Lease Accounting as a LesseeHow does the new standard affect lease accounting?

Lease accounting or accounting for leases is still a developing topic in the world of accounting.

Just July this year (2021), the FASB released an Accounting Standards Update on topic 842 (Leases).

Even before that, IFRS 16 was issued in 2016 and only became effective in 2019.

It wasn’t fully implemented that year though. Businesses we’re given leeway due to the global pandemic.

Not only that, only public companies were required to follow the new accounting standard.

Private companies were given until 2022 to comply.

Lease accounting is a pretty controversial topic.

In the US alone, the apartment rental market is worth more or less $174 billion in revenue.

And that’s just apartment rentals.

There are still markets for vehicle leasing, plant leasing, etc.

Imagine having a majority of these lease arrangements not appearing on financial statements.

Doesn’t it grossly understate the assets and liabilities of the leasing industry?

Before IFRS 16 became effective, only finance leases were required to be reflected in a business’s balance sheet.

Operating leases don’t have to be shown on the balance sheet, which is why there are sometimes called “off-balance leases”.

This provided a loophole for businesses to just recognize finance leases as operating leases.

That way, leases don’t have to be reflected on the balance sheet.

The IASB was having none of that. And so, IFRS 16 was released after a decade-long process.

With it, even operating leases are required to be presented in a business’s balance sheet.

IFRS 16, released in early 2016, is undoubtedly one of the most impactful standards that caused a major change in the accounting landscape of business.

There’s a reason why it was given three years before it became effective.

In this article, we will discuss the impact of the recently released standard in lease accounting.

What is a lease?

IFRS 16 defines a lease as:

“A contract that conveys the right to control the use of an identified asset for a period of time in exchange for consideration.”

From the definition above, we can gather that a lease is a legal contract wherein one party acquires the right to use a property, and the other is entitled to compensation.

A lease will always at least have two parties: the lessor and the lessee.

The lessor is responsible for providing the property to be leased.

In exchange, the lessor is entitled to lease payments.

On the other hand, the lessee is responsible for providing lease payments to the lessor.

In exchange, the lessee acquires the right to use the leased property.

Depending on the terms of the lease agreement, it can be considered a finance or operating lease.

A finance lease is typically long-term as it covers a major part of the leased property’s useful life.

Operating leases, on the other hand, can be short-term or long-term.

A lease can be as short as 30 days, or as long as the useful life of the leased property.

When IFRS 16 became effective, leases that have a term of more than 12 months are required to be reflected on the business’s balance sheet.

This is regardless of whether the lease is a finance or operating lease.

Before, only finance leases were required to be reflected on the business’s balance sheet.

This provided a loophole for businesses to make every lease an operating lease.

This prompted global accounting boards to review the accounting for leases.

And after a decade-long process, IFRS 16 was completed and issued.

An estimate of more than $2 trillion of operating leases is expected to be moved to balance sheets due to the change in lease accounting.

Lease classification (for a lessee)

On the lessee’s part, a lease can be classified into two types: finance lease, or operating lease.

A lease must be classified as a finance lease if it meets any of the following conditions:

- The present value of lease payment and guaranteed residual is equal to or greater than the fair value of the leased property.

- The lessee has an option to purchase the leased property at a lower price than the prevailing fair value. This purchase option is also referred to as a “bargain purchase option” due to the lower price. The lessee is reasonably certain to exercise this option.

- There is a transfer of ownership of the leased property at the end of the lease term. Ownership is transferred from the lessor to the lessee.

- The lease has a term that covers more than 75% of the leased property’s useful life. For example, a leased property has a useful life of 10 years. If the lease has a term of more than 7.5 years, it is considered a finance lease

- The property is specialized for the use of the lessee. When the lease ends, the lessor does not have any alternative use for the leased property. An example of this would be a lease of a piece of specialized equipment used for the production of a specific product that only the lessee produces. Since no other business has of any use for the piece of specialized equipment, the lessor has no alternative use for it

If the lease does not meet any of the above conditions, the lessee is to recognize it as an operating lease.

As per IFRS 16, if a lease has a term of no more than 12 months, the lessee is not required to report the lease on the balance sheet.

Lease Accounting as Lessee

Upon commencement of the lease

As per IFRS 16, the lessee is required to recognize a right-of-use asset and a lease liability upon commencement of the lease.

The right-of-use asset is initially measured by computing the sum of the lease liability and any initial direct cost shouldered by the lessee.

If there are lease incentives, payments at or before the commencement of the lease, or any similar payments, adjustments to the computation may be required.

To get the initial measurements for the lease liability, the present value of the sum of the lease payments must be computed.

The sum of the lease payments must be discounted at the designated discount rate to arrive at its present value.

For example, let’s say that a lease has a term of 5 years, with annual lease payments of $12,000.

The lease is to be discounted at a rate of 12%.

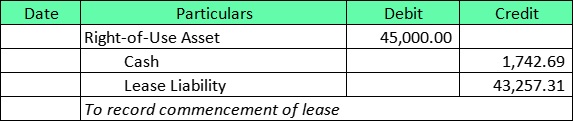

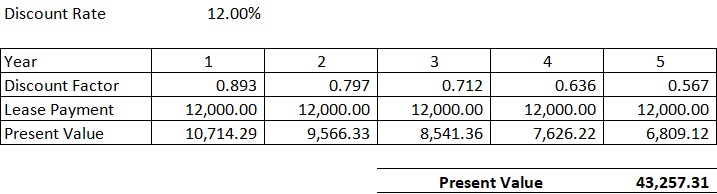

The following table will show the present value of the lease payments:

As per computation, the present value of the sum of lease payments is $43,257.31.

This will be the initial measurement of the lease liability.

If the lessee incurred an initial direct cost of $1,742.69, then it will be added to the initial lease liability to compute the right-of-use asset to be recorded.

Right-of-use asset equals $43,257.31 plus $1,742.69.

= $45,000.00

The journal entry upon lease commence will be as follows:

The lease liability is to be subsequently remeasured so that it reflects any changes in:

- The term of the lease

- The assessment of the purchase option

- Future lease payments; or

- The amount expected to be paid due to a guaranteed residual value

After commencement of the lease

Under the IFRS and GAAP, leasing accounting upon commencement of the lease is virtually the same.

However, they differ after the commencement of the lease.

Under the IFRS, all leases are treated as if they’re finance leases.

As such, the lessee will account for the lease as if it is a finance lease.

Things are different with the GAAP though. Under GAAP, the lessee would have to determine if the lease is a finance or operating lease.

Accounting for the two is different.

This is where the IFRS and GAAP mainly differ. It poses quite a conundrum for businesses that comply with both IFRS and GAAP.

If the lease is a finance lease

The lessee will have to recognize the following if the lease is considered a finance lease:

- Amortization of the right-to-use asset

- Interest on the lease liability

- Variable lease payments that are not included in the initial measurement of lease liability, if there are any

- Impairment of the right-to-use asset, if there is any

Let’s continue with our example above.

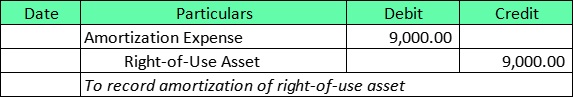

We computed that the lease liability is $43,257.31, and the right-to-use asset is $45,000.00.

Assuming that the straight-line method will be used for the amortization of the right-to-use assets, the annual amortization will be $9,000.

The journal entry for the first year of right-to-use asset amortization will be:

For the lease payments, interest on the lease liability must be allocated.

Interest is equal to the current balance of the lease liability multiplied by the discount rate.

In the above example, the discount rate is 12%.

This makes the interest for the first year as follows:

Interest = $43,257.31 x 12%

= $5,190.88

The journal entry upon the first annual lease payment will then be:

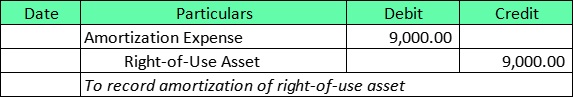

Let’s continue to the second year of the lease.

The amortization expense would still be the same.

Thus, the journal entry for the second year amortization will be:

The interest for the second will be the new current balance of the lease liability.

Since $6,809.12 was deducted from the lease liability account, the new balance of the lease will be $36,448.19.

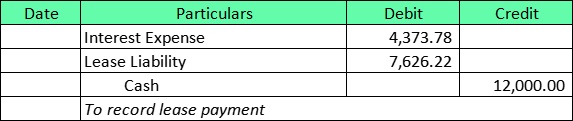

The interest for the second year will then be:

Interest = $36,448.19 x 12%

= $4,373.78

Thus, the journal entry will be:

Under a finance lease, interest and amortization experience are recognized.

If the lease is an operating lease

The lessee will have to recognize the following if the lease is considered an operating lease:

- A lease expense for each period that the lease is still live. The total cost of the lease (lease payments + initial direct cost) is to be amortized over the lease term using the straight-line basis. For example, if the annual lease payment is $10,000 with a lease term of 5 years, the lease cost will be $50,000. Suppose there is an initial direct cost of $2,000, the total lease cost will then be $52,000.

- Variable lease payments that are not included in the initial measurement of lease liability, if there are any

- Impairment of the right-to-use asset, if there is any

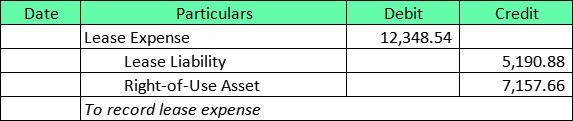

Let’s once again use our example above, only this time, we will be accounting for an operating lease.

The first we need to do is to compute our annual lease expense.

The lease has a term of 5 years.

Annual lease payment amounts to $12,000, and there is an initial direct cost of $1,742.69.

The total lease cost will then be:

The total lease cost is calculated as follows: multiply $12,000 by 5 and then add $1,742.69.

= $60,000 + $1,742.69

= $61,742.69

We will then compute for our annual lease expense by using the straight-line method:

Lease Expense = Lease Cost ÷ Lease Term

= $61,742.69 ÷ 5

= $12,348.54

The journal entry for recording the lease expense will then be:

The credit to lease liability is computed by multiplying the current balance of lease liability by the discount rate.

The credit to right-of-use Asset is computed by subtracting from the lease expense, the credit to lease liability.

The journal entry for recording the lease payment will then be:

After this journal entry, the balance of the lease liability will be as follows:

$43,257.31 + $5,190.88 – $12,000 = $36,448.19

If you notice from our finance lease computation, the balance of lease liability for both finance and operating lease are the same.

It’s just that if the lease is an operating lease, the interest is incorporated in the lease expense.

If the lease is an operating lease, then only a lease expense will be recorded in the income statement.

Conclusion

Lease accounting under the new accounting standard is definitely different from the lease accounting of the old.

With it, a new asset account emerged: the right-of-use asset.

A new liability account also emerged: lease liability.

If implemented right, the new standard should result in financial statements that truly represent the financial landscape of the leasing industry.

We still only discussed the changes on the lessee’s part, however.

The new standard also affects lease accounting for lessors, but that will be a topic for another day.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard Business School Online "What Is Lease Accounting and Why Is It Important?" Page 1 . January 3, 2022

IFRS "IFRS 16 Leases " Page 1 . January 3, 2022

Florida State University College of Law "New FASB Rules on Accounting for Leases: A Sarbanes-Oxley Promise Delivered" White paper. January 3, 2022