFRS acknowledge these two systems, so the one that you choose will really come down to your preferences and needs.

If you understand the differences between period and perpetual inventory systems, you can better choose which one works best for your business.

Nowadays, the perpetual inventory system has become increasingly popular due to the advent of technology.

It’s easier to keep track of inventory with barcodes and specialized software.

This lessens the need to do an inventory count whenever a stock goes in or out.

That’s not to say that the periodic inventory system is phased out though.

Many businesses, mostly small businesses, still use the periodic inventory system because of its simplicity and ease of implementation.

Periodic Inventory vs Perpetual Inventory

The periodic and perpetual inventory systems are the two ways to track inventory.

Of the two, the perpetual inventory system is the more sophisticated one.

It requires more effort as you’ll have to constantly update the inventory account.

Every time there is a sale or purchase, you will have to update the corresponding inventory account.

Hence, why we call it “perpetual”.

In contrast, the periodic inventory system only updates the inventory account whenever you do an actual inventory.

This can be once a week, month, or year depending on the business’s policy.

In short, under the periodic inventory system, you only update the inventory account periodically, hence the name “periodic”.

In summary, the main difference between the two inventory management systems is how often you update the inventory account.

Other than that, there’s also the difference in recording movement in the inventory.

Differences such as how you record sales and purchases in each system.

That also includes their corresponding returns, allowances, and discounts.

The next sections will illustrate how movements in the inventory are recorded under each inventory management system.

Periodic Inventory System

The periodic inventory system is probably the older one of the two.

It’s simple and easy to implement.

You just need to set a ‘period’ in which you update the inventory, hence, “periodic”.

It could be hourly, weekly, monthly, or yearly, though oftentimes, it’s yearly.

This ‘period’ is usually paired with an actual inventory count.

When you do an inventory count, you update the inventory account.

The periodic inventory system is more favorable for businesses that have a low volume of sales.

When the volume of sales is low, the cost of setting up a perpetual inventory system isn’t worth it.

Usually, it is small businesses that use a periodic inventory system.

However, medium and large businesses may also opt to use a periodic inventory system depending on the products that they’re selling.

For example, a car dealership deals with high-value products (cars) but will usually have a low volume of sales.

In such a case, the periodic inventory system might be the more preferable choice.

That said, the periodic inventory system is not really compatible with businesses that have high volumes of sales.

It also isn’t compatible with inventory that has fast movement.

You’d want to have constant updates for fast-moving inventory as you want to prevent losses due to shrinkage.

Pros and Cons of the Periodic Inventory System

PROS

- Simple and easy to implement

- Less expensive to maintain than the perpetual inventory system

- Best suited for businesses that have low sales volume or slow inventory movement

- You only need to update the inventory account periodically

- You can readily use it even without any major preparation

- There is freedom in setting the ‘period’ in which you update the inventory account

CONS

- It may be costly depending on how you conduct inventory counts; you might have to pay overtime for your employees if you don’t want to disrupt business operations just to conduct inventory counts; this becomes more obvious the larger the business becomes

- Is not compatible with businesses that have high sales volume or fast inventory movement

- You cannot get a truly accurate representation of inventory until it is updated; this becomes an issue if you want to know the value of inventory at interim periods

Recording inventory movement with a Periodic Inventory System

Under the periodic inventory system, the inventory account is only updated during the period which is set by the business.

So, how do you record inventory movement under a periodic inventory system?

The answer: we use the “purchases” account.

“Purchases” is a temporary account and will always have a zero balance at the start of the period.

When the inventory account is updated, we close the “purchases” account to reflect changes in the inventory and also to account for the cost of goods sold.

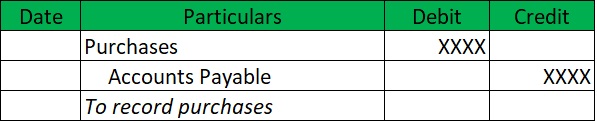

When a business makes a purchase, the “purchases” account is updated to record the purchase.

The debit entry will be “purchases”.

Then the credit entry will be “cash” or “accounts payable” depending on whether it’s a cash or credit purchase.

Journal entry for cash purchases

Journal entry for credit purchases

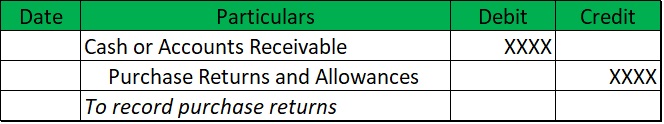

When there is a purchase return or allowance, we use a temporary account called “purchase returns and allowances”.

It is a contra account that serves to reduce the balance of the “purchases” account.

Journal entry for purchase returns on credit purchases

Journal entry for purchase returns on cash purchases. The debit entry will change depending on whether or not you receive cash upon return

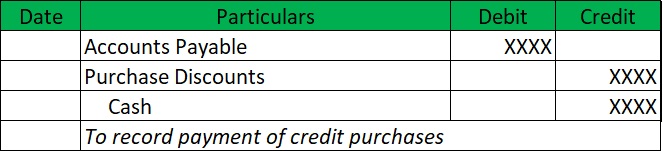

For purchase discounts, we use a temporary account called “purchase discounts” to reflect them.

It is another contra account that serves to reduce the balance of the “purchases” account.

Journal entry for payment of credit purchases that have a purchase discount

When there’s a sale, we only need to record one entry to record the sale itself.

We don’t have to record a separate entry to reflect the movement in inventory.

The same goes for sales returns, allowances, and discounts.

We don’t record additional entries to reflect movement in the inventory.

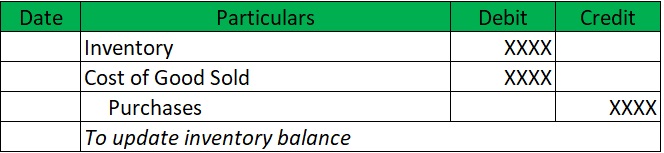

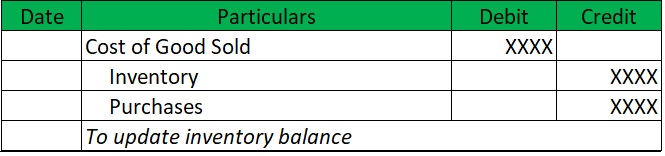

Updating the inventory account

To update the inventory account, we close the “purchases” account.

We do this at the end of the period that was set for updating the inventory account.

This way, we can reflect the new balance of the inventory account according to its actual physical account.

We also compute the cost of goods sold whenever we update inventory .

Cost of Goods Sold = Beginning Inventory + Net Purchases – Ending Inventory

If there are purchase returns, allowance, and discounts, we need to close those accounts before we compute the cost of goods sold.

Closing entry to close contra-purchases accounts

Journal entry for when the ending balance is greater than the beginning balance

Journal entry for when the ending balance is lesser than the beginning balance

Perpetual Inventory System

Under the perpetual inventory system, we update the inventory account whenever there is inventory movement.

Made a sale? We update the inventory account.

A customer returned a product? We update the inventory account.

Purchased additional merchandise for inventory? We update the inventory account.

You get the picture right?

From the get-go, we can see that the perpetual inventory system is more involved than the periodic inventory system.

It requires more record-keeping and monitoring.

This system may also be impossible to do manually.

You will need specialized software to maintain an effective perpetual inventory system.

The perpetual inventory system does not automatically account for theft or spoilage though.

That’s why we still need to conduct actual physical counts even with a perpetual inventory system.

That said, as long as there’s no shrinkage, the inventory balance should accurately reflect actual physical inventory.

Unlike the periodic inventory system which can be implemented easily, that’s not the case with a perpetual inventory system.

You’ll need a specialized accounting system to have an effective perpetual inventory system.

For example, the Point-of-Sale (POS) system.

You need to have specific software that can account for all of your inventory.

Aside from that, you need to acquire computers to run the software. Lastly, you’ll need to train people to handle the POS system.

If you think that that’s costly, that’s because it is.

In the old days, running a perpetual inventory means that you have to perform an inventory count whenever there is inventory movement.

Can you imagine how costly that is? Thankfully, that is no longer the case nowadays.

With the advent of technology, we now have specialized systems that can perpetually monitor inventory balances without having to perform physical inventory counts all the time. Isn’t that convenient?

Pros and Cons of the Perpetual Inventory System

PROS

- You have access to real-time information regarding your inventory

- More accurately represents inventory movement

- Having access to real-time information helps in making efficient reordering decisions

- If the inventory system is centralized, it’s easier to track stocks across different locations

- You’ll know immediately if a product is in stock or not

- Allows for more direct inventory control

CONS

- You’ll need to hire competent employees to minimize human error. The system can only be as good as the ones running it

- The start-up cost of running a perpetual inventory system is much higher than that of a periodic inventory system

- Recording transactions every time they occur can be time-consuming

Recording inventory movement with a Perpetual Inventory System

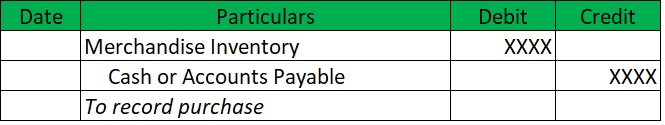

In contrast to the periodic inventory system, we don’t have to maintain a “purchases” account.

This is because whenever there is movement in the inventory, we update the inventory account.

When we purchase inventory, we record an increase in inventory.

Meaning, we debit inventory instead of purchases.

Journal entry for recording the purchase of merchandise. The credit side of the entry will vary depending on whether the transaction is a cash purchase or a credit purchase.

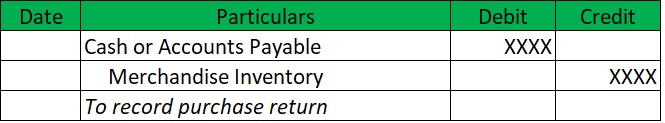

When there is a purchase return, the actual inventory level will decrease.

We need to reflect this decrease.

As such, whenever there is a purchase return, we credit the inventory account to reflect the decrease.

The same goes with purchase allowances.

The actual inventory count does not decrease, but the value of inventory decreases.

Journal entry to record purchase returns. The debit entry will depend on whether or not your receive cash upon return

Purchase discounts decrease the total cost of inventory.

They do not decrease the actual inventory though.

Still, there is a decrease in the cost of inventory, and as such, we need to reflect that.

Journal entry to record payment of credit purchase with a purchase discount

When there’s a sale, your actual inventory count decreases.

As such, we need to record this movement.

In addition to the usual sales entry, we record an additional inventory to reflect the decrease in inventory.

But what about the debit entry?

For that, we use the cost of goods sold (COGS) account.

Additional entry to record the decrease in inventory whenever a sale is made

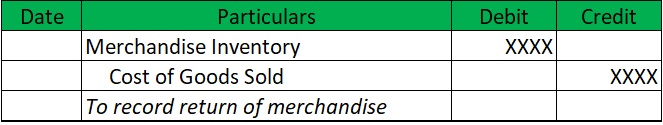

When a customer returns a product, your actual inventory count increases.

As such, we need to record this increase.

In addition to the sales return entry, we record an additional entry to reflect the increase in inventory.

This reduces the actual cost of goods sold too.

Additional entry to record the increase in inventory whenever a sale is returned

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Minnesota "8.2 Perpetual and Periodic Inventory Systems" Page 1 . January 21, 2022

Massachusetts Institute of Technology "Perpetual Inventory" Page 1 . January 21, 2022

Carleton "Inventory Costing Methods (Periodic Inventory System)" Page 1 . January 21, 2022