Can You Open a Business Bank Account Without an EIN?Explained, Advantages & Disadvantages, and Examples

A business bank account is a crucial tool for business owners to separate their business and personal finances.

However, when you go to the bank to open a business checking account, one of the first things that you will be asked to provide is an employer identification number, better known as an EIN.

The fact is that many small-business owners may not intend to hire any employees.

But many businesses still acquire an EIN simply as a valuable tax identification number.

This does not mean that your business has to, though, and it is possible for sole proprietorships and single-member limited liability companies (LLCs) to open a business bank account without an EIN.

What Is an EIN?

An employer identification number or EIN is a tax identification number issued by the IRS to uniquely identify your business.

This nine-digit number is used when you file an income tax return to allow the IRS to quickly and easily identify your business.

For companies doing business as a partnership, an LLC with multiple members, or a corporation, an EIN is required.

An EIN is also necessary for any company intending to hire employees, no matter their structure.

However, an EIN is not just for filing taxes with the IRS, it can also offer a lot of benefits for small-business owners.

This includes easily opening business bank accounts, opening lines of credit, and preventing identity theft by creating a unique and confidential identifier for your business.

It is also easy and free to file for an EIN by going to the IRS website.

Here you can answer a few simple questions about you and your business and receive an EIN in only a few minutes.

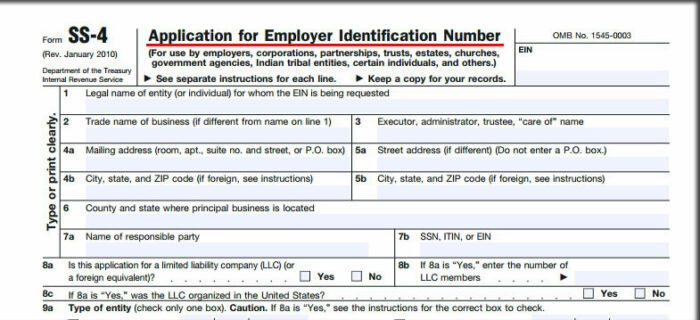

It is also possible to file through fax or mail by filling out IRS Form SS-4.

Can You Open a Business Bank Account Without an EIN?

An EIN operates as proof of your company’s identity as well as the nature of your business.

These are two things that every bank will need to verify before allowing you to open a business bank account.

As a result, many financial institutions will require an EIN, but not all.

Some banks will permit owners of sole proprietorships and single-member LLCs to instead use their Social Security number as proof of their identity.

It will simply depend on the individual bank and their policies regarding what documentation they may require to verify your and your business’s identity.

In some cases, a bank may require a fictitious name certificate, formation documents, business licenses, or tax information to verify your business details.

You will also likely need to provide your own contact information and a government-issued photo I.D., such as a driver’s license or passport.

Advantages & Disadvantages of Opening a Bank Account Without an EIN

Advantages of Opening a Bank Account Without an EIN

Though most business owners will benefit from acquiring an EIN, there are a few advantages to opening a bank account without one.

First of all, for owners of sole proprietorships, opening a bank account under your Social Security number instead of an EIN can make it easy to file your taxes, though this may not be the case if you attempt to claim deductions for business expenses.

Another advantage is that repaying a business loan taken out under your own Social Security number can help to build your personal credit.

This may help you to acquire personal loans or improved lines of credit.

Disadvantages of Opening a Bank Account Without an EIN

There are a number of disadvantages to opening a bank account without an EIN, starting with the fact that many banks will not do business with a company that does not have an EIN.

This will greatly reduce your options and may prevent you from choosing your preferred bank.

Plus, using your own Social Security number to open an account will open you up to more risks of identity theft by tying your own information to the account.

It will also make it more difficult to separate your own finances from your business ones when filing taxes because your personal and business accounts will both be filed and opened under the same Social Security number.

This can increase the chances that the IRS will choose to perform an audit.

Lastly, by opening a bank account under your own Social Security number, your personal credit is on the line.

This means that if your business suffers from financial difficulties, your own personal credit score can suffer the consequences.

Importance of Opening a Business Bank Account

Whether it is with or without an EIN, it is important to open a business bank account rather than using a personal account.

By only using a personal bank account, it can be extremely difficult to effectively separate your business and personal finances, which is crucial both for recordkeeping and accurately filing your taxes with the IRS.

Having a business checking account can also help to build credibility with vendors and customers.

By having a business checking account, customers can pay using cards, and when you pay vendors, they can see your business’s name on the checks instead of your own.

This can go a long way to establishing your organization as a business rather than a hobby.

A business bank account, when opened with an EIN, is also a great way to begin building ties with a financial institution.

Once you have a checking account open with a financial institution, they may be more willing to offer you a line of credit which is important for beginning to build your company’s credit score.

Final Thoughts

Though in most cases, an EIN makes it easier to open a business bank account, it is not necessary.

Sole proprietors and owners of single-member LLCs can open a bank account with their Social Security number instead of an EIN with certain financial institutions.

However, acquiring an EIN from the IRS is free and only takes a few minutes when filed online.

Acquiring an EIN can offer a number of benefits for your business, not least among which is making it easy to open a bank account for your business.

However, whether it is with an EIN or a Social Security number, it is possible and important to separate your personal and business finances by opening a business bank account for your company.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Internal Revenue Service "Apply for an Employer Identification Number (EIN) Online" Page 1 . November 2, 2022