Notes PayableDefined with Examples

Introduction to Notes Payable

Notes Payable are considered to be long-term liabilities in a company’s Balance Sheet if it has terms of more than 12 months, or recorded under short-term liabilities if the repayment period is less than a year.

A Notes Payable is a written promise that a borrower will pay the lender a specified sum plus interest during the period agreed upon.

Among the basic information included in the Notes Payable are the following:

- Principal Amount of the Loan

- Due Date

- Interest Rate / Interest Amount

- Details of the collateral (for secured loans)

- Limitations on the Creditor

In the Balance Sheet presentation, it is possible that there are components of the Notes Payable that are going to be recorded as current liability while the remaining portion is recorded under Long Term Liabilities.

Notes Payable vs. Interest Payable

With Notes Payable, a borrower will also have to pay back interest and that portion is recorded under another account called Interest Payable.

All the accrued interest that has not been paid yet is going to be recorded in this account.

Notes Payable vs. Accounts Payable

Confusion may arise with some people when they see both Accounts Payable and Notes Payable in the Balance Sheet.

Notes Payable includes signing a formal loan agreement whereas an Accounts Payable is less formal.

Transactions recorded under Accounts Payable do not include signing loan agreements or promissory notes.

Instead, the purchases that a company makes on credit are recorded under this account.

Companies look at their Accounts Payable account to determine which of the transactions still need to be paid off.

Accounts Payable and Notes Payable are both liability accounts but are presented differently in the Balance Sheet.

Balance Sheet Presentation – Notes Payable

From the time a promissory note is signed and cash is received up to the payment of the interest accrued and the payment of the principal loan amount, there are balance sheet accounts that are created to show these transactions: Notes Payable, Cash, Interest Expense and Interest Payable.

When a firm receives the loan proceeds, a debit to cash and credit to Notes Payable is entered into the books thereby creating a liability account.

Each time a firm accrues interest, a debit to interest expense and a credit to interest payable is also recorded.

But when the loan is paid back along with the interest payable balance, the Notes Payable and Interest Payable accounts are debited, reducing the liability of the company and the cash account is credited to reflect the payment.

Balance Sheet Presentation – Accounts Payable

As opposed to Notes Payable, Accounts Payable transactions are less formal and companies do not necessarily have to pay interest for purchases or services availed on credit.

For every purchase or service received on credit, the transaction is recorded with a debit to its corresponding expense account and then credited to the Accounts Payable account.

With Accounts Payable, the balances change based on how frequent the account is used and will change each time that each purchase or payment transaction is added.

Notes Payable Example

Company X wants to expand the business operations and in order to do that, they will need financing in the amount of $750,000.

A bank was able to lend them the amount and they signed the loan agreement with the following terms:

Principal Loan Amount: $750,000

Annual Interest: $26,250

Loan Maturity: after 4 years

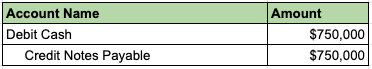

To record the receipt of the loan amount, Company X will record it in the books with the following journal entry:

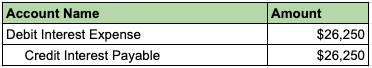

To record the interest accrued annually, the journal entry to be passed is:

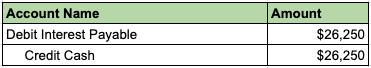

When Company X makes a payment on the interest due the following year, the entry will be:

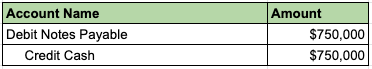

At the end of the loan period, when Company X pays back the amount to the bank, the entry to be recorded is:

Based on the example above, it must be noted that each time a company receives a loan amount, there are four accounts that will be maintained until the loan amount is completely paid off: Notes Payable, Interest Expense, Interest Payable and Cash accounts.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

UMass Lowell "Chapter 10: Current Liabilities " Chapter 10. January 11, 2022

Penn State University "3: Notes Payable and Interest Expense" Page 1 . January 11, 2022

Cerritos College "1 ACCOUNTING 101 CHAPTER 9: CURRENT LIABILITIES" Page 1 - 8. January 11, 2022