Branch AccountingExplained with Journal Entry Examples

What is Branch Accounting?

A bookkeeping system of creating separate accounts for branches or geographically separate operating units is called Branch Accounting.

Under this bookkeeping method, a company is able to show better transparency, cash position, financial performance, and financial position of each of their branches.

In short, it is a measure of performance for each branch.

With branches keeping their own sets of books, they eventually send that to the head office to be consolidated along with the books of other branches.

How Branch Accounting Works

With each branch keeping their own sets of books, they are treated as an individual profit and cost center.

Within these branches, they maintain a separate Trial Balance, Income Statement, and Balance Sheets.

They also use the double-entry bookkeeping system – recording debits and credits in the General Ledger including assets, liabilities, income, and expenses.

A branch account is considered a nominal or temporary account because, at the end of the accounting period, their balances are transferred to the head office accounts.

For the next accounting period, the balances will start at zero.

Branch Accounting Methods

In Branch Accounting, different methods will be used depending on the system of bookkeeping kept in each of the branches, or the nature of the branches.

They are the following:

- Debtors Method

- Stock and Debtors Method

- Final Accounts Method

- Income Statement Method

- Wholesale Branches Method

Branch Accounting System Example

ABC Company operate with a single branch for its retail operations.

In the books of ABC Company, inventory is transferred at cost, and depreciation is applied on their equipment at 25%.

Here is the information extracted pertaining to their branch:

| Accounts | Beginning Balance | Ending Balance |

| Inventory | $158,450.00 | $87,760.00 |

| Accounts Receivable | $44,000.00 | $52,000.00 |

| Petty Cash | $5,000.00 | $2,200.00 |

| Prepaid Expenses | $14,000.00 | $13,000.00 |

| Salaries Payable | $4,200.00 | $0.00 |

| Equipment | $32,500.00 | $19,000.00 |

| Total | $258,150.00 | $173,960.00 |

Beginning Balance Journal Entry

| Accounts | Debit | Credit |

| Branch Account | $249,750.00 | |

| Inventory | $158,450.00 | |

| Accounts Receivable | $44,000.00 | |

| Petty Cash | $5,000.00 | |

| Prepaid Expenses | $14,000.00 | |

| Salaries Payable | $4,200.00 | |

| Equipment | $32,500.00 | |

| Total | $253,950.00 | $253,950.00 |

In addition to that, the branch had the following transactions during the year:

- Goods Received – $144,000

- Cash Collected from Accounts Receivable – $66,500

- Petty Cash received from the Head Office – $3,500

- Insurance Payment – $12,000

- Salaries Payment – $48,000

- Rent Payment – $8,500

- Sales in Cash – $296,000

With the above transactions, the following journal entries will be posted:

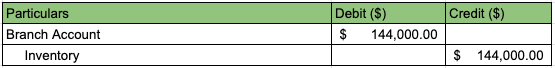

- Inventory Movement

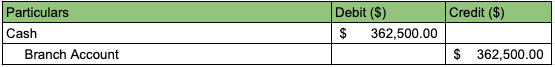

- Cash Receipts ($66,500 from Accounts Receivable, $296,000 from Sales in Cash)

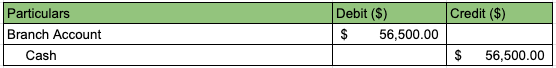

- Cash Payments ($12,000 for Insurance, $48,000 for Salaries, $8,500 for Rent)

Ending Balances Journal Entry

| Accounts | Debit | Credit |

| Branch Account | $173,960.00 | |

| Inventory | $87,760.00 | |

| Accounts Receivable | $52,000.00 | |

| Petty Cash | $2,200.00 | |

| Prepaid Expenses | $13,000.00 | |

| Salaries Payable | $0.00 | |

| Equipment | $19,000.00 | |

| Total | $173,960.00 | $173,960.00 |

Advantages and Disadvantages of Branch Accounting

Through Branch Accounting, companies are better able to report transparency – not only in their bookkeeping but with their operations as well.

Through this, branches will be able to determine the profitability of each of the branches and evaluate their performance.

However, there is also a disadvantage with this kind of accounting system.

Being a geographically separate operating unit means the company incurs additional cost in infrastructure, manpower, administrative expenses, etc.

And because a separate set of books need to be maintained, a branch accountant would have to be hired to ensure proper and accurate reporting.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

New Horizon "Branch Accounts" Page 1 . February 25, 2022

University of Mississippi "Branch accounting: E anch accounting: Evidence fr vidence from the accounting r om the accounting records of the ds of the North American Moravians " White Paper. February 25, 2022