Staggered BoardDefined along with Examples

A corporation is a legal entity that is typically owned by a lot of individuals.

Now can you imagine having each one of those individuals having a say on all business decisions?

It will take weeks, maybe even months, or worse, years just to approve a single business decision!

And in a world where the competition between businesses gets fiercer and fiercer every day, being slow with business decisions can be very costly.

The competition will probably leave the company behind.

So, what’s the solution to this predicament?

Well, the shareholders can elect of group of individuals to represent them.

We refer to this group as the board of directors.

The board holds the ultimate decision-making authority, meaning that it can make certain business decisions on behalf of all the shareholders.

Aside from that, they are also to oversee the business activities of the corporation.

Do note that the board of directors is different from the corporation’s executive officers who supervise its day-to-day operations.

For one, executive officers (CEO, CFO, COO) are always employees of the corporation after all.

On the other hand, members of the board of directors may or may not be employees of the corporation.

That’s not to say that the board’s power is unlimited. They are determined by government regulations as well as the company’s articles of incorporation and by-laws. Among their functions are the following:

- Make major business decisions on behalf of the shareholders

- Provide strategic direction for the corporation

- Appoint, evaluate, and compensate the corporation’s executive officers

- Monitor financial and operational performance

- Evaluate the outcome of strategic decisions

- Establish a risk assessment plan

In this article, we will be discussing a special type of board of directors, the staggered. We will discuss its definition, as well its advantages and disadvantages over a normal board.

What is a Staggered Board?

A staggered board (a.k.a. classified board) is a type of board structure where its member are grouped into several classes.

These different classes serve different term lengths.

For example, let’s say that a staggered board has three classes: class A, class B, and class C.

Class A is to serve a term of 1 year, class B a term of 2 years, and class C a term of 3 years.

In this case, a portion of the board can turn over in any given year.

In the case of our example, at the end of year 1, only class A directors are open for elections.

At the end of year 2, only class A and Class B directors are open for elections.

This results in the board having a new set (or rather, a portion of it) of new directors every year.

This is different from a normal board of directors where they all serve the same term length and as such, all of the directors are elected at once.

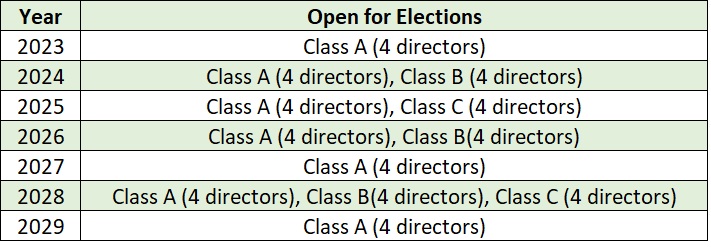

To further understand what a staggered board looks like, here is an illustration (let’s say that the board consists of 12 directors):

Suppose that the corporation starts its operation in 2022, here’s what the yearly elections would look like:

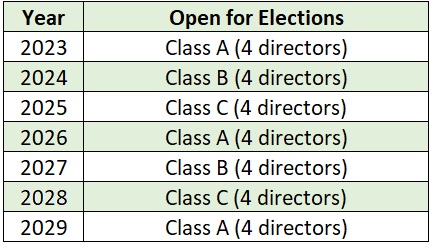

In some cases, the difference in term length is only applicable for a certain number of years, after which all the directors serve the same term length.

The only thing that differentiates them is when their term expires.

Let’s go back to our above example.

Let’s say that starting in 2023, all newly-elected class A directors will serve a term of 3 years.

Starting in 2024, all newly-elected class B directors will also serve a term of 3 years.

Here’s what the yearly elections would look like instead:

The Staggered Board as a Defense Against a Hostile Takeover

One worthy reason why a corporation would opt for a staggered board is that it is an effective defense against a hostile takeover.

This is because of its staggered style of elections – it will take several years for the hostile bidder to take control of the corporation.

Even more if it wants to occupy all the seats of the board (if ever it happens).

In the meantime, the board remains independent even if the corporation is inevitably sold to the hostile bidder.

They can still operate independently even with outside parties (such as the hostile bidder) exerting pressure.

Again, the hostile bidder will have to wait several years before it can gain control of the board of directors.

The hostile bidder will have to wait for a specific director class to be open for elections.

Since each class serves different term lengths, not only will the hostile bidder have to secure a seat for each class, but it also has to maintain those seats.

Due to the extra difficulty in gaining control of the board, the hostile bidder might give up on attempting to do so.

Thus, the board of directors remains independent of outside influence.

Other Advantages of a Staggered Board

Aside from being an effective defense against a hostile takeover, there are other reasons why a corporation would want to opt for a staggered board:

- It provides continuity in the top-level management. This results in a more stable form of governance. Long-term projects can be monitored more effectively.

- The board will more than likely consist of veteran and new directors. This can potentially avoid training costs as the veteran directors can train the new directors instead.

- Helps in corporate restructuring. Since there are veterans among the board of directors, they can gauge which employees should be kept and which ones shouldn’t.

- Executive officers of the corporation can think less about takeovers due to the independence of the board. This results in increased morale among the workforce, thereby increasing productivity.

- Under a staggered board, all shareholders, even the minority shareholders, get enough weight when it comes to voting.

Disadvantages of a Staggered Board

The downside to a staggered board is it has the potential to lower shareholder returns.

Several studies have shown that corporations with a staggered board often have lower shareholder returns than those that have a normal board structure.

A staggered board also runs the risk of entrenching individuals within the board of directors.

These individuals might secure their personal interests first rather than that of the shareholders.

This is an anti-shareholder move and can result in certain disadvantageous situations.

Also, since these individuals are more or less immovable from their spot as directors, they are less likely to work hard without the presence of external pressure.

This means that they might not always ensure that the corporation is working at its most optimal level.

While the defense against a hostile takeover is generally a plus, it also has a downside that some may fail to consider.

It runs the risk of the shareholders missing out on activist investors or unsolicited bidders who have genuine intentions for the corporation.

They may genuinely want to improve the performance of the corporation, or they may want to instill practices that can lead to better profits.

Whatever the case may be, a staggered board runs the risk of missing out on such individuals.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Penn Law "SETTLING THE STAGGERED BOARD DEBATE " White paper. May 31, 2022

Stanford LawSchool "Can Staggered Boards Improve Value? " White paper. May 31, 2022