Net Income Defined

Revenue is what a business earns from its sales of goods or services.

Gross Profit is what a business earns after considering the cost of sales.

Operating Income is what a business earns after considering the cost of sales and operating expenses.

These measures of profitability are related to the overall financial performance and efficiency of the operating activities of a business.

However, a business can sometimes earn income and incur expenses outside of the core operating activities.

Not to mention the income taxes that businesses are required to pay.

Revenue, gross profit, and operating income do not capture these other aspects of a business.

So what do we refer to as the earnings after considering the cost of sales, operating expenses, income and expenses from non-operating activities, and income tax?

That is what we refer to as the Net Income.

What is Net Income?

Net income is a comprehensive view of a business’s financial performance.

It is arrived at by using the formula:

Net income is calculated using the following formula: Net Income = Revenue – Cost of Sales – Operating Expenses + Non-operating Income – Non-operating Expenses – Income Tax.

It is much more inclusive than gross profit and operating income as it does not only capture the earnings (or loss) from operating activities, it also captures the earnings and losses from non-operating activities such as the gain or loss from the sale of a long-term asset, the interest expense related to a loan, or the dividends earned from the shares of another company that is being held by a business.

It also captures the income tax that businesses are required to pay.

Net income is the amount of earnings left that a business can distribute to its owners as dividends, or retain for reinvesting and capital growth.

It is also referred to as the “bottom-line” as it usually is the last line item in an income statement.

Among the gross profit, operating income, and net income, the net income is probably the most complete measure of a business’s financial performance as it considers all the financial aspects of the business (operating activities, investing activities, and financing activities).

A business can have good figures in gross profit and operating income but still have a small, or even negative net income (referred to as net loss).

On the flip side, a business can have low gross profit and operating income but have a high net income due to a huge injection of profit from non-operating activities.

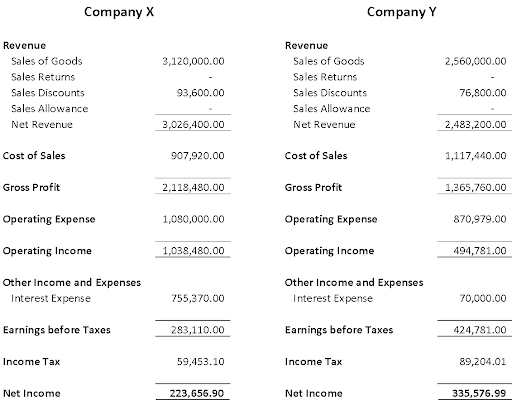

To illustrate, let’s take a look at the income statements of company X and company Y, and compare them:

If we take a look at the gross profit and operating income of the two, company X is the clear winner with a gross profit of $2,118,480 and an operating income of $1,038,480 compared to company Y’s gross profit of $1,365,760 and operating income of $494,781.

Assuming that the two are from the same industry, we can infer that company X is financially doing better with its operations.

However, when we go down further the income statements, we can see that company Y actually had the higher net income of $335,576.99 compared to company X’s $223,656.90.

This is because company X spent way more on interest payments compared to company Y.

Company X’s interest expense of $755,370 ate a huge chunk of its operating income, which caused a huge dent in its net income.

In contrast, company Y’s significantly lower interest expense of $70,000 didn’t have as much impact as company X’s.

So in overall financial performance, company Y is better than company X.

In the above example, we see the effects of having a high interest expense (a non-operating expense) in a business’s net income.

Even though company X had a good financial performance on its operations, its net income was lower compared to company Y which had a relatively lower financial performance on its operations.

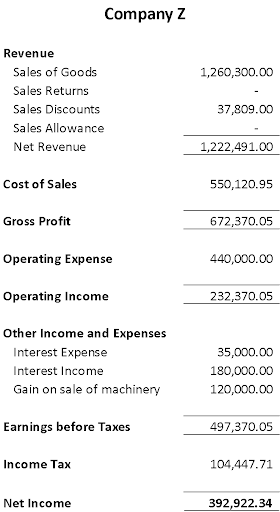

Let’s add a third player to the mix:

Company Z had even lower gross profit and operating income than company Y, but it had the highest net income of the three, with a figure of $392,922.34.

This is because other than its operating income, company Z earned from non-operating activities, such as the disposal of a fixed asset which resulted in a gain of $120,000, and interest income of $180,000 from lending its cash, not to mention the lower interest expense of $30,000 when compared to company X’s and company Y’s.

However, does this mean that company Z is the best of the three in terms of financial performance?

Well, if we strictly base it on the numbers, then yes, we can say that company Z performed the best among the three.

However, we must keep in mind that a significant portion of company Z’s net income came from non-operating activities, one of which is the gain on the sale of machinery.

It is safe to assume that this kind of income is non-recurring as you can’t expect a business to sell its capital assets every year, and if company Z keeps on operating on the same level as it is now, it will probably fare less than company X and company Y.

It is important to have a critical eye when looking at a business’s net income.

While it is always a good thing to have a high net income as it represents a business’s profitability, it is important to know where it came from.

As an owner or investor, you would want it to come from reliable and consistent income sources (usually operating activities).

Though income from other sources is always welcome, it isn’t a good sign if a business relies on it more than its income from operating activities.

Rather, treat them as bonuses, and focus more on the core operations of your business.

Gross Profit vs Net Income

Gross profit is a business’s earnings after deducting the cost of sales from its revenue.

For example, if a business has a revenue of $350,000 and a cost of sale of $150,000, then its gross profit would be $200,000.

Net income is a business’s earnings after deducting from its total revenue and income from non-operating activities all of the expenses incurred.

Expenses include the cost of sales, operating expenses (including depreciation and amortization), non-operating expenses (e.g. interest expense, loss from the sale of a long-term asset), and income tax expense.

Gross profit and net income are both measurements of a business’s profitability.

It is in their scope where they differ.

Gross profit only captures the profitability of a business’s operating activities, specifically sales of goods or services.

Net income captures all of the financial aspects of a business including operating activities, investing activities, and financing activities.

Gross profit is helpful if you want to know how profitable a business’s products or services are.

It is especially helpful if a business maintains multiple products.

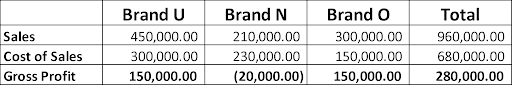

For example, company P offers three products: Brands U, N, and O. These products’ sales data can been seen from the table below:

From the data above, we can see that Brands U and O were profitable, while Brand N failed to generate profit and rather caused a loss of $20,000.

From here, management can decide what to do with Brand N: whether to discontinue it, increase its sales price, or find ways to reduce its costs.

Net income on other hand is most helpful if you want a more comprehensive view of a business’s financial performance.

Not only does it inform you of how well a business’s operations are performing, but it also informs you about its investing and financing activities.

Operating Income vs Net Income

Operating income is a business’s earnings after deducting from the revenue the cost of sales and operating expenses.

For example, if a business has a revenue of $500,000, a cost of sales of $270,000, and a total operating expense of $130,000, then its operating income will be $100,000.

The operating income is similar to the gross profit as it captures the financial performance of a business’ operating activities.

It’s a step further though as it includes the operating expenses into consideration.

Operating expenses are necessary and unavoidable expenses for a business’s operations that don’t directly contribute to the cost of a product or service.

The operating income is a good measure of how well a business is managing its operating costs (cost of sales + operating expenses).

A business can have a good gross profit margin, but can still have a poor or even negative operating income due to poor handling of operating expenses.

The net income takes a step even further than the operating expense, as aside from the data captured by the operating income, it also includes the income and expenses from non-operating activities, as well as income taxes.

As the operating income only captures financial performance from operating activities, it does not consider the effects of non-operating expenses, the most common being the cost of borrowing.

The net income, on the other hand, does.

Net Revenue vs Net Income

The gross revenue is a business’s earnings before any deductions.

It is what the business earns in exchange for its goods and/or services.

Net revenue on the other hand is gross revenue less any sales returns, discounts, allowance, and commissions.

For example, a business had gross revenue of $300,000 from its sales of goods but $20,000 of the goods sold were returned, resulting in net revenue of $280,000.00.

On the other hand, net income is net revenue plus non-operating income less the cost of sales, operating expense, non-operating expense, and income taxes.

It is a business’s earnings after considering all the expenses and income, be they from operating or non-operating activities.

In the income statement, the gross or net revenue is the top line item, while the net income is usually the last or bottom line item.

Net Income vs Cash Flow

Net income captures all the income and expenses of a business, be it from cash or non-cash transactions.

Hence, it is not an accurate representation of a business’s cash flow.

For that, we have the cash flow statement, which shows us the net cash flow of a business from its operating, investing, and financing activities.

Personal Gross Income vs Net Income

Personal gross income refers to the total earnings of an individual.

After accounting for deductions such as social security taxes, retirement contributions, wage garnishment, and taxes, what we get is an individual’s net income (also referred to as net pay).

For example, in 2020, Jacky earned $70,000 of gross income and qualified for $23,000 in deductions.

This makes Jacky’s taxable income equal to $47,000 and assuming that his income tax amounted to $7,000, then his net income would be $40,000.

An individual’s net income is also considered as his/her disposable income.

It is what an individual can freely spend on personal expenses such as living expenses, debt payments, bills, groceries, etc.

It is recommended that an individual’s budget be based on his/her net income rather than personal gross income.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "Adjusted Net Income Defined" Page 1 . September 21, 2021

Cornell.edu "Definition of net income and proceeds and standard for allocating net income or proceeds to various periods" Page 1 . September 21, 2021