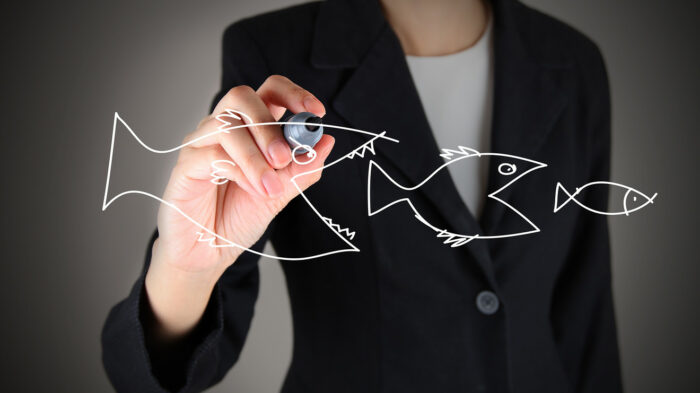

Merger ArbitrageAn investment strategy that aims to generate profits from merger or acquisitions

You may have heard of large companies acquiring or merging with other companies.

For example, there’s the recent announcement of Microsoft, a tech giant, planning to acquire Activision Blizzard, a company famously known for developing games.

Microsoft offered to purchase the shares of Activision Blizzard for $95 each, which was trading at around $65 per share at the time.

That’s a premium of around $30 per share!

Well, it’s typical for an acquiring company to purchase the target company’s shares at a premium.

This incentivizes the shareholders of the target company to allow the acquisition instead of selling its share in the open market.

But how does the stock market react to that?

Well, typically in a merger, the price of the target company will increase, but not to the point of being equal to or higher than the offer price of the acquiring company.

As an example, let’s go back to the acquisition announcement of Microsoft above.

When Microsoft made the announcement, the share price of Activision Blizzard rose to around $80 to $85 per share.

It’s a price higher than the initial $65/share but still lower than the offer price of $95/share.

Some individuals and businesses looked at this phenomenon and saw an opportunity for profit.

By purchasing the shares of the target company well before the merger or acquisition closes, the investor seeks to make a profit when the merger or acquisition actually closes.

We have a term to identify this action: merger arbitrage.

In this article, we will be discussing what merger arbitrage is.

How does it work?

Is it always profitable?

How does an investor profit from a merger arbitrage?

What are the factors that make a profitable merger arbitrage?

We will try to answer these questions as we go along with the article.

What is Merger Arbitrage?

Merger arbitrage (a.k.a. risk arbitrage) is an investment strategy that aims to make profits from a successful merger or acquisition.

It is an event-driven hedge fund strategy that capitalizes on the difference between share prices before and after a merger or acquisition closes.

Not all mergers or acquisitions successfully close though.

And because of this uncertainty, the share price of the target company will typically sell at a price that is lower than the acquisition price.

A merger arbitrage aims to profit from this uncertainty by purchasing the shares at a lower price, and then selling them for the acquisition price when the merger or acquisition successfully closes.

We refer to investors that employ merger arbitrage strategies as arbitrageurs.

Merger arbitrageurs will review whether or not a merger or acquisition will close on time, if at all. F

rom there, the arbitrageur will gauge if purchasing the target company’s shares could lead to the generation of profits.

Investors who already own stocks of the target company may also earn profits whether or not the deal closes.

Typically, when there’s an announcement of a merger or acquisition, the target company’s share price will rise.

Just from the announcement, an investor who already owns stocks of the target company can profit by taking advantage of the increase in the share price.

Of course, the investor may choose to hold on to the shares until the merger or acquisition successfully closes, but that comes with the risk of the deal not going through.

If the deal does not go through, then the investor wasted the opportunity to earn profits by selling the shares at a price that is higher than usual.

How Merger Arbitrage Works

In a typical merger or acquisition, the acquiring company often has to purchase the target company’s shares at a premium.

This incentivizes the shareholders of the target company to let the acquisition or merger go through rather than sell their share in the open market.

Just the announcement of the merger or acquisition drives up the share price of the target company.

This allows the investors who already own shares of the target company to profit from the price increase.

These investors also have the option to earn more profits by holding on to the stock until the merger or acquisition successfully closes.

Investors who purchase the target company’s shares after the announcement can profit from their investments depending on whether the merger or acquisition successfully closes or not.

If the deal does go through, their gains will depend on the “arbitrage spread”.

The arbitrage spread refers to the difference between the acquisition price (offer price of the acquiring company) and the market price at the time the investor purchases the shares.

The larger the arbitrage spread, the higher the profits for the investor will be… that is if the acquisition or merger successfully closes.

Typically, the highest arbitrage spread is attained if the shares were purchased before the announcement of the merger or acquisition.

Take note that the success of a merger arbitrage will depend on the probability that the acquisition or merger will push through.

The lower the probability, the higher the risk. However, this also presents an opportunity for higher returns because such a situation will typically result in lower increases in the share price (before the acquisition or merger closes).

This makes purchasing the shares much cheaper than with a high probability of acquisition or merger.

Merger Arbitrage in Cash Mergers

Cash mergers occur when the acquiring company offers to pay cash (typically at a premium) for the purchase of shares of the target company.

Usually, when an acquiring company announces a cash merger, it will announce the price at which it will purchase the target company’s share if the merger successfully goes through.

In this case, the merger arbitrageur earns a profit if the merger or acquisition successfully goes through.

The amount of profits will depend on the difference between the acquisition price and the price at which the merger arbitrageur purchased the shares of the target company.

We refer to this difference as the “arbitrage spread”.

For example, let’s say that the shares of the TG company are currently trading at $65 per share.

On July 1, the AQ company announces that it will purchase a majority of TG company’s shares for $120 each to be paid in cash.

AQ company believes that the value of the merger warrants such a premium.

The announcement caused the share price of TG company to rise to $85 per share.

Meg, an experience arbitrageur, sees an opportunity to profit from the merger.

As such, she decides to purchase shares of TG company at $85 per share.

Meg is confident that the deal will go through.

As the date of the merger closes, the price of TG company’s shares steadily increase until it was equal to the acquisition price announced by AQ company. The merger was completed successfully.

In our example above, Meg had an arbitrage spread of $35 ($120 – $85) per share.

This is the amount of profit Meg would make if the merger successfully goes through.

Merger Arbitrage in Stock Mergers

In stock-for-stock mergers, the acquiring company offers the purchase of the target company’s shares by offering its own shares to the shareholders of the target company.

In a stock merger, the merger arbitrageurs profit by purchasing the shares of the target company, while short-selling the acquiring company’s shares.

By short-selling the acquiring company’s shares, the number of outstanding shares in the market increases.

This dilutes the value of the acquiring company’s shares.

When the merger successfully closes, the target company’s stock will then be converted into the acquiring company’s stocks.

The merger arbitrageur can then use the converted stock to cover the short position.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Southern Indiana "Merger Arbitrage Investment an Effective Strategy for High Rollers and Small Time Investors: Evidence from U.S. Cash Deal Mergers" White paper. August 25, 2022

Harvard Business School "WHAT IS ARBITRAGE? 3 STRATEGIES TO KNOW" Page 1. August 25, 2022