Accrual vs DeferralDifferences You Need to Know Between the Two!

Accounting for revenue and expense is fairly simple when you’re using the cash accounting method.

You record revenue whenever you receive cash and you record an expense whenever you part with cash.

In other words, transactions are only recorded whenever cash is involved.

However, the cash accounting method does not conform to the US GAAP or the IFRS.

This means that if you want your public financial statements to conform to any accounting standard, you need to use the other method of accounting: the accrual accounting method.

Under the accrual accounting method, you record revenue whenever you earn it.

It won’t matter whether you receive payment or not at the time you earn revenue.

As for expenses, you record them when you incur them.

Similar to revenue, it doesn’t matter whether you’ve actually paid for them or not.

What matters is that you have incurred an expense.

Do you see the point of confusion here for anyone who’s not well-versed with accounting?

The thing is, in real life, businesses won’t always receive payment upon the delivery of a good or completion of a service.

Sometimes, they receive payment at a later date, depending on the terms of credit extended to the customer.

On the other hand, businesses won’t always pay for their expenses as they incur them.

Sometimes, they pay at a later date.

So for someone not familiar with the accrual accounting method, it can get confusing.

They might think “why should I record a transaction when there is no cash involved?”.

In this article, we will learn one of the by-products of the accrual accounting method which is accounting for accruals and deferrals.

We will learn why we record them, as well as the differences between the two.

What is an accrual?

An accrual is either:

- Revenue that you earn but you have yet to receive payment

- An expense that you incur but has yet to still have to pay for it

Do you see the common factor between the two above?

It is that they are both transactions that don’t involve cash.

Well, not yet anyway.

You’ll eventually be receiving or shelling out cash for these transactions.

But the thing with accruals is that you don’t have to wait for the involvement of cash for you to record transactions.

You only need to earn revenue or incur an expense.

Under the cash accounting method, you won’t be recording these transactions until you receive or part with cash.

And that’s one of the major flaws of the cash accounting method: it has the probability of failing to record transactions in a timely manner.

For example, let’s say that you own a business that sells specialized products.

In December 2021, you were able to deliver an order of your product to a certain customer.

However, the customer was only able to pay in January 2022.

Under the cash accounting method, you would be recording revenue when you receive cash, which in this case, in January of the following accounting period.

This creates an issue in which the revenue earned in one period is recorded in another.

This ultimately understates the revenue you made in December 2021, possibly even the whole 2021 accounting period.

It also overstates the revenue you made in January 2022.

But accruals go away with that.

Accruals allow you and your business to record transactions even if there is no cash involved, so long as they are earned (revenue) or incurred (expense).

This means that you can more accurately record the revenue and expense transactions of your business.

Recording for accruals: are they an asset or a liability?

Accruals can either be an asset or a liability depending on the transaction.

If the transaction is a revenue that has been earned but has yet to be paid for, the corresponding accrual will be an asset.

This is to represent the fact that you will be receiving cash sometime in the future.

A prominent example of this is the recording of accounts receivable.

For credit sales, your credit entry will still be the same as a cash sale: Sales Revenue, Sales, or Revenue.

However, for your debit entry, you cannot debit cash as you haven’t received any cash yet.

Rather, you need to debit an accrued asset, which is in this case, accounts receivable.

The journal entry would then be:

Or the debit entry could also be Accrued Revenue (which is an asset) for earned but unbilled revenue:

If the transaction is an incurred expense that has yet to be paid, the corresponding accrual would instead be a liability.

This is to represent the fact that you’ll be parting with cash sometime in the future.

For example, if your rent is already due but you still have yet to pay for it, then you’ll be accruing a liability.

A prominent example of this accrual is the accounts payable.

A business records accounts payable for purchases that it has yet to pay for.

The accounts payable account represents an obligation to pay for the goods or services that a business receives.

Here’s an example of a typical journal entry that involves account payable:

You can also accrue other expenses such as utility, rent, salaries & wages, etc.

The liability account will instead be Accrued expenses but it can also be more specific such as Accrued Rent or Rent Payable, Salaries & Wages Payable, Utilities Payable, etc.

What is a deferral?

A deferral is the opposite of an accrual.

It refers to delayed recognition of an accounting transaction.

It occurs when:

- Cash is received but the corresponding revenue is yet to be earned

- Cash is parted with but the corresponding expense is yet to be consumed or incurred

So why is a deferral the opposite of an accrual?

Well, it’s because there is the involvement of cash.

Also, you have yet to earn the corresponding revenue or incur/consume the corresponding expense.

As such, you need to put on hold the recognition of revenue or expense until you earn or incur them respectively.

But since there is the addition or reduction of an asset (cash), we still have to record a journal entry.

Under the cash accounting method, you record deferrals as if they’re actual accounting transactions.

Meaning that for cash receipts, you will record revenue.

And for cash disbursements, you will record an expense.

This creates the same issue with accruals in that there’s a possibility to record the revenue or expense of a certain period in another period.

For example, let’s say that in December 2021, you receive advance payment from a customer for a service that you will render in January 2022.

You successfully completed the service in January 2022.

Under the cash accounting method, it doesn’t matter when you completed the service.

What matters is when you receive cash, which in this case, was in December 2021.

This ultimately overstates your revenue in December 2021.

It also understates your revenue in January 2022.

Deferrals allow a business to record cash receipts for revenue that you have yet to earn or cash disbursements for expenses that you have yet to incur.

It allows the recording of transactions without having to recognize revenue or expense… yet.

Recording for deferrals: are they an asset or a liability?

Same with accruals, deferrals can either be an asset or liability depending on the transaction.

If the transaction involves a cash receipt but the corresponding revenue is still unearned, it will create a liability.

Since you still have to earn the revenue, you need to defer it even if you already received the payment.

As such, the deferral creates an obligation for you to satisfy the advanced payment.

It could be the delivery of goods or rendering of service at a later date.

For example, let’s say that a customer pays you in advance for a pre-order of a certain product that your store is still about to stock.

In this case, you receive payment for a product that you still have to deliver.

As such, you have to defer the recognition of revenue as you have not earned it yet.

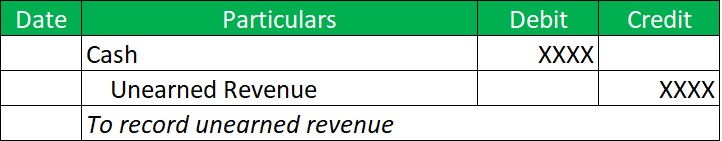

The journal entry for the cash receipt will then be:

Unearned Revenue is a liability account.

It represents a business’s obligation to deliver a good/s or render service/s.

It will be debited instead of cash when revenue is finally earned.

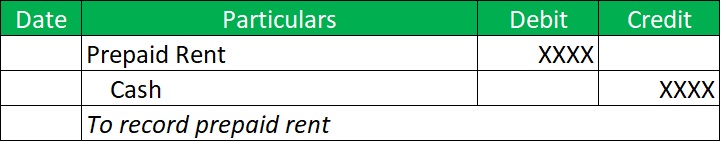

If the transaction involves a cash disbursement for an expense that has yet to be incurred or consumed, the deferral will create an asset.

For example, you paid a whole year’s worth of rent to your landlord.

Under the cash accounting method, you’ll be recording the transaction as an expense.

But that’s not the case under the accrual accounting method.

Instead, you defer the recognition of rent expense until you consume/incur it.

In this case, since you made a prepayment, you will create an asset account: prepaid rent.

Now when you incur rent expenses (which usually occurs every end of the month), you credit prepaid rent instead of cash as you already paid for it.

Accrual vs Deferral

While both accrual and deferral are the by-products of the accrual accounting method, their similarities end there.

Each has a specific purpose.

Accruals are meant to bring transactions forward in the current time.

Meaning that they are meant to recognize revenue or expense that would have been otherwise recorded at a later date under the cash accounting method.

On the other hand, deferrals are meant to record transactions without having to immediately record revenue or expense.

Meaning that they are meant to delay the recognition of expense or revenue that would otherwise be recorded at the current period under the cash accounting method.

The creation of an asset or liability differs between the two as well.

An accrued revenue transaction creates an asset whereas a deferred revenue transaction creates a liability.

On the other hand, an accrued expense transaction creates a liability whereas a deferred expense transaction creates an asset.

Accrual and deferral may not be the same, but that doesn’t mean that they’re mutually exclusive.

A business can have both accruals and deferrals.

They are an integral part of the accrual accounting method.

Together, they will help you make your financial reporting be a more accurate representation of your business’s financial condition.

They ensure that revenue and expenses are recognized in the period that they are earned and incurred.

Exercise: Accrual or Deferral?

I will be presenting transactions that you will have to identify either as an accrual or a deferral:

1 ) John receives $500 from Maria for a cleaning service that he has to perform a week from now. (Determine whether John should record accrual or deferral)

2) Melissa estimates that her utility bill will be $400. She plans on paying such a bill on the first day of the next month.

3) Marvin sells a cleaning product to Max. Max promises that he will pay on the fifth day of the next month. (Determine whether Marvin should record accrual or deferral)

4) Jonathan has complete maintenance services for a client. The client promises to pay Jonathan within 3 days.

5) Mavis pays her landlord six months worth of rent for $6,000

Answer key: 1) Deferral (Revenue) 2) Accrual (Expense) 3) Accrual (Revenue) 4) Accrual (Revenue) 5) Deferral (Expense)

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard University "Accounting Accruals – What are they and why do we do them? " White Paper. February 9, 2022

Harvard Business School "WHAT IS ACCRUAL ACCOUNTING?" Page 1 . February 9, 2022

University of San Francisco "Accruals and Deferrals" Page 1 . February 9, 2022