LLC FactsHere's Some Hard Facts about Limited Liability Companies

LLCs are getting popular these days.

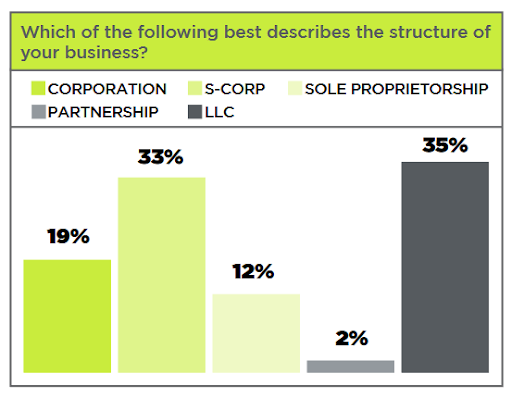

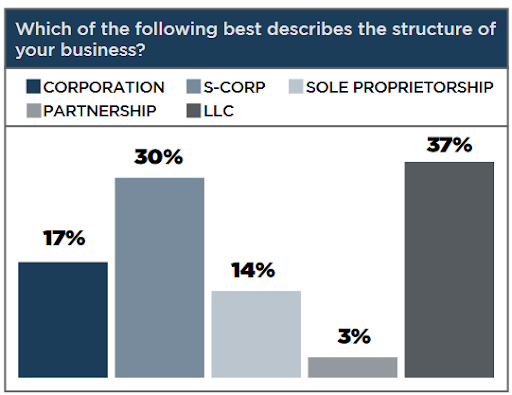

A 2017 year-end economic report from the NSBA gathered that 35% of small businesses are LLCs, and it grew to 37% by mid-year of 2018.

Source: NSBA 2017 Year-End Economic Report

Source: NSBA 2018 Mid-Year Economic Report

From the charts above, we can see that a relatively high percentage of small businesses are LLCs.

They have the highest percentage when compared to other business types.

With that, we can confidently say that LLCs are indeed popular.

This is despite the fact that LLCs only became a thing in the 1990s (though the State of Wyoming already recognized LLCs in 1977).

If you’re planning to start a business, it’s good to know about the different types of businesses that you can form.

One of those business types is the LLC. In this article, we will learn what is an LLC and why it is popular along with some LLCs facts that both would-be LLC and already existing LLC owners should know.

To start with the facts, did you know that the owners of an LLC are called members?

What is an LLC and why is it popular?

An LLC (stands for Limited Liability Company) is a business entity that offers its owner/s limited liability protection.

It combines certain characteristics of a sole proprietorship or partnership and a corporation: it enjoys the “pass-through entity” status just like a sole proprietorship or a partnership while offering limited liability protection to its owner/s just like a corporation.

What makes LLCs popular is that it combines the advantages of a partnership/sole proprietorship and a corporation.

You have the simple taxation offered by sole proprietorships/partnerships while enjoying limited liability protection offered by corporations.

Not only that, LLCs do away with their disadvantages such as being subject to double taxation, or the owner/s being held liable for more than the extent of their investment.

Generally, LLCs are easier to form and run than corporations.

It takes less paperwork, there’s no requirement to have an annual meeting, shares don’t have to be issued, and annual reports don’t have to be as elaborate as that of a corporation’s.

Enjoying the “pass-through entity” status of a sole proprietorship/partnership, offering limited liability protection to its members, and being easier to form and maintain than a corporation, it’s no wonder why LLCs have become popular.

An LLC is either member-managed or manager-managed

Just like any other business entity, an LLC would need to have someone who manages its day-to-day operations and other affairs.

The thing is though, LLCs are not required to formally appoint someone as a manager – the members themselves can be the managers of the LLC.

In most states, an LLC is assumed to be directly managed by its members by default if a manager is not appointed.

All of its members are treated as managers, and the LLC is considered a member-managed LLC.

This is beneficial if all of the LLC’s members want to have an active role in its operations such as making business decisions, handling customer and supplier relations, hiring and managing employees, etc.

For example, if a donut shop is structured as an LLC and all its members want to handle all business operations such as purchasing materials and supplies, making and selling the donuts, manning the counter, or other business transactions, then it would be beneficial if the donut shop operates as a member-managed LLC.

If a manager is appointed, then the LLC would then be considered a manager-managed LLC.

In this management structure, the LLC would be managed by an individual, a group of individuals, or another business entity (as allowed by the law).

The manager of the LLC can either be a member of the LLC or an outside party.

There can be as many managers as the members want and agreed upon.

A manager-managed LLC is preferred if not all of the members would want to directly participate in its management.

Some members only want to be passive investors and are comfortable in delegating management responsibilities to other people.

Or it could be that some members are not really well-versed in managing a business, and so they’d be more confident if someone knowledgeable can do it for them.

Another situation in which a manager-managed LLC is preferred is when an LLC is too large (in terms of assets, business, and members).

There is no limit as to how many members can have, so it may reach a point where sharing management among all of them can be near impossible.

Imagine having all stockholders of a large corporation (think Apple Inc. level of large) be elected as directors – seems like a disaster waiting to happen huh?

That’s why appointing a manager/s can be more beneficial in such a case.

Now whether you’d go with a member-managed or manager-managed LLC is ultimately up to you and your co-members.

There is no law that requires you to choose one or another. What is required though is that an LLC should have at least one manager.

An LLC can have one or more members (and there’s no limit to how many members an LLC can have)

Unlike other business/legal entities that need more than one owner (e.g. limited partnership, limited liability partnership, corporation), an LLC can have just one owner.

An LLC with only one member is called a single-member LLC, while an LLC with more than one member is called a multi-member LLC.

This makes LLCs more flexible than the other types of business entities as you can form one even on your own.

Speaking of being flexible, did you know that an LLC can have the same tax treatment as either a sole proprietorship, partnership, corporation, or even an S corporation?

Members of an LLC can choose how it will be treated for tax purposes: as a sole proprietorship/partnership, an S corporation, or a C corporation

By default, an LLC is considered a pass-through entity in the eyes of the IRS.

That means that for tax purposes, single-member LLCs are treated the same as sole-proprietorships, while multi-member LLCs are the same as partnerships.

The LLC isn’t taxed directly, rather its income is reflected on the tax returns of its members.

An owner of a single-member LLC can directly claim its net income and reflect it on his tax return (Schedule C) – just like a sole proprietorship.

A multi-member LLC would have to file an IRS For 1065 so that the IRS can know how much of its income would be reflected on each member’s individual tax returns.

However, an LLC can also be considered a corporation for tax purposes if its members elect it to be treated as one.

Doing so would make the LLC taxable as either a C corporation or S corporation.

Unless its members elected it to be treated as a corporation, an LLC will not be subject to corporate taxes

Typically, an LLC does not file corporate tax returns.

However, if the members of the LLC elected to treat it as a corporation, then it would be taxed as a corporation.

That means that it would have to pay and file corporate taxes.

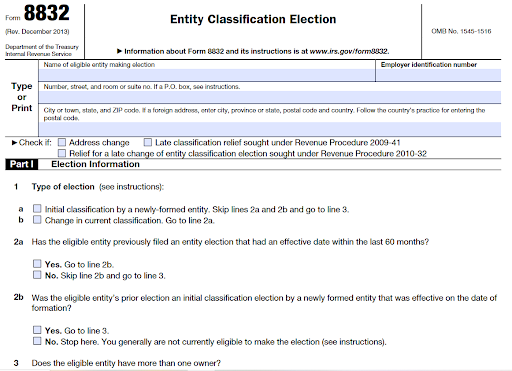

To be treated as a corporation, members of the LLC would have to file a Form 8832 – Entity Classification Election to the IRS.

On line 6 of part 1 of the form, check box A “A domestic eligible entity electing to be classified as an association taxable as a corporation” or box D “A foreign eligible entity electing to be classified as an association taxable as a corporation” so that the LLC will be treated as a corporation by the IRS.

Source: IRS Form 8832

While electing to be treated as a corporation will forego an LLC’s advantage of being able to avoid double taxation, there are reasons why some LLC owners opt to do it.

For one, the income tax rate for corporations is a flat rate of 21%, which is significantly lower than the ceiling tax rate for individuals of 37% (rates are as of October 2021).

This can be beneficial for the LLC’s members if they are already reporting huge amounts of taxable income in their individual tax returns.

An LLC can be elected as an S corporation if its member opted for it

In addition to having the option to be treated as a C corporation for tax purposes, an LLC’s members can also elect it to be treated as an S corporation.

Certain requirements would have to be complied with before an LLC can be treated as an S corporation such as being a domestic entity with no foreign investors, not having more than 100 shareholders, etc.

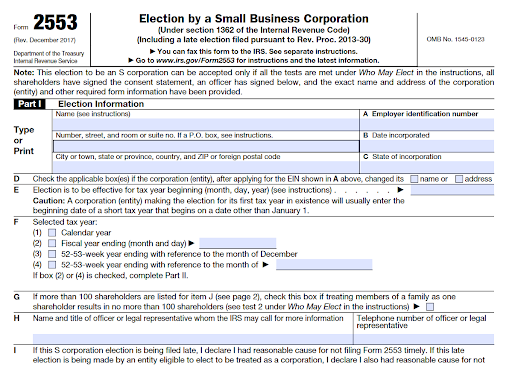

If conditions are met, an LLC can be elected to be taxed as an S corporation by filing an IRS Form 2553.

Source: IRS Form 2553

While an S corporation enjoys the same “pass-through entity” status of a sole proprietorship or partnership (default tax treatment for LLC), owners of an S corp can also be treated as employees which means that they won’t have to pay self-employment taxes.

Members who work or perform substantial services for the LLC will also be treated as employees.

This could result in savings for these working members, provided they are paid a “reasonable salary”.

LLC members can choose how to split up the profits (and the consequent tax burden)

So you and your co-members chose how your LLC will be taxed, but did you know that you can also choose how to split up the shared tax burden?

The default option for splitting profits (and the tax that comes with it) is based on the ownership interest or capital contribution of each member.

For example, if an LLC has two members where one member holds 60% of the ownership interest, while the other holds 40%, then profits will be split 60:40 which is the same ratio of ownership the members have in the LLC.

However, members of an LLC may also decide how they would split the profits.

It could be the default profit sharing, equal profit sharing regardless of ownership interest, giving members who contributed cash more percentage of the profit, etc.

They just have to make sure that it’s put into writing and that it’s legal.

If it’s not written in the LLC’s operating agreement, then the state’s default rules on splitting profit apply.

A verbal agreement by the members will not suffice.

An LLC that opted to be taxed as a corporation (be it C or S corporation) is not allowed this luxury of having an alternative profit splitting agreement though.

As per IRS rules, an LLC that is taxed as a corporation must allocate and distribute its profits according to the ownership interest of each of its members.

Members of an LLC will have to pay self-employment and estimated taxes

Unless an LLC is treated as an S corporation, all of its members are not considered to be its employees.

And even if an LLC is treated as an S corporation, a member can only be considered an employee under certain conditions.

Most of the time, the IRS will treat an LLC’s members to be self-employed and as such, are responsible for self-employment taxes.

This includes the Social Security tax of 12.4% for the first $142,800 worth of net income and Medicare tax of 2.9% of all net income. T

hose are not negligible amounts. It’s best to be aware of this tax when making your budgets for both personal and business affairs.

That’s not all though – members of an LLC will also have to pay estimated taxes.

This is because of their self-employed status. Since there’s no employer to withhold taxes from their income, the IRS will have to resort to another way of collecting taxes –requiring the payment of estimated taxes.

Members of an LLC are required to pay estimated taxes to the IRS every quarter (more information on estimated taxes can be found here).

Most LLCs will have to acquire an EIN

Just like any other business, an LCC that has employees will need to secure its EIN (Employer Identification Number).

It will also probably be required to open business bank accounts.

Thankfully, securing an EIN isn’t complicated.

It is as simple as filling out an application form, waiting for it to be validated, and then downloading, saving, and printing your EIN confirmation notice.

It can all be done online (accessible during operating hours of 7 a.m. to 10 p.m. EST, Monday to Friday).

The instructions can be found here.

An EIN can be used for opening a business bank account, application for business licenses and/or permits, etc.

Do note though that it will take time before an EIN can be used for electronic tax return filing or electronic payments.

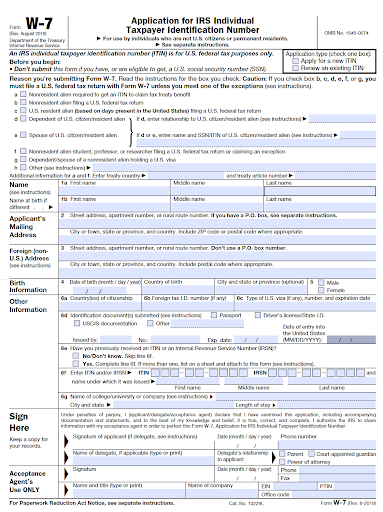

LLC’s for non-U.S. Citizens using a TIN

Since there are no citizenship or residence requirements for ownership of an LLC, non-U.S. citizens are allowed to form one, provided that they have a TIN (taxpayer identification number).

A TIN serves as a substitute for a social security number.

This allows noncitizens to pay taxes for their businesses.

To acquire a TIN, you will have to fill out and file Form W-7 Application for IRS Individual Taxpayer Identification Number to the IRS.

Source: IRS Form W-7

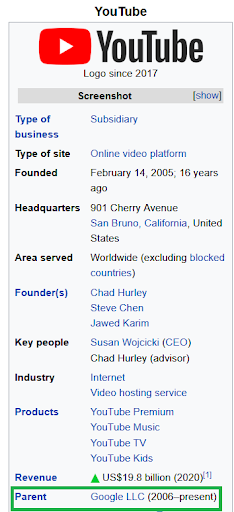

LLC’s and Large Businesses

While LLCs are indeed popular among small businesses, it does not mean that it’s exclusive to them.

In fact, one of the websites you probably visit frequently started as an LLC: YouTube.com.

It started as LLC and remained as one until Google bought it.

And oh, its parent company is an LLC: Google LLC.

Source: Wikipedia.org

So if you’re still hesitating to form an LLC thinking that it’ll remain a small business, don’t.

Who knows? Your LLC might be the next Google!

Except for certain niches such as insurance companies and banks, anyone can form an LLC for any kind of business -as long as it’s legal of course!

With its many advantages, you almost always can’t go wrong with choosing LLC as your business’s legal structure.

Forming an LLC in another state does not necessarily reduce taxes

It is already well-known that the states of Nevada or Wyoming are considered “tax havens’ not just for LLCs, but for other types of business entities too.

Because these states lack business income taxes, you’d commonly find them in lists of “Best States To Form an LLC”.

That’s why many would-be owners of an LLC look to form it in these states even if they aren’t their home states so that they could reduce or even avoid taxes.

This isn’t necessarily the case though.

Say you form your LLC in Wyoming, but it mostly operates in Arkansas.

Sure, you don’t have to pay for income taxes in Wyoming, but you’d still have to pay taxes for the profits you make in Arkansas.

On top of that, you’d have to register your LLC as a foreign LLC in your supposedly home state.

That comes with additional fees and compliance responsibilities, all of which could have been avoided if you registered your LLC in your home state.

Unless you plan to do business in the above mention states, it is best to form your LLC in your home state.

Forming it in another state does not necessarily translate to reduced taxes.