Service RevenueDefinition and How to Recognize Service Revenue

Accounting for your business’s revenue is important as without it, you cannot accurately gauge how your business is doing.

Without proper accounting, you might overstate or understate your business’s revenue, which might lead to poor business decisions.

For example, granting bonuses to employees when a certain revenue amount is met, only to discover later that said revenue figure is overstated.

A business can typically earn revenue in two ways: by selling a product, or by selling a service.

Accounting for the sale of a product is pretty straightforward: a business earns revenue when the ownership of the product is transferred to the customer.

A retail store is a go-to example of a business that is engaged in the sale of products.

Accounting for the sales of service is pretty tricky though.

Generally, service revenue is earned when the service is performed or rendered.

The question now is, when can you tell when a service is performed or rendered?

Is it when it is completed?

Or is it when a certain milestone is reached?

It wouldn’t be much of an issue if there is a clear-cut guideline upon which completion can be based.

For example, a business that offers cleaning services would know that it earns service revenue once it completes a cleaning assignment.

Such a business can do this because a cleaning service can usually be completed within a day.

But for businesses that offer services that last for more than a period or even a year, when do they earn service revenue?

Do they only earn revenue if a service is completed?

What if they don’t complete any service within a year?

Would it be fair to say that they didn’t earn anything during that year?

This article aims to answer such questions and more regarding service revenue.

What is Service Revenue?

Service revenue refers to revenue earned from the sale of services.

This includes rendered services whether they are paid for already or are still to be paid for.

What constitutes a service will depend on the business itself.

For example, for a cleaning company, its services will primarily be any service that is related to cleaning.

For a construction company, its services will primarily consist of construction services.

Service providers or businesses that offer services typically have to employ strategies different from what product-based businesses would usually employ.

They often combine different types of skills to provide more coverage and more avenues of service revenue.

For example, an accounting firm may provide bookkeeping, accounting, audit, and consultancy services.

Service revenue is an important metric for any business that offers services, especially for a business that exclusively offers services.

It is a key performance indicator that can help you assess a business’s overall financial health.

A better understanding of service revenue can help a business owner in making informed decisions regarding business operations as well as future investments.

Service revenue under the accrual accounting method

Under the accrual accounting method, the service revenue account includes revenue earned from services that are performed or rendered whether payment has already been received or not.

It is an income statement account and can usually be found at the very top of an income statement among other revenue accounts.

Since it is an income statement account, it is also a temporary account.

That means that it must be closed or zeroed out at the end of the accounting period.

Service revenue is typically a credit account.

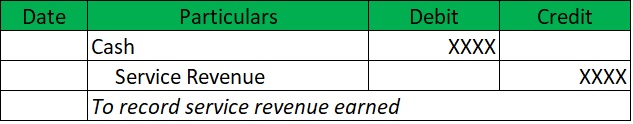

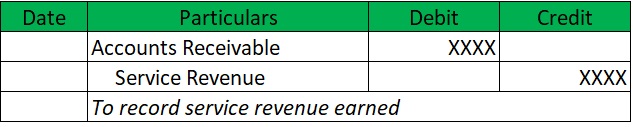

If a business earns service revenue, the journal entry will be:

For when cash is received when service revenue is earned; or

For when payment is still to be received when service is earned.

Types of service revenue

Service revenue can be categorized depending on how they are earned.

Typical service revenue is earned upon the completion of service.

However, some services are recurring or persistent such as subscription services.

The following are are the types of service revenue based on how they are earned:

Transaction-based service revenue

Transaction-based service revenue refers to revenue earned from one-time services.

For example, the service revenue earned from a cleaning service that is contracted only for a single event.

Since it is a one-time service, the service revenue earned from it is a transaction-based service revenue.

Another example, the payment you make for consultation services is transaction-based service revenue on the service provider’s part.

Transaction-based services can be usually completed within a period, or more commonly within a day.

Service revenue earned from services that last for more than a project may fall under the other types of service revenue.

Recurring service revenue

Recurring service revenue refers to service revenue earned from ongoing services (e.g. subscription services).

It is called recurring because the service provider is expected to receive recurring payments for the offered services.

For example, for subscription-based services, monthly payment is typically expected.

The aforementioned subscription-based service is one of the services from which recurring service revenue can be earned.

Other examples of such services are licensing fees, monthly retainer, or monthly rent.

Project service revenue

Project service revenue refers to service revenue earned from project-based services.

A project-based service typically spans over several weeks, months, or even years.

As such, the recognition of project service revenue may be divided depending on the business’s management.

For example, service revenue may be earned when a certain percentage of completion is reached.

Examples of services from which project service revenue can be earned are construction services, or software development services which are expected to span over several periods.

The many ways of recognizing service revenue

Depending on the type of services a business offers, it may need to apply a specific method of recognizing revenue.

For example, a business that mainly offers project-based services may not want to employ a method that only recognizes service revenue upon completion of service.

Rather, it may want to employ a method that recognizes service revenue at certain percentages of completion.

Likewise, a business that offers services that can be completed in less than a week may not want to employ a method that recognizes service revenue based on the percentage of completion.

It’s inefficient and just adds more unnecessary workload to the accounting department.

Rather, it would want to employ a method that recognizes service revenue upon completion of service.

Collection Method

Under this method, service revenue is only recognized when payment has been collected.

This method is typically employed when there is considerable uncertainty on whether or not the business will be paid for the service/s it rendered.

As such, it is considered to be the most conservative method of recognizing service revenue.

However, the collection method may not be acceptable under accrual accounting as it does not follow the matching principle.

Specific Performance Method

Under this, service revenue is recognized upon completion of a specific activity or service.

This method is usually employed for services that can be performed on their own and/or do not have to be bundled with other services.

For example, a laundry service is a service activity that can be availed of by a customer on its own.

This method is the most commonly employed method of service revenue recognition.

Completed Performance Method

The completed performance method is similar to the specific performance method in that service revenue is only recognized upon completion of a specific service.

The difference is that the completed performance method is used for bundled services rather than a single service activity.

Under this method, service revenue is only recognized when the entire set of services is fully rendered or performed.

For example, let’s look at a business that offers moving services.

The business is typically hired to box up, transport, and redeploy the movable assets of the customer.

Here, the boxing up, transportation, and redeployment of assets are bundled together.

However, the redeployment of assets is the key part of the moving service.

Hence, service revenue is only recognized when the redeployment of assets is fully performed.

Percentage of Completion Method

Under this method, service revenue is recognized at certain levels of completion.

It is mainly employed for long-term services (ones that can span over several periods).

By doing so, the business can reliably recognize some revenue related to a long-term project in every accounting period that it is active.

This is as opposed to only recognizing when the project is completed which could mean that a business won’t be recognizing revenue in a certain accounting period.

A construction company will more likely employ this method as most construction services can span over several periods.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Harvard Business School "What Is Accrual Accounting?" Page 1 . December 21, 2021

Colorado State "ACCRUAL ACCOUNTING AND YEAR-END TIPS" Page 9 - 28. December 21, 2021