Fixed Asset AccountingDefined along with Formula & How to Calculate

What is a Fixed Asset?

Fixed Assets refer to the tangible assets purchased by a company that cannot be sold or converted to cash within an accounting year, and has a useful life of more than 1 year.

It is considered part of Property, Plant and Equipment (PPE), which is classified under Noncurrent Assets in the Balance Sheet.

An Asset is defined as any resource that can be measured dependably, and owned by an individual or a company, where economic benefits are expected to flow from.

Fixed Assets and Inventories are part of a company’s assets but the latter’s purpose is for consumption and includes raw materials, finished goods, and other supplies needed for repairs and maintenance of operations.

List of Fixed Assets in Accounting

There are different types of fixed assets found in the Balance Sheet.

Examples of Fixed Assets include:

- Computer Equipment

- Furniture & Fixture

- Building

- Software

- Land and leasehold improvements

- Heavy Machinery and Equipment

- Vehicles

- Tools

Classification of Fixed Assets in Accounting

Assets are classified in order for companies to properly recognize them and understand a company’s net working capital and solvency.

Fixed Assets are classified according to their convertibility, physical existence, and usage.

Convertibility

The ability of the assets to be converted to cash.

Fixed Assets

Fixed Assets are held by the company for more than one accounting period and are expected to provide benefits to the company for the long term.

These assets are not used or sold by companies within the accounting period.

Current Assets

Current Assets are considered liquid assets and contain the assets of the company that can easily be converted to cash within the accounting cycle.

Current Assets include Cash and Cash Equivalents, Securities, Inventories, etc.

Physical Existence

Assets can either be physically touched (tangible) or not (intangible).

Tangible Assets

Tangible Assets can be physically touched and can include equipment, vehicles, inventories, cash, etc.

Intangible Assets

Assets such as software, copyright, trademarks, intellectual property, goodwill, licenses, trade secrets, and other assets that hold a significant value for the company but cannot be touched are classified as Intangible Assets.

Usage

There are assets that are used to support the operations of the business.

Operating Assets

Operating Assets help companies run their day-to-day business operations and are used to create output for the company.

It includes cash, equipment, software licenses, etc.

Non-Operating Assets

As opposed to Operating Assets, Non-Operating Assets help support a company’s revenue but are not used in daily operations.

Land that is not yet used can be classified as a non-operating asset along with Certificate of Deposits (CDs), and other short-term investments.

What’s the Difference Between Total Assets and Net Assets?

The Total Assets refer to the sum of the assets that a company holds – Total Liabilities plus Owner’s Equity.

On the other hand, Net Assets or Net Worth refers to an entity’s value and is computed by subtracting the Total Liabilities from the Total Assets.

To show it as a formula:

Total Assets = Total Liabilities + Owner’s Equity

Net Assets = Total Assets – Total Liabilities

Their formulas are derived from the Accounting Equation: Assets = Liabilities + Owner’s Equity.

Determining the Service Life of an Asset

The Service Life or the Useful Life of an asset is an estimate that management provides in determining for how long the assets would prove to be useful in the company’s operations.

The estimate of its useful life can be based on several factors including whether or not the asset is brand new or already used, whether or not the asset is frequently used in the operations of the business, a general idea of its service life, etc.

What is Fixed-Asset Accounting?

All the financial activities related to Fixed Assets are recorded in Fixed Assets Accounting, which provides all the details and life cycle of assets – from purchase to disposal.

In the company’s books, each asset acquired is recorded in the books where they are classified into.

This asset account will contain all the related information pertaining to the asset.

The Fixed-Asset Accounting Cycle

When a company purchases an asset, the asset will have to undergo at least three of the stages of its life cycle: Acquisition, Depreciation, Revaluation, Impairment, and Disposal.

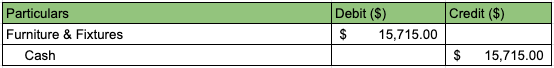

Acquisition

The Acquisition cost of the asset is the purchase price including any shipping or installation costs.

For example, a company has purchased furniture worth $15,000 in cash with a shipping fee of $175. To record the purchase, the journal entry will be:

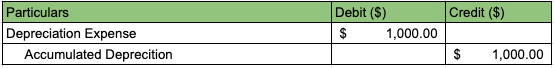

Depreciation

Assets reduce in value over time and this decline is recorded in the books as depreciation when referring to tangible assets, and amortization for intangible assets.

Salvage Value refers to the resale value of an asset after it has been fully depreciated. This is subtracted from the purchase price of the asset to determine the depreciable amount of the asset.

The formula to compute for the Salvage Value is:

Salvage Value = Original Cost – Estimated Resale Value

There are different depreciation methods that companies use:

Straight Line Depreciation

Depreciation in this method is spread over the useful life of the asset. To compute for the depreciation using this method, this formula is used:

Depreciation Expense = (Cost – Salvage Value) / Useful Life

For example, an asset purchased at $6,500 with a salvage value of $1,500 and useful life of 5 years will record annual depreciation expense of $1,000 (($6,500 – $1,500) / 5).

Journal Entry:

Units of Production

The computation for depreciation will depend on the usage of the asset in production. If the asset is used more, the higher the depreciation expense. To formula to compute for depreciation using Units of Production is:

Depreciation Expense = (Depreciable Cost / Life in # of Units) x # of Units Produced

A company purchases a waffle machine for $3,000 with a useful life of 5 years, a salvage value of $300, and a has an estimated life in the number of units of $15,000.

At the end of year 1, the company has produced a total of 750 units. The depreciation expense will therefore be $135.

Depreciation Expense = (($3,000 – $300) / $15,000) x 750 units

Depreciation Expense = $135

Double Declining Balance

This is one of the two methods used by companies when recording for depreciation of long-lived assets and is also referred to as an accelerated depreciation method because it depreciates twice as quickly as that of a declining balance method.

The formula used for Double Declining Balance (DBB) is:

DBB = 2 x SLDP x BV

Where:

SLDP = Straight Line Depreciation Percentage

BV = Book Value at the beginning of the period

As an example, assume a company purchases a delivery truck for $120,000 with a salvage value of $10,000 and an estimated useful life of 10 years.

To compute the depreciation expense using DBB, the straight-line depreciation rate must first be computed. In this case, it is 10% (1/10).

This rate will be multiplied by 2 (20%) and multiplied to the original purchase price of the asset which is $120,000.

Thus, for the first year, the depreciation expense is $24,000 (20% x $120,000).

This depreciation amount will be recorded in the next years and will only be stopped once the remaining amount of the asset is the salvage value.

Accelerated or Sum of Remaining Years

In computing for depreciation using this method, the assumption is that the productivity of the asset decreases over time. Using this method, the formula is:

Depreciation Expense = (Remaining Life / Sum of the Years’ Digits) * (Cost – Salvage Value)

For example, a company purchases a new machine for their factory for $60,000 with an expected useful life of 4 years and a salvage value of $5,000.

To compute for the annual depreciation, the Sum of the Years’ Digits must first be computed.

In this example, the denominator is the total of each year of the asset’s useful life: 1 + 2 + 3 + 4 = 10.

Given the above formula and example, the annual depreciation can be computed as:

| Year | Depreciable Cost | Remaining Useful Life | Depreciation Fraction | Depreciation Expense |

| 1 | $ 55,000.00 | 4 | 4/10 | $ 22,000.00 |

| 2 | $ 55,000.00 | 3 | 3/10 | $ 16,500.00 |

| 3 | $ 55,000.00 | 2 | 2/10 | $ 11,000.00 |

| 4 | $ 55,000.00 | 1 | 1/10 | $ 5,500.00 |

Based on the table above, the asset is fully depreciated at the end of Year 4.

Revaluation

Revaluation is the method of bringing the value of a fixed asset to its Market Value.

When revaluing assets, the gain or loss on revaluation must also be recorded.

Typically, revaluation of the assets is done when companies need to determine the value of the asset before it is sold, a merger or acquisition is anticipated, a loan application, preparation of financial reports, or when a company is soliciting for investors.

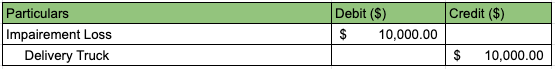

Impairment

Impairment refers to the process of writing down the value of an asset when the market value is less than the valuation entered in the company’s Balance Sheet.

To determine the impairment cost, simply subtract the lower market value of the asset from the asset’s carrying cost.

If the impairment cost of a delivery truck is $10,000, the journal entry to be recorded are as follows:

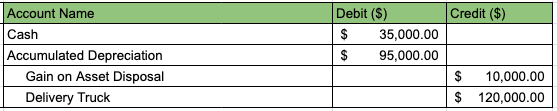

Disposal

When an asset is fully depreciated and is already at the end of its useful life, companies have the option of disposing of an asset by either selling it, scrapping it or accepting a trade-in.

At disposal, the asset is removed from the books of the company, and sometimes, a gain or loss on disposal is recorded.

Example:

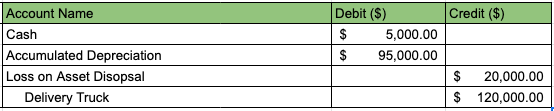

The Delivery Truck was purchased for $120,000 and the total accumulated depreciation recorded is $95,000. Another company purchased the delivery truck for $35,000 resulting in a gain from disposal of $10,000.

This is the journal entry to be posted by the accountant to record the disposal:

Suppose the buyer only paid for $5,000, the disposal of the asset will result to a loss of $20,000. The company will then record the loss as:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Clover Park Technical College " Chapter 3 Section 10 Accounting for Fixed Assets" Page 1 . February 11, 2022

Duke "Difference Between Fixed & Movable Assets " Page 1 . February 11, 2022

Marquette University "A Case of Fixed Asset Accounting: Initial and Subsequent Measurement" White paper. February 11, 2022